Summary:

- Despite exceeding second-quarter revenue and earnings guidance, the stock price pulled back due to slowing revenue growth and delayed introduction of the Blackwell AI chip.

- Nvidia Corporation is diversifying beyond hardware into software and services, like NIM and AI Foundry, to sustain long-term growth and profitability amidst increasing competition.

- My previous hold recommendation for Nvidia was accurate, as investor sentiment recently turned sour due to fears of an AI infrastructure bubble popping and slowing revenue growth.

- The stock’s valuation remains high, with significant regulatory risks and competitive pressures, which is why I maintain a hold recommendation despite its strategic moves into software and services.

JHVEPhoto

I last wrote about Nvidia Corporation (NVDA) on July 08, 2024, and gave it a Hold recommendation because its valuation did not justify its stock price. I also said the following in that article:

If the company disappoints in the slightest, positive sentiment surrounding it could quickly evaporate. Therefore, most prudent investors would be better off not buying NVIDIA today.

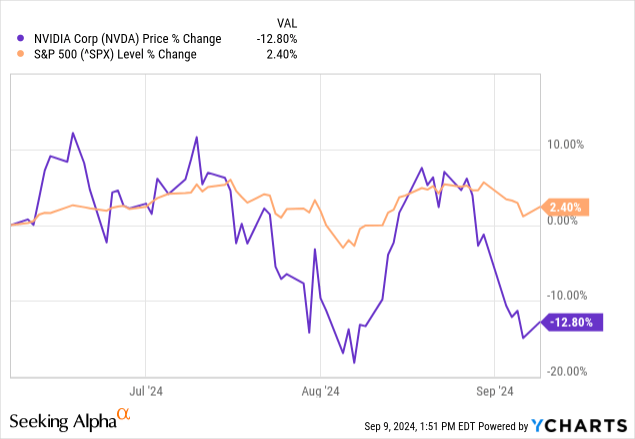

That assessment turned out to be accurate over the last three months. Investor sentiment has turned sour towards AI infrastructure stocks, fearing the sector may be in a bubble. Although the company’s second-quarter fiscal year (FY) 2025 report exceeded analysts’ revenue and earnings guidance, Wall Street was disappointed to see revenue growth slow. Additionally, investors don’t like hearing the news that the company may delay the introduction of its new Blackwell AI chip, causing the company to issue lower-than-expected third-quarter guidance. Since my last article, the stock is down 17.11% compared to the S&P 500’s (SPX) loss of 1.73%.

This article will discuss how the company plans to sustain its long-term revenue growth and profitability and its latest earnings report. It will also examine several risks, its valuation, and why I maintain my hold recommendation.

Maintaining long-term growth and profitability

Nvidia is becoming more than just a hardware company. Management likely realizes that selling hardware uses a one-time sales model, involving a constant effort to sell the newest AI chip and associated hardware to generate revenue. Today, that model works because the company dominates the AI chip and networking industry. Demand for AI chips also exceeded supply at the beginning of this AI era. However, that may no longer be the case five years or a decade from now.

Advanced Micro Devices (AMD) is beginning to provide a serious alternative to Nvidia’s AI accelerators on both the training and inferencing sides. The AI market is also starting to shift from training to inferencing. Nvidia has far more competition on the inferencing side of AI, including Broadcom (AVGO), Qualcomm (QCOM), Habana Labs under Intel (INTC), a whole slew of AI hardware start-ups, and its cloud customers developing their own AI inference chips. At some point, competition in the AI hardware market could commoditize the industry and reduce Nvidia’s margins if it remained only a hardware company.

Nvidia guards against that possibility by attaching various software and services to its hardware, similar to how Apple (AAPL) has attached many services to the iPhone. One Seeking Alpha analyst recently briefly discussed the importance of one of the company’s software initiatives, Nvidia Inference Microservices (NIM). Chief Financial Officer (CFO) Colette Kress discussed NIM on Nvidia’s second quarter FY 2025 earnings call (emphasis added):

Nvidia NIM accelerate and simplify model deployment. Companies across healthcare, energy, financial services, retail, transportation, and telecommunications are adopting NIMs, including Aramco, Lowe’s, and Uber. AT&T realized 70% cost savings and 8 times latency reduction after moving into NIMs for generative AI, call transcription, and classification.

The first sentence in the above quote describes what NIM does for customers. If you read the technical definition of what NIM accomplishes for developers on the company’s website and are not in the tech industry, confusion about what NIM does and why companies may want it may abound. Let’s make things more understandable. Enterprises may not have the in-house expertise to train and deploy AI models effectively. So, NIM offers customers pre-trained AI models that customers can easily install in their existing computing architecture. The software improves the performance of AI applications and reduces the time and cost of an organization attempting to train and deploy AI models.

CFO Kress also discussed another service the company offers customers: Nvidia AI foundry service. She said the following on the second quarter earnings call:

During the quarter, we announced a new NVIDIA AI foundry service to supercharge generative AI for the world’s enterprises with Meta’s Llama 3.1, collection of models. This marks a watershed moment for enterprise AI. Companies for the first time can leverage the capabilities of an open-source frontier-level model to develop customized AI applications to encode their institutional knowledge into an AI flywheel to automate and accelerate their business. Accenture (ACN) is the first to adopt the new service to build custom Llama 3.1 models for both its own use and to assist clients seeking to deploy generative AI applications.

At first glance, it may seem to the non-techie that AI Foundry and NIM do the same thing, but that’s a false assumption. The AI Foundry service does a lot more than NIM. It helps enterprises develop custom AI models from the rooter to the tooter. In other words, AI Foundry assists the company’s developers create AI models for specific company needs, train those models, optimize the AI model to run faster and more efficiently, and deploy those models for use. NIM only helps customers deploy pre-existing models, which may be suitable for general needs but not specific needs unique to the customer. Nvidia hosts AI Foundry on DGX Cloud, available on Amazon’s (AMZN) AWS (Amazon Web Services), Alphabet’s (GOOGL, GOOG) GCP (Google Cloud Platform), Microsoft’s (MSFT) Azure, and Oracle’s (ORCL) OCI (Oracle Cloud Infrastructure).

On July 8, 2024, a Seeking Alpha analyst wrote a detailed explanation about AI Foundry and the DGX cloud in an article titled “Nvidia: Upside Potential Is Greater Than You May Think.” That whole explanation boils down to NVIDIA is establishing a SaaS (Software-as-a-Service) opportunity that, in 2023, the company estimated at $150 billion. A SaaS opportunity adds a recurring revenue model to its overall business, diversifying the company from only selling hardware in a one-time sales model. Investors often value a recurring revenue model more than a one-time sales model.

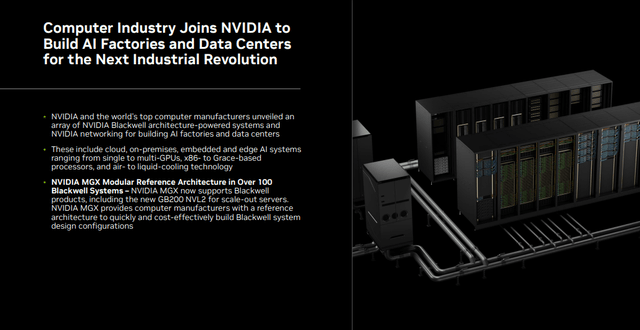

Last, Nvidia has aligned itself with several top computer manufacturers to build AI factories and data centers. The company issued a press release on June 2, 2024, that stated,

“During his COMPUTEX keynote, NVIDIA founder and CEO [Chief Executive Officer] Jensen Huang announced that ASRock Rack, ASUS, GIGABYTE, Ingrasys, Inventec, Pegatron, QCT, Supermicro, Wistron and Wiwynn will deliver cloud, on-premises, embedded and edge AI systems using NVIDIA GPUs and networking.”

NVIDIA Second Quarter FY 2025 Investor Presentation

The same press release quoted Super Micro Computer’s (SMCI) (Supermicro) CEO as saying,

“Our building-block architecture and rack-scale, liquid-cooling solutions, combined with our in-house engineering and global production capacity of 5,000 racks per month, enable us to quickly deliver a wide range of game-changing NVIDIA AI platform-based products to AI factories worldwide.”

I recently wrote about Supermicro, announcing that it was getting into the business of designing whole data centers with its Supermicro 4.0 DCBBS, Datacenter Building Block Solutions. If it is successful in that venture, Supermicro may become one of Nvidia’s most valued partners in designing and constructing an AI Factory data center from the ground up more rapidly than any other company.

Although Nvidia’s CEO didn’t mention Dell (DELL) at COMPUTEX, the Dell Nvidia AI factory concept could be another revenue growth driver. Dell describes its AI factory partnership with Nvidia on its website:

“The Dell AI Factory with NVIDIA is the industry’s first end-to-end AI enterprise solution integrating Dell’s compute, storage, client device, software, and services capabilities with NVIDIA’s advanced AI infrastructure and software suite, all underpinned by a high-speed networking fabric.”

Company fundamentals

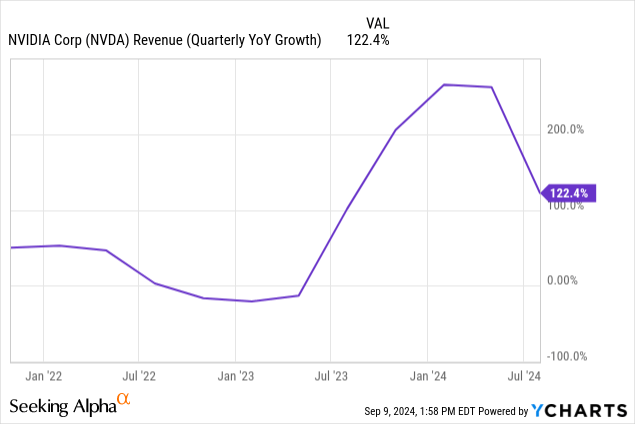

Nvidia’s total revenue increased by 122.4% over the previous year’s comparable quarter to $30.04 billion. Although triple-digit revenue growth is impressive in today’s economy, the chart below shows revenue growth decelerating—a trend investors hate to see.

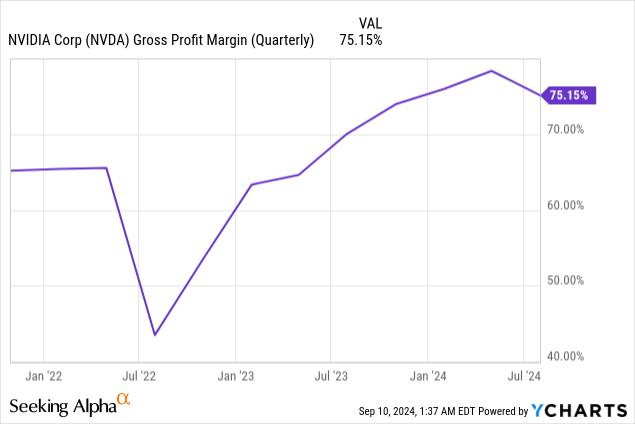

Nvidia’s GAAP (Generally Accepted Accounting Principles) gross margin dropped from 78.9% in the first quarter of FY 2025 to 75.15% in the second quarter, the first sequential decline since the introduction of ChatGPT in late November 2022. The CFO also explained why gross margins were down on the earnings call (emphasis added):

“[Gross margins were] down sequentially due to a higher mix of new products within the data center and inventory provisions for low-yielding Blackwell material.”

Because newer data center hardware products can sometimes be pricier to produce until the company can optimize the manufacturing process, a larger mix of new products can sometimes lower the overall gross margin. Additionally, when semiconductor manufacturers introduce new chips into production, especially when using a new process, the number of functional chips per wafer is lower than expected until the company perfects the new chip manufacturing method.

When the CFO mentions Blackwell as low-yielding, the company’s gross margins are lower because the cost to manufacture each wafer remains the same. However, the company generates less revenue with fewer functional chips per wafer. Nvidia has apparently resolved this issue. The company’s second-quarter CFO Commentary states (emphasis added), “We executed a change to the Blackwell GPU mask to improve production yield.”

Investors must continue to monitor gross margins because there is another potential reason why gross margins could go lower. A declining gross margin could indicate the emergence of genuine competition in the market for AI accelerators. Advanced Micro Devices has started gaining traction with its new AI accelerator, the AMD MI300, the equivalent of an Nvidia H100 chip. Additionally, its cloud customers Amazon’s (AMZN) AWS, Alphabet’s (GOOGL, GOOG) GCP, and Microsoft’s (MSFT) Azure have developed their own AI chips. Furthermore, many AI startups with inference chips have emerged over the last ten years that may provide competition. Suppose Nvidia management maintains gross margins in the high 70s through higher pricing. In that case, there’s a genuine threat of losing market share as cloud customers rely more on their chips, and enterprises look for equivalent AI chips at lower prices from providers like AMD or Intel (INTC).

By slightly lowering its gross margins, Nvidia can increase its competitiveness and have a better chance of maintaining or improving its dominant market share. However, if gross margins ever steadily decline in the future, it may indicate a price war and the commoditization of the AI chip market.

The company’s operating expenses took a massive jump over last year. The company’s CFO Commentary stated:

GAAP [Generally Accepted Accounting Principles] operating expenses were up 48% from a year ago and up 12% sequentially, and non-GAAP operating expenses were up 52% from a year ago and up 12% sequentially. These increases were largely driven by compensation and benefits, reflecting growth in employees and compensation.

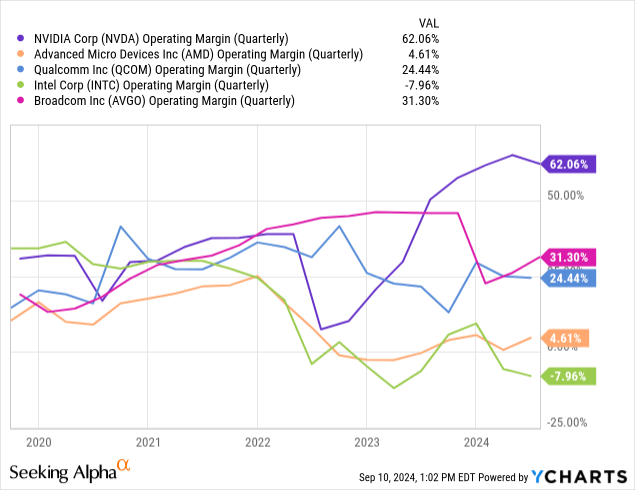

The AI infrastructure market is very competitive, and Nvidia likely needs to raise compensation to attract and retain quality talent. However, this increase in operating expenses and the lower gross margin likely helped reduce operating margins sequentially to 62.06%. Still, its operating margins are outstanding compared to competitors.

Nvidia’s GAAP diluted earnings-per-share increased by 168% year over year and 12% sequentially to $0.67, beating analysts’ consensus estimates by $0.06.

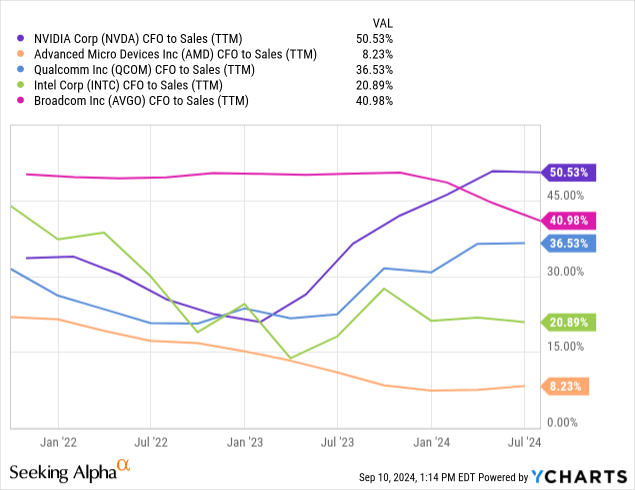

Nvidia produced an eye-popping TTM cash flow from operations (CFO) to sales of 50.53% in the second quarter, meaning the company produced fifty cents for every $1 of sales. No other hardware company comes close. If it can maintain a CFO to sales this high and a high revenue growth rate, it will portend great things for FCF.

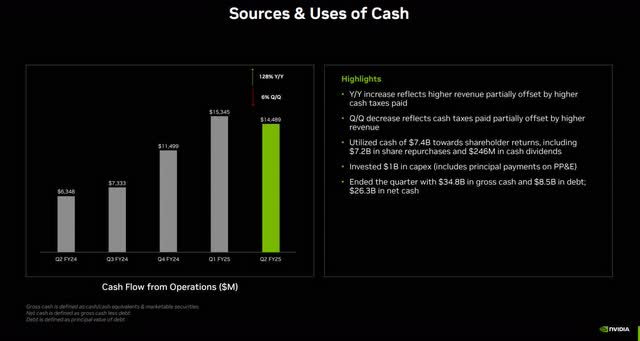

The following chart shows the company’s sources and uses of cash in the second quarter. Nvidia ended the second quarter of FY 2025 with $34.8 billion of cash and short-term investments, an increase of 18.8 billion over the previous year. It had $8.4 billion in long-term debt. The company has a debt-to-EBITDA ratio of 0.16. A number under one means Nvidia has more than enough cash flow to cover its outstanding debt. The company is in excellent financial condition.

NVIDIA Second Quarter FY 2025 Investor Presentation

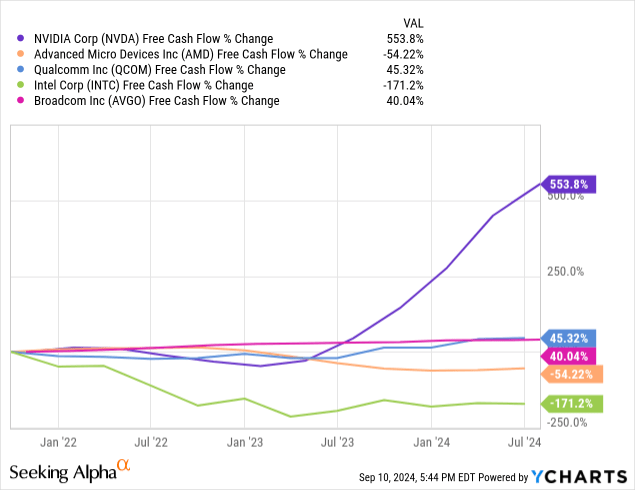

The following chart shows that since the AI era took off after the introduction of ChatGPT in late 2022, the company’s FCF has skyrocketed. The company’s FCF growth over the last year and a half is a prime reason investors value Nvidia higher than other AI hardware stocks. The company’s second quarter FY 2025 TTM FCF is 46.786 billion.

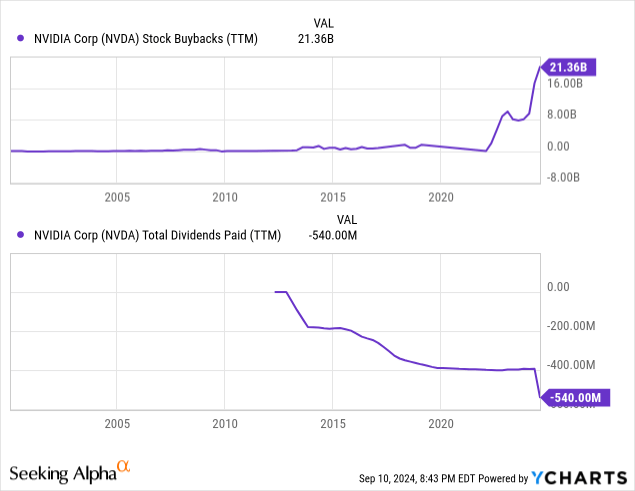

Over a TTM period, the company spent $21.36 billion on stock buybacks and $540 million in total dividends. The following chart shows that the company started share buybacks in 2022 and raised them substantially over the last year. It also raised, returning capital to shareholders via dividends in 2024 after several years at the $400 million level.

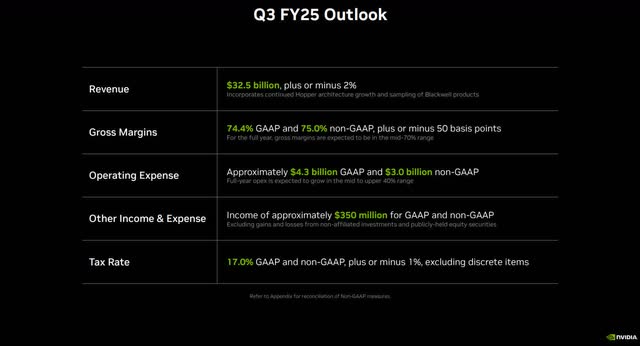

The following image shows the company’s guidance for the third quarter of FY 2025.

NVIDIA Second Quarter FY 2025 Investor Presentation

If the company hits third-quarter revenue guidance of $32.5 billion, revenue growth will be 79%, another sequential revenue decline. The market will often punish growth stocks with decelerating revenue growth. Third-quarter non-GAAP gross margin guidance of 75% was below the analyst consensus forecast of 75.5%. After seeing this disappointing guidance, the stock dropped 6.4% the day after earnings.

Significant risks

The company’s decelerating revenue and disappointing gross margin guidance exacerbated worries over whether the AI infrastructure market is in a bubble. Wall Street worries that all the investments that cloud companies and enterprises are making in AI infrastructure are not providing enough return on investment. Cloud companies and enterprises could potentially slow investments in AI, negatively impacting Nvidia.

Nvidia’s move into software and services may make the company’s revenue growth more sustainable over a more extended period. However, it makes government regulators nervous. They would rather not see one company dominate an industry as important as some believe AI can become. Today, the company is on the way to becoming the toll collector on every road to AI globally. So, there is a genuine risk that regulators globally will do things to impede Nvidia’s business, including breaking the company up.

Valuation

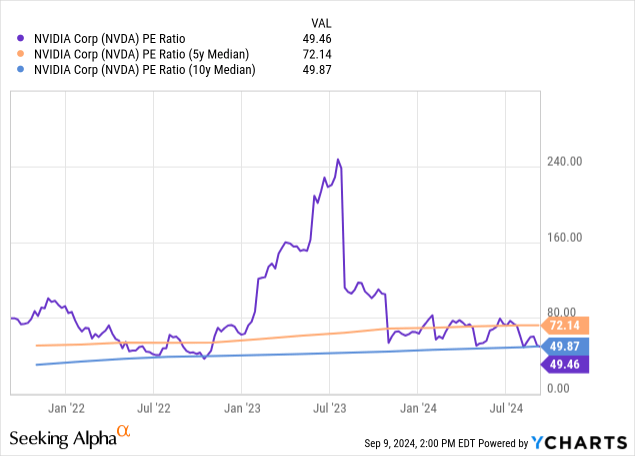

Nvidia’s TTM price-to-earnings (P/E) ratio is 49.46, well below its five-year median P/E but around even with its ten-year median. Some may consider the stock undervalued because it is well below its five-year median. Yet others may think it is fairly valued based on its being even with its ten-year median.

One flaw in assessing a stock by its TTM P/E is that it’s a backward-looking valuation method, and the market often values stocks based on what it believes will happen in the future. Nvidia has a forward Price/Earnings-to-Growth (PEG) ratio of 0.30 (FY 2025 forward P/E of 36.19 divided by FY 2025 analyst EPS estimated growth rate of 119.25%) and a one-year forward PEG ratio of 0.64 (FY 2026 forward P/E of 25.76 divided by FY 2026 analyst EPS estimated growth rate of 40.50%). A PEG ratio below one may indicate that the market undervalues analysts’ estimated earnings growth.

Suppose it trades at an FY 2025 PEG ratio of 1.0; the stock price would be $338.67, a 218% increase above its September 9 closing price of $106.47. If it trades at a one-year forward PEG ratio of 1.0, the stock price would be $161.60, a 51.77% rise above its September 9 closing price.

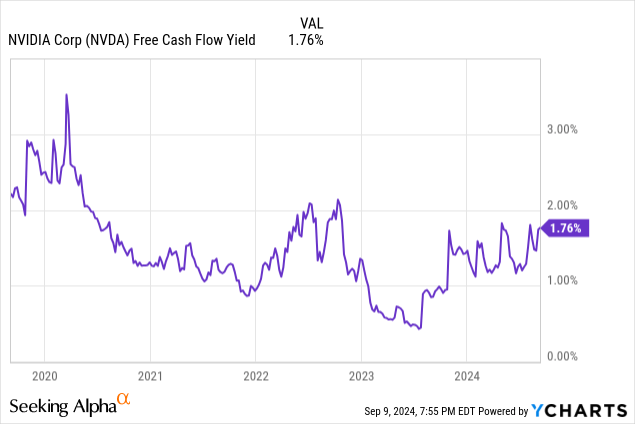

The chart below shows that Nvidia’s FCF yield is 1.76%. Based on how the stock has traded over the last five years, I believe the ideal time for more cautious value investors to buy it is when the FCF yield exceeds 2.0%. Value investors should consider selling when the FCF yield goes below 0.70%. In my opinion, the stock sells at a fair valuation based on a 1.76% yield, which means there is still a significant potential upside for aggressive growth investors. However, there is a genuine risk that the stock could continue to drop for more risk-averse investors.

Using a reverse discount cash flow (DCF) analysis, let’s analyze Nvidia. This DCF uses a terminal growth rate of 4% because the company should continue steadily growing its cash flow well above the market average after the ten-year analysis period. I use a discount rate of 10%, which is the opportunity cost of investing in Nvidia, to reflect a moderate risk level. This reverse DCF uses a levered FCF for the following analysis.

Reverse DCF

|

The first quarter of FY 2025 reported Free Cash Flow TTM (Trailing 12 months in millions) |

$46,786 |

| Terminal growth rate | 4% |

| Discount Rate | 10% |

| Years 1-10 growth rate | 19.5% |

| Stock Price (September 9, 2024, closing price) | $106.47 |

| Terminal FCF value | $288.954 billion |

| Discounted Terminal Value | $1856.736 billion |

| FCF margin | 48.58% |

If Nvidia can maintain a 49% FCF margin for the next ten years, the company must grow revenue by 19.5% annually to justify the September 9 closing price. Nvidia grew its revenue by around 31% over the last ten years. Revenue growth should slow from that pace over the next ten years. However, considering the potential size of Nvidia’s opportunity, which the company estimated at $1 trillion in 2023, and its current dominance in AI and general-purpose computing, the company may be able to grow revenue 20% annually over the next ten years. Still, that’s a very aggressive assumption.

Nvidia produced $96.31 of TTM revenue in the second quarter of FY 2025, meaning the company has already captured 9.63% of a $1 trillion opportunity. Suppose the company grows revenue at 20% annually for the next ten years; it will produce $594 billion in TTM revenue, or 59% of its current total addressable market. This calculation doesn’t factor in its estimated total addressable market (TAM) growing over the next ten years. However, Precedence Research forecasts that the global AI market will grow at a Compound Annual Growth Rate (CAGR) of 19.1% from 2024 to 2034 to reach $3.68 trillion. Suppose Nvidia’s revenue growth matches the estimated growth rate of the global AI market over the next ten years; it will produce $546.69 billion in annual revenue in 2034, or 14.9% of the global AI TAM in 2034, something that may be feasible.

The big issue is that Nvidia will likely encounter more competition in AI chips over the next ten years than today; it is unlikely to maintain an FCF margin of nearly 50%. Assuming it can achieve an average FCF margin of 35% and grow revenue at 19% annually over the next ten years, its estimated intrinsic value is $74.02, or 30% below the September 9 closing stock price. Assuming it can grow at 20% annually over the next ten years at an average FCF margin of 35%, its estimated intrinsic value is $79.73.

The above analysis contains many assumptions; no one should accept them as the Gospel. Be aware that no valuation tool holds all the answers and that a stock can sometimes remain undervalued or overvalued for long periods due to market conditions, investor sentiment, or company-specific situations.

Nvidia remains a hold

In my last article on Nvidia, I said:

Suppose you are a momentum investor only looking for short-term profits and willing to accept the risks. In that case, you may still be able to buy the stock and achieve potential gains over the next year due to the optimistic sentiment surrounding the company.

That statement remains true. If an investor has an aggressive growth mindset or is a momentum investor looking for short-term profits and is willing to accept some risk, this pullback may be an ideal time to buy the stock for a one- to three-year time horizon. Additionally, investors who already own shares should continue to hold, as there is still potential upside in the near term from the adoption of Nvidia’s new Blackwell chip. However, after FY 26, there is a rising risk that competition or regulators could negatively impact revenue growth, profitability, FCF, or investor sentiment.

Longer-term buy-and-hold investors may be better off waiting for a more significant sell-off to bring the FCF margin over 2% or investing in other companies with a better risk versus reward ratio.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.