Summary:

- Last week, Taiwan Semiconductor Manufacturing released its June revenue report.

- The report showed 33% revenue growth–well ahead of expectations.

- The report bodes well for the company’s upcoming July 18 earnings release.

- In this article, I explain why I remain bullish on TSMC stock ahead of earnings.

View of the Tainan Science Park in Taiwan, Asia. BING-JHEN HONG

Last week, Taiwan Semiconductor Manufacturing (NYSE:TSM) (OTC:TSMWF), also known as TSMC, released its June revenue report. The company reported NT$207 billion in revenue for the month. This Taiwan Dollar sum works out to $6.5 billion in U.S. dollars, assuming that the average exchange rate during the quarter was the same as today’s exchange rate. TSMC has not reported an official U.S. dollar figure for the month yet. The fact that we now have three monthly revenue reports means we can model how much full quarter revenue the company is likely to earn, with a high degree of accuracy.

These reports seem to indicate that TSMC is making a lot of money off the massive global investment in generative AI. The company has seen high-double digit sales growth for each of the last three months, which means that revenue growth for the entire second quarter was high. We can estimate the company’s second quarter revenue already: the April, May and June revenue figures sum to HK$673.51 billion. At today’s exchange rate, that’s worth US$20.69 billion. The year ago figure was $15.4 billion. So, it looks like we have a year-over-year revenue growth rate close to 35%.

Now, the actual exchange rate that TSM will use in calculating its U.S. dollar revenue on Wednesday, will likely be the average one over the duration of the quarter, which isn’t the same as the exchange rate today. The New Taiwan Dollar spent most of this year declining against the U.S. dollar, meaning that the exchange rate from the perspective of foreign shareholders was “better” than today’s exchange rate (a stronger Taiwan dollar converts to a larger number of U.S. dollars). Based on a quick glance at the data, it appears that the New Taiwan Dollar averaged about $0.031 in the second quarter (it’s $0.0307 now). So it’s possible we will see TSMC top $21 billion in quarterly revenue for the first time ever when it reports its earnings on Wednesday.

TSMC’s AI chip success is an important thing to note because not all companies that are involved in AI are making money off it. Meta Platforms (META), for example, has said that it will take several years for its own AI investments to pay off. Then you have companies like NVIDIA (NVDA), which are making money off of AI, but whose share prices fully reflect that fact. While TSMC is not dirt cheap, it is fairly modestly valued by the standards of big tech companies these days, trading at 35.69 times earnings. So, it is a relatively affordable means through which to get some generative AI accelerator chip exposure in your portfolio.

When I last covered Taiwan Semiconductor stock, I rated it a ‘buy,’ and explained why I had made an investment in the stock after a previous sale. Specifically, I felt the stock was comparatively cheap while having high-growth potential. Today, the “high growth” part of my thesis has largely been confirmed. In fact, the growth has been much better than I expected when I last covered the stock. For this reason, I’m upgrading my rating to ‘strong buy,’ even though TSM stock has risen significantly in price since I last wrote about it.

TSM’s June Revenue Report in Detail

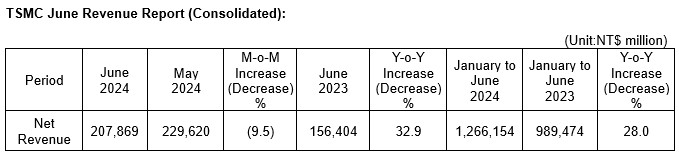

When Taiwan Semiconductor Manufacturing released its June revenue report, it included a number of useful tidbits of information apart from the revenue figure itself. These included:

-

First half revenue of NT$1.26 trillion.

-

28% first half revenue growth.

-

32.9% year over year (y/y) June quarter revenue growth.

-

-9.5% month over month (m/m) June quarter revenue growth.

TSMC revenue report (TSMC)

For the most part, the numbers TSMC put out were encouraging. On a year-over-year basis, revenue increased considerably. On the other hand, the -9.5% m/m growth was disappointing. The March quarter saw semiconductor sales growth well above the established seasonal trend. So, the June quarter sales slowdown may simply have been a return to the established trend. If that’s the case, and if demand for AI chips remains strong, then we should eventually see TSMC re-take and then surpass the May level, as the “established” trend is one of high long-term growth. For example, according to Seeking Alpha Quant, TSM has a 17.5% five-year CAGR revenue growth rate and a 20.69% five-year CAGR earnings growth rate. Though it has booked a bad quarter/month here and there, the company is growing long term.

Valuation

Having looked at TSMC’s revenue trends in detail, we can now begin to model its second quarter results. I already did some of this work in preceding paragraphs, where I wrote that I expected between $20.6B and $21B in revenue for the quarter. Let’s put our estimate at $20.8B (the average) to keep things simple.

The next step is the expenses. Reviewing TSM’s past earnings releases, I found that the company’s cost of goods sold (“COGS”) increased pretty reliably with revenue from year to year. COGS was 46% of revenue last quarter; therefore, if TSM hits my $20.8B revenue target, COGS will be about $9.56B.

TSM’s operating expenses do not rise in tandem with revenue in any predictable fashion. The company’s first quarter operating expenses were actually lower than its fourth quarter and third quarter 2023 operating expenses. TSM’s “expense” category includes a lot of R&D and other hard to predict categories. For this reason, I will assume that second quarter operating expenses remain unchanged from last quarter at $2.08 billion. So we get $9.16 billion in EBIT, which is $7.78 billion after subtracting a 15% tax (the company’s interest expenses are negligible, about 0.4% of revenue last quarter). TSM has 25.929 billion shares outstanding, so we get approximately $0.30 in earnings per share, or $1.50 in earnings per ADR. This represents approximately 36% growth from the year ago quarter when TSMC earned $0.22.

If we assume that $1.50 reflects TSM’s average quarterly earnings per ADR over the next 12 months, then the stock will earn $6 and trade at 31.2 times forward earnings, which is cheaper than the multiple you’d get by using trailing earnings. Seeking Alpha Quant projects a 29 forward P/E ratio, lower than mine. This stock is certainly getting a bit pricey, but if it can continue growing at the pace it has been, then it will end up doing more than $1.50 in quarterly earnings. If it can achieve $2 in quarterly EPS, then the forward multiple (assuming the stock price doesn’t change) will come down to 23.5.

I think TSM stock will prove to have been well worth the investment at today’s prices if the scenario just mentioned plays out. It isn’t inconceivable either: TSM’s December 2022 EPS was $0.37, which is equivalent to $1.85 in earnings per ADR–just a stone’s throw away from $2. If Taiwan Semiconductor still has all the competitive advantages it had back then, and if companies keep spending big on AI chips, then $2 in quarterly EPS should be do-able.

Will Taiwan Semiconductor’s Moat Last?

It’s one thing to note that a company has very good financials and a fairly sensible valuation, but quite another thing to predict that the party will continue. In order to determine whether the party will continue, we need to look at the company’s competitive edge.

As of today, Taiwan Semiconductor is the biggest semiconductor manufacturing company in the world, with a 61% market share. It also has a 100% share of NVIDIA and Apple’s (AAPL) business–those are some of the most lucrative contracts in the world of semiconductor manufacturing.

We also know that the U.S. government is giving a lot of money to TSMC’s competitors. Intel (INTC), for example, has received over $8.5 billion in CHIPS Act grants, and a lot of that is for manufacturing. Intel is trying to make itself into the next semiconductor manufacturing giant, and it is getting considerable government support in this enterprise. However, as a company that both designs and manufactures chips, it has possible conflicts of interest (specifically, it has an interest in privileging its own orders over clients’ orders). The company’s executives evidently consider this a serious concern, as they spent some time touting how Intel Foundry charges Intel “fair market prices” for its services. It could be that Intel will succeed with this model, but for now, TSMC’s total lack of conflicts of interest is a major competitive edge.

Another competitive edge that Taiwan Semiconductor enjoys is its technological know-how. The company has been building chips for Apple and NVIDIA for so long now, that it is intimately familiar with their designs. This fact incentivizes those companies to stick with TSMC, as fulfilling their orders is a complex technical task involving the use of high-end EUV lithography machines that cost $380 million. New upstarts can’t just enter this industry on a whim, while established competitors lack TSMC’s massive manufacturing capacity (TSMC’s capacity is 16 million wafers per year, while Intel’s is only 2.5 million).

The Bottom Line

If Taiwan Semiconductor Manufacturing can continue growing at the pace it has been growing, then its stock is worth owning today. It just needs to hit $2 in quarterly earnings per ADR to be worth more than the price it trades for. Getting to that level will take some doing, but considering its competitive edge, TSMC will probably get there eventually.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of TSM either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.