Summary:

- TSM’s strong September net sales and robust AI demand from Nvidia and Apple suggest a promising Q3 earnings report on October 17, 2024.

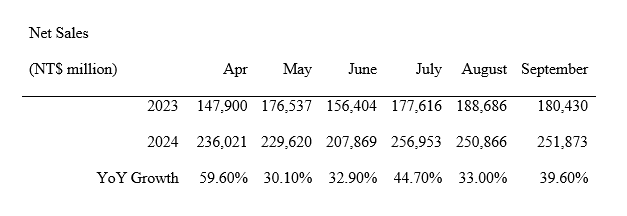

- TSM’s net sales in Q3 totaled NT$759.7 billion, surpassing the high-end guidance and reflecting a 39.6% YoY growth in September.

- With a profit multiple of 28.2x and strong AI-driven growth, TSM presents a compelling long-term investment opportunity.

- Potential risks include a slowdown in AI spending, but current momentum indicates a likely beat in operating income and margins for Q3.

Jonathan Kitchen

Chip manufacturing capabilities are obviously remaining very much in high demand, and this is the conclusion we can draw from the early release of net sales figures for the third quarter of Taiwan Semiconductor Manufacturing Company Limited (NYSE:TSM).

The chip company is seeing robust demand from big customers in the AI market, mainly Nvidia Corp. (NVDA) and Apple Inc. (AAPL) which resulted in an acceleration of TSM’s net sales in the month of September.

In my view, the early net sales release bodes very well for TSM’s earnings release that is planned for October 17, 2024.

I think that TSM still offers investors a decent entry point into the stock before Q3 earnings are revealed and with a decent valuation multiple to boot, I think that Taiwan Semiconductor Manufacturing Company could be a winning investment for investors long-term.

My Rating History

My last stock classification on TSM was Buy primarily because the chip company profited from skyrocketing demand for 5 nano-meter chips and growing demand from the high performance computing sector.

Furthermore, Taiwan Semiconductor Manufacturing Company just released 3Q24 net sales which indicate that this momentum is not waning and TSM therefore has very solid chance to impress investors with its third quarter earnings in the coming week.

3Q24 Sales Preliminary Release And Expectations

TSM’s net sales in the third quarter totaled NT$759.7 billion (US$23.5 billion) which surpassed the company’s predicted sales range of $22.4 billion to $23.2 billion by $300 million on the high end of guidance. The real net sales figure also beat the estimate of NT$748 billion in 3Q24 net sales.

TSM’s growth comes amid a spending boom in the artificial intelligence market that requires tech companies to keep investing heavily into the newest AI-capable chips which obviously is a boon for strategically well-positioned chip manufacturers like TSM.

On a YoY basis, TSM’s net sales skyrocketed 39.6% in September which was the fastest rate since July 2024. In my view, the preliminary release of net sales figures could lead to some pleasant surprises in the company’s 3Q24 earnings report which investors will have an opportunity to look at in more detail on October 17, 2024.

Net Sales (TSM Net Revenue Report)

Nvidia has led the market here in terms of sales growth and just informed investors that the Blackwell chip is sold out as big tech companies like Meta Platforms Inc. (META), Amazon Inc. (AMZN) or Alphabet Inc. (GOOG) invest heavily into new AI chips and are scrambling to get their hands on GPU supply capable of doing demanding AI tasks. These companies, which dominate the hyperscale market, are responsible for driving substantial gains at Taiwan Semiconductor Manufacturing Company.

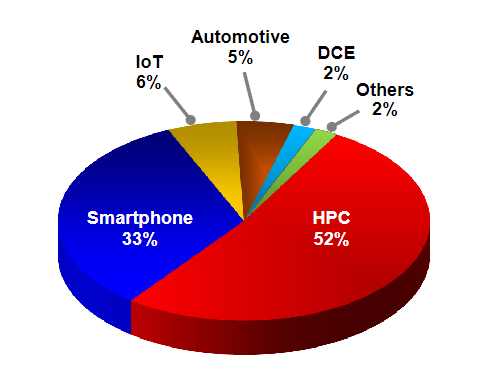

In the second quarter, high performance computing accounted for more than half of sales, a percentage that will likely have increased in the third quarter. I think we could be looking at an HPC sales percentage of close to 55% by the end of the year, with further gains being probable in 2025.

High Performance Computing Sales (Taiwan Semiconductor Manufacturing Company)

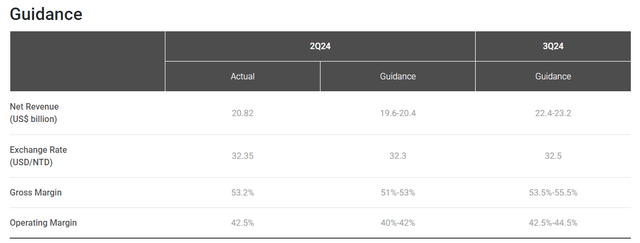

With TSM seeing ongoing momentum from the artificial intelligence industry, the chip company has a good chance to beat other guidance items as well, particularly gross and operating margins. For operating margins, TSM anticipated to grow its margins from 42.5% in 2Q24 by up to 2 percentage points in 3Q24.

I think that the strength in the underlying order momentum and eye-popping sales surge could yield a substantial operating income beat when the company reports 3Q24 earnings this week.

Guidance (Taiwan Semiconductor Manufacturing Company)

TSM Presents Strong AI Growth Value

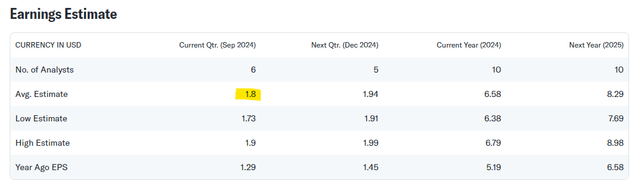

The market presently models $1.80 per share in profits for the last quarter which reflects 40% YoY profit growth. The market also anticipates a total of $6.58 per share for the present financial year, implying a profit jump of 27% YoY.

This anticipated profit increase is a reflection of TSM profiting from robust demand for new AI semiconductors that handle exponentially growing AI workloads.

Since TSM is selling for $185.78 at the time of writing, TSM is selling at a profit multiple of 28.2x. Based on next year’s estimated profits of $8.29, which reflect a YoY profit jump of 26%, TSM is selling for a leading profit multiple of 22.4x.

Nvidia Corp. (NVDA) is selling for 33.5x leading profit multiple and the average profit estimate for next year reflects 42% profit growth YoY.

Earnings Estimate (Yahoo Finance)

Why The Investment Thesis Might Disappoint

I don’t see the AI train slowing down any time soon for TSM, but that doesn’t mean it couldn’t happen in the future.

If companies don’t see a return on investment on their artificial intelligence spending, then there is going to be a reckoning at some point that could force companies to scale back orders with chip companies like Taiwan Semiconductor Manufacturing Company.

As a consequence, TSM might have to deal with a contraction of its operating income margins and slowing net sales growth, all of which would probably not be well-received by the company’s investors.

In my view, as far as 3Q24 earnings are concerned, the odds are widely in favor of a profit and margin beat.

My Conclusion

TSM’s September net sales release strongly suggests that the market for chip manufacturing capacity is not anywhere near the danger zone.

In fact, quite the opposite is true: Chip companies are scrambling to accommodate chip production orders which points to a rosy outlook for Taiwan Semiconductor Manufacturing Company in the very near-term.

As the 3Q24 earnings date approaches, I think there is a potential alpha opportunity here for TSM, in particular after the company’s September net sales accelerated again over the prior month.

Sales growth in September was not exactly as strong as in July, but 40% YoY net sales growth is hardly something to complain about.

I anticipate that Taiwan Semiconductor Manufacturing Company is going to be able to beat its own forecast for operating income (and gross) margins on October 17, 2024 and I don’t see any reason for investors to scale back their exposure to TSM in the slightest.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of TSM either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.