Summary:

- Mastercard’s acquisition of Recorded Future enhances cybersecurity capabilities, leveraging AI to mitigate risks and drive synergies, expected to close by Q1 2025.

- The Payment Passkey Service, piloted in India, aims to streamline online shopping with biometric authentication, reducing fraud and enhancing security.

- Mastercard outperforms Visa in revenue growth, maintains high EBITDA margins, and rewards shareholders with dividends and share repurchases.

- Despite a higher EV/EBITDA multiple than Visa, Mastercard’s dynamic growth and profitability justify a ‘buy’ rating, with potential for further multiple expansion.

yalcinsonat1

Brief Intro

I’ve recently covered Mastercard (NYSE:MA). I apologise to investors who are unacquainted with the business. I wouldn’t like to prolong this coverage by repetitively introducing MA. Please refer to my previous article, when I presented a bullish case for Mastercard and assigned it a ‘buy’ rating if you are willing to get a bit more background on developing my views on MA. You can do that by clicking the link below:

Mastercard: On The Path To Leadership Position

As mentioned, I initiated a position in MA around a week after publishing the article. Since then, the share price has increased by ~6.8%. Naturally, I am not stating anything about the thesis panning out, as such a short period doesn’t give me confidence. I’m a long-term-oriented investor with a (mostly) buy-and-hold approach, so time will tell how this unravels further.

Nevertheless, I am happy to have initiated my position, and today, I’m revisiting my MA to provide you with three updates that will facilitate my previous thesis.

Update #1: Acquisition Of Top-Tier Cybersecurity Business

For clarity, the deal hasn’t been closed yet, as it’s still subject to regulatory review and closing procedures. In M&A (mergers and acquisitions, which is a fancy name for buying and selling companies), the transaction ‘finish’ is often divided into two separate dates – the ‘signing’ date and the ‘closing’ date.

Between both dates, some things have to occur before the transaction closes. The signing date comprises the signing of the (so-called) PSPA (preliminary share purchase agreement) that also includes conditions precedent (things that have to occur before the closing date). The list of such ‘things’ may include:

- Acquiring financing sources by the buyer.

- Receiving final investment committee approvals.

- Positive regulatory review (incl. antitrust approvals).

- Approvals from parties related to the target (financing providers, major suppliers or customers – they may have a change-of-control clause in their agreements).

Nevertheless, PSPA is a binding agreement, so there’s something to discuss, especially given the target company – Recorded Future, the largest threat intelligence business in the world with over 1900 clients operating globally (including business-to-business and business-to-government clients).

As presented in MA’s press release:

Recorded Future provides real-time visibility into potential threats by analyzing a broad set of data sources to provide insights that enable its customers to take action to mitigate risks. This ability, coupled with Recorded Future’s use of AI and other best-in-class technologies, will add to Mastercard’s identity, fraud prevention, real-time decisioning and cybersecurity services, bringing expanded threat intelligence capabilities to its network of merchants and financial institutions.

Given MA’s business model, it’s easy to comprehend how broad the synergistic effects can be. It’s worth mentioning that according to Statista, cybercrime is estimated to cost as much as $9.2T worldwide. That already overwhelming number is projected to increase by over 69% until 2029.

Both Mastercard and Recorded Future use AI to analyze billions of data points to identify potential threats, helping to protect people and businesses. Bringing these teams, technology and expertise together will enable the development of even more robust practices and drive greater synergies in cybersecurity and intelligence, reinforcing the Mastercard brand as a trust mark.

The transaction is expected to close by Q1 2025.

Update #2: Payment Passkey Service Will Launch Globally

Mastercard will first launch its Payment Passkey Service in India as a pilot, cooperating with some of the market’s most prominent players, including PayU, Juspay, Razorpay, and Axis Bank.

The solution is designed to improve the online shopping experience and reduce consumers’ exposure to phishing threats and other forms of online robbery. For instance, one-time passwords, which have been rising in popularity, are increasingly exposed to various scams, including phishing, SIM swapping, and message interception. In India alone (the debut country for MA’s solution), such fraud cases have recorded a scary 300% growth since 2022.

Mastercard is all about the security, time efficiency, and smoothness of the transaction processes:

Enter payment passkeys. They use device-based biometric authentication methods such as fingerprints or facial scans, but for an entirely new purpose: to streamline online shopping experiences. By replacing traditional passwords and OTPs, the Mastercard Payment Passkey Service makes transactions not only faster, but also more secure against fraud and scams. With payment passkeys, consumers can say goodbye to the hassle of forgetting or accidentally sharing their passwords or OTPs.

Should the pilot phase in India run smoothly, MA will expand its Payment Passkey Service worldwide.

Mastercard In Nutshell

Before we proceed to the summary section, let me briefly recap the key points about Mastercard’s value drivers and factors, which make it one of the top tech players I’ve ever investigated.

- Mastercard outperforms its largest competitor – Visa (V) in terms of revenue growth.

- MA delivered a dividend per share CAGR of 17.9% during the 2019-2023 period.

- Low debt maturities in the upcoming years, ensuring limited exposure to higher debt costs resulting from refinancing activities.

- Apart from substantial dividend payments (~$1.2B in Q1-Q2 2024), MA rewards its shareholders with significant share repurchases, which amounted to $4.8B in the same period.

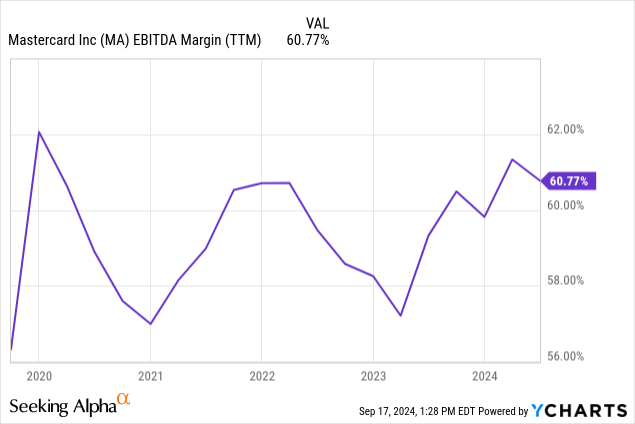

- Outstanding profitability supports MA’s business model, investment activity, and shareholder rewards. Mastercard achieves EBITDA margins as high as 55% to over 60%.

Valuation Outlook

The world would be perfect if we could always buy top-tier businesses at bottom-low prices. Unfortunately, this is rarely the case, and it certainly isn’t for MA.

As an M&A advisor, I usually rely on a multiple valuation method, a leading tool in transaction processes. This method allows for accessible and market-driven benchmarking. Numerous metrics are available for valuing a company, with EV/EBITDA being a rule of thumb for most sectors and transactions.

With that said, the forward-looking EV/EBITDA multiple stood at:

Since the last time I covered MA, its stock price has increased, driving its EV/EBITDA multiple higher. On a positive note, the valuation gap between Visa and Mastercard decreased slightly, as Visa recorded an even higher stock price increase.

Nevertheless, there’s no going around the fact that Visa is cheaper than MA and may constitute a more attractive opportunity from the valuation standpoint. However, given the higher growth dynamic of MA, a multiple premium is justified.

Despite recent increases, MA still has room for multiple expansion – as I previously indicated, I see its EV/EBITDA multiple reaching ~28x EV/EBITDA as a reasonable scenario.

Investment Thesis and Risk Factors

I am happy to uphold my previously assigned ‘buy’ rating for MA, as the Company features:

- Dynamic growth.

- Safe financing structure.

- Outstanding profitability resulting in substantial shareholder rewards.

- Technology-driven, cutting-edge business model facilitating a modern economy.

Mastercard is a perfect example of a business we seek at Cash Flow Venue. I was very pleased to read about their most recent initiatives, and given my M&A background – especially thrilled about the $2.65B deal announcement. I feel secure with my holding and may initiate further purchases.

Unfortunately, no stock investment is just sunshine and rainbows (salut to Rocky fans). There are also risk factors to consider:

- With a technology-driven business model accompanied by a strong brand factor – any technological, system, security, or PR failures will take a toll on MA’s position and its stock price volatility.

- Uncertainty around the interest rate environment and consumers’ strength, driving the payments volumes.

- Global geopolitical and economic tensions may limit MA’s expansion capabilities.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of V, MA either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

The information, opinions, and thoughts included in this article do not constitute an investment recommendation or any form of investment advice.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.