Summary:

- TSMC is poised to capture a significant share of AI-driven value accumulation within the semiconductor industry, a trend that should extend for a few years.

- As the world’s leading foundry service provider, TSMC is benefiting from a multi-year shift towards increased semiconductor content in mobile devices and cloud centers.

- TSMC’s AI revenues are expected to increase from less than $5 billion in 2021 to over $30 billion by 2027.

- Overall, I expect TSMC’s revenue growth over the next three years to exceed a 20% CAGR, with a slightly higher expansion rate for EPS due to potential margin improvements.

- Based on a valuation anchored on a residual earnings model, I maintain a “Buy” rating on TSMC stock, and set my target price at $200.

BING-JHEN HONG

Taiwan Semiconductor Manufacturing Company (NYSE:TSM) is strategically positioned to capture a lion share of the AI-driven value accumulation within the semiconductor industry. The world’s leading foundry service company is benefiting from the multi-year shift towards increased semiconductor content in mobile devices, the rise of artificial intelligence, and the further proliferation of the Internet of Things. Furthermore, TSMC’s strategic alliances with key growth customers such as NVIDIA and Apple amplify its market position and commercial moat. Overall, I expect TSMC’s revenue growth over the next 3 years to be above 20% CAGR, with a slightly higher expansion rate for EPS due to potential margin expansion. As a function of valuation anchored on a residual earnings model, I maintain a “Buy” rating on TSM stock, and set my target price at $200.

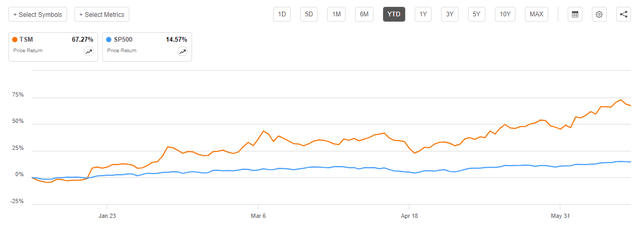

For context: TSMC stock has significantly outperformed the broader U.S. stock market this year. Since the beginning of the year, TSMC shares are up by approximately 67%, compared to a gain of about 15% for the S&P 500 (SP500).

Strong AI Momentum Drives EPS Upgrade Cycle

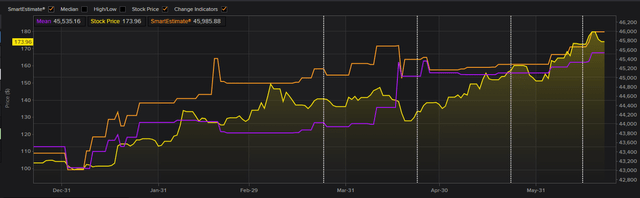

Over the past 12-24 months, TSMC has enjoyed a strong upgrade cycle in EPS estimates, with analysts now expecting about $46 billion of EBIT next year (FY 2025), compared to approximately $43 billion expected back in December 2023.

Pointing to this bullish consensus momentum, I highlight that the earnings revision cycle is primarily driven by positive AI exposure. In fact, TSMC’s advanced node and packaging segments are poised to benefit from hyperscalers’ shift towards increasingly diverse data center ecosystems, as well as the growing demand for custom compute chips, also in mobile devices.

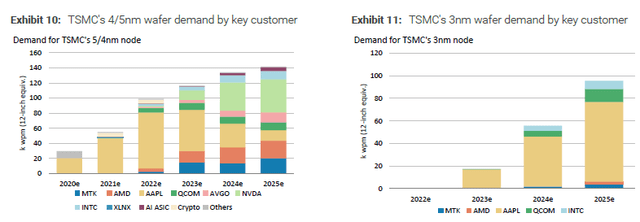

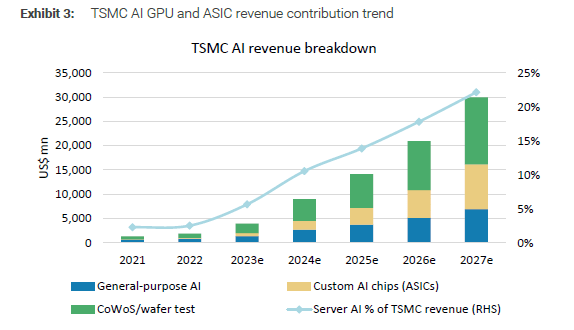

Morgan Stanley mapped estimates for TSMC’s AI GPU and ASIC revenue contribution trend from 2021 to 2027e, projecting a significant upward trajectory in AI-related sales towards 25% of total revenues. Specifically, TSMC’s AI revenues are expected to increase from less than $5 billion in 2021 to over $30 billion by 2027. The growth upside underscores TSMC’s strategic positioning in high-growth markets that anchor their momentum on AI–areas like autonomous driving, smart devices and edge computing, and cloud computing. In a broader context, growth is driven by three primary segments, including General-purpose AI, Custom AI chips (ASICs), and CoWoS/wafer test. (Source: Morgan Stanley, TSM research note dated June 17th: AI semi demand upside from Apple AI, OW).

Morgan Stanley

On that note, I am especially bullish on TSMC’s partnership opportunities with major AI-winners including Apple (AAPL), NVIDIA (NVDA), Broadcom (AVGO). In fact, Apple and NVIDIA are significant contributors to the demand: Increasing demand and expanding requirements for high-performance, power-efficient GPUs is set to surge dramatically from 2023 onwards (see 3nm wafer demand, RHS). (Source: Morgan Stanley, TSM research note dated June 17th: AI semi demand upside from Apple AI, OW).

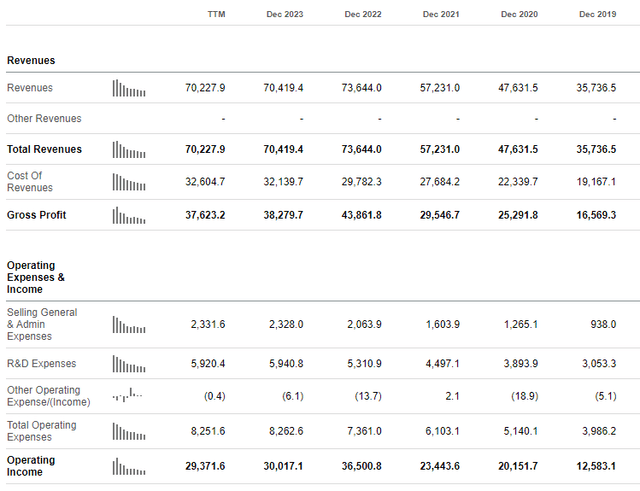

Strong Financial Performance

TSMC’s financial metrics illustrate the company’s promising growth trajectory: Since 2019, TSMC’s topline has almost doubled, growing from $35.7 billion to $70.2 billion (CAGR of 18-19%). Over the same period, gross profit has surged from $16.5 billion to $37.6 billion (CAGR of 22-23%), while operating profit jumped from $12.6 billion to $29.4 billion (CAGR of 23-24%). You see, there is solid operating leverage in TSMC’s business model, with gross profit growth outpacing revenue growth, and operating income growth outpacing gross profit growth.

Looking ahead, I project TSMC’s revenue growth to accelerate, for the reasons discussed in the previous section of this article. Moreover, I expect ongoing operating leverage to drive earnings growth ahead of top-line expansion. According to analyst estimates, the company is expected to maintain gross margins above 50%, with projections reaching nearly 60% by 2026 due to price hikes in advanced nodes (N3 and N5). In fact, NVIDIA’s commentary on TSMC’s low service prices highlights TSMC’s ability to potentially increase wafer prices. Overall, I model a 20-25% CAGR in operating earnings up to 2027. This robust operating earnings growth supports TSMC’s policy of distributing up to 70% of FCF as cash dividends, potentially doubling its dividend per share from $14 in 2024 to $30-35 by 2027 .

Valuation Update: Raise TP To $200/ Share

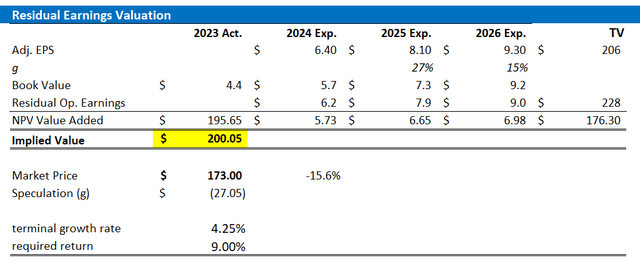

Anchored on strong commercial momentum, which is projected to be maintained over the next few years, I am revising my valuation assumptions for TSMC stock. With gross margin and OPEX estimates based on analyst consensus estimates, with adjustments of +/- 10%, I now project TSMC’s earnings per share for FY 2024 to range between $6.3-6.5 (non-GAAP). Additionally, I forecast these earnings will rise to $8.1 in FY 2025 and $9.3 in FY 2026. Beyond FY 2026, I anticipate a compound annual growth rate in earnings of approximately 3.25%, which is about 100 basis points above the projected nominal GDP growth and thus likely conservative. I am maintaining my cost of equity assumption at 9%. With these updates, I now assess the fair value of TSMC stock at $205, a significant increase from my previous estimate of $105, but still below TSMC’s current market trading price.

For context, the value “Speculation” is just the difference to fair implied value. A positive value implies a premium; or in other words, markets are speculating to price more fundamental upside compared to my estimates.

Company Financials; Bloomberg & Author’s EPS Estimates; Author’s Calculation

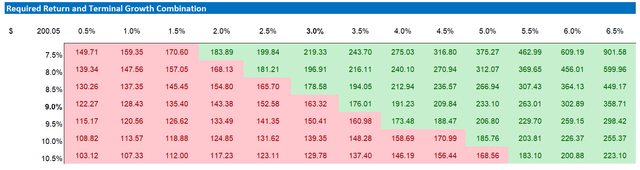

Below also the updated sensitivity table.

Company Financials; Bloomberg & Author’s EPS Estimates; Author’s Calculation

Investor Takeaway

TSMC is poised to capture a significant share of AI-driven value accumulation within the semiconductor industry, a trend that should extend for a few years. As the world’s leading foundry service provider, TSMC is benefiting from a multi-year shift towards increased semiconductor content in mobile devices, the rise of artificial intelligence, and the proliferation of the Internet of Things. Overall, I expect TSMC’s revenue growth over the next three years to exceed a 20% CAGR, with a slightly higher expansion rate for EPS due to potential margin improvements. Based on a valuation anchored on a residual earnings model, I maintain a “Buy” rating on TSMC stock, and set my target price at $200.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Not financial advice

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.