Summary:

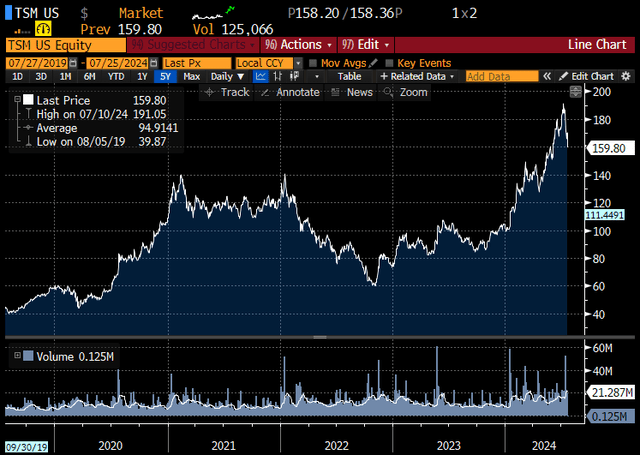

- TSMC stock has generated a 73.5% return since January 2023, outperforming the S&P500.

- TSMC’s strong competitive advantage lies in its leadership in advanced process technologies, driving future above-average returns.

- The company’s diversification of supply chain and focus on advanced technologies position it well for future growth and profitability.

Monty Rakusen

Investment thesis

The first time I wrote about Taiwan Semiconductor Manufacturing Company Limited (NYSE:TSM) was in January of 2023. At that time, TSMC stock was moving sideways without any visible price catalyst. My investment thesis was built on the premise that semiconductor technology is the foundational technology in today’s digital world and TSMC would directly benefit from this trend. Since my last analysis until the day of this writing, TSMC has generated a 73.5% return, composed of stock appreciation and dividend payments. In the same time frame, the S&P500 generated a “meager” 35% return. While various investment banks are writing about rotation from the Magnificent Seven stocks, AI-related stocks, or geopolitics, I argue that investors should ignore this investment noise and instead focus on fundamentals. TSMC has a strong competitive advantage that stems from its leadership in advanced process technologies. For competitors, it would be very hard, if not impossible, to replicate TSMC’s position. Contrary to the currently popular view, I believe that TSMC’s position has not changed and that the company will be able to generate above-average returns in the years to come.

Second quarter preview

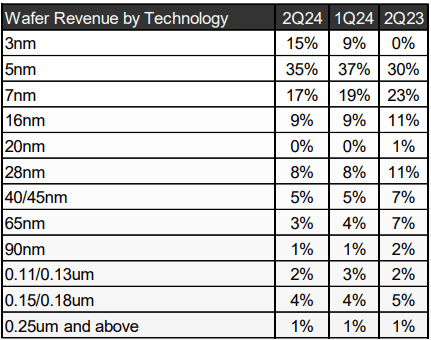

TSMC’s strong competitive position comes mainly from two sources: its economies of scales and its technological dominance. Both sources are mutually intertwined because, without economies of scale, the company cannot achieve technological dominance, and vice versa. In 2024, the company expects to spend USD 30 to USD 32 billion in capital expenditures, which is USD 5.0 billion more than its closest competitor, Intel, spent in FY2023. Higher CAPEX is a response to strong demand for AI-related processors. Due to its size, TSMC can outspend most of its competitors, which only increases the technological gap among them. In terms of technological leadership, the company generates a higher amount of revenues from its advanced technologies. Advanced technology chips are chips with a size of 7 nanometers and below.

TSMC 2Q report

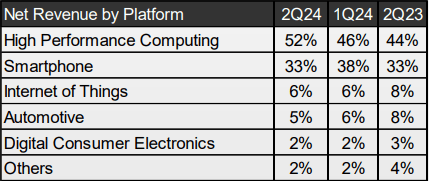

The company’s most advanced 3N and 5N nodes are the main factors behind the growth in 2Q revenues (+32.8% YoY). Management states that higher advanced nodes, especially 3N nodes, could significantly contribute to 20% plus revenue growth in FY2024 and FY2025. Even though it seems apparent that company has strong pricing power over its customers, in the second quarter earnings call, the company stated that its main goal is to bring value to their customers by saving money for those who buy more chips. The “more you buy, more you save” strategy helps the company better forecast future needs in terms of capacity and capital expenditures. This explains why TSMC’s biggest customers are Apple, Nvidia and AMD, which can benefit from their large sizes.

Profits will grow, despite geopolitics

In the mid-term, the transition to more technologically advanced 2N chips and their derivatives, along with improvements in advanced packaging, will be the main profit drivers. Additionally, seasonality in smartphone market, which is currently a drag on revenues growth, could finally stabilize and grow again. Management believes it can achieve a long-term gross profit margin of 53% or higher, compared to a 53.2% margin in 2Q24. Processors with AI capabilities in the high-performance computing (HPC) platform are expected to be the largest contributor to overall incremental profit growth in the next several years. The growth of HPC platform is directly linked with the development of the AI industry, and TSMC will undoubtedly benefit from this trend.

TSMC 2Q Report

Diversification of supply chain is undergoing

TSMC generates 65% of revenues from the US, 9% from Asia Pacific, 6% from Japan and only 4% from EMEA region. Diversification of its supply chain is a serious issue, especially in the case of any armed conflict with China. In response to this, the company announced development of three foundries in Arizona, including one with 2-nanometer technology. Production at the first factory should start in the first half of 2025, while the second factory is scheduled for 2028 and the third before 2030. Additionally, TSMC opened one foundry in Kumamoto, Japan in January 2024, with construction of the second plant starting by the end of this year. TSMC also announced plans for a factory in Dresden, Germany, which should be in full operation by the end of 2027. The fab in Dresen will focus on automotive and industrial applications, with an estimated annual capacity of 40,000 wafers, primarily producing 28/22 nanometer sizes and 16/12 nanometer sizes. TSMC’s philosophy of being closer to its biggest customers is slowly materializing, which at the same time helps to mitigate possible geopolitical uncertainties.

Valuation

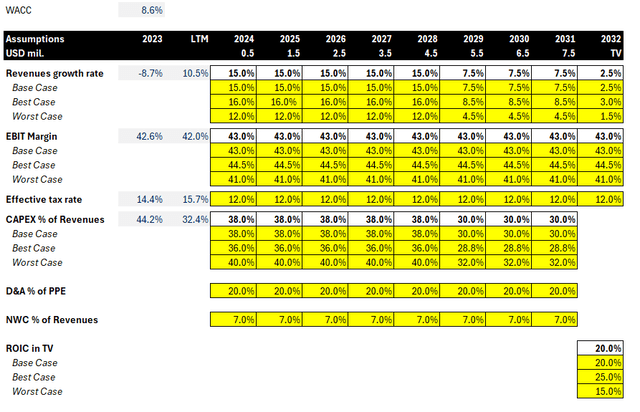

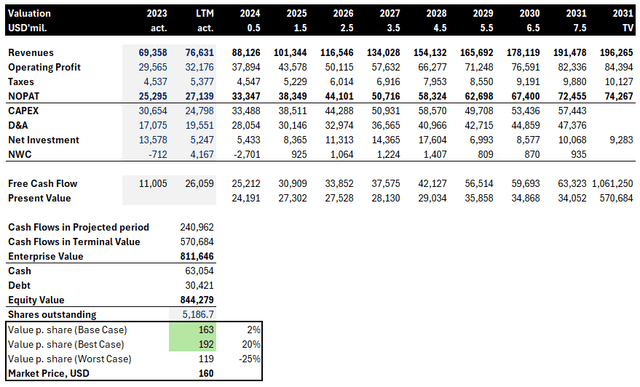

My valuation is build on the premise of a slow recovery in electronic equipment [EE] devices, such as smartphones and PC’s, which was the main determinant of a decline in revenues in FY23. Recovery in EE segment should be supported by strong demand for AI solutions. The company expects high-single digit growth in the worldwide semiconductor market throughout 2028, with the foundry subsegment outpacing the growth of the total market. This estimate makes me believe that TSMC should be able to grow up to 15% per annum until 2028 with a subsequent decline in growth to mid-single digit numbers in the following years. In 2032, I assumed that the company will reach a steady state and will growth at the pace of global GDP. To better reflect various scenarios, I modeled three scenarios: base case, best case and worst case scenario. All inputs used in these scenarios are highlighted in yellow.

Under my assumptions, the implied value per share should be in the range of US 163 to US 192 dollars. If the best case could be achieved, TSMC is 20% undervalued, if not, then the company trades at fair value, and its future returns should be equal to the average return on invested capital.

TSMC FY23 annual report, 1Q24, 2Q24 reports Own Work, xls

Conclusion

Even though TSMC, at its current price, is not a stellar buy as it was in 2023, I think investors should ignore news about geopolitical tensions and instead focus on long term prospects. TSMC continues to lead in advanced technologies, and significant future capital expenditures will help defend their position.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of TSM either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.