Summary:

- Qifu Technology is an undervalued Credit-Tech player in China with a compelling growth story fueled by advanced technological credit assessment.

- Qifu Technology is well-positioned to capitalize on the growing Chinese fintech market, with the potential for multi-growth returns and sustained profitability.

- With a forward dividend yield of 4.08% and trading at a forward EV/EBITDA multiple of just 3.0x, the stock price offers an irresistible margin of safety for contrarian investors.

I going to make a greatest artwork as I can, by my head, my hand and by my mind.

Investment Thesis

Qifu Technology (NASDAQ:QFIN), a leading Credit-Tech player in China, presents a hidden gem amidst the fears of geopolitical tensions and regulatory challenges. Despite being undervalued by Wall Street, this company boasts a compelling growth story fueled by its highly advanced technological credit assessment. In a world embracing machine learning for loan origination, QFIN’s advanced capabilities make it a standout in the financial landscape. With a forward dividend yield of 4.08% and trading at a forward EV/EBITDA multiple of just 3.0x, QFIN’s stock price offers an irresistible margin of safety for the astute investors. The potential for multi-growth returns is undeniable, especially when considering the company’s steady profitability and promising prospects in the burgeoning Chinese fintech market. Therefore, I initiate an overweight rating on QFIN, projecting a target share price of $31.26 based on a discount rate of 17.50% and an exit EV/EBITDA multiple of 3.5x.

Business Overview

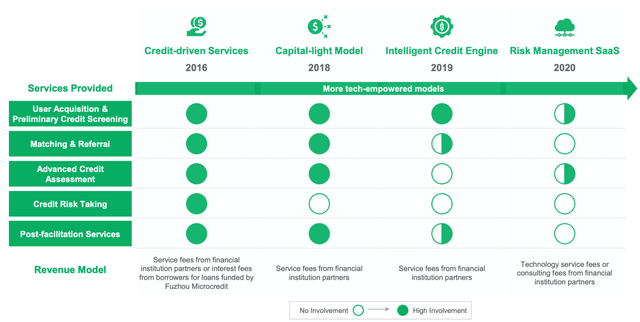

Founded in 2016, Qifu Technology has emerged as a leading Chinese Credit-Tech platform, empowering financial institutions, consumers, and SMEs with a comprehensive suite of technology services throughout the loan lifecycle. From borrower acquisition to credit assessment, fund matching, and post-facilitation services, Qifu Technology leverages cutting-edge artificial intelligence and machine learning models to cater to the diverse needs of its clients. The company’s business can be categorized into two main segments: credit-driven services and platform services, each playing a vital role in their success.

Company’s Q1 Presentation

In the credit-driven services segment, Qifu Technology generates revenue by facilitating connections between prospective borrowers and financial institutions, providing robust support in borrower acquisition, credit assessment, and post-facilitation services through a capital-heavy model. Moreover, they charge borrowers interest fees for loans funded by Fuzhou Microcredit, a subsidiary under their variable interest entity. Additionally, they offer contractual guarantee arrangements against potential defaults, showcasing their commitment to managing credit risks effectively. To safeguard against risks, prudent provisions are made to ensure their assets remain resilient even during challenging times.

On the other hand, the platform services segment serves as a source of consistent income. Here, Qifu Technology charges pre-negotiated terms to financial institution partners for providing loan facilitation and post-facilitation services through their innovative capital-light model and intelligent marketing services powered by the Intelligence Credit Engine (“ICE”). Furthermore, they refer prospecting users to other online lending companies if they fail to meet certain lending criteria, expanding their network and creating valuable partnerships. This segment does not assume credit risk, resulting in less working capital requirements while generating substantial revenue.

In the fiscal year 2022, Qifu Technology generated 11,586 million RMB and 4,968 million RMB from its credit-driven services and platform services, respectively. Although the platform services experienced a temporary decline of -22.94% due to COVID-related lockdowns and temporary effect from loan repricing, it had been growing impressively at a CAGR of 42.45% for the past four years until then. Meanwhile, the credit-driven services maintained steady growth, with a CAGR of 9.66% over the past four years. Looking ahead, I believe Qifu Technology is envisioning an even brighter future as it strives to generate a larger share of its revenue from platform services. In my view, this prudent strategic move is a very positive catalyst since the future business model will require less working capital and pose lower credit risks, thus providing a solid foundation for sustained growth and success in the dynamic Credit-Tech industry.

Industry Overview

According to the Fintech Development Plan (2022-2025), issued by the People’s Bank of China (“PBoC”) in January 2022, they have outlined crucial strategies for advancing the fintech industry in China. From my perspective, it is advantageous for the People’s Republic of China (PRC) to persist in facilitating their comprehensive economic progress by enhancing the accessibility of credit to all citizens within their nation. The recent report to the 20th National Congress of the Communist Party of China, which emphasizes the need to “cultivate new growth engines such as next-generation information technology” and “accelerate the development of the digital economy,” reinforces my belief that fintech is a prioritized area for development in the country. This is especially encouraging given the past crackdowns on peer-to-peer lending platforms, suspension of Ant Group’s IPO, and consumer finance lending rate cap.

Out of these three events, the one that seems most impactful to Qifu’s business fundamentals is the last one because the outstanding balance of loans with an IRR exceeding 24% had dropped from RMB 62.1 billion as of December 31, 2021, to RMB 5.4 billion as of December 31, 2022, which caused the overall facilitation fee to go down significantly. However, I was encouraged to hear from management in their latest earnings call that “future pricing will maintain at a stable level compared to the current level.” Despite the impact of the consumer finance lending rate cap on Qifu’s fundamentals, the management’s commitment to maintaining future pricing at a stable level is a reassuring sign. As the regulatory environment stabilizes, the company’s focus on maintaining stable pricing may position them well to navigate potential challenges while continuing to offer competitive services to borrowers.

Despite past regulatory scrutiny, the Fintech Development Plan demonstrates that China remains supportive of the fintech domain. The plan’s objective to achieve improvement in the sector’s core competitiveness by 2025 indicates the government’s determination to foster fintech innovation in a regulated, balanced, and high-quality manner. Therefore, I believe fintech-based companies such as Qifu will play a crucial role in facilitating efficient financial resource allocation and propelling overall economic growth. The government’s commitment to building internationally competitive digital industry clusters underscores its dedication to driving innovation and technology-driven development.

According to recent news, the Chinese central bank’s decision to fine Ant Group and Tencent’s TenPay indicates a shift in the regulatory approach towards major players in China’s technology and finance sectors. In my opinion, this move signals a potential end to the previous crackdown, as Beijing aims to foster a more supportive environment for the private sector in tackling various economic and geopolitical challenges, which include post-COVID-19 recovery efforts, boosting consumer spending, addressing youth unemployment, and navigating tensions with the United States. The government’s approach is likely to be determined yet balanced, seeking to rally the private sector for sustainable growth and innovation.

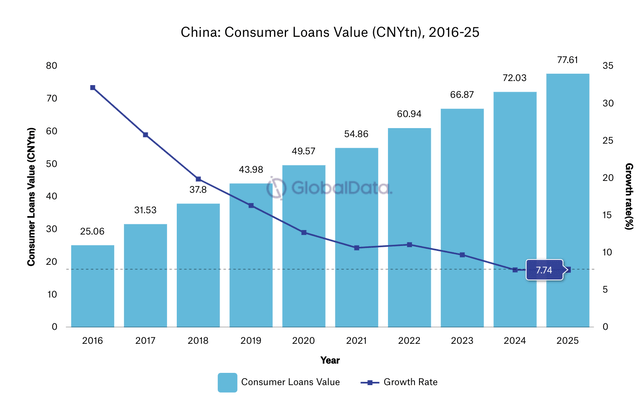

Retail Banker International

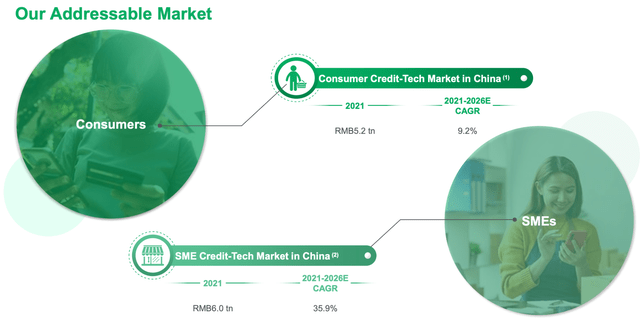

Company’s Q1 Presentation

According to Retail Banker International, GlobalData forecasts a Compound Annual Growth Rate (“CAGR”) of 9.1% for total China consumer loan balances outstanding from 2021 to 2025. This aligns closely with iResearch Report’s expectation of 9.2%, as mentioned in the company’s recent presentation. These projections indicate a promising future for the fintech industry in China, suggesting continuous growth and transformation. With the government’s unwavering support and a balanced regulatory approach, I am confident that we will witness a flourishing fintech ecosystem in China. This industry not only propels economic progress but also ensures stability and sustainable development. As the company continues to solidify its leading position in the consumer finance sector, leveraging enhanced technological capabilities and offering viable solutions, I am convinced that the company is well-positioned to capitalize on the growing SME credit-tech market. In light of these developments, I anticipate double-digit revenue growth for Qifu Technology, and I believe the company has the potential to achieve at least a 12.5% revenue growth over the coming years. As the fintech landscape evolves, Qifu Technology’s innovative approach and commitment to excellence will undoubtedly contribute to its continued success in the dynamic Chinese market.

Key Drivers & Catalysts

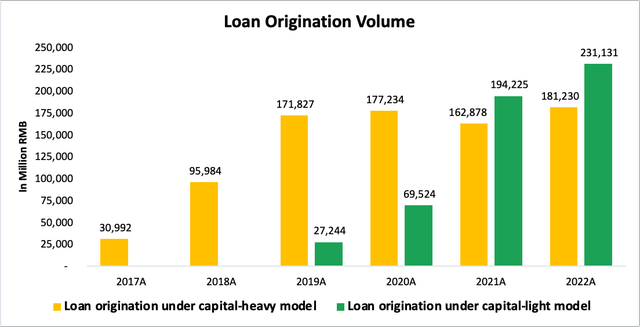

Company’s 10-K’s

Since its inception, Qifu Technology has shown an outstanding track record of growth in loan origination volume, expanding from $30.99 billion RMB to a 412.36 billion RMB in just 5 years, thus representing a CAGR of 67.81% over the said period. Notably, the loans originated under the capital-light business model have been a standout success, growing over 8 times in a span of only 3 years.

In my view, the management team’s strategic direction to reduce exposure to the capital-heavy business model is a prudent and forward-thinking move as this segment often involves credit risks and requires a substantial amount of working capital to support loan origination and expansion. By shifting towards a capital-light model, the company can effectively lower the level of risk it assumes and optimize its use of resources. Under the capital-heavy business model, the company may be required to provide back-to-back guarantees for loans in case of defaults. This model operates within a legal loophole to bypass the restrictions of Circular 141, as it does not directly offer guarantees to banking financial institutions but requires the company to cover losses for third-party companies that provide guarantee services to financial institutions. Additionally, taking loans onto their balance sheet can tie up capital, limiting the company’s ability to invest in other growth opportunities.

On the contrary, loans originated under the capital-light model do not carry the burden of back-to-back guarantees or the need to take loans onto their balance sheet. Instead, the company acts as a facilitator, connecting borrowers and lenders through its technology platform. This approach allows the company to reduce its exposure to credit risk, as the actual lending is conducted by external financial institutions. By embracing the capital-light model, I believe the company can effectively mitigate risks and potential losses, providing a more stable and resilient financial foundation.

Company’s Q1 Presentation

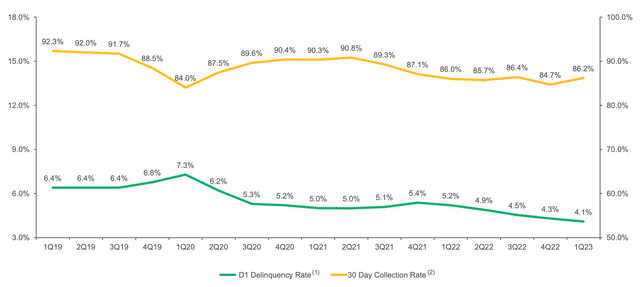

In my view, one of Qifu’s competitive advantages lies in its highly advanced technological capabilities that can provide continuous improvement in loan writing and a reduction in delinquency rates. The chart above illustrates the company’s impressive track record of sequentially declining D1 delinquency rates over the past 3 years, even amidst challenging times for Chinese consumers during the COVID lockdown. This achievement is a testament to the tremendous effort, technological expertise, and data-driven approach behind the firm’s exceptional loan writing. As the company’s profiling of users and loan pricing techniques continue to evolve, it gains a unique edge that is hard to replicate. As a result of this proficiency, I expect Qifu to continue attracting financial institutions keen on embracing the digital landscape and recognizing the value of leveraging advanced machine learning and artificial intelligence to enhance their own loan pricing strategies. This trend has been evident in the company’s explosive growth in partnerships with financial institutions, expanding from 24 in 2018 to a substantial 150 as of Q1 2023.

Company’s 10-K’s

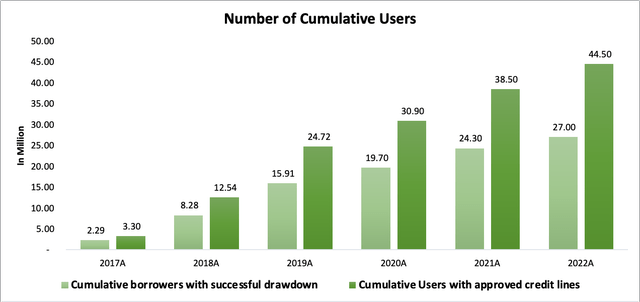

Next, the majority of the growth in loan origination can be attributed to the company’s highly effective marketing campaigns, which have led to a significant increase in cumulative users. Over the past five years, the number of cumulative users with approved credit lines on the platform has grown from a modest 3.3 million to 44.5 million (and now stands at 46.0 million as per the company’s Q1 release), representing a remarkable 13.5x expansion. Regarding the conversion rate of users approved with credit lines to those who ultimately complete successful drawdowns, it has been gradually declining, currently standing at approximately 60%, down from 69% previously. The management team addressed this situation during the recent earnings call and shared their proactive approach to enhance user engagement and risk management:

We have tried to use enterprise WeChat to cover our existing users to increase effectiveness for us to outreach our existing users. And we refine our risk management models to better understand our users and identify different profiles of our users. For example, we enhanced our customer profiling capabilities by improving data dimensions and increased our percentage of accurately identifiable customers within the broadly defined SME segment, which accounts for more than 40%. So later, we can optimize our offer and improve our user engagement process to better engage the existing users to improve their long-term value.

In other words, management’s proactive efforts are centered around enhancing user engagement and refining risk models, with a special focus on understanding diverse user profiles, especially within the SME segment, to create long-term value. As an investor, there’s no need to be overly concerned about the decline in the conversion rate as the company is taking strategic steps to leverage the power of WeChat and capitalize on the lucrative SME market to sustain growth effectively. In my view, these strategic initiatives are likely to yield positive outcomes and foster strong customer loyalty.

Company’s 10-K’s

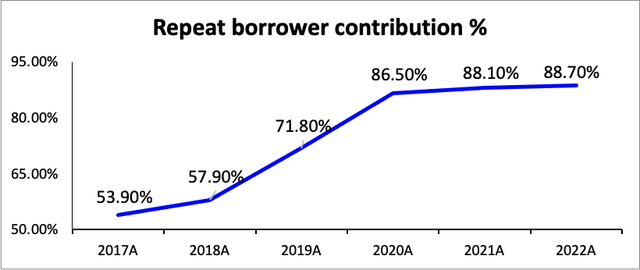

One notable aspect of Qifu’s platform is its stickiness for borrowers, as evidenced by the steady climb in repeat borrower contribution over the past five years. The chart illustrates a clear trend, with repeat borrower contribution reaching 88.70% in 2022 (most recent data from Q1 Release suggests that this number has reached 91.9%), highlighting the platform’s ability to retain customers effectively. This sustained high retention rate is a testament to the value customers find in Qifu’s offerings, indicating their satisfaction with the platform’s services. The fact that borrowers return for additional loans highlights the trust they have developed in Qifu.

As time goes on, I anticipate this figure to consistently remain above the 90% level as more satisfied users continue utilizing the platform for borrowing needs. Additionally, the likelihood of these contented customers recommending Qifu’s services to others can potentially drive organic growth through word-of-mouth referrals. Overall, the increase in repeat borrower contribution is a positive signal for the company, as it not only leads to a more stable and predictable revenue stream but also speaks volumes about the company’s ability to deliver value and maintain customer loyalty in the competitive fintech landscape.

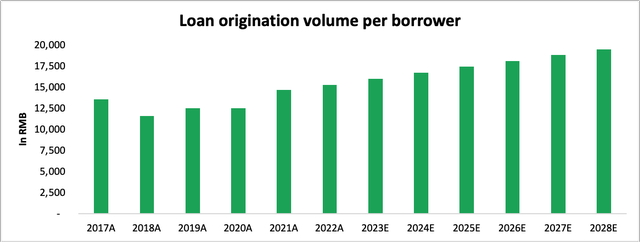

Author’s Contribution

Based on my analysis, I have projected a steady increase in the loan origination volume per borrower, with an average growth rate of 3.50%. This projection is conservative, as it is below the estimated China’s GDP growth rate of between 5% and 6% reported by reputable sources like S&P Global and Statista. The growth in loan origination volume per borrower is supported by factors such as the consistent rise in repeat borrower contribution over time, as discussed previously, and the increasing consumer budget and higher standard of living, which contribute to the demand for loans.

This trend is expected to have a positive impact on the overall loan volume originated by the company, as each borrower contributes higher loan amounts. Consequently, revenue growth is likely to closely follow this expansion in loan origination volume. The primary drivers of this growth are the increasing number of cumulative borrowers with successful drawdown and the growth in loan origination volume per borrower. Overall, I believe that Qifu Technology is well-positioned to capitalize on these favorable market conditions and achieve sustained revenue growth, particularly if loan pricing remains stable and is not affected by regulatory changes.

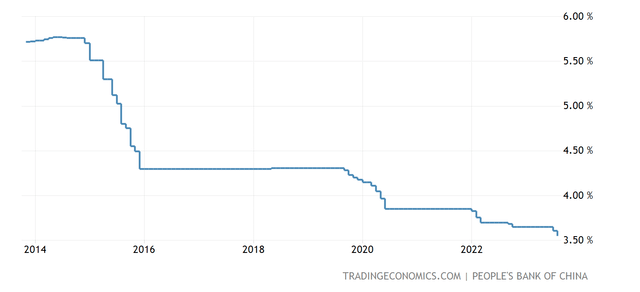

Trading Economics

Amid the gradual easing of COVID restrictions, the PBoC’s recent decision to reduce key lending rates by 10 basis points is a welcome move for consumer finance borrowers, as it is expected to encourage increased consumer spending. While some analysts may be fixated on China’s short-term economic challenges, I remain steadfast in my optimistic outlook for the long-term growth prospects of the Chinese economy. As an investor, it is vital to maintain patience and refrain from being swayed by short-term market fluctuations, instead focusing on the broader and more enduring trends. Inspired by the timeless wisdom of Howard Marks’ “Mastering the Market Cycle,” a favorite quote of mine resonates deeply:

Investment markets make the same pendulum-like swing: between euphoria and depression, between celebrating positive developments and obsessing over negatives, and thus between being overpriced and underpriced.

In the current scenario, the investing sentiment towards China appears to lean towards the latter, signaling a unique opportunity for astute investors to capitalize on undervalued assets.

While short-term challenges and uncertainties are inevitable in any market, I firmly believe that China’s long-term potential remains robust and promising. Rather than being swayed by transient sentiment, a prudent investor would evaluate opportunities based on a comprehensive analysis of the economic landscape, the financial health of specific companies, and their long-term growth prospects. China’s investing environment today presents an intriguing juxtaposition of undervalued assets amid prevailing negative sentiment.

CEIC DATA

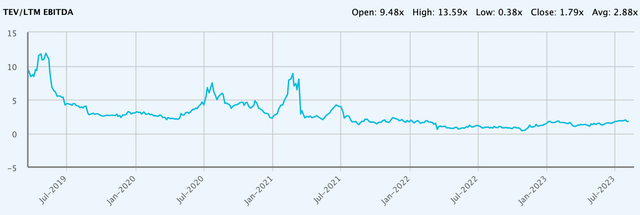

Capital IQ

China’s market valuation, depicted in the P/E chart from CEIC DATA, currently appears near an all-time low, primarily influenced by concerns over regulatory crackdowns, geopolitical tensions, and trade war with the US. While acknowledging these genuine risks, the current valuation offers an appealing opportunity for contrarian investors. Analyzing QFIN’s valuation, taking into account its net cash balance of 5.214 billion RMB, the EV/EBITDA remains below past averages, even with the stock price rebounding from its 52-week low in November 2022. Adding to the allure, management recently announced plans to repurchase up to US$150 million worth of its American depositary shares or Class A ordinary shares over the next 12 months, starting from June 20, 2023.

In my view, this represents a rare window of opportunity for those with a contrarian mindset, recognizing the long-term potential and seizing the moment to position themselves strategically for potential gains in the future. Additionally, I believe there is ample room for multiple expansion as positive sentiment strengthens and growth resumes. The current market sentiment in China may be pessimistic, but astute investors can navigate this landscape skillfully to uncover value and capitalize on opportunities such as QFIN.

Financial Valuation

When it comes to financial valuation, there are several key factors that will remain consistent across all three scenarios of my discounted cash flow (“DCF”) model. Firstly, I won’t overly emphasize the impact of the buyback on the number of shares outstanding, as predicting QFIN’s stock price movement over the next twelve months is inherently uncertain. Secondly, the growth in loan origination volume per borrower will maintain a steady rate of 3.50% in all three scenarios, as mentioned earlier, along with a consistent tax rate of 18%. While I acknowledge the potential for improvement in the conversion rate between users with credit lines and borrowers, I conservatively assume a stable conversion rate of 60%.

(Note: The fundamental driver of revenue growth lies in two key components: the cumulative borrowers who complete successful drawdowns and the average loan volume each borrower is projected to obtain. This multiplication results in the total loan origination volume, on which a fee percentage is applied).

The total shares outstanding used in my calculation are approximately 336.11 million, taking into consideration potential dilution from restricted stocks and options. These robust assumptions provide a stable foundation for the valuation analysis, allowing us to focus on other important variables to assess Qifu Technology’s financial outlook with greater accuracy.

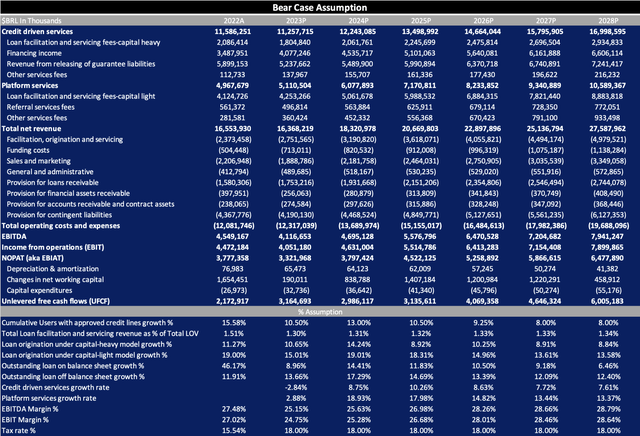

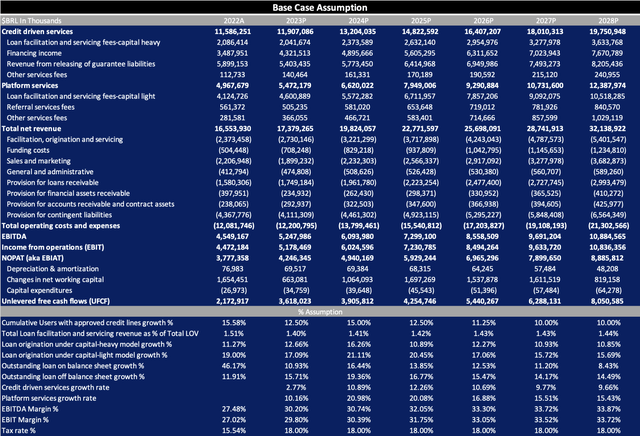

Author’s Contribution

Author’s Contribution

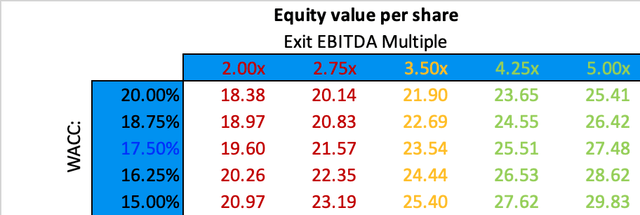

Based on my analysis for the bear case scenario, I estimate QFIN’s intrinsic value to be in the range of $19.60 to $27.48, considering an exchange rate of 7.50 for the CNY/USD and a discount rate of 17.50%. The utilization of such an elevated discount rate underscores the considerable returns that both myself and fellow investors should demand in order to counterbalance the prevailing risks in the Chinese market.

In this scenario, the growth trajectory of cumulative users with approved credit is expected to follow a low-teen percentage increase for the initial three years, which gradually tapers off as market competition intensifies. My forecasts indicate an average growth rate of approximately 13.51% for the total loan origination volume across both the capital-heavy and capital-light segments over the subsequent five years, which surpasses industry averages due to Qifu’s technologically advanced approach to facilitate more efficient loan origination processes. Based on the recent interest rate cap, a fee percentage of around 1.30% is assumed to reflect additional decline attributed to loan repricing. Additionally, it’s anticipated that the growth of outstanding loans on the balance sheet, as compared to those off the balance sheet, will parallel the facilitation volume growth from the capital-heavy model. This alignment is expected to lead to increased financing income for the company, tied to the growth of outstanding loans on its balance sheet.

While there may be a slight revenue dip in 2023 due to loan repricing and a decrease in take rates compared to 2022, growth is projected to rebound in 2024. Notably, the growth of platform services, under the capital-light model, is expected to outpace the growth of credit-driven services linked to the capital-heavy model. Combining both revenue streams, an average revenue growth of approximately 11% is projected to commence from 2024 onwards. Although a short-term dip in EBITDA margin is expected due to loan repricing, a recovery to around 28% is anticipated over time. It’s worth highlighting that Qifu has historically achieved EBITDA margins close to 33%. My conservative estimate allows for a significant margin of safety, providing a cushion for potential investors. Despite the bear case scenario, the current share price continues to offer attractive potential returns, driven by multiple expansion and the gradual stabilization of market sentiment.

Author’s Contribution

Author’s Contribution

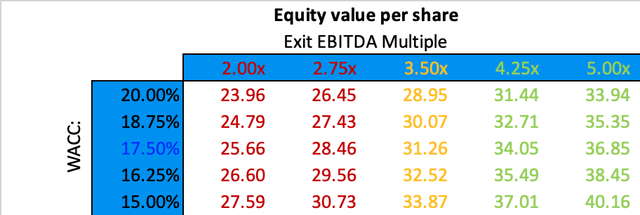

Transitioning to a more normalized base case scenario, I have estimated QFIN’s intrinsic value to fall within the range of $25.66 to $36.85, considering an exchange rate of 7.25 for the CNY/USD and a discount rate of 17.50%. In this scenario, I anticipate cumulative users with approved credit to experience mid to low-teen growth over the next five years, as the company steadily expands its reach and reputation to attract more borrowers. Forecasts indicate an average growth rate of approximately 15.58% for the total loan origination volume over the next five years. While revenue growth may not appear remarkable initially, I expect a modest upturn starting in 2024, driven by the company’s efforts to refine its loan pricing to closer to 1.40% and enhance customer engagement. As for the EBITDA margin, I foresee gradual improvement, returning closer to the more normalized historical level of 33%. This will be facilitated by a reduction in general and administrative expenses as the company optimizes its operations and cost structure. Additionally, I believe Qifu’s marketing initiatives will become more effective in driving customer acquisition, contributing to the improvement in EBITDA margin.

My approach aligns closely with current Wall Street estimates (according to data from CapitalIQ), and I am confident in providing investors with a margin of safety through these reasonable projections. The conservative assumptions in the base case scenario provide a prudent outlook, taking into account potential challenges and risks in the market environment. Even without accounting for multiple expansion, investors have the potential to achieve approximately 40% returns on their investment, in addition to the 17.5% discount rate, given that the share price has recently been trading around $18.

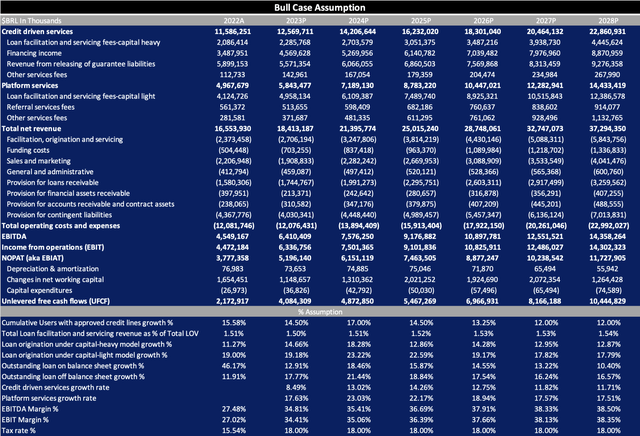

Author’s Contribution

Author’s Contribution

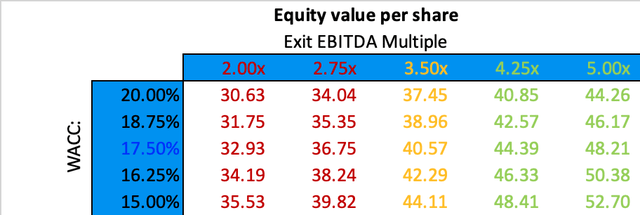

In the bull case scenario, I have derived a more optimistic price target range for QFIN, projected to be within $32.93 to $48.21, taking into account a discount rate of 17.50% and an exchange rate of 7.00 for the CNY/USD. However, I urge investors to approach this scenario with caution, as it assumes a highly optimistic outlook on several key factors, including the growth of cumulative users with approved credit lines, the stability of the loan servicing fee percentage, and huge potential from margin expansion. In this scenario, the number of growing users is projected to maintain its current pace throughout the entire year, continuing into 2024, driven by the allure of lower interest rates, which incentivize Chinese consumers to borrow more money. This trend is expected to make platforms like Qifu more appealing to the country’s citizens. Forecasts indicate an average growth rate of approximately 17.64% for the total loan origination volume over the subsequent five years as the company resumes its historical growth level after COVID lockdown has been over. Additionally, the stabilization of loan pricing of 1.50% eliminates the need for continuous adjustments of the take rate to attract financial institutions and borrowers. According to my estimate, the company achieved an EBITDA margin of 37.06% in 2019 and 41.19% in 2021. I have a positive outlook that Qifu can achieve these high margins again in the future, assuming management optimizes the cost structure and utilizes operational leverage as it achieves economies of scale.

Considering the above assumptions materialize, the potential returns from this bull case scenario could be significant, possibly leading to a multi-bagger investment opportunity, especially given the current trading price of the stock. However, it is essential to exercise caution and recognize that such optimistic projections entail higher levels of risk and uncertainty.

Risks

Qifu Technology currently employs a unique approach to provide guarantee services, leveraging a back-to-back guarantee model in conjunction with third-party guarantee companies. However, it is essential to note that if this loophole were to be closed in the future, it could have a material impact on Qifu’s top line, although the bottom line effect may be relatively small as contingent liabilities provision could be eliminated.

Moreover, the Fintech sector and VIE structure in China are subject to high-level uncertainties and potential regulatory changes. Past crackdowns on major companies like Alibaba and the suspension of Ant Group’s IPO have led to global investor concerns, contributing to an undervaluation of assets in the region. Additionally, some investors may find the VIE structure unattractive, as it doesn’t provide real ownership within the company. At last, geopolitical risks surrounding China, such as a potential invasion of Taiwan or the imposition of U.S. sanctions, can pose a threat to U.S. investors’ portfolios, leading to potential permanent losses.

In light of these risks, it is crucial for investors to exercise caution and carefully evaluate their risk appetite when considering investments in Qifu Technology. While the company shows promising growth potential and competitive advantages in the fintech domain, regulatory uncertainties and geopolitical events warrant a thorough assessment of potential risks and rewards.

Summary

In conclusion, I recommend an overweight rating on QFIN’s stock, with a target share price of $31.26 based on a discount rate of 17.50% and an exit EV/EBITDA multiple of 3.5x, considering reasonable future growth expectations in my base case scenario. Qifu’s competitive advantage in advanced technological capabilities positions it to attract financial institutions eager to embrace the digital landscape and optimize loan pricing through cutting-edge machine learning and artificial intelligence. The notable increase in repeat borrower contribution bodes well for the company, indicating both a steady revenue stream and a testament to its ability to cultivate customer loyalty in a competitive fintech landscape. While short-term challenges and market uncertainties may arise, China’s long-term potential remains robust and promising, presenting a unique opportunity to acquire undervalued assets amidst prevailing negative sentiment. Though risks associated with Qifu’s equity price exist, I believe they are already factored into the current valuation, leaving investors with a generous margin of safety against potential losses. As we look ahead, I remain optimistic about Qifu’s prospects and encourage investors to seize this opportune moment to participate in the thriving fintech industry of China.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of QFIN either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.