Summary:

- AT&T has had a phenomenal last 12 months, handily beating the S&P 500’s performance on a total return basis.

- The company has worked diligently to reduce its debt burden, with more to come in the future.

- Despite a strong 12 months, the stock remains relatively inexpensive on a forward earnings basis.

jetcityimage

A Brighter Day?

We first covered AT&T (NYSE:T) on July 18, 2023 (you can read that article here). At the time, we were optimistic about AT&T’s ability to perform better than what the swirl of negative headlines around them would indicate. As luck would have it, the day we published the article was the same day the stock tagged a 20-year low of $13.43.

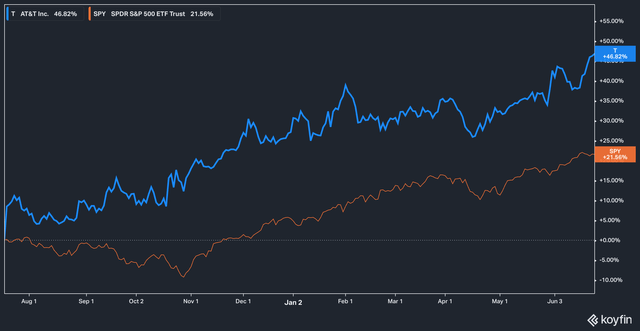

T vs SPY since July 18, 2023 (Koyfin)

On a total return basis, AT&T has handily beaten the broader S&P 500 (SPY), delivering a 46% return against the index’s 12%.

To top things off, the company reported the results of its earnings on April 24th, and they were generally good–free cash flow increased year over year from $1 billion 1Q23 to $3.1 billion in 1Q24, for example.

But is the telecom giant really out of the woods, or is the stock’s recent performance a rally that can’t be trusted?

Let’s dive in.

Debt Is Becoming Less Of A Problem

The looming mountain of debt on AT&T’s balance sheet has long been a problem for investors, who wonder how the company can balance its legendary dividend against interest payments. What made this concern all the more real was that, for a long time, a majority of the debt was variable rate. Management largely rectified the problem of variable rate debt last year, stating in the Q1 2023 earnings call that “more than 95% of our debt is now fixed at an average rate of 4.1%.”

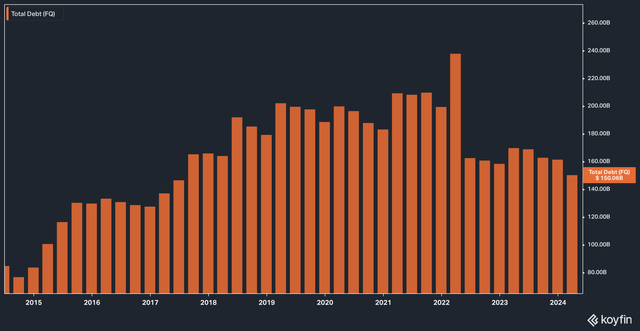

The company has also worked to bring down its total debt overall from its dizzying highs:

AT&T Total Debt (Quarterly) (Koyfin)

After seeing total debt peak in March 2022 at $237 billion, management has been successful in lowering this figure to more palatable levels (relatively speaking). After ending 2023 with $161 billion in net debt, AT&T closed with first quarter with that number lowered to $150 billion, a level not seen since 2017.

Management highlighted this point in the latest quarterly earnings call, with CEO John Stankey stating that

Our strong free cash flow has also enabled us to pay down debt. We finished the first quarter with net debt to adjusted EBITDA of 2.9x and continue to expect to reach our target in the 2.5x range in the first half of 2025. So it’s clear we’re operating well against our business priorities.”

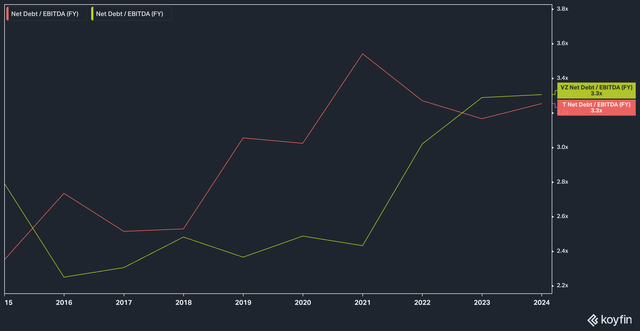

Of course, we have to point out that Stankey utilizes adjusted EBITDA, which tends to skew things a bit more positive. While the company’s net debt/EBITDA isn’t the greatest it’s ever been, it is not in an inordinately bad place. To this point, AT&T’s net debt/EBITDA currently sits beneath that of its competitor, Verizon (VZ).

T vs VZ, Net Debt / EBITDA (Koyfin)

Importantly, the company also reduced its vendor and direct supplier financing obligations “by about $2.3 billion during the quarter”, according to CFO Pascal Desroches. When companies engage in large vendor and supplier financing programs, the result oftentimes ends up being a bunch of debt more or less hidden away on the balance sheet, so reducing this amount is an encouraging sign that management means what they say about de-leveraging the business.

Business Outlook

AT&T runs in three primary business segments. Mobility encompasses the company’s wireless service and equipment. The Business Wireline unit ethernet-based broadband as well as VOIP services (among other things) to enterprise customers. Finally, Consumer Wireline provides broadband services to residential homes as well as the traditional legacy telephone service (yes, you can still get a phone that plugs into your wall).

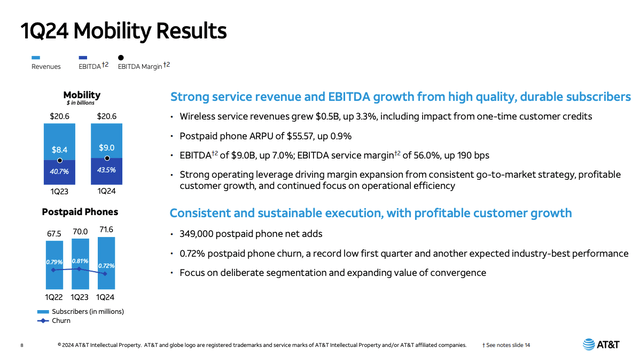

The three business segments above are listed in order of magnitude of revenue they generate, with Mobility bringing in $20.6 billion for 1Q24, Business Wireline producing $4.9 billion, and Consumer Wireline coming in at $3.4 billion for the same period.

It should go without saying, then, that Mobility is where the lion’s share of attention goes, as it should. And things, at the moment, seem to be going well.

AT&T Mobility Results, 1Q24 (Company Presentation)

The company was able to pull churn down in its postpaid phone subscriber base to the lowest level in three years–even below Verizon’s churn, according to AT&T’s investor presentation–and while the top line revenue numbers of $20.6 billion remained unchanged year over year, diving into the core of Mobility reveals that non-equipment wireless revenue growth was up by 4.4%, a figure which AT&T claims is at least 100 basis points higher than competitors T-Mobile and Verizon.

Valuation

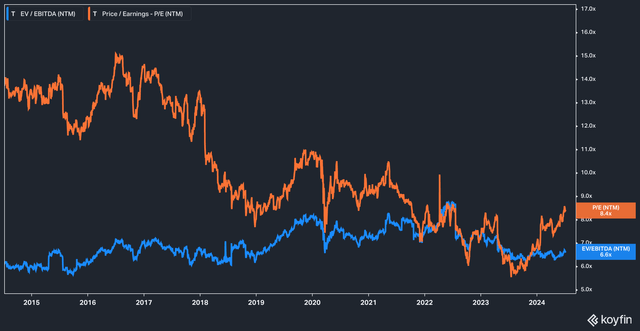

When we last wrote about AT&T, the company was trading at an absurd ~6x forward price to earnings (P/E) and ~6.5x EV/EBITDA. Today, the stock trades slightly higher, but not by much.

Today, AT&T stock trades at 8.4x forward earnings estimates, while its EV/EBITDA remains essentially unchanged over the last year. While we cannot say that AT&T will eventually reclaim the glory days where it commanded a forward P/E in the low- to mid-teens, we think that the current valuation is attractive based on management’s execution over the past year.

Risks

Risks to our thesis include any further consolidation in the telecom industry (which, to be fair, seems quite unlikely at this point), as well as higher-for-longer interest rates, which could offer investors a more attractive yield without the volatility of an underlying stock. On the revenue front, any contraction in the economy could cause business customers to pull back from spending.

The Bottom Line

Overall, we think AT&T stock remains attractive given the strong business performance, the continued paying down of debt, and execution by management. For a long time, the popular opinion was to look down on AT&T and its stock, and for a long time, there was some merit to that approach. We think that, for the reasons stated above, that day is behind us.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

The content in this article is for informational, educational, and entertainment purposes only. This content is not investment advice, and individuals should conduct their own due diligence before investing. The author is not suggesting any investment recommendations—buy, sell, or otherwise. This article is not an investment research report but a reflection of the author’s opinion and own investment decisions based on the author’s best judgement at the time of writing and are subject to change without notice. The author does not provide personal or individualized investment advice or information tailored to the needs of any particular reader. Readers are responsible for their own investment decisions and should consult with their financial advisor before making any investment decisions. No statement or expression of opinion, or any other matter herein, directly or indirectly, is an offer or the solicitation of an offer to buy or sell the securities or financial instruments mentioned. Any projections, market outlooks, or estimates herein are forward-looking statements based upon certain assumptions that should not be construed as indicative of actual events that will occur. Any analysis presented is based on incomplete information, and is limited in scope and accuracy. The information and data in this article are obtained from sources believed to be reliable, but their accuracy and completeness are not guaranteed. The author expressly disclaims all liability for errors and omissions in the service and for the use or interpretation by others of information contained herein.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.