Summary:

- My dividend portfolio is heavily invested in defense contractors, focused on innovation.

- Northrop Grumman, one of the companies in my portfolio, has underperformed recently but has a strong historical track record and potential for growth.

- Northrop Grumman recently increased its dividend for the 21st consecutive year, demonstrating confidence in its future prospects.

- Thanks to promising growth projects and increasing profitability, I believe NOC remains misunderstood and in a great spot to generate elevated returns on a consistent basis.

Elen11

Introduction

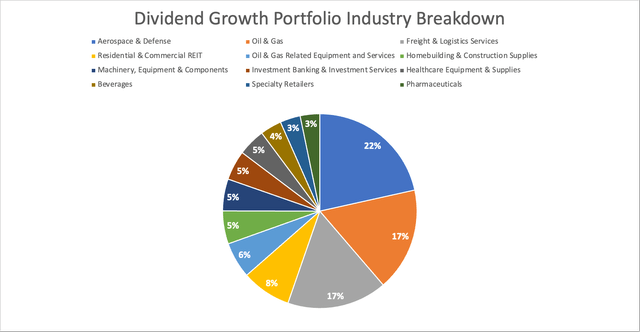

Most readers will be aware that my dividend growth portfolio is massively overweight defense contractors.

As we can see in the overview below, $0.22 of every $1.00 in my dividend growth portfolio is invested in the aerospace & defense industry.

Leo Nelissen – Dividend Growth Portfolio

In this sector, I own four companies. Three of which have done very well recently.

- Lockheed Martin (LMT) – 22% return (excluding dividends).

- RTX Corp. (RTX) – 48% return.

- L3Harris Technologies (LHX) – 18% return.

- Northrop Grumman (NYSE:NOC) – 1% return.

Northrop Grumman is the star of this article, a company I have been bullish on for a long time.

My most recent article was written in March when I went with the title “Undervalued And Underestimated: Why Northrop Grumman Is A Buy.”

Since then, shares have fallen by 5% (versus a flat S&P 500), which is one of the reasons why I’m writing this article.

Moreover, since then, the company has released its 1Q24 earnings and presented at the Bernstein Annual Strategic Decisions Conference, which included extremely important comments regarding the company’s path to higher growth.

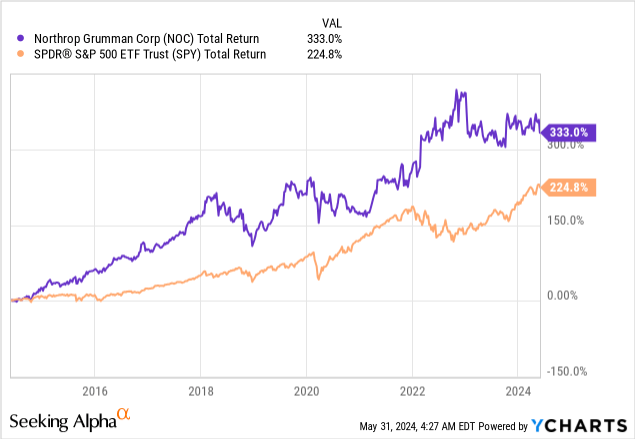

See, while NOC may be “struggling” now, it has a fantastic history of outperformance.

Over the past ten years alone, NOC shares have returned 333%, including dividends. This is more than 100 points above the return of the S&P 500, which benefitted from being overweight in FANG+ stocks.

While the performance since 2020 may not be great, I believe NOC remains a deeply misunderstood company for a number of reasons that we’ll discuss in this article.

One of them is that the company suffered from supply chain-related problems after the pandemic. Another issue is that it is at the start of a few major defense programs that have not even started to pay off.

Although subdued growth expectations make it look like the company is fairly valued at best, its true potential makes it a high-conviction dividend growth investment for me.

So, as a lot has happened in recent weeks and months, let’s dive into the details!

Dividend Growth, Buybacks, And Improving Growth

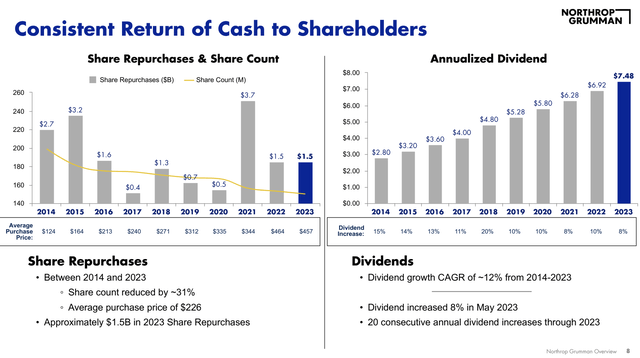

Northrop Grumman has a lot of confidence in its future.

It showed this to the world by hiking its dividend by 10.2% on May 15.

It now pays $2.06 per share per quarter, which translates to a yield of 1.8%.

This hike continues the company’s impressive dividend growth streak. It’s also the 21st consecutive year it has hiked the dividend!

Moreover, while its 1.8% yield may not be spectacular, the company has grown its dividend by roughly 12% annually since 2014 while buying back almost a third of its shares.

Northrop Grumman Corp.

What’s interesting is that the company’s dividend growth rates have not “matched” its earnings per share growth rates, which is quite uncommon, as companies usually try to keep their payout ratios flat.

Below are the company’s recent annual EPS growth rates, including expectations. It’s FactSet data you’ll also find in the FAST Graphs chart in the valuation section of this article.

| Year | EPS Growth |

| 2021 | 8% |

| 2022 | 0% |

| 2023 | -9% |

| 2024E | 6% |

| 2025E | 11% |

| 2026E | 5% |

These numbers are far from spectacular.

Also, all but one are below the company’s average dividend growth rate.

So, is Northrop Grumman creating an unsustainable dividend?

No, it’s not.

- The current dividend has a 2024E payout ratio of just 33%.

- The company has a 2024E net leverage ratio of 2x EBITDA, a top-tier BBB+ credit rating (one step below the A range), and a business model of roughly 100% anti-cyclical demand from government agencies.

Northrop Grumman Corp.

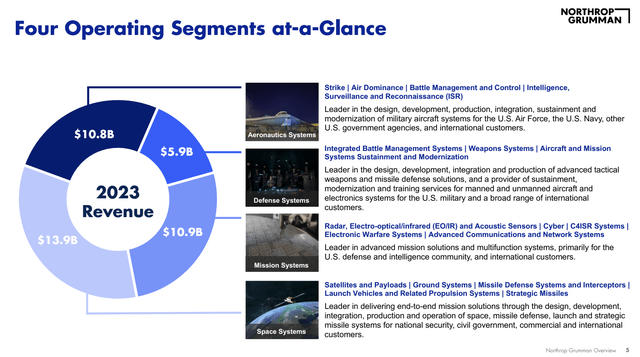

In general, NOC has an almost impenetrable wide-moat business, benefitting from major contracts for missile defense, the next-gen bomber, and its position as a supplier for major programs like the F-35 – on top of countless other programs in segments with high entry barriers, including space.

Speaking of major programs, that’s my third reason why Northrop is so confident in long-term growth and one of the main reasons why I’m writing this article.

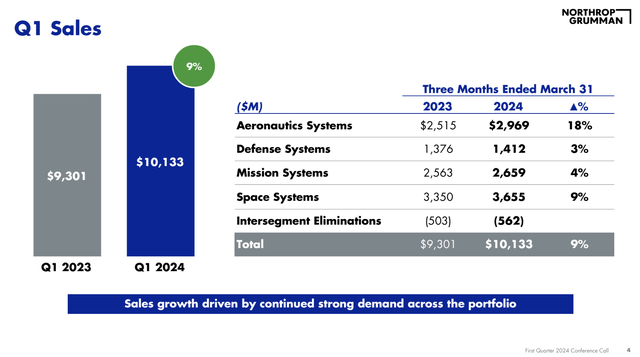

In April, the company reported its 1Q24 earnings, which showed 9% higher sales, supported by rising global demand for the company’s advanced defense programs.

In fact, each segment contributed to growth, with Aeronautics Systems leading with an 18% increase supported by higher volumes on the next-gen bomber B-21 program and established production programs like the F-35.

Northrop Grumman Corp.

Defense Systems sales grew by 3%. Mission Systems sales rose by 4%, which was led by advanced microelectronics programs.

Meanwhile, Space sector sales increased by 9%.

This was supported by broad-based growth, mainly in the Space Development Agency’s transport layer programs.

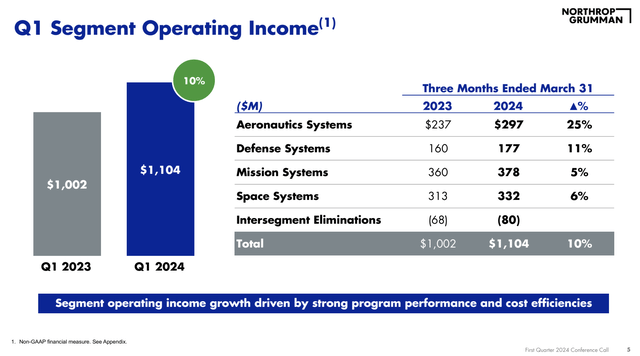

Moreover, because of the implementation of productivity and cost-efficiency measures, the company was able to boost operating profit by 10%, with growth in all segments. This also allowed the company to reaffirm its 2024 guidance.

Northrop Grumman Corp.

Expectations also include a book-to-bill ratio close to 1x, which indicates that for every $1 in finished work, it will likely receive $1 in new orders.

While this may not be as spectacular as the elevated book-to-bill ratios from peers like RTX Corp., we find a lot of good news when digging deeper.

Northrop’s Bright Future

One of the things that stood out to me during the 1Q24 earnings call was the company’s investments in innovation.

Bear in mind that the main reason I own so much defense exposure is the mix of wide-moat business models and innovation. Defense contractors are mainly paid to innovate, which makes them some of the most high-tech companies in the world.

The only difference from other “technology” companies is that defense contractors are classified as industrial companies.

Personally, I believe that Northrop Grumman is more innovative than 99.9% of the companies that the average investor classifies as “technology” companies.

This includes innovation and new developments for satellites, radars, integrated battle management systems, and advanced “vehicles,” including the B-21 bomber, drones, and a wide range of missiles.

Northrop Grumman Corp.

Going back to the 1Q24 earnings call, the company noted it has been heavily investing in microelectronics, which are key for advanced defense applications.

Essentially, Northrop Grumman’s U.S. facilities produce over one million microchips annually, tailored for advanced defense systems and sensors.

On top of that, the company works with commercial technology leaders like NVIDIA (NVDA) to integrate next-gen technologies into national security solutions.

This industry-leading agreement, facilitated by Future Tech Enterprise, gives Northrop Grumman access to NVIDIA’s extensive portfolio of AI and generative AI software, its platforms and frameworks, including NVIDIA Omniverse.

The agreement also opens research and development pathways, enabling Northrop Grumman to quickly apply advanced AI technologies across its portfolio of capabilities while also increasing operational efficiency. – Northrop Grumman

Based on that context, during the Bernstein Annual Strategic Decisions Conference in May, the company elaborated on high-profile margins that are expected to significantly shape its future.

These programs include the B-21 bomber and the Sentinel missile system, which are key to national security.

The U.S. Air Force LGM-35A Sentinel weapon system, formerly known as the Ground Based Strategic Deterrent (“GBSD”), is a critical modernization of the ground-based leg of the strategic nuclear triad, the bedrock of U.S. national security. The Sentinel system replaces the aging Minuteman III intercontinental ballistic missile (“ICBM”) system, which has been in service for over 50 years. – Northrop Grumman

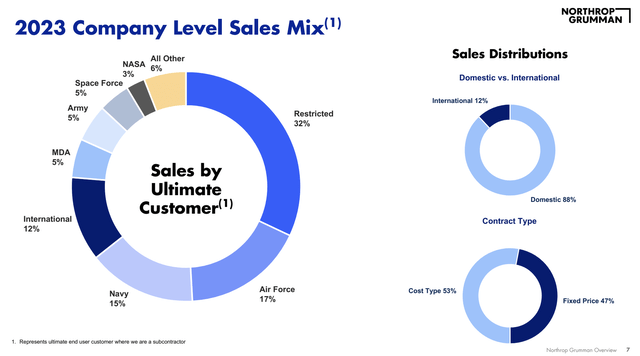

Before I elaborate on that, Northrop Grumman made clear that it adapted its products and services for higher international demand – especially in light of higher overseas spending since the start of the war in Ukraine.

This includes exportable products in unmanned systems, integrated air and missile defense, and tactical missiles.

The Triton is a great example of this.

The MG-4C Triton, which is its full name, is a high-altitude, long-endurance (“HALE”) unmanned aircraft system (“UAS”). This “drone” is produced for maritime intelligence, surveillance, reconnaissance, and targeting.

In other words, it provides eyes in critical places.

Northrop Grumman Corp. (MG-4C Triton)

The reason I’m bringing all of this up is to show how powerful these programs are.

As reported by Airforce Technology, Northrop was awarded $11.5 billion to produce 65 Tritons with multi-sensor upgrades.

It also has 20% of the North American UAV market, with expectations to become the second-largest player.

Programs like the Triton are very promising to achieve this, including the company’s ability to benefit from overseas demand, like major deals with Japan and Norway.

Moving beyond Triton, the company is key in replenishing NATO stockpiles, which have been neglected for many years – even before the war in Ukraine.

According to the company, it has seen major funding increases, mainly in solid rocket motors, which have been a bottleneck in the tactical missile supply chain for a while.

Thanks to these tailwinds, the company has massively expanded its production capacity, which will likely result in higher future growth – the same goes for other programs that are currently in the investment stage (like the B-21 and Sentinel).

And so we’ll be off executing that to further increase capacity above what Northrop Grumman invested to get to 3x our capacity, and I shared this in our first quarter earnings call, that work is largely complete. And fueling what you’ve heard from some other companies about their ability to deliver more growth because the supply chain bottlenecks are starting to be alleviated in that space, and we’re proud of our investment and contribution to make that happen. – NOC Bernstein Annual Strategic Decisions Conference (emphasis added)

Additionally, the company has roughly $10 billion in orders from European IBCS (integrated battle command systems). This includes seven nations in addition to existing customers like Poland.

As a result of these tailwinds, the company expects mid-single-digit growth in 2024 despite a flat-ish U.S. defense budget.

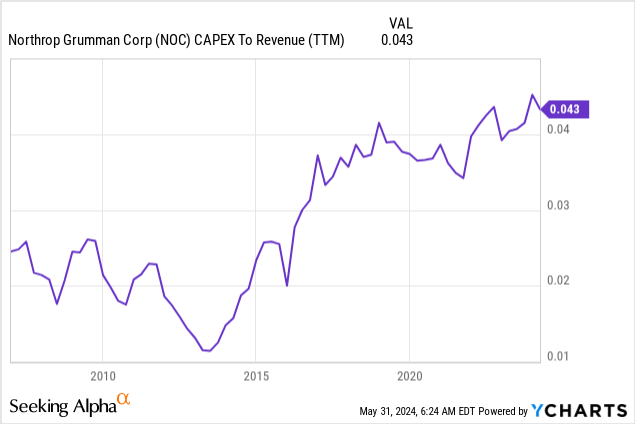

Furthermore, on top of increasingly benefitting from major programs becoming profitable, the company has plans to reduce CapEx (capital expenditures).

By 2025, it aims to reduce CapEx to roughly 3% of total sales.

In recent years, the company has boosted CapEx to more than 4% of its sales, as it heavily invested in the aforementioned programs.

This bodes well for future growth and free cash flow.

Valuation

NOC currently trades at a blended P/E ratio of 18.7x, which is above its long-term normalized P/E ratio of 14.7x.

However, like most (sell-side) analysts, I’m applying a 20x multiple because the company is moving into a higher-growth stage, supported by falling CapEx requirements, strong demand in the U.S. and overseas, and the fact that major programs are becoming profitable. I highlighted this in my prior article as well.

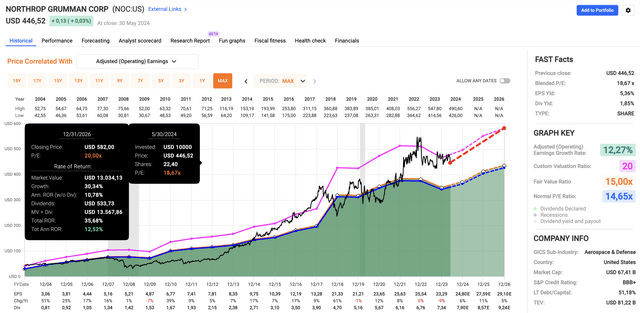

FAST Graphs

Since January 2004, NOC has returned 12.9% per year, making it one of the best large-cap performers during this period.

Going forward, I expect a similar performance.

Using a 20x multiple, the company has a fair price target of $582 based on 2026E EPS. That’s 30% above the current price.

When adding its 1.9% yield, we get an annual total return outlook of 12.5%.

Hence, I remain bullish, as I believe NOC is one of the few large-cap quality stocks that is flying far under the radar, making it a high-conviction pick of mine.

Takeaway

Northrop Grumman remains a high-conviction investment in my portfolio despite recent setbacks.

The company has a strong history of outperformance and is well-positioned for future growth, driven by its promising pipeline of advanced defense programs.

The recent 10.2% dividend hike and solid earnings report further support its confidence and stability.

Meanwhile, with its investments in key areas like microelectronics and AI, in addition to significant international demand, NOC is set to benefit from multiple tailwinds.

Trading at an attractive valuation and poised for substantial upside, I maintain my bullish view of Northrop Grumman as a top-tier dividend growth stock.

Pros & Cons

Pros:

- Strong Dividend Growth: NOC maintains a stellar dividend growth profile, with double-digit hikes on a very consistent basis.

- Robust Pipeline: Major defense programs like the B-21 bomber and Sentinel missile system promise significant future growth.

- Innovation Leader: Significant investments in next-gen technologies, including microelectronics and AI, position NOC at the forefront of defense innovation. This also bodes well for future growth.

- International Demand: Rising global defense spending, especially due to geopolitical tensions, boosts NOC’s growth prospects.

- Solid Financials: A low payout ratio, strong credit rating, and an expected decline in the CapEx/revenue ratio pave the way for elevated dividend growth and buybacks on a long-term basis.

- Anti-Cyclical Demand: Northrop Grumman benefits from a stable revenue foundation provided by anti-cyclical government spending.

- Diversification: As a highly diversified defense player, NOC is not overly dependent on any single program.

Cons:

- Supply Chain Issues: Pandemic-related supply chain disruptions have impacted the company’s short-term performance.

- High Valuation: In order to justify a higher multiple, NOC needs to effectively execute its growth plans.

- U.S. Defense Budget: Subdued U.S. defense budget growth may pressure domestic revenue growth potential.

- Market Volatility: NOC’s performance could be influenced by market volatility and investor sentiment.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of NOC, RTX, LMT, LHX either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Test Drive iREIT© on Alpha For FREE (for 2 Weeks)

Join iREIT on Alpha today to get the most in-depth research that includes REITs, mREITs, Preferreds, BDCs, MLPs, ETFs, and other income alternatives. 438 testimonials and most are 5 stars. Nothing to lose with our FREE 2-week trial.

And this offer includes a 2-Week FREE TRIAL plus Brad Thomas’ FREE book.