Summary:

- United Airlines’ strong financials and record passenger demand position it for robust shareholder returns despite industry volatility and high debt obligations.

- The company’s low P/E ratio and strategic debt repayment highlight its financial health and potential for increased profitability.

- United Airlines’ operational excellence, including record passenger numbers and improved on-time performance, underscores its competitive edge.

- Consolidation in the airline industry and potential lower fuel costs could further boost United Airlines’ profitability and shareholder value.

John M. Chase

United Airlines (NASDAQ:UAL) is one of the largest airlines in the world, with a market capitalization of almost $15 billion. The company has a mid-single digit P/E and one of the strongest asset portfolios of any airline. As we’ll see throughout this article, the company’s strong pricing will enable strong shareholder returns.

United Airlines Financial Results

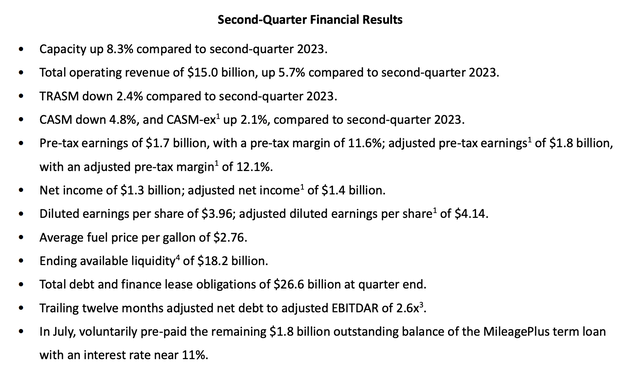

United Airlines saw capacity go up by more than 8% as the company has seen incredibly high demand.

United Airlines Press Release

The company saw total operating revenue of $15 billion, up almost 6%, however, total revenue per available seat mile declined just over 2%. Still, the company’s business remained strong with costs down almost 5% enabling margins to remain relatively strong at roughly 11.6%. The company saw pre-tax earnings of $1.8 billion, which is massive earnings.

The company trades at a single-digit P/E as airlines remain a heavily volatile market frequently affected by black swan events. The company’s liquidity remains incredibly strong, but debt and lease obligations of almost $27 billion are expensive, especially in a high-interest rate environment. The company managed to repay $1.8 billion of 11% interest rate debt.

The company’s strong net income will enable it to continue cleaning up its financial position and driving returns.

United Airlines Performance

The company’s business has continued to perform incredibly well, as it hasn’t rapidly increased costs despite a strong market.

United Airlines Press Release

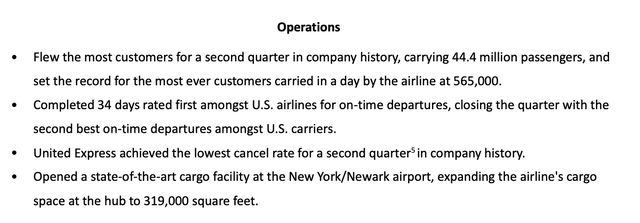

The company flew the most customers for the 2nd quarter in history, carrying more than 44 million passengers. The company also set a daily record at 565k passengers. Despite a mantle that’s traditionally held by Delta, the company has managed to improve its on-time performance, with 34-days at ranked first and a low cancellation rate.

The company is building up cargo facilities and maintenance hubs, important in a world where getting new airplanes is difficult. This strong performance and high demand from customers is essential for the company to get future shareholder returns.

United Airlines Segment Performance

This shows how strong the company’s segments have been.

United Airlines Press Release

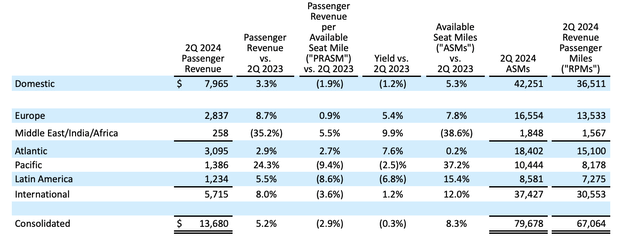

The company earned almost $14 billion in passenger revenue for the quarter, split across almost 80 billion ASMs. RPMs are more than 67 billion. The company remains strong in all of the markets where it serves, and it’s actually had more pricing power in domestic markets where it operates in oligopolies versus in international markets.

The company’s passenger load factor sits at roughly 85%, showing continued demand for its assets. A sign of the company’s strength is an almost 16% increase in cargo revenue per ton miles. Fuel prices have gone up by 3.8% and that remains a major cost for the company at more than $3 billion for the quarter. That eats up more than 22% of the company’s revenue.

With recent weakness in energy markets, United Airlines could see costs drop and even stronger earnings in upcoming quarters.

Our View

United Airlines trades at a low valuation given investors’ expectations of volatility in the airline industry. However, the airline industry is increasingly consolidated and the company has a strong product offering and a dominant U.S. market position. The airline has become my personal airline of choice thanks to its superior business class product (Polaris) and its strong integration with international partners versus other airlines like Southwest.

Concerns about a recession and long-term demand has pushed down fuel prices substantially. That could be a substantial catalyst for United Airlines in upcoming quarters as demands for air travel remain high. The company remains profitable, and delays in plane delays could even help keep costs lower and enable more immediate shareholder returns.

The company has been able to make more immediate decisions like paying down a $1.8 billion 11% loan, saving shareholders almost $200 million in annual interest payments. All of this together helps make United Airlines a valuable investment.

Thesis Risk

The largest risk to our thesis is how luxury-based the airline industry is and how susceptible it is to an economic downturn as we hit the end of an economic cycle. The Fed is considering decreasing interest rates as we hit the end of a cycle and if they fail to achieve a soft landing that could be a major downturn for United Airlines.

Conclusion

United Airlines has reported strong earnings and record passenger demand as customer demand remains hefty. The company’s revenue remains strong, and its profits give it a mid-single digit P/E as investors remain uncertain about the airline industry. However, consolidation in the industry helps the company and the company’s loyalty program remains strong.

The company has been able to utilize its cash flow for shareholder returns. Paying off the $1.8 billion in debt is a great move. We expect the company to continue increasing its shareholder returns, making the company a valuable long-term investment. Let us know your thoughts in the comments below.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of UAL either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

You Only Get 1 Chance To Retire, Join The #1 Retirement Service

The Retirement Forum provides actionable ideals, a high-yield safe retirement portfolio, and macroeconomic outlooks, all to help you maximize your capital and your income. We search the entire market to help you maximize returns.

Recommendations from a top 0.2% TipRanks author!

Retirement is complicated and you only get once chance to do it right. Don’t miss out because you didn’t know what was out there.

We provide:

- Model portfolios to generate high retirement cash flow.

- Deep-dive actionable research.

- Recommendation spreadsheets and option strategies.