Summary:

- In 1Q 2024, cutting-edge technologies made up 65% of the company’s total revenue (-2 pp q/q).

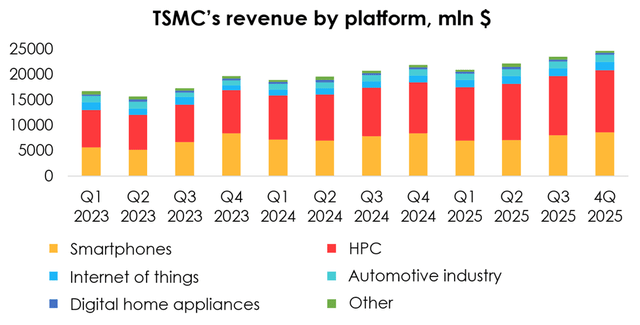

- In terms of revenue breakdown by platform, there was weak demand in the smartphones segment (due to seasonality), which was offset by strong demand in the HPC segment.

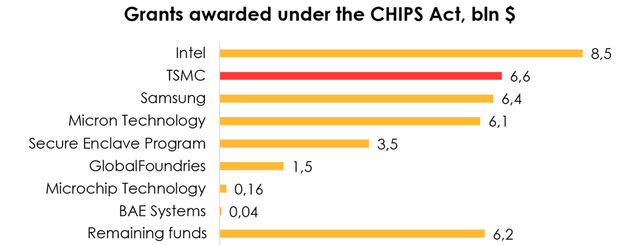

- TSMC received a grant of up to $6.6 billion from the US government under the CHIPS Act.

- TSMC’s revenue forecast for the smartphone segment has been lowered, but the outlook for the HPC segment remains strong. The rating is Hold.

hapabapa/iStock Editorial via Getty Images

Investment thesis

We have covered Taiwan Semiconductor Manufacturing Company Limited (NYSE:TSM) before, and as we expected, our revenue distribution expectations were met, with the percentage of HPC revenue exceeding the percentage of smartphone revenue. This was not only due to the increased demand for advanced chips from the HPC segment, but also due to a seasonal decline in smartphone shipments in Q1 2024.

It is also worth noting that:

- TSMC was awarded a grant from the US government under the CHIPS Act. The company is set to receive up to $6.6 bln in grant money, and it will also be provided with about $5 bln in loans.

- The April 3, 2024, earthquake in Taiwan, which was the biggest earthquake since 1999, left only a marginal impact on the production process. Operations fully resumed within 3 days of the tremors, with only minor disruptions.

We have lowered our revenue expectations for the smartphone segment, which was offset in the valuation by the decrease in the company’s projected net debt, as the calculations now include FTM FCF and the US grant of $6.6 bln. We are assigning a HOLD rating to the stock.

Since our last report, ADR prices have risen more than 20% and our BUY recommendation was correct (as well as our earlier purchase recommendation).

TSMC’s revenue structure

The company earned a revenue of $18.9 bln (+13% y/y) in 1Q 2024, down from our forecast of $20.2 bln. Revenue from cutting-edge technology (7-nanometer and lower) made up 65% of the total (-2 pp q/q), with revenue from 3-nanometer technologies going down to 9% of the company’s total (-6 pp q/q), which was partially mitigated by rising sales of 5nm and 7nm chips.

Cutting-edge technologies are chiefly utilized in the segments of HPC and smartphones:

- Demand in the HPC segment remains strong due to persisting need for technology for accelerated computing. Revenue in the segment reached $8.7 bln (+18% y/y and +3% q/q), making up 46% of the company’s total revenue (+3 pp q/q).

- Demand in the smartphones segment fell in 1Q 2024 on the back of the seasonality factor in the global market of smartphone shipments. Revenue in the segment reached $7.2 bln (+26% y/y and -15% q/q), making up 38% of the company’s total revenue (-5 pp q/q).

Previously, we forecast revenue in the smartphone segment based on projected revenue from advanced chips and the proportion of the chips that were used for shipments in the smartphone segment. Now to forecast revenue for this segment, we rely on projections for smartphone shipments, with are provided by research companies such as IDC, Canalys.

Given the change in the method that we use to model future revenue in the smartphone segment, we are lowering the forecast for 2024 revenue in this segment from $34.9 bln (+34% y/y) to $30.4 bln (+17% y/y). We expect slower smartphone shipments in 2Q 2024, and consequently, slower sales of chips used in smartphones.

With respect to revenue in the HPC segment, we are maintaining the outlook for its growth and expect it to rise to $37.4 bln (+25% y/y) in 2024.

The company’s global presence

It was announced in early April 2024 that TSMC was awarded a grant from the US government under the CHIPS Act. The company is set to receive up to $6.6 bln in grant money, and it will also be provided with about $5 bln in loans.

The CHIPS Act provides billions of dollars in incentives to companies that will produce chips in the US on the condition that they do not expand production of advanced semiconductor devices in China and other countries that are considered a threat to US national security.

TSMC has committed to building three plants in Arizona, each producing advanced technology:

- The first plant will focus on the production of 4nm technology. According to comments from TSMC management, pilot production already started in April 2024, and the start of mass production is scheduled for 1H 2025.

- The second plant is still under construction. It will produce 2nm and 3nm technologies. The start of mass production is scheduled for 2028.

- The third plant is still in the design phase but will be up and running by the end of this decade. It will produce 2-nanometer and more advanced technologies.

In its other countries of presence, besides domestic production in Taiwan and the already mentioned production in the US, TSMC will not produce advanced technology in the next 3-4 years.

Currently, the company’s first plant in Japan (which had a grand opening ceremony in February 2024) produces 12/16nm and 22/28-nm technologies. The second plant in Japan (which has an estimated start date in late 2027) will target 40nm, 12/16nm and 6/7nm.

The plant in Germany is still on the drawing board and will mainly focus on the automotive industry.

TSMC’s financial results

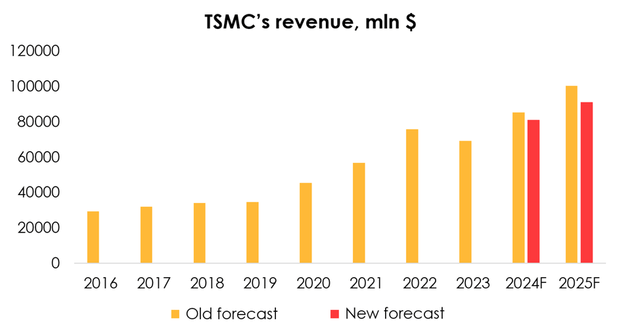

We have lowered the revenue forecast from $85.4 bln (+23% y/y) to $81 bln (+17% y/y) for 2024 and from $100.5 bln (+18% y/y) to $91.2 bln (+13% y/y) for 2025 following the reduction of the forecast for revenue in the smartphone segment from $34.9 bln (+34% y/y) to $30.4 bln (+17% y/y) for 2024, and from $40 bln (+15% y/y) to $30.6 bln (+1% y/y) for 2025.

The company’s other segments are developing in line with our expectations, and revenue projections for them have been left unchanged.

We are also maintaining our forecast that the greatest demand for TSMC’s products will come from the HPC market, as orders for 3nm chips come from companies that need accelerated computing for AI.

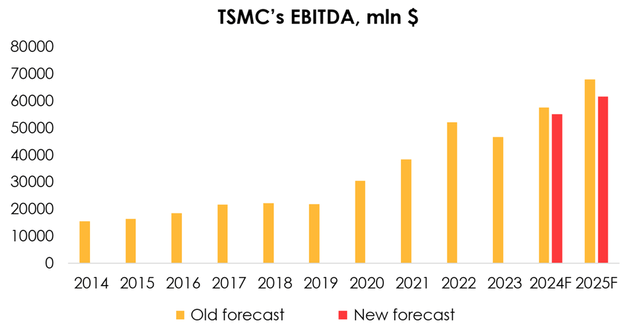

We have lowered the EBITDA forecast from $57.6 bln (+24% y/y) to $55.1 bln (+18% y/y) for 2024 and from $68 bln (+18% y/y) to $61.7 bln (+12% y/y) for 2025 on the back of a reduced forecast for TSMC’s revenue in the smartphones segment.

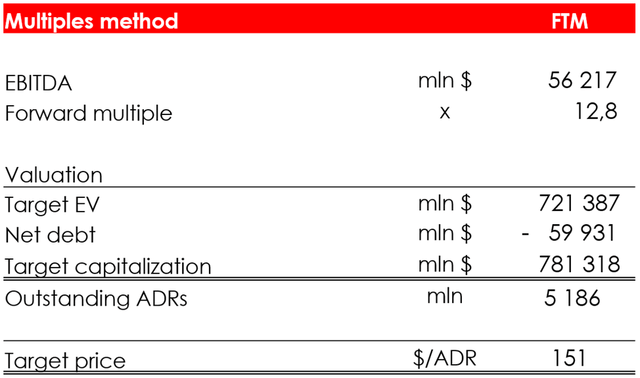

We are raising the target price of the shares from $148 to $151 due to:

- the decrease in the company’s projected net debt, as calculations now include FTM FCF and the US grant of $6.6 bln, which was in part offset by the lower EBITDA forecast for 2024 and 2025 and the reduction of the EV/EBITDA target multiple from 12.9х to 12.8х due to cuts to the forecast for the pace of the company’s future growth.

- the shift of the FTM forecast period. Future financial results have become closer by one quarter.

We are assigning a HOLD rating to the stock.

Conclusion

Thus, TSMC’s leadership in the development and production of advanced chips gives it an advantageous market position that will ensure strong financial results in the future. For example, the development of the 2-nanometer technology is progressing according to the previously announced plan: mass production is scheduled for the end of 2H 2025.

One risks to the company’s financial results is a possible global oversupply of technologies beyond 7nm. However, at the moment we assess the probability of this scenario specifically for TSMC as low, as the company is focused on improving the performance of all its products, not just the cutting-edge technologies, which will enable it to continue to outperform competition and retain customers.

The company will continue to expand globally (now in the U.S. with government funding through the CHIPS Act), which will help increase future growth potential. However, based on our current financial forecast, we assign a HOLD rating.

To manage your positions, we recommend following TSMC’s earnings releases, semiconductors market updates.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.