Summary:

- Coca-Cola’s stock has declined year-to-date, leading some investors to question its performance in the future.

- Coca-Cola’s historical performance has significantly underperformed the S&P 500 index over the past decade.

- Despite being a profitable company with steady growth, Coca-Cola’s focus on dividends over share buybacks has hindered its stock performance.

ByoungJoo/iStock via Getty Images

Sell Thesis

We are initiating a neutral rating on Coca-Cola (NYSE:KO) in April 2023 due to limited upside potential in the near term. Recently, we conducted a review comparing Coca-Cola’s stock performance to the S&P 500 index. We found Coca-Cola has significantly underperformed the broader market for the past 10 years. The company possesses strong fundamental business attributes, including industry-leading profitability metrics, although the company has moderate growth prospects given its massive size and maturity. However, in our view, the primary reason Coca-Cola has substantially underperformed the broader stock market index over time is due to the company’s lack of a robust share buyback program.

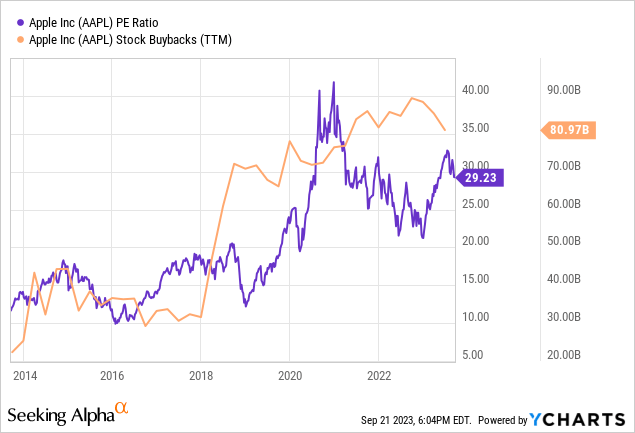

While Coca-Cola’s current valuation appears reasonably fair, we would still like to see the company enact a more expansive share buyback program. Even if repurchases happen at fair value levels, they can reduce the outstanding share count and boost earnings per share. This can subsequently lower the P/E ratio and make valuations even more attractive. Valuation should not be the only consideration when executing buybacks either. As we illustrated in the valuation section below, Apple aggressively repurchased shares to create shareholder value even when its valuation was stretched well above historical P/E ratios.

Coca-Cola appears unlikely to prioritize buybacks under current CEO James Quincey, a company veteran who has favored dividends during his tenure. Without a shift in capital allocation strategy, the upside for the stock looks constrained given limited room for valuation multiple expansion after recent price increases.

With no clear catalysts for substantial outperformance, passive investors may be better served investing in index funds rather than Coca-Cola shares at this time. Thus, we downgraded the stock to “Sell”.

Coca-Cola’s stock is a lagger

Coca-Cola has long been one of Warren Buffett’s favorite stocks, accounting for around 7% of Berkshire Hathaway’s portfolio. The company’s competitive strengths are well-known – its unrivaled brand recognition and distinctive taste have enabled it to build wide economic moats through cost leadership and economies of scale. However, Coca-Cola’s stock price has declined year-to-date, leading some investors to wonder if it could be a laggard in 2023. However, we recommend investors sell Coca-Cola shares and reallocate the funds elsewhere. We believe Coca-Cola will likely continue lagging the broader market for another decade or more. We will illustrate as follows:

Historical Performance Comparison

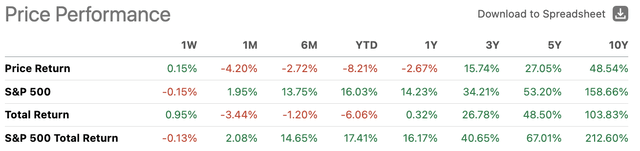

Over the past 10 years, Coca-Cola’s stock price has significantly underperformed the S&P 500 index. Coca-Cola’s price appreciation alone was only 48% over the past decade, compared to the S&P 500’s price return of 158% over the same period. Even when including dividends, Coca-Cola’s total return was 103% over the past 10 years, which is less than half of the S&P 500’s total return of 212% over the same timeframe. So while Coca-Cola has provided positive returns, it has lagged the broader market significantly, with price appreciation alone trailing the S&P 500 by a factor of over 3X. This underperformance illustrates Coca-Cola’s challenges in keeping pace in recent years.

Coca-Cola’s Profitability Metrics

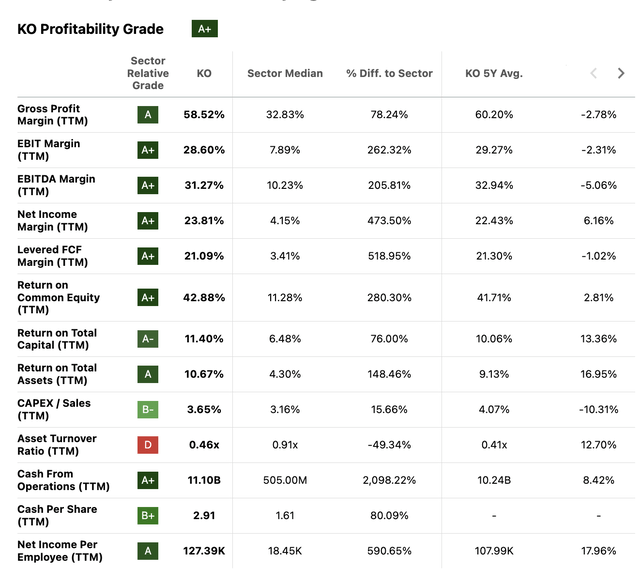

Is Coca-Cola a profitable company? Yes.

There is no doubt that Coca-Cola remains a highly profitable company. It boasts robust margins, with a gross margin of 58% and a net income margin of 23% that far exceed industry medians. Coca-Cola’s return on equity stands at a healthy 42%, again topping its peer group average. These stellar financial metrics speak volumes about the enduring power of the Coca-Cola brand and the strength of its business model.

Growth Challenges

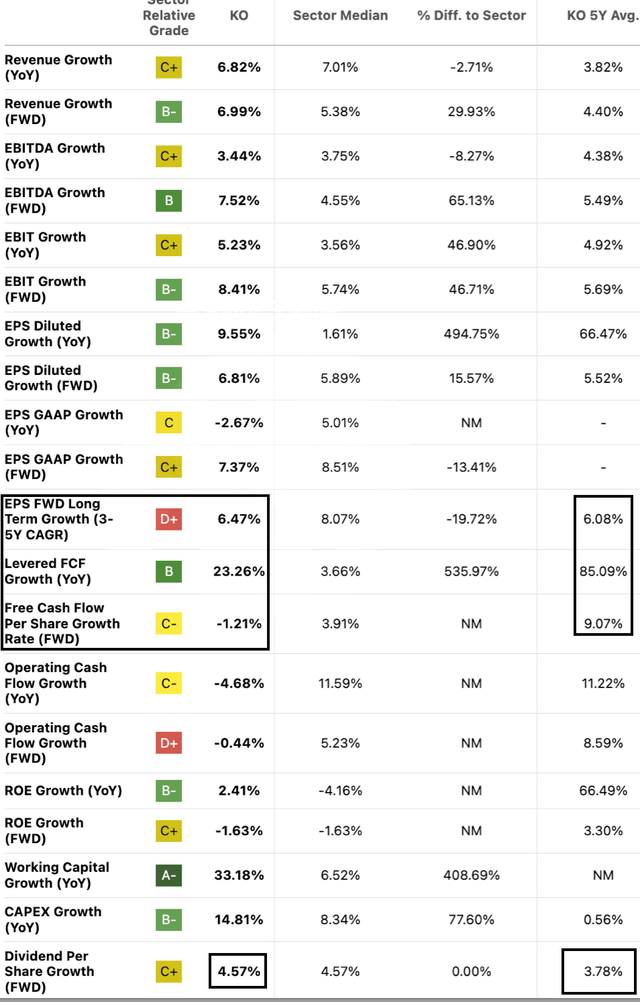

Does the company face any growth problems? Not really.

Despite being a mature company, Coca-Cola has demonstrated it can still deliver steady growth. With a dominant 43% market share of the global non-alcoholic beverage industry, Coca-Cola has managed 3.8% average annual revenue growth and 5.5% diluted EPS growth over the past 5 years. This outpaces the Federal Reserve’s 2% inflation target. Additionally, Coca-Cola has increased its dividend at a 3.78% annual rate over the past 5 years. While not explosive, this growth is respectable for a company of its size and tenure.

The Dividend Versus Buyback Dilemma

So, what’s the issue?

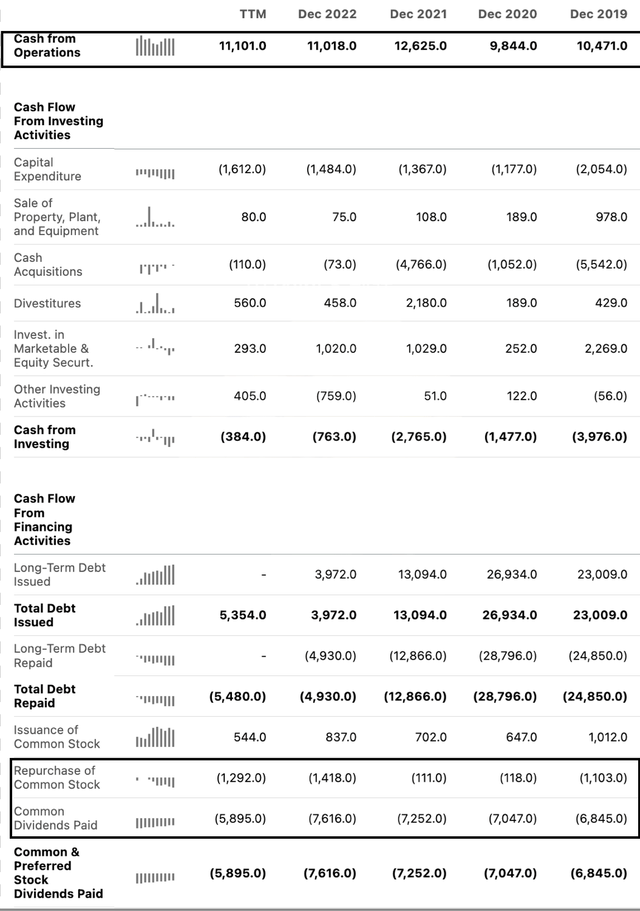

Coca-Cola’s shareholder return policies appear to be a key factor in its lackluster stock performance. The company generated robust annual operating cash flow, averaging around $10 billion over the past few years. With capital expenditures of just $1.5-$2 billion annually thanks to an asset-light business model, Coca-Cola is left with substantial excess cash. However, it has chosen to allocate the bulk of this cash to dividends rather than more impactful share buybacks. Coca-Cola has spent approximately $6 billion on dividend payments yearly, while share repurchases amounted to only around $1 billion annually. The company could potentially unlock more shareholder value by redirecting its cash priorities towards larger stock buybacks versus dividend payouts. An increased focus on share repurchases may help catalyze the stock and close the performance gap to market indexes.

Buffett’s Take on Share Buybacks

Warren Buffett has extolled the benefits of share buybacks, stating in a CNBC interview:

1. Buybacks, when done right, are a value investment

2. It is a free increase in stock ownership

3. Buybacks are better than hasty acquisitions, maybe even most acquisitions

However, Buffett cautions that the buyback price matters – companies should repurchase shares only when they are trading below intrinsic value.

Buffett said that buyback plans were getting “a life of their own, and it’s gotten quite common to buy back stock at very high prices that really don’t do the shareholders any good at all.”

Doing buybacks because they are “fashionable” is not a good reason, but Buffett said it was happening. “It’s fashionable and they get sold on it by advisors.”

We agree with Buffett’s perspective and believe Coca-Cola’s heavy focus on dividends over buybacks is a key reason for its underperformance versus the S&P 500. Repurchasing more shares at reasonable valuations could have boosted Coca-Cola’s stock return.

The Power of Share Buybacks: A Simulation

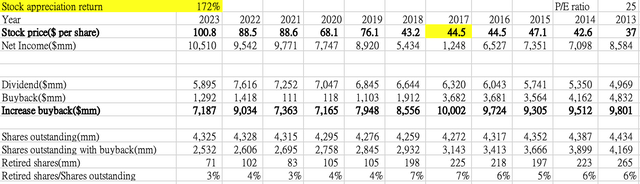

While Buffett advocates patience on timing buybacks, we believe companies have room to be more proactive. To illustrate, we conducted a hypothetical calculation of Coca-Cola’s 10-year return if it had allocated all dividend expenditures to buybacks instead, assuming a constant P/E of 25 and steady net income growth except during its 2017 trough.

This simulation found repurchasing shares versus dividends would have provided a substantially higher total return. While simplified, this shows the power of diverting dividends to buybacks prudently executed over time. Coca-Cola may have achieved better returns by making repurchases a higher priority.

Two thoughts:

- The Potential of Prioritized Buybacks: A Decade-Long Impact If Coca-Cola had allocated all its excess cash to buybacks over the past decade, our model shows its stock price today could be around 172% higher at $100 per share, far exceeding its actual 100% total return under current practice and more closely matching the S&P 500’s 212% return.

-

The Power of Steady Buybacks Over Perfect Timing In the hypothetical scenario we simulated, we did not assume that Coca-Cola times its buybacks to purchase during dips or lows in the stock price. However, the returns in our simulation still came out much higher than Coca-Cola’s actual returns even without optimized buyback timing. There are several reasons this occurred:

First, if Coca-Cola can maintain its competitive advantages that have created a moat around its business, the company should theoretically be able to continue improving its profit margins and grow revenues over the long term. Expanding margins can catalyze P/E multiple expansion for the stock, boosting the share price. So in theory, buying back shares at today’s valuations will be cheaper than buying back shares at higher valuations tomorrow. If an investor has a long-term outlook and believes in Coca-Cola’s ability to sustain its moats, the investor should welcome buybacks being executed steadily over time, even at current prices.

Additionally, Coca-Cola’s growth prospects suggest the company can deliver above-inflationary growth in earnings and cash flows for the foreseeable future. This means the company should be able to maintain substantial capacity for buybacks year after year going forward. Executing buybacks consistently, while not perfect, will accumulate compounding benefits over decades. A simple rule of thumb is that buybacks are accretive if the annual reduction in shares outstanding exceeds the dividend rate. Though Coca-Cola’s current 3.11% dividend yield approximates this threshold, the company’s growth prospects suggest buybacks could deliver greater long-term returns for shareholders.

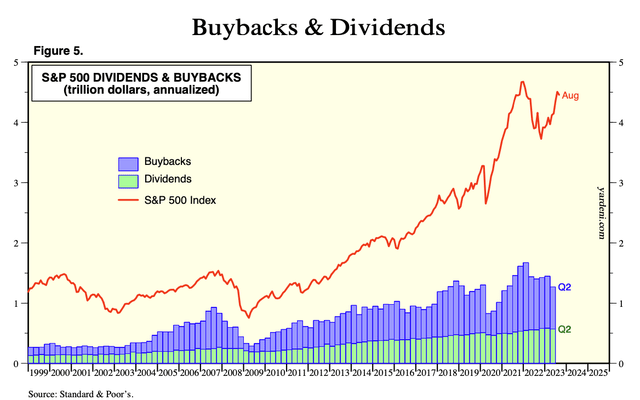

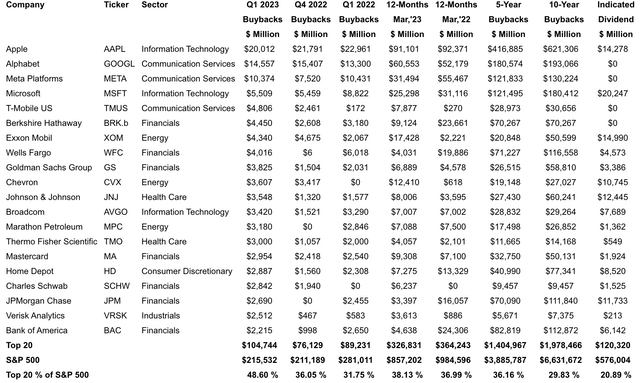

Shifting Priorities: Buybacks Over Dividends Among Top S&P 500 Companies

Share buybacks have been gaining prominence over dividends in capital allocation policies among major companies recently.

Looking at the top 20 companies in the S&P 500 index by market capitalization, the weighted average allocation to buybacks now approaches 48% of total capital returned to shareholders. This is almost 20% higher than the weighted allocation to buybacks among these top companies 10 years ago.

This shift illustrates that the largest, most influential companies have been steadily raising the importance of buybacks in their capital return programs over the past decade compared to dividends. The top companies recognize the benefits of buybacks for boosting their stock prices and are directing nearly half their excess cash to repurchases.

Quincey and his Capital Allocation Decisions

Given Coca-Cola’s entrenched leadership, a major shift in capital allocation policy seems unlikely. CEO James Quincey has been with Coca-Cola for over 25 years and at the helm since 2016. With his long tenure and stewardship of the dividend focus, Quincey is unlikely to suddenly pivot strategies. Additionally, Quincey’s relatively low insider stock ownership offers little incentive for him to prioritize shareholder-friendly buybacks over dividends.

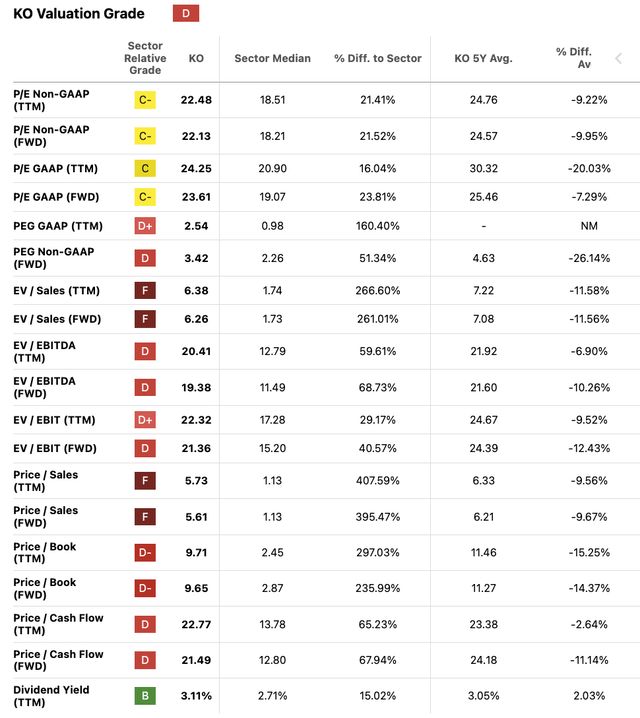

Valuation

From a valuation perspective, we believe there is limited room for significant price appreciation in Coca-Cola stock currently unless new growth drivers or margin expansion opportunities emerge. The current share price appears close to fair value.

Coca-Cola’s 3.11% dividend yield is approximately equal to its recent annual reduction in shares outstanding from buybacks. However, we would prefer to see Coca-Cola expand its share repurchase program as buybacks can, at a minimum, reduce the outstanding share count. This reduction can subsequently bolster the company’s EPS and lead to a lower and more favorable P/E ratio.

Moreover, it’s essential to recognize that buybacks serve purposes beyond just valuation considerations. To illustrate this point, we’ve included an example of Apple. From the below chart, Apple aggressively executed share buybacks, even when its stock was trading at elevated valuations above the historical P/E ratio.

We believe that despite Coca-Cola’s current suboptimal valuation, due to the absence of clear growth drivers and margin expansion opportunities, a forward-looking perspective suggests that the company’s dominant position will lead to new drivers in the future. Consequently, a consistent and robust buyback program in place today could prove to be accretive for shareholders in the long term.

Given Coca-Cola’s historical emphasis on using excess cash flows for dividend payments rather than share buybacks, we lack confidence that they will pivot strategies and begin directing a much larger portion of cash flows towards buybacks anytime soon.

Conclusion

While Coca-Cola will likely continue leading the beverage industry and delivering steady growth, its stock may remain lackluster until there is a shift in capital allocation priorities. Though the company dominates with its brands and distribution reach, the focus on dividends over buybacks hampers shareholder returns.

Even if Coca-Cola maintains its strengths, investors seeking stable income can likely find more attractive options among other blue-chip stocks. Passive investors may be better served investing in a low-cost index fund such as SPY rather than Coca-Cola shares if they wish to avoid conducting diligence on capital allocation.

However, Coca-Cola would warrant a fresh look if management meaningfully pivots to share repurchases. The stock could finally perk up if the company aligns its massive cash flows with shareholders’ interests. But until capital allocation changes, Coca-Cola seems destined for more subpar returns relative to alternatives.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.