Summary:

- United Airlines has improved its balance sheet and operating model, making it a high-quality player in the industry.

- The company’s focus on fixing its mid-continent business and on the profitable long-haul routes has contributed to its improved fundamentals.

- United’s stock is undervalued compared to its peers, making it an attractive investment option relative to the rest of the airline space.

Alvin Man

As airline earnings season approaches, I have been revisiting my theses on the sector. I have recently called Spirit Airlines (SAVE) “a terrible addition to a portfolio“, doubling down on my most bearish call in the airline space published in 2018. International Consolidated Airlines (OTCPK:ICAGY), on the other hand, looks both cheap and fundamentally solid today.

Now is United Airlines’ (NASDAQ:UAL) turn. Once the growth story among the US legacy names, United has pivoted its strategy toward better margins and a healthier balance sheet. Today, I see the airline as a high-quality player in the industry, which puts the stock squarely in the “relative buy” camp, in my view.

How United changed over time

To be honest, United Airlines has often been a question mark for me. While I once saw the company and stock as a growth play in the sector, I turned more skeptical at the start of the COVID-19 crisis and a full bear in 2021. My concerns included a leveraged balance sheet and heavier exposure to markets that would likely take longer to recover from the pandemic days, namely international and business travel.

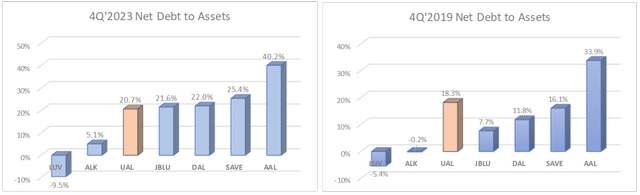

Fast forward to 2024, and those specific concerns have turned into reasons to be more optimistic about United Airlines. Starting with the balance sheet, the Chicago-based airline has done a wonderful job keeping its leverage under control, more so than any peer. Despite the COVID-19 crisis, the company barely added to its net debt position relative to the last quarter of 2019, in part due to stock issuance in 2020. The chart below shows how United went from being the second most indebted US airline in 2019 to one of the least.

DM Martins Research, data from company reports

United’s good-looking balance sheet is only a symptom of how the company’s fundamentals have improved, even through the COVID-19 crisis. In 2023, the company reported the best per-unit margin in the space, at a quarterly average PRASM (a measure of per-unit revenues) minus CASM-ex (operating cost per unit, excluding items like fuel) of $4.76 vs. American Airlines’ (AAL) $4.32 and its own $3.66 in the year that preceded the start of the pandemic.

The improved operating model seems to have resulted from United’s focus on fixing its mid-continent business (think Denver, Houston, and Chicago hubs), doubling down on its profitable long-haul routes, and keeping a lid on operating costs – United remains the lower-cost legacy airline by a good bit.

On the international and business exposure, what was once a weakness for United may now be a relative strength. The company continues to be the most international of the US legacy airlines, with 40% of 2023 revenues having come from its Atlantic, Pacific, and Latin American routes vs. 31% for Delta Air Lines (DAL) and 29% for American Airlines. I believe that the days of strong post-COVID recovery in domestic and leisure travel relative to international and business are largely behind us.

UAL’s valuation is de-risked

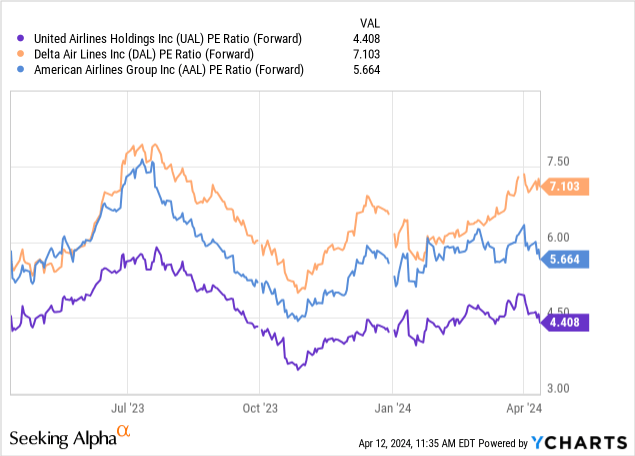

Despite United’s fundamentals looking solid, as I have argued above, the stock is still valued at a discount to peers DAL and AAL. The chart below shows United’s current year P/E at only 4.4x vs. an average of 6.4x for the rest of the peer group. Worth noting, the valuation multiple is low despite projected EPS growth of 19% in 2025, suggesting a rock-bottom PEG of 0.23x.

Make no mistake: investing in the airline space is very risky. The sector is quite sensitive to the economic cycles and the ups and downs of oil prices. In addition, the industry is highly competitive, as margins remain under assault at all times.

Therefore, I don’t (and probably never will) consider UAL an absolute long-term buy, given the stock’s high volatility and deep drawdowns. Instead, I think the stock is a compelling buy relative to the peer group due to the combination of solid fundamentals and very attractive valuations.

United’s upcoming earnings report

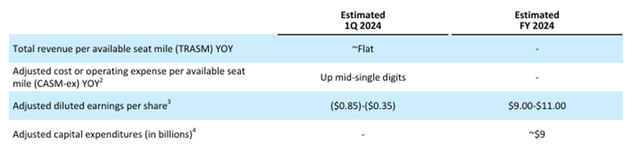

With the core fundamentals out of the way, it may be worth addressing United Airline’s upcoming earnings report to be released after the closing bell, on April 16, with the earnings call scheduled to take place the following morning. Analysts are projecting roughly 8.5% in revenue growth and a per-share loss of $0.57.

The first quarter of the year is traditionally much weaker than the other three periods due to seasonality, especially as we come off the busy travel season of November and December. Operating leverage works against the airline in this case, which helps to explain the negative EPS. Also a headwind to earnings, but one that should not surprise investors, is the slightly higher fuel cost YOY.

Investors should measure United’s results against the company’s partial outlook provided in January (see above), although it only previews a few important results or metrics. Per-unit revenues are expected to be flat, while per-unit operating costs should increase noticeably.

To counter some of these headwinds to operating income, I would hope to see sustained growth in capacity and, maybe more importantly this quarter, better occupancy rates relative to what United delivered in Q4 of last year: 82.3% load factor, a whopping 290 basis points lower YOY.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.