Summary:

- NVIDIA’s Blackwell GPUs are sold out, indicating robust demand for AI-boosting hardware, but AMD’s MI325x and upcoming MI350 series show promising value.

- Despite NVIDIA’s dominance, AMD’s technological advancements and potential for market share growth make it a compelling investment, especially with the AI revolution accelerating.

- AMD has historically been valued cheaper than NVIDIA, but its recent progress suggests it may experience solid growth driven by its latest MI environment.

- While I consider NVDA superior and hold a higher share, I rate AMD a ‘buy’ due to its noticeable progress and favorable AI market conditions.

BlackJack3D/E+ via Getty Images

There’s no denying that NVIDIA (NVDA) is the top player and the first business that comes to mind when talking about the AI revolution. That’s thanks to NVDA’s historical focus on graphic processing units (GPUs).

GPUs are highly effective in massive, repetitive, and parallel computing tasks. Originally invented to render images on display devices, they have proven themselves key components facilitating the ongoing AI revolution with their ability to handle high throughput.

Although NVDA offers the best GPU hardware for AI processing purposes, which was proved not only by its leading Hopper solutions but also by the recent sell-out of its Blackwell products, Advanced Micro Devices (NASDAQ:AMD) (NEOE:AMD:CA) seems to be overlooked.

Is NVIDIA’s Success With Blackwell Proves Robust Demand For AI-Boosting Hardware

As I’ve recently indicated in my recent coverage of NVDA: Nvidia Is Breaking The Bank With Blackwell. How so? Well, its latest architecture (Blackwell) which is set to launch soon had its products sold out, as mentioned by Data Center Dynamics.

According to Moore, the product rollout is on schedule and Nvidia’s Blackwell GPUs are “booked out 12 months,” meaning customers who have not yet placed an order with the company won’t receive any Blackwell products until late 2025.

Such a dynamic sell-out proves one thing for sure: the demand for AI-boosting hardware remains as strong as ever. I’ll dare to say more – it keeps on growing.

As a result, not every business will be able to get its hands on NVIDIA’s Blackwell solutions. Regardless of the pricing, shortages themselves should help AMD’s GPU sales. The question remains: is AMD competitive with NVDA?

AMD May Have Beaten Hopper But Blackwell Remains Ahead

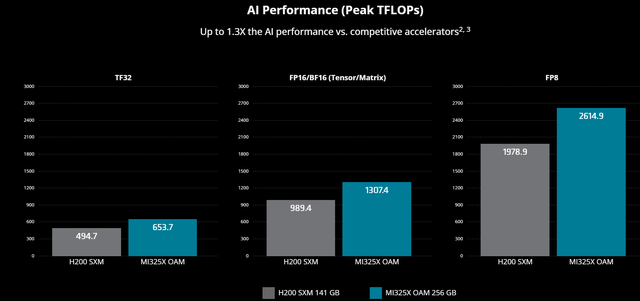

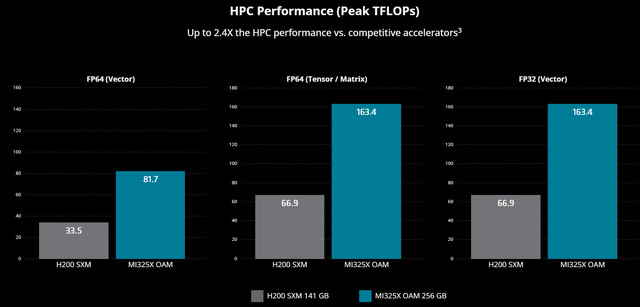

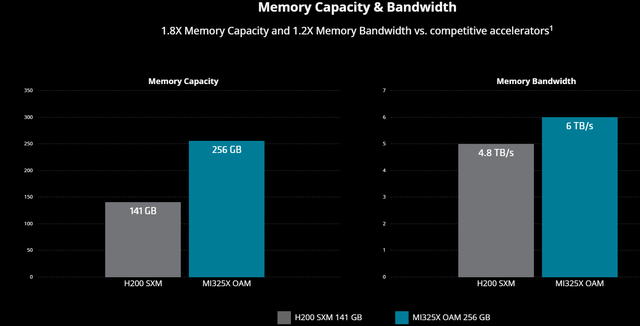

As AMD announced its upcoming MI325x, the company provided quite broad comparisons to one of the most prominent products in NVDA’s history: H200. There’s no denying that MI325x (which is set to production shipment this quarter):

AMD Instinct MI325X accelerators are currently on track for production shipments in Q4 2024 and are expected to have widespread system availability from a broad set of platform providers, including Dell Technologies, Eviden, Gigabyte, Hewlett Packard Enterprise, Lenovo, Supermicro and others starting in Q1 2025.

MI325x brings noticeable improvements over H200 in terms of computing power, high-performance computing, and memory capabilities.

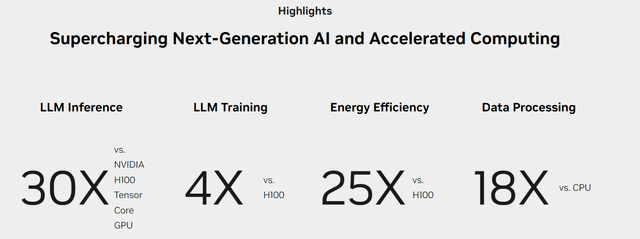

However, one has to remember that H200 isn’t NVDA’s most advanced solution, as new architecture has already not only been announced but sold out: Blackwell. While AMD hasn’t provided a direct comparison of either MI325 or MI350 to Blackwell, NVDA provided a comparison of Blackwell vs highly popular H100 (depicted in the picture below). The conclusion is that although AMD recorded a substantial improvement in its competitiveness in the data center computing space, it still lags behind NVDA’s most recent innovations:

The Nvidia H200 may be a stale comparison as it made its debut earlier this year. Nvidia’s newer more powerful Blackwell GPUs have just started reaching customers this quarter—and those are likely to far outperform AMD’s MI325X, which based on the same CDNA 3 microarchitecture as AMD’s older MI300X GPU.

The hope to reduce the gap between AMD and NVIDIA in terms of hardware relevance to the broad computing era lies in the recently previewed MI350:

Continuing its commitment to an annual roadmap cadence, AMD previewed the next-generation AMD Instinct MI350 series accelerators. Based on AMD CDNA 4 architecture, AMD Instinct MI350 series accelerators are designed to deliver a 35x improvement in inference performance compared to AMD CDNA 3-based accelerators.

The AMD Instinct MI350 series will continue to drive memory capacity leadership with up to 288GB of HBM3E memory per accelerator. The AMD Instinct MI350 series accelerators are on track to be available during the second half of 2025.

While MI350 is more likely to create direct competition with Blackwell, it remains a question whether NVIDIA will come up with another innovation by its launch. Competing with the leader is hard.

AI Revolution Is More Than Just A Story – I Encourage Skeptics To Review The Data

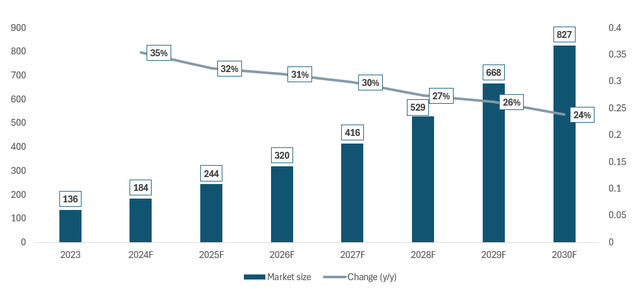

Statista’s research suggests that the global AI market size will record an overwhelming CAGR of 29.4% during the 2024-2030 period. Please review the chart below for details.

While such a dynamic forecast may be surprising or even doubtful for many investors, especially those accustomed to more stable industries, I don’t find them unlikely. I would rather guess that they underestimate the potential of AI market size rather than overestimate.

By no means am I an expert on technology, building LLMs, etc. I’m simply an enthusiast with a finance/business background. However, my research leads me to believe that the AI revolution is not only just a story but that it has also just begun.

Robust demand recorded by hardware providers like AMD, NVIDIA, etc. is one thing, but there’s another, even more important. The demand from end-users is reflected in the results and comments from the most prominent figures in the technological landscape, including the likes of Microsoft (MSFT) and Amazon (AMZN).

Within my coverage of Microsoft, I quoted some of the remarks shared during the last Earnings Call of the Company that paint a clear picture of the increasing adoption of its AI-driven Copilot for Microsoft 365:

Now, on to future of work. Copilot for Microsoft 365 is becoming a daily habit for knowledge workers, as it transforms work, workflow, and work artifacts. The number of people who use Copilot daily at work nearly doubled quarter-over-quarter, as they use it to complete tasks faster, hold more effective meetings, and automate business workflows and processes.

Copilot customers increased more than 60% quarter-over-quarter. Feedback has been positive, with majority of enterprise customers coming back to purchase more seats. All-up, the number of customers with more than 10,000 seats more than doubled quarter-over-quarter, including Capital Group, Disney, Dow, Kyndryl, Novartis. And EY alone will deploy Copilot to 150,000 of its employees.

That’s just one of many examples of the increasingly popular adoption of AI-based tools, which need sufficient computing power to facilitate. That’s where the demand for AI-boosting hardware is built.

Valuation Outlook

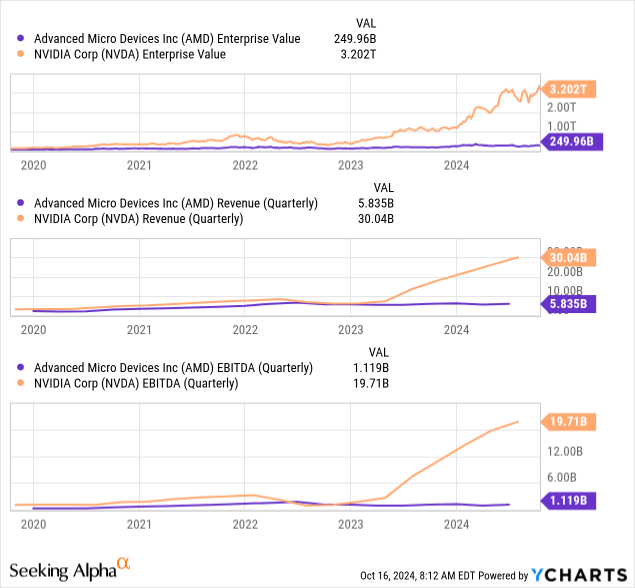

When we compare the performance of NVDA and AMD in terms of the development of their Enterprise Values, business scale, and EBITDA, we arrive at a simple and evident conclusion: NVIDIA outperformed drastically.

However, past performance is not indicative of future results. That’s worth remembering. Two years after the ChatGPT release and the adoption of generative AI tools in global awareness, AI-related investments and demand keep on increasing.

When combining:

- Blackwell shortages experienced by NVDA

- the increasing technological sophistication of AMD’s solutions (despite lagging behind Blackwell)

I believe it’s fair to assume that AMD may experience solid growth driven by its latest MI environment.

As an M&A advisor (fancy name for advising on buying and selling businesses), I usually rely on a multiple valuation method that is a leading tool in transaction processes, as it allows for accessible and market-driven benchmarking.

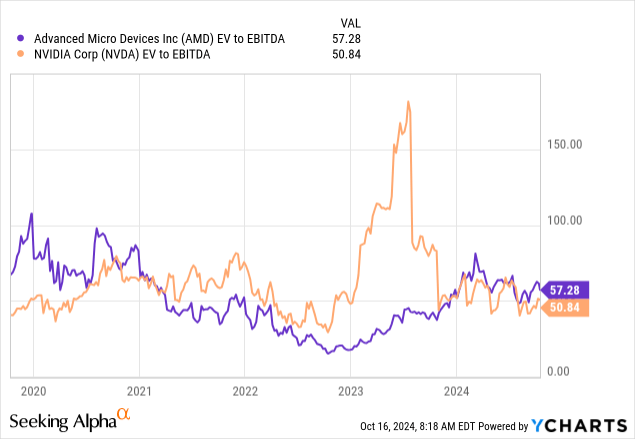

During the last five years, AMD tended to be valued cheaper than NVDA (based on the EV/EBITDA multiple). Currently, their forward-looking EV/EBITDA stands at:

Please keep in mind that we take valuation multiples into account, not stock prices, as they don’t include the impact of changes in the capital structure or scale of the business. NVDA’s multiple was usually higher but the Company kept growing in its valuation. So did AMD, but its Enterprise Value growth has outpaced EBITDA growth recently.

I believe that’s set to change and AMD will grow in its valuation given its meaningful technological progress.

Investment Thesis and Risk Factors

For transparency, I own both AMD and NVDA. NVDA has a higher share in my portfolio than AMD, and I don’t intend to change that, as I consider NVDA superior. However, the market seems to be sleeping on AMD’s noticeable progress and the fact that despite lagging behind NVDA, the company still has plenty of room to enhance its market position and grow market share in this dominated niche.

The ongoing AI revolution is not going anywhere. On the contrary, I believe it’s set to accelerate, providing a favorable environment for the likes of AMD to capitalize on. The entry point from the valuation standpoint isn’t perfect (naturally), but I still consider AMD a ‘buy’ and believe it will benefit its shareholders. Many state that AMD is just a non-relevant player in NVDA’s shadow, but I disagree with that.

Regardless of my ‘buy’ rating, one should prepare proprietary research, as there are risk factors to consider in the case of AMD:

- stock price volatility

- susceptibility to geopolitical tensions and political decisions

- susceptibility to the state of the economy

- highly competitive market with a clear leader (NVDA) that AMD still can’t catch up to on the technological level

Analyst’s Disclosure: I/we have a beneficial long position in the shares of MSFT, AMZN, AMD, NVDA either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

The information, opinions, and thoughts included in this article do not constitute an investment recommendation or any form of investment advice.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.