Summary:

- TSMC has greatly benefited from the AI chip boom in recent months.

- The potential price hikes for its 3nm chips should help the company fairly easily meet its fiscal goals this year.

- However, the rising geopolitical risks along with the non-existent margin of safety at the current price make me believe that TSMC’s shares have reached their top for now.

JHVEPhoto

TSMC (NYSE:TSM) started the year on a high note as the rising demand for AI chips has helped the company exceed expectations in the recent quarter and provide a positive outlook for the rest of the year. However, while the company’s business has everything going for it to meet its fiscal goals in FY24, it’s likely that the company’s shares have reached their top for now and currently offer a minimal margin of safety. As such, I believe that it’s best to wait for a potential pullback before accumulating a long position in TSMC.

AI Chip Boom Continues

Back in January, I wrote an article about TSMC, where I noted that the company faces major geopolitical challenges that could undermine its business model in the long term. While geopolitical risks still remain, they were overshadowed by the rising demand for AI chips in recent months, which helped TSMC significantly improve its performance and resulted in an appreciation of its shares by over 40% since that time.

The latest earnings report for Q1, which was released in April, showed that TSMC’s revenues increased by 12.9% Y/Y to $18.87 billion and beat the estimates by $860 million. At the same time, TSMC’s EPADR of $1.38 was above the estimates by $0.06 and the company’s new chairman recently noted that the semiconductor market is on its way to recovery in 2024 thanks to the rising demand for AI chips. Add to all of this the fact that the macroeconomic environment is also improving, and we’ll likely start seeing the Federal Reserve cutting rates later this year, and it becomes obvious that the demand for AI chips is unlikely to significantly decline anytime soon.

At the same time, the potential price hike for its 3nm chips in the foreseeable future will likely help TSMC to continue to boost its sales and exceed expectations. Given that Nvidia (NVDA) has recently rolled out a multiyear plan under which it plans to release new AI GPUs annually, it’s safe to assume that TSMC will be able to perform successfully going forward, especially if it hikes prices for its American client even more.

On top of all of that, TSMC continues to be on track to enter the volume production stage for its 2nm chips next year. If it manages to meet its goal, then it would be safe to assume that the company will once again strengthen its leadership position in the foundry business and ensure that its offerings continue to be indispensable for fabless chipmakers which are striving for dominance in the CPU and GPU markets.

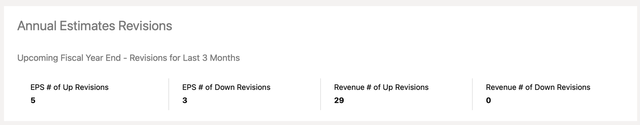

Considering all of this, it’s not a surprise that the street has recently made dozens of upward revisions for TSMC’s revenues, as its business continues to boom.

TSMC’s Revisions (Seeking Alpha)

Major Risks To Consider

As I’ve already noted earlier in this article, TSMC’s major geopolitical risks were overshadowed by the rising demand for AI chips. While investors are celebrating the significant appreciation of TSMC’s shares in recent months, those risks have not gone anywhere and will likely continue to haunt the company for years to come.

First of all, despite TSMC’s efforts to diversify its business across the globe, somewhere around 80% and 90% of its production capacity remains in Taiwan and the company admitted that it would be impossible to move fabs away from the island in case a war breaks out. Given that the tensions in the Taiwan Strait continue to increase and U.S. officials start to admit that Beijing wants to have the military ability to invade Taiwan by 2027, there’s a risk that TSMC’s business could go down in flames in the following decade if the worst-case scenario materializes.

In addition to that, TSMC’s business could already be negatively affected in the upcoming quarters if the U.S. strengthens its export restrictions on chips and chipmaking tools to China. As of 2023, TSMC has been generating 12% of its revenues in China, and there’s a risk that the sales there will be declining if trade tensions continue to increase. On top of that, TSMC’s clients like Nvidia have already admitted that their sales in China have significantly declined recently due to the export restrictions. While Nvidia was able to offset the China-related losses thanks to the rising demand for its chips elsewhere, it’s unlikely that it will be able to do so all the time. This could also have an indirect negative impact on TSMC in the future.

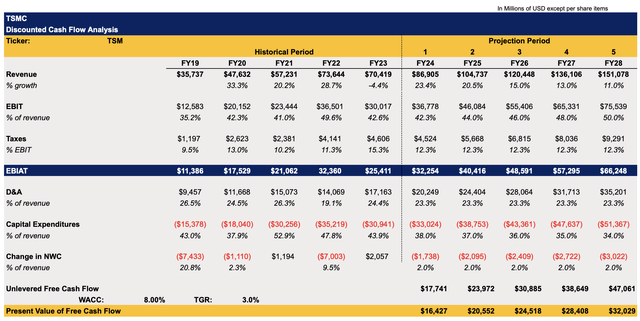

Considering all of this, it all comes down to whether the growth opportunities outweigh the risks to justify a long position in TSMC at the current price. To answer that question, I decided to create a DCF model that can be seen below. The revenue assumptions in my model closely correlate with the street expectations for the next two years. It’s not unrealistic to believe that the top-line growth rate is likely to be over 20% given that the rising demand for AI chips is not slowing down significantly. After the next two years, the revenue growth rate is likely to stabilize, which is reflected in the model. The assumptions for all the other metrics closely correlate with TSMC’s historical performance. The terminal growth rate in the model is 3%, which closely aligns with the long-term GDP growth rate, while the WACC in the model is 8%, which is close to the market’s average cost of capital rate.

TSMC’s DCF Model (Historical Data: Seeking Alpha, Assumptions: Author)

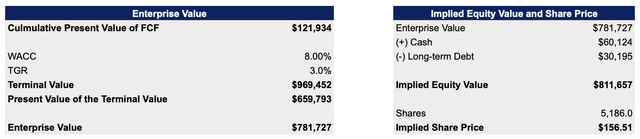

The model shows that TSMC’s fair value is $156.51 per share, which represents a downside of ~9% from the current market price.

TSMC’s DCF Model (Historical Data: Seeking Alpha, Assumptions: Author)

My model shows that TSMC is likely to be overvalued at this stage, and its shares have a minimal margin of safety to justify opening a long position at the current price. Seeking Alpha’s Quant system also gives the company a rating of ‘D’ for valuation, which makes me believe that it’s best to wait for a potential major pullback before opening a long position.

The Bottom Line

TSMC is a great company that has everything going for it to meet its fiscal goals this year. However, at the current price, it seems that its shares have a minimal margin of safety and offer no upside, especially if we consider all of the geopolitical risks that will haunt the company for years to come.

While there’s always a possibility that the demand for AI chips will accelerate in the following quarters and lead to the upward revision of assumptions and a higher valuation, I believe that at the current price, the risks outweigh the growth opportunities. That’s why, in my opinion, it’s better to wait for a potential pullback before accumulating a long position in the company.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of NVDA either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Bohdan Kucheriavyi is not a financial/investment advisor, broker, or dealer. He's solely sharing personal experience and opinion; therefore, all strategies, tips, suggestions, and recommendations shared are solely for informational purposes. There are risks associated with investing in securities. Investing in stocks, bonds, options, exchange-traded funds, mutual funds, and money market funds involves the risk of loss. Loss of principal is possible. Some high-risk investments may use leverage, which will accentuate gains & losses. Foreign investing involves special risks, including greater volatility and political, economic, and currency risks and differences in accounting methods. A security’s or a firm’s past investment performance is not a guarantee or predictor of future investment performance.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.