Summary:

- TSMC’s $530.6 million acquisition of Innolux Corp’s Tainan plant aims to double CoWoS capacity by 2025, addressing AI chip demand.

- 2024 CapEx of $30-$32 billion, with 70-80% for advanced technologies, underscores its commitment to AI, HPC, and 5G market leadership.

- TSMC’s 28% foundry market share (2023) reflects its leadership in advanced technologies, which is expected to increase with continued innovation and capacity expansion.

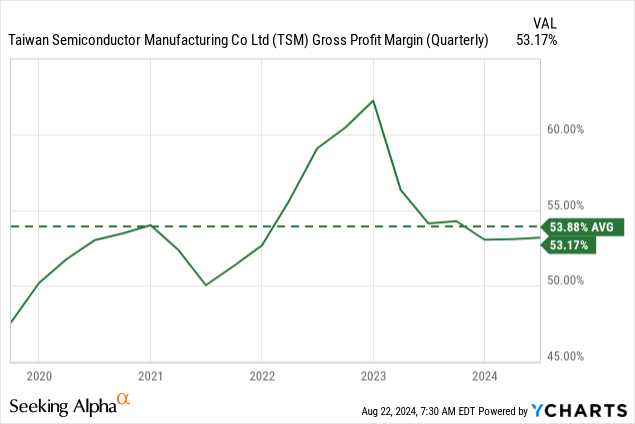

- 53.2% Q2 2024 gross margin faces pressure from N3 technology ramp-up and rising electricity costs, despite strong revenue growth.

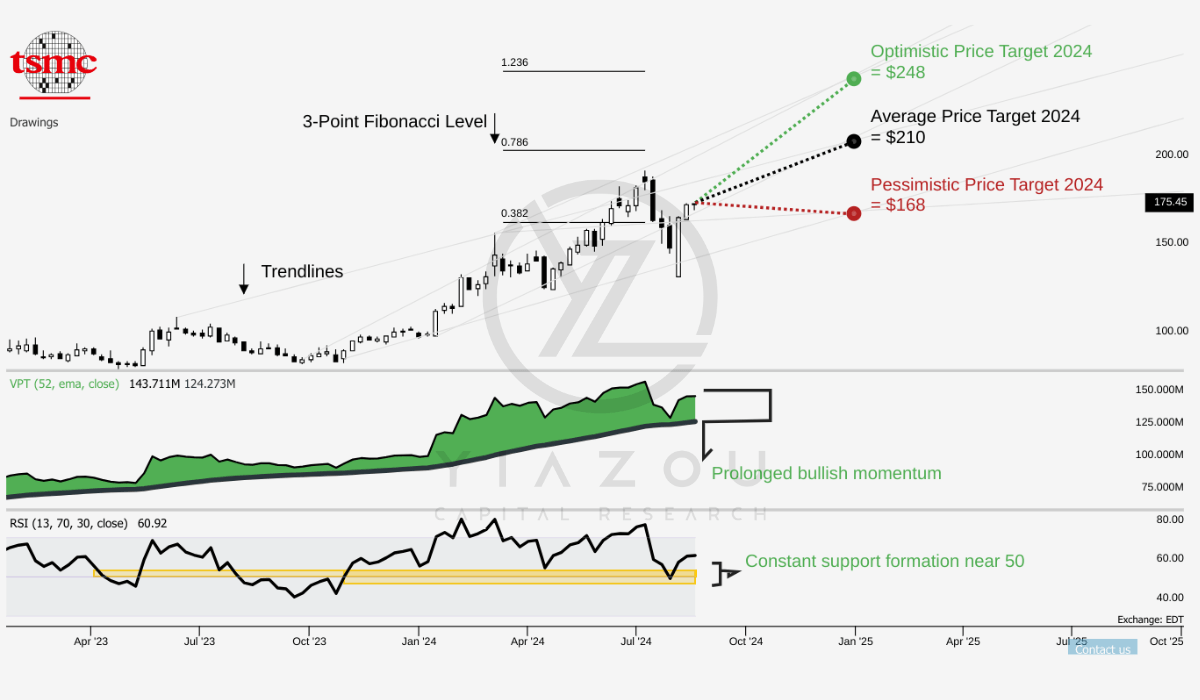

- TSMC’s stock, priced at $175, shows strong upward potential with a 2024 price target of $210, supported by bullish technical indicators.

redstallion/iStock via Getty Images

Investment Thesis

Following our May coverage of TSMC (NYSE:TSM), the stock quickly climbed close to our initial target price of $185, doing so sooner than expected. Based on TSMC’s leading revenue growth and strong positioning in core markets, we are revising our target price upward to $210.

Key growth drivers include TSMC’s leadership in advanced technologies such as AI and high-performance computing (HPC). Its ability to make strategic acquisitions also solidified its market leadership and put it in good stead to continue capturing greater demand for advanced chip solutions.

The company strongly emphasizes the latest cutting-edge solutions for the rapidly growing AI and HPC markets, making it one of the largest beneficiaries of global trends in the digital transformation space. Therefore, we reaffirm our buy rating on TSM based on solid market leadership and robust fundamentals.

Fibonacci Levels and Bullish Signals Point to $210+ potential in 2024

TSMC’s stock, at its current price of $175, has upward solid potential. The average price target for 2024, set at $210, aligns closely with the 0.786 3-point Fibonacci retracement level, indicating a potentially strong resistance point that could act as a target for medium-term gains. The optimistic price target of $248 matches the 1.236 Fibonacci extension, reflecting the upper bound of potential gains if bullish momentum continues.

Conversely, the pessimistic price target of $168 aligns with the 0.382 Fibonacci level, suggesting a possible support level should bearish conditions prevail. The Relative Strength Index (RSI) at 60.92 indicates moderate bullish momentum, with the line trend showing a reversal upwards. The presence of bullish divergence reinforces the likelihood of a continued upward trend. The RSI’s alignment with a touchdown-long setup around the 50 mark suggests that recent lows may serve as a solid support base for further gains.

The Volume Price Trend (VPT) also exhibits a positive reversal, with the VPT line trending upwards at 140.80 million, surpassing its moving average of 133.49 million. This volume increase supports growing investor confidence, potentially driving prices higher. Based on this trend, the long setup will emerge by a touchdown on the VPT moving average. This further supports the notion of a bullish technical outlook.

Finally, considering the monthly seasonality pattern, with a 56% probability of positive returns in August, the technical indicators suggest a favorable environment for potential gains in the near term.

Yiazou (trendspider.com)

Strategic $530.6M Acquisition of Innolux Plant: A Game-Changer for AI Chip Production

TSMC has acquired Innolux Corp’s Tainan flat-panel display plant for $530.6 million. This fundamental value-creating strategic move aligns with TSMC’s response to the growing demand for AI chips by scaling its core operations to capture market demand (at maximum). TSMC may overcome supply restrictions in advanced packaging by repurposing the facility to expand its chip-on-wafer-on-substrate (CoWoS) capabilities. This was a bottleneck under the booming demand for AI-related core technologies.

Moreover, the investment may double its CoWoS capacity by the end of 2025. The necessity for such expansion is rooted in the demand for AI chips, which has placed unprecedented pressure on TSMC’s existing packaging capacities. The expansion of CoWoS capability reflects a focused strategy to capture the market growth presented by AI and High-Performance Computing (HPC) markets that require advanced packaging solutions.

Further, the acquisition also reflects TSMC’s vertical integration strategy to gain control over more stages of the semiconductor manufacturing process. This move may improve margins (in the long run) by reducing TSMC’s reliance on third parties for advanced packaging. TSMC being an AI tech supplier, the investment may derive high business returns, considering that the AI market may grow exponentially.

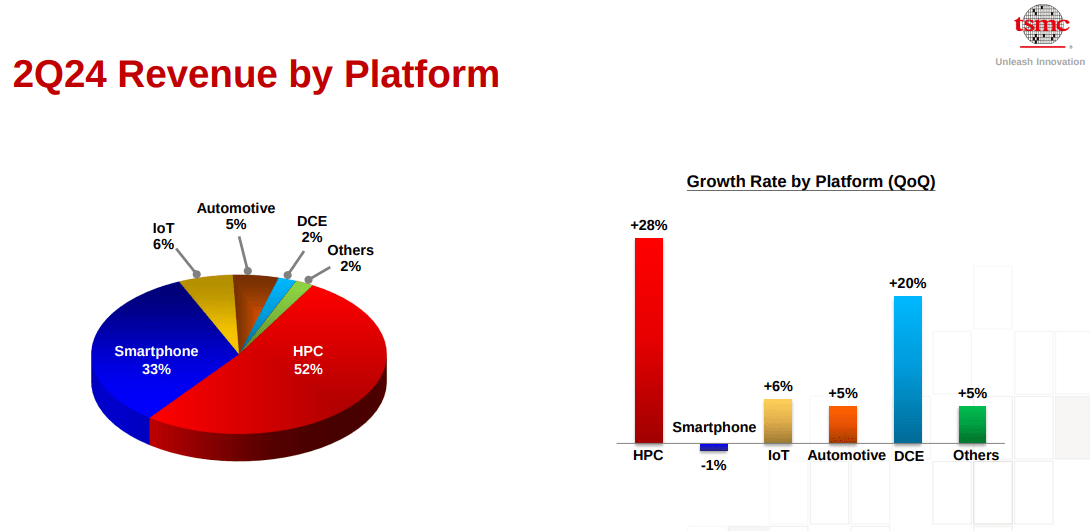

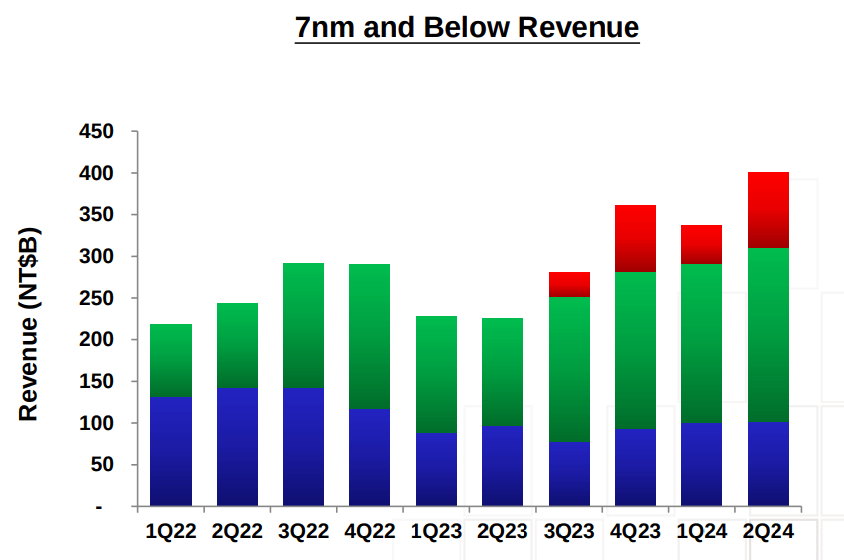

TSMC 2Q24 Presentation

TSMC’s $30B CapEx Strategy: Powering AI, HPC, and 5G Growth in 2024

TSMC’s CapEx plans for 2024 focus on achieving long-term growth through strategic investments in advanced tech. The company has narrowed its CapEx range to $30-$32 billion. Within that, 70- 80% of CapEx is allocated for advanced process technologies. Further, 10-20% of CapEx is allocated for specialty technologies, and another 10% is assigned for advanced packaging, testing, and mask making. This configuration reflects a sharp approach to production capacity building.

Additionally, TSMC’s CapEx strategy expands production capacity and boosts its specific tech capabilities to capitalize on the growing demand for AI, HPC, and 5G applications. This approach ensures that TSMC can deliver its clients the most advanced semiconductors and packaging solutions.

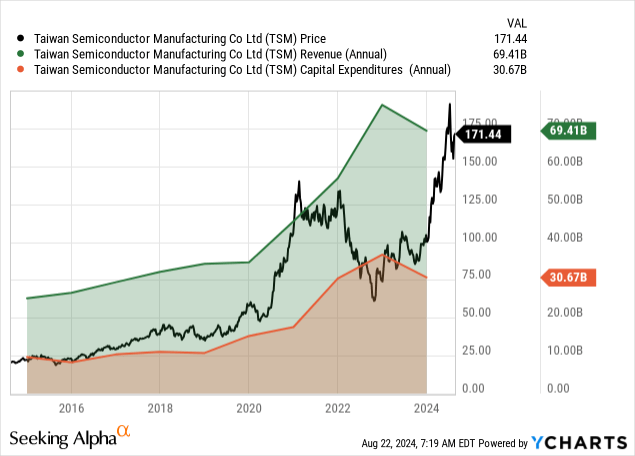

Moreover, the high correlation between high CapEx and stock value growth can be observed in TSMC’s price performance. The company’s previous investments in advanced technologies (5N and 3N) have consistently resulted in higher revenues and market share in subsequent years.

For instance, TSMC’s CapEx strategy has led to ongoing investment in 3-nanometer (N3) and 5-nanometer (N5) technologies, which are now major revenue contributors (15% and 35%). This pattern may continue as the current investments will generate top-line growth in line with accelerating demand for AI and HPC technologies.

As a result of the CapEx strategy, TSMC’s lead semiconductor foundry market may support its growth potential and broad customer base. Under the new Foundry 2.0, the company’s market share stood at 28% in 2023 and may increase further in 2024. The Foundry 2.0 definition includes packaging, testing, mask making, and other advanced backend services that will benefit from the acquisition of the plant.

N3 Ramp-Up Fuels Demand, But Margin Pressures Threaten Profitability

TSMC’s Q2 2024 performance indicates strong demand for its industry-leading N3 and N5 technologies. However, ramping up these advanced technologies has introduced margin pressure that could block rapid growth. The Q2 gross margin of 53.2% represents a modest sequential increase of 0.1%. However, this improvement is partly offset by the margin dilution from the ramp-up of N3 technology.

The transition to N3 and the associated costs, which include N5 to N3 tool conversion and higher electricity prices in Taiwan, have added to the cost structure. While the gross margin may increase to 54.5% in Q3, the continued margin dilution from the N3 ramp poses a risk to sustaining high profitability.

The margin impact is observable numerically when considering that the advanced technology segment (7-nanometer and below) accounts for 67% of TSMC’s wafer revenue. The transition to newer nodes is crucial for maintaining technological leadership, but comes with higher costs.

Notably, the N3 technology alone may introduce significant CapExes, further straining margins. The relationship between CapExes and margins is critical here. Most of TSMC’s 2024 capital budget focuses on advanced process technologies like N3. This high level of capital investment could limit short-term profitability with downward pressure on margins.

Furthermore, the high electricity costs in Taiwan add another layer of margin pressure. As TSMC expands its manufacturing footprint in regions with higher operational costs (EU and US), its ability to maintain its margins will be challenged. The rising process complexity, leading-edge technology costs, and regional cost disparities could result in lower-than-expected profitability, even if revenue growth remains strong. This can be observed in the pattern of a drop in gross margin below the long-term average, even if N3 revenues are materializing.

TSMC 2Q24 Presentation

Takeaway

Strategic acquisitions and investments in advanced technologies bolster TSMC’s growth potential. However, margin pressures from ramping up advanced technologies like N3 remain challenging to watch closely. Despite this, TSMC’s positioning in the rapidly expanding AI and HPC sectors continues to drive a positive outlook.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of TSM either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.