Summary:

- I maintain a concentrated portfolio and believe that holding a number of high-conviction plays is a great way to build wealth.

- Northrop Grumman is one of my biggest dividend investments and has performed well in the past despite challenges in the defense sector.

- The company’s innovation, robust backlog, and strategic positioning indicate resilience and growth potential, although budget uncertainties remain a concern.

Stocktrek/DigitalVision via Getty Images

Introduction

As most of my readers will know by now, I maintain a highly concentrated portfolio. Sometimes, this leads to some frustration, as people are annoyed that I don’t own every company that I’m bullish on – I get that.

However, I believe in a concentrated portfolio because my opinion is that holding many small positions does not add much value. Currently, I hold 20 stocks in my dividend growth portfolio. While I’m diversified, I have a considerable amount of money in each play.

I believe that having a portfolio of many more holdings would not add value to my strategy. For example, if I had 1% of my portfolio in stock XYZ, it would not make much difference to the overall portfolio – unless that company were to return 15-20% per year (or better).

Hence, I decided to go big on high-conviction plays – even if that meant not buying every stock that I would like to own.

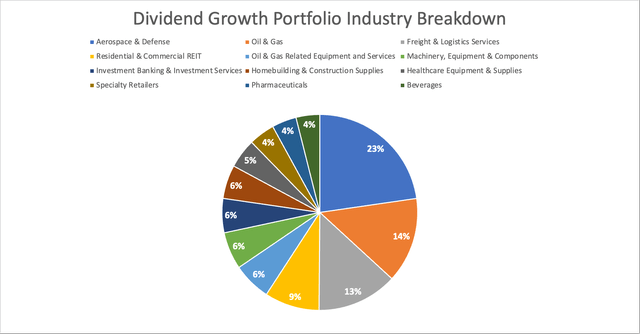

The overview below shows the industry breakdown of my portfolio. As we can see, half of it consists of defense, energy (excluding midstream), and transportation.

This article is dedicated to aerospace and defense, the sector that holds roughly a quarter of my total net worth.

While some may make the case that having considerable exposure to a sector makes me biased, I would argue that the opposite is true.

- If I put a huge portion of my hard-earned money into a sector, I need to be on top of things. There’s no room for error. After all, I want to grow my wealth, not create a cult. Being biased would have a huge negative impact on my ability to make money.

- The moment I become biased, my articles become worthless. That doesn’t benefit anyone.

Having said all of this, the star of this article is Northrop Grumman (NYSE:NOC), one of America’s largest defense contractors and one of my biggest dividend investments.

My most recent article on this stock was published on January 27, when I went with the title “Seizing The Moment: Why I Just Bought Even More Northrop Grumman.”

I got “lucky,” as it marked the bottom in NOC’s stock price. Since then, NOC shares have returned 7.6%, beating the S&P 500 by roughly 100 basis points.

Seeking Alpha – Leo Nelissen NOC Ratings History

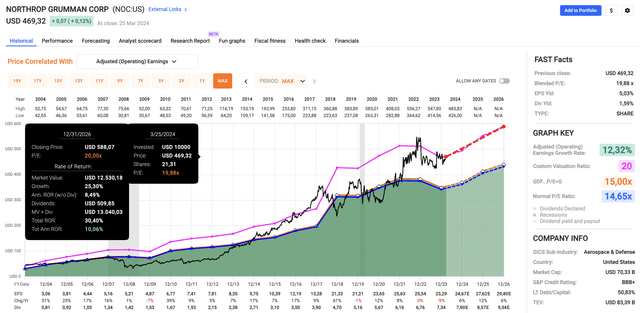

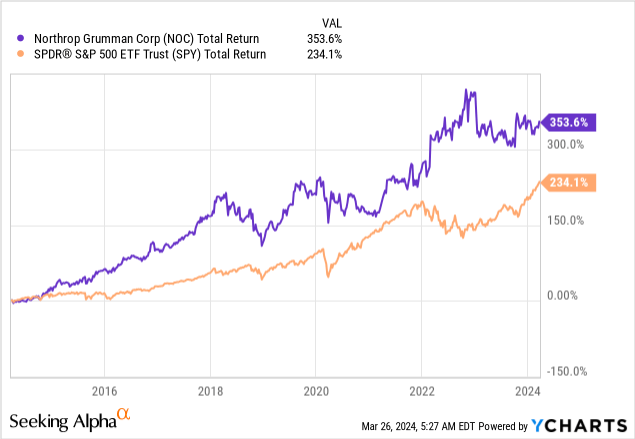

Unfortunately, while the company has beaten the S&P by a huge margin over the past ten years, returning more than 350%, its performance has been lackluster since early 2022.

The problem is past supply chain issues, elevated inflation, uncertainty in major defense programs, and budget funding risks.

In this article, we have a few very important things to discuss that could have a major impact on NOC’s stock price, including but not limited to the two bullet points below.

- We just got a lot more data on budget funding from the nation’s capital.

- Northrop Grumman presented at a major industrial conference.

So, as we have a lot to discuss, let’s dive right in!

Budget Risks Are An Issue

As much as I love that most major defense contractors come with anti-cyclical demand, there’s no denying that being dependent on the government for most of one’s revenue comes with (headline) risks.

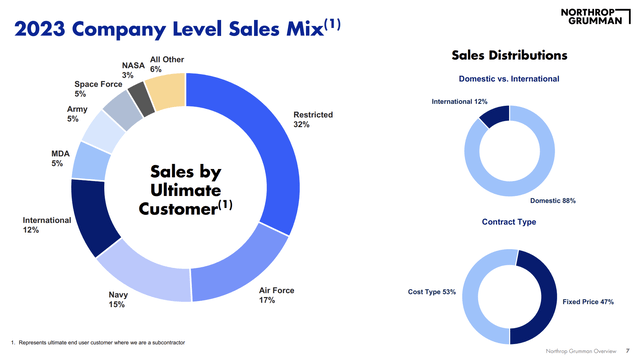

Using the data from the chart below, we see that more or less every penny of NOC’s revenue comes from government-related customers, including the Air Force, Navy, Army, Space Force, NASA, international governments, and restricted customers (32%!).

Especially in an environment of elevated government debt ratios and aggressive deficit spending, some investors want to avoid the defense industry.

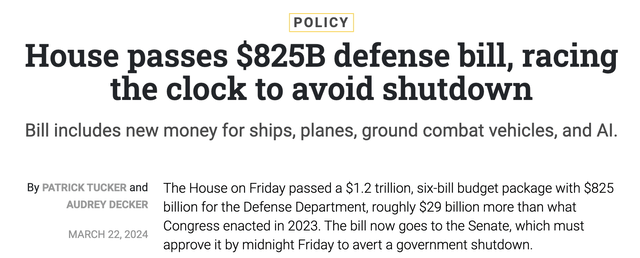

Having that said, a few days ago, the House passed an $825 billion defense bill. This is $29 billion more than what Congress enacted in 2023.

As reported by Defense One, highlights include increased spending on defense initiatives concerning China, Europe, and drone technology.

Moreover, provisions include additional funding for the Pacific Deterrence Initiative and security cooperation with Taiwan, as well as improved security measures in Eastern Europe and support for Ukraine.

The bill also includes funding for 86 F-35 fighter jets, 15 KC-46 tankers, 24 F-15EX jets, and a wide range of advanced missiles (that’s an area I’m very bullish on).

- $826 million for 285 anti-radar missiles from Northrop Grumman Corp. for launch from Air Force and Navy fighter jets.

- $697 million for 205 Lockheed Long-Range Anti-Ship missiles for the Air Force and Navy, up from 118 in this year’s request, most of which are a new longer-range version.

- $676 million to buy 230 Lockheed long-range Precision Strike Missiles, up from 110 this year, to field with Pacific units.

While this may sound like good news, it’s not. At least not for people who expected the government to get serious about boosting defense spending.

According to Bloomberg, this means the U.S. is tapping its own stockpiles to send arms overseas to Taiwan. It’s also a defense spending boost that does not even beat the inflation rate.

The Defense Department’s share of the $7.3 trillion budget proposed to Congress on Monday reflects only a 1% increase. The Pentagon is already in a tough spot because Congress has yet to pass a spending measure for this fiscal year, which started Oct. 1, and hasn’t approved a supplemental security spending bill for Ukraine, Israel and Taiwan. – Bloomberg

Even worse, according to a Wall Street Journal op-ed, the defense budget has been severely neglected since 2010.

Adjusted for inflation, it’s about $140 billion below the 2010 budget that many analysts, including these pages, deemed insufficient in far less challenging times.

In order to fix these issues, the Wall Street Journal article makes the case that annual defense spending hikes of $100 billion (0.4-0.5% of GDP) are needed to prevent the U.S. from neglecting its defense capabilities.

The good thing is that as bad as all of this may sound, Northrop Grumman is not in a bad spot. After all, over the past ten years, it has returned more than 350%, despite insufficient defense spending – at least compared to historical levels by incorporation of inflation.

Why Northrop Remains In A Good Space

The key to why Northrop Grumman remains in a good space is innovation.

Below are two of the Department of Defense’s key priorities:

- Defending the homeland, paced to the growing, multi-domain challenge posed by the People’s Republic of China (“PRC”).

- Building a resilient joint force and defense ecosystem.

The keywords here are “multi-domain” and “defense ecosystem.”

While the DoD may have been neglected, targeted defense spending has become critical to stay on top of evolving defense requirements.

During last month’s Barclays Annual Industrial Select Conference, NOC CEO Kathy Warden made clear that defense spending provides a stable foundation for the company’s operations and future growth plans.

She also emphasized the importance of aligning with budget priorities and navigating potential budget uncertainties. This means NOC aims to produce the most important technologies, which are the most likely to see accelerated funding.

This way, Northrop Grumman can effectively plan and allocate resources to the right projects without being subject to elevated funding risks.

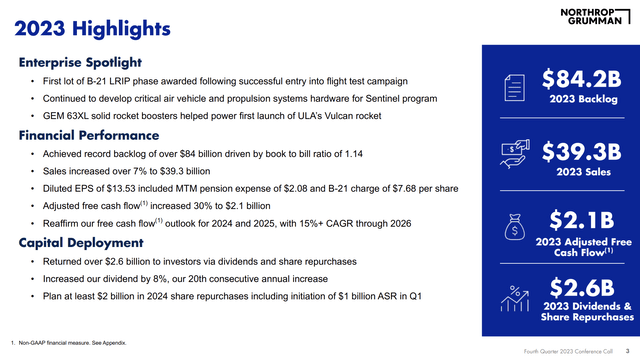

So far, these comments are fully backed by facts. Going into this year, the company had a 1.14x book-to-bill ratio. This means it received $1.14 in new orders for every $1.00 in finished work. It’s also sitting on an $84 billion backlog, the highest ever.

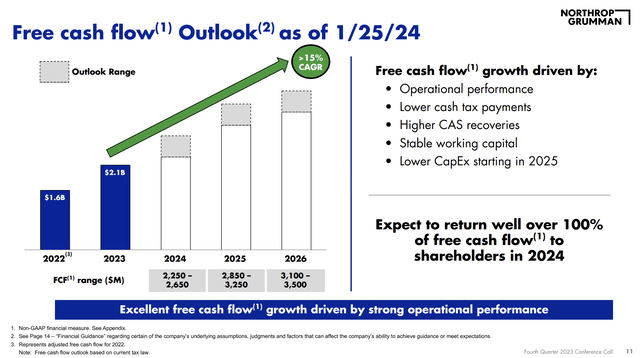

This allowed the company to reaffirm its free cash flow outlook for both 2024 and 2025, with more than 15% annual compounding growth through 2026.

As we can see below, the company aims to return more than 100% of its free cash flow to shareholders in 2024. It can do that, as it has a 2024E net leverage ratio of 2.0x EBITDA and an investment-grade credit rating of BBB+. That’s one step below the A range.

Speaking of shareholder distributions:

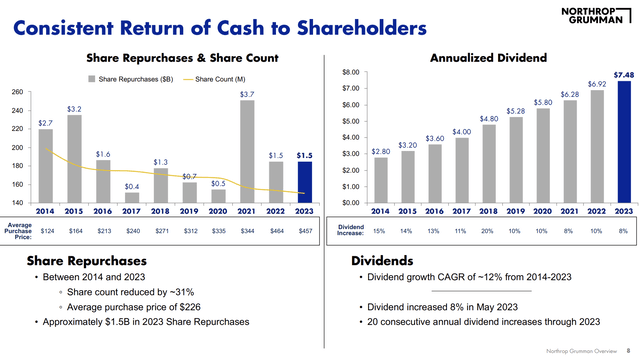

- Since 2014, the company has bought back almost a third of its stock!

- During this period, it has grown its dividend by 12% per year. The most recent hike was 8% in May 2023.

- The company has grown its dividend for 20 consecutive years.

- Currently, NOC yields 1.6%. This dividend is protected by a 2024E payout ratio of just 30%.

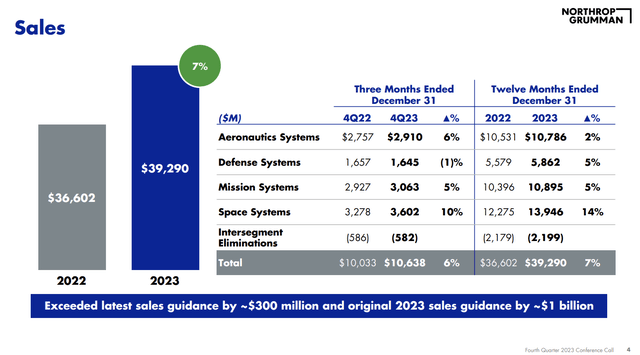

Moreover, during the Barclays conference, the company confirmed its 4-5% revenue growth outlook for 2024, as it remains confident in its ability to be in the right place at the right time – despite funding uncertainties.

Even better, in order to be prepared for future growth and to add new talent where needed, the company gained more than 6,500 employees last year. It now employs more than 100,000 people.

Especially after the challenging pandemic years, the company has solved employment issues.

Moreover, with regard to pricing, NOC isn’t just taking on each contract it can get its hands on. In times of inflation, margins are key! After all, one of the main reasons why investors have disliked defense stocks since 2020 is the fact that elevated inflation hurts margins.

Going into this year, the company had 53% cost-type contracts. 47% of its contracts were fixed-price.

But what I would say is that our discipline around bidding has been in place, and we feel good about the backlog growth that we’ve seen in these recent years and that we have done that in a way that sets our teams up for success with the contract type at large matches a risk-reward scenario that’s fair for us and our shareholders, but also is in line with creating value for our customers. – NOC Barclays Conference

In general, Northrop is increasingly focused on margins, using better contract structures, international growth opportunities, and cost efficiency improvements.

[…] we’re sitting now around to 11% segment operating margins with an expectation that we can now start to expand that as some of the macroeconomic pressures subside, our cost efficiency kicks in, and our mix begins to shift in a favorable way. – NOC Barclays Conference

That said, on top of benefits from the B-21 and Sentinel programs, which I covered in my prior article as well, the company sees benefits from the weapons and munition market – both as a prime contractor and as a supplier of rocket engines.

It also sees new opportunities in existing programs, including the F-35, cyber securities, computing and processing technologies, and others.

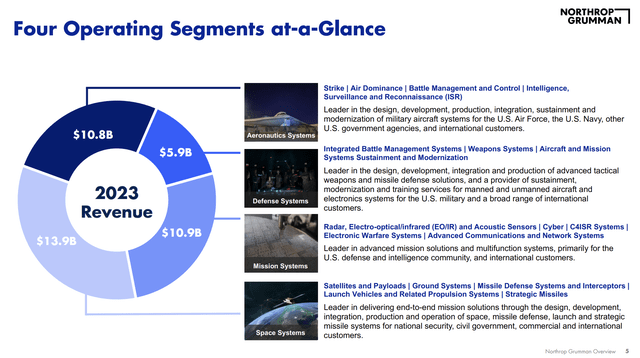

Bear in mind that NOC is a highly diversified defense player, which is not highly dependent on a number of major programs. Even better, fast-growing areas like Space Systems account for more than a quarter of total revenues.

Speaking of space, in the space sector, Northrop Grumman expects sustained growth driven by a portfolio of programs, including Sentinel and Next Generation Interceptor (“NGI”).

While certain programs may see slower growth rates, overall demand remains robust. This is fueled by increasing investments in space-based technologies and national security initiatives.

In 4Q23, revenue growth in space was 10%. Four points above the average 6% growth rate of the company. On a full-year basis, revenue growth was 14%. That’s twice the average growth rate of Northrop Grumman.

So, what about its valuation?

Valuation

Is NOC operating in a favorable environment? The answer to that question is “no.” This also means that I understand it if people do not invest in defense companies.

However, NOC remains in a fantastic spot. It has the right products to satisfy elevated demand growth in certain areas, a healthy balance sheet, accelerating free cash flow, and a history of consistent dividend growth and buybacks.

It also has a favorable valuation.

Currently, Northrop Grumman trades at a blended P/E ratio of 19.9x. That’s above its long-term normalized P/E ratio of 14.7x.

However, in light of elevated expected free cash flow growth, secular demand tailwinds, and a consistent EPS growth outlook (6%, 12%, and 6% growth in 2024, 2025, and 2026, respectively), I am applying a 20x multiple. In comparable years like 2016 and 2017, the company has traded at comparable valuations.

Combining the dividend, expected EPS growth, and a 20x multiple, we get an implied annual return of 10%.

NOC has returned 13.3% per year since 2004.

While this is no guaranteed return, I believe NOC continues to be undervalued.

It also implies a price target of roughly $590, which is 26% above the current price.

The consensus price target is $485, which is a lot more conservative, as it seems that analysts aren’t willing to be very bullish in an environment of ongoing budget uncertainty and cost issues.

My opinion is that this creates opportunities for long-term investors like myself – especially in high-quality stocks like Northrop.

Takeaway

Maintaining a concentrated portfolio may raise eyebrows, but for me, it’s about quality over quantity.

By focusing on high-conviction plays like Northrop Grumman, I make sure each investment has a significant impact on my portfolio. So far, this has worked out quite well.

Despite recent challenges in the defense sector, NOC’s innovation, robust backlog, and strategic positioning indicate resilience and growth potential.

While budget uncertainties remain an issue, NOC’s valuation suggests it’s currently undervalued, offering long-term dividend (growth) investors an opportunity for potentially double-digit annual returns.

Pros & Cons

Pros:

- Anti-Cyclical Demand: Northrop Grumman benefits from a stable revenue foundation provided by anti-cyclical government spending.

- Innovation: NOC’s focus on innovation aligns with Department of Defense priorities, positioning it to capitalize on next-gen defense requirements.

- Strong Financials: With a healthy balance sheet, accelerating free cash flow, and a history of consistent dividend growth and buybacks, NOC offers consistent shareholder distributions.

- Diversification: As a highly diversified defense player, NOC is not overly dependent on any single program.

Cons:

- Budget Uncertainty: Ongoing budget uncertainties and cost issues in the defense sector may impact NOC’s growth potential in the short term.

- Valuation: While NOC’s current valuation appears favorable considering expected free cash flow growth, it trades above its long-term normalized P/E ratio. This leaves little room for error.

- Market Volatility: NOC’s performance could be influenced by market volatility and investor sentiment.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of NOC either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Test Drive iREIT© on Alpha For FREE (for 2 Weeks)

Join iREIT on Alpha today to get the most in-depth research that includes REITs, mREITs, Preferreds, BDCs, MLPs, ETFs, and other income alternatives. 438 testimonials and most are 5 stars. Nothing to lose with our FREE 2-week trial.

And this offer includes a 2-Week FREE TRIAL plus Brad Thomas’ FREE book.