Summary:

- United Airlines Holdings, Inc. has been a consistent profit machine, with strong earnings and cash flows even before the pandemic.

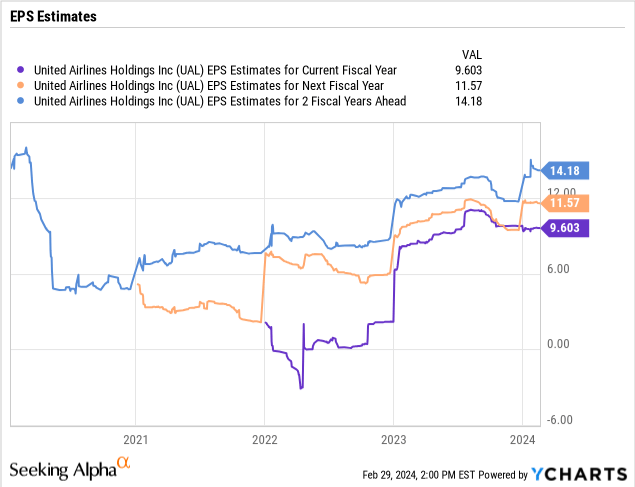

- The airline forecast a $9 to $11 EPS this year, with analysts predicting big jumps to future profits.

- United Airlines’ massive asset base, including valuable aircraft, should be considered when evaluating its debt levels and overall valuation.

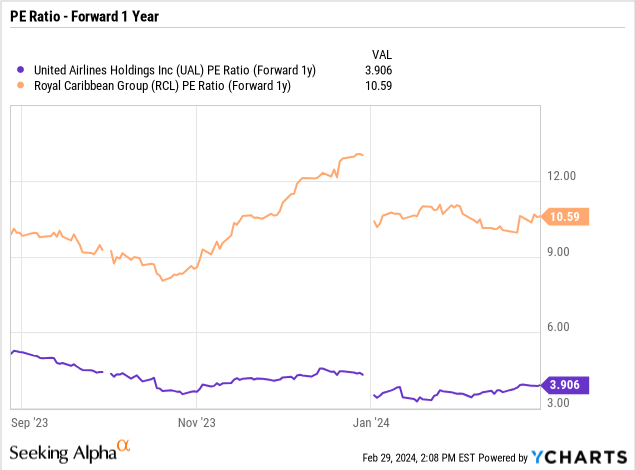

- The stock trades at only 4x EPS targets, far below cruise lines hit even harder during Covid.

CHUYN

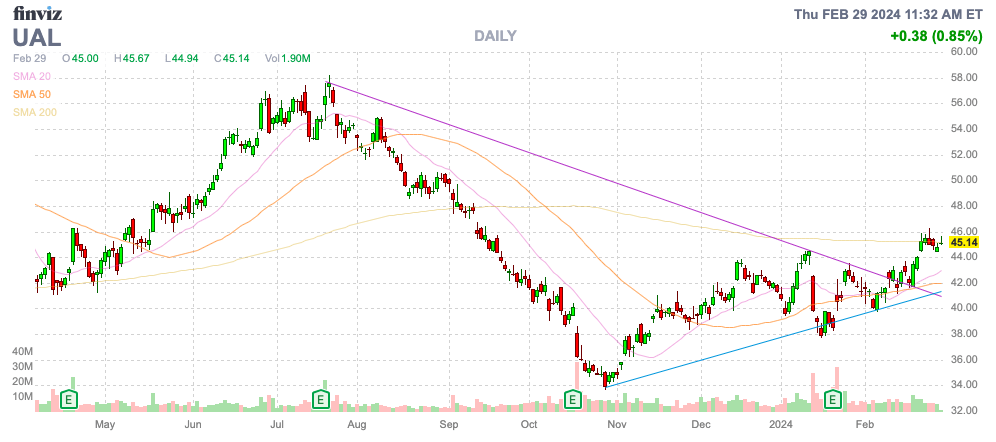

While some cruise line stocks recently surged to new all-time highs, airlines like United Airlines Holdings, Inc. (NASDAQ:UAL) are still stuck with stocks going nowhere. The airline industry survived the Covid lockdowns better than the cruise lines, but the sector remains hated despite massive cash flows and profits. My investment thesis is ultra Bullish on the business heading to new heights and the stock being dragged higher.

Source: Finviz

Profit Machine

No matter what one thinks about the airline sector, the major legacy players have been profit machines going back years before Covid. United Airlines earned an EPS of $12 in 2019 and guided to a midpoint of $12 in 2020 when reporting in January, before the global shutdowns occurred.

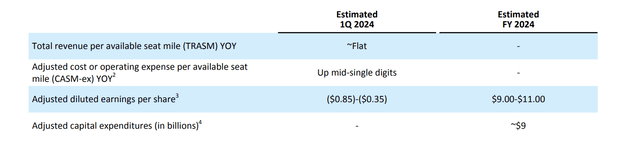

The legacy airline just returned in Q4 to an EPS of $10.05 in 2023 and forecast strong earnings again in 2024. Management forecast an EPS of $9 to $11 for a stock currently trading at only $45.

Source: United Airlines Q4’23 investor update

In the pre-Covid period, United Airlines traded at up to $90 due to the forecast for a $12 EPS. The stock was even seen as cheap at twice the current price, but now airline stocks trade as if a virus-related shutdown will occur again, though the cruise line stocks don’t trade in a similar manner.

The consensus estimates now have United Airlines building on the current profit stream over the next couple of years. The analysts now forecast the 2026 EPS soaring to over $14 for a stock again trading at only $45.

As mentioned above, the airline stocks are so unloved that even the cruise line stocks now trade at far higher valuation multiples. Royal Caribbean Cruises (RCL) was completely shut down for over a year, yet the stock has now roared to new heights. While United Airlines only trades at 4x forward EPS targets, Royal Caribbean is at nearly 11x forward targets.

The ironic part is that Royal Caribbean has a similar EPS target. Analysts forecast a 2024 EPS of ~$10 and the stock trades at $122. United has a 2024 EPS target of $10 and the stock trades at only $45.

Note, United Airlines could actually produce a higher EPS in 2024 with fuel costs under control. On the Q4 ’23 earnings call, CEO Scott Kirby highlighted the fact that costs are generally flow through numbers now and the company will now focus investors more on margins over costs and revenue trends:

Another way of saying that is that we believe that a new link between United’s CASM and RASM was being solidified. And while it might be hard to get either a CASM or RASM forecast exactly correct, we can have higher confidence in forecasting the relationships between the two, and therefore, have higher confidence in our earnings [Indiscernible] margin forecast.

The airline industry was easily able to absorb the fuel cost jump while still reporting robust profits for Q4 and guiding to strong 2024 earnings. With United Airlines plans no longer reporting unit metrics in order to shift the investment community away from financial measurements, the stock market might finally quit seeing volatile fuel costs as such a negative.

Don’t Fret Debt

One of the other big excuses for not investing in the airlines is the total debt levels. Whether one looks at gross debt or net debt, investors always overly fret the debt amounts, not realizing the airlines collect the debt from purchasing very costly and valuable aircraft (no different from cruise lines with ships).

United Airlines forecast spending a massive $9 billion on capex in 2024, though the number is likely to come in lower due to the production issue at Boeing (BA). The airline spent $7.2 billion on capex last year, slightly topping the $6.9 billion generated by operating cash flows.

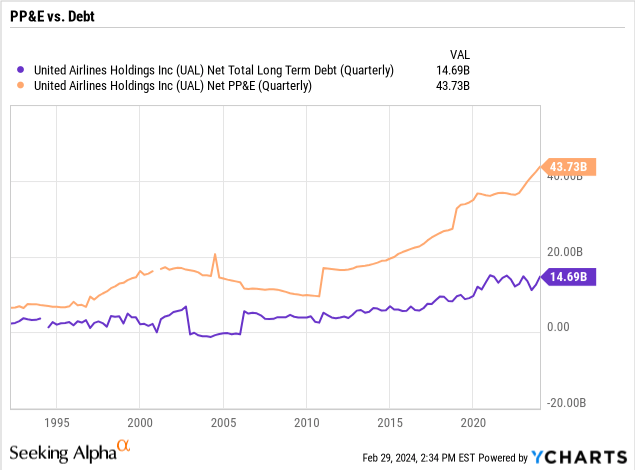

While the market is taught that a negative free cash flow is bad, the airline sector is vastly different due to the ability to turnaround and sell these aircraft at strong market values. In this case, United Airlines saw the operating PP&E asset grow by $5.4 billion YoY to account for the new aircraft added to the lineup.

What actually matters in airlines is the valuation difference between PP&E and the net debt levels. United Airlines hasn’t seen the net debt paid down in the last couple of years, but the company has boosted the asset account to now $44 billion, vastly above the less than $15 billion in net debt down.

In essence, the airline has a massive asset base that can be encumbered with new debt or sold to raise cash. Spirit Airlines (SAVE) just sold 25 planes to generate $419 million in cash to repay debt

The constant focus on an enterprise valuation leads to valuations that only include the debt levels and never account for the massive assets of the airline. United Airlines only has a market cap of $16 billion, and while the airline isn’t likely to pay down net debt this year, the PP&E asset value will surge to over $50 billion, far above the debt levels.

Takeaway

The key investor takeaway is that United Airlines Holdings, Inc. stock shouldn’t trade at only $45 when the airline is consistently producing massive profits. Investors should continue using the ongoing weakness in the sector to build up positions in the stock.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of UAL either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

The information contained herein is for informational purposes only. Nothing in this article should be taken as a solicitation to purchase or sell securities. Before buying or selling any stock, you should do your own research and reach your own conclusion or consult a financial advisor. Investing includes risks, including loss of principal.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

If you’d like to learn more about how to best position yourself in under valued stocks mispriced by the market to start 2024, consider joining Out Fox The Street.

The service offers a model portfolio, daily updates, trade alerts and real-time chat. Sign up now for a risk-free 2-week trial.