Summary:

- United Airlines stock gained 32% since October 2023, in line with market performance.

- Q2 earnings show revenue growth falling short of capacity growth, leading to margin contraction.

- Despite demand pressure and weakening industry sentiment, United Airlines stock is undervalued with potential for 40% upside.

John M. Chase

In October 2023, I reiterated my buy rating after United Airlines (NASDAQ:UAL) stock dropped on a soft outlook, and since then, the stock has gained 32%, which is in line with the market performance. So, that’s not bad. But airlines are higher-risk investments in my view, and for such investments I would like to see some sort of premium. That was not the case, and that’s partially driven by the fact that United Airlines stock surged after posting its Q1 2024 earnings, only to see the stock price slide afterwards.

For airlines and airline stocks, it seems to be extremely difficult to hold on to gains, which I partially attribute to the tendency of airlines to throw capacity in excess of demand on the market. In Delta’s (DAL) latest earnings report and call, we also saw signs of overcapacity on the market. In this report, I will be discussing the Q2 earnings for United Airlines, the guidance for Q3, and evaluate my price target and rating.

United Airlines Revenue Growth Falls Short Of Capacity Growth

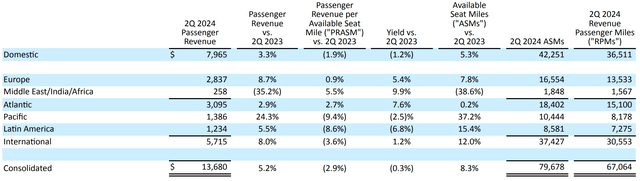

United Airlines

Taking a look at the revenues, we see that passenger revenues increased 5.2% on a 8.3% increase in capacity. So, unit revenues continue to soften year-on-year. The only regions where PRASM did not decline was in the European and Middle East/India/Africa market, which together form the Atlantic market. In Europe, there was a 7.8% capacity increase that generated 8.7% higher revenues, while in the other Atlantic markets the capacity decreased by 38.6% but unit revenues increased 5.5%. The situation in Israel and decreased stability in the Middle East are the reasons for the significant capacity reduction, primarily on flights to Israel. The Pacific remains a high-growth market from a revenue perspective, but as more capacity comes online, we’re also seeing the unit revenues decrease. The same (but to a lesser extent) is visible in the Latin American market.

What we’re currently seeing is that airlines are not really preserving unit revenue strength, but they’re throwing capacity on the market to maintain some growth in revenues while also hoping it will better amortize costs. I wouldn’t say there’s an overcapacity in all end markets, but unit revenues are under pressure and airlines likely need to start discounting more aggressively to fill seats. So, the elements that indicate overcapacity are already there.

United Airlines Q2 Margin Contracts On Cost Growth And Softer Fares

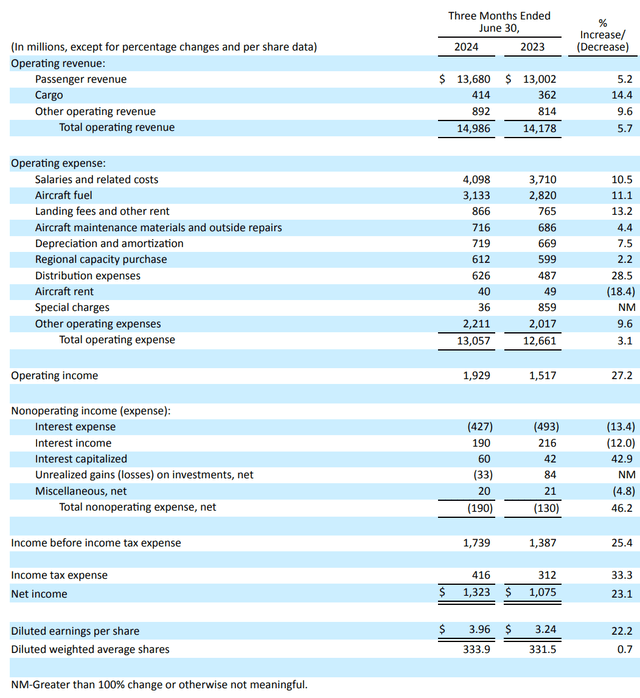

United Airlines

Total revenues grew 5.7% to $14.99 billion, beating analyst estimates by $20 million. Total operating expenses grew 3.1%, and against an 8.3% capacity growth that looks good. However, last year there was a special charge, and when we exclude this charge, the cost growth would be 10.3% higher and 10% higher when excluding fuel costs. So, revenue growth fell short of cost growth and capacity growth exceeded revenue growth but was lower than cost growth. So, you’re essentially looking at margin contraction. Adjusted operating margin fell from 16.8% to 13.1%.

On a unit basis, revenues declined 2.9% and cost per available seat mile declined 4.8%, driven by the charge. Excluding special items and fuel, the unit costs increased by 2.1%. I wouldn’t say United Airlines did badly during the quarter, because that’s not the case. The company’s EPS of $4.14 beat analyst estimates by $0.21.

United Airlines Guidance Is Soft, Could Indicate Further Weakening In Demand

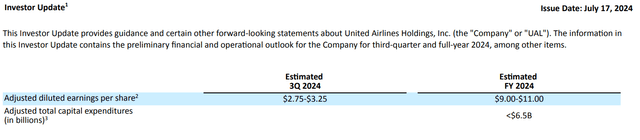

United Airlines

In terms of guidance, United Airlines does not provide a lot other than EPS and capex. The only thing that we can see is that the EPS guidance of $2.75-$3.25 for the third quarter falls materially short of the $3.36 that analysts are expecting. It’s a guidance we cannot do a lot with other than noting that United Airlines has only missed analyst estimates once over the past eight quarters and the $9.76 consensus for the full year still falls within the guided range.

However, if we look at the overall airline industry, it seems to me that this is not necessarily conservative guidance for the third quarter, but demand is materially weaker than was initially expected for the summer season.

Is United Airlines Stock Still A Buy?

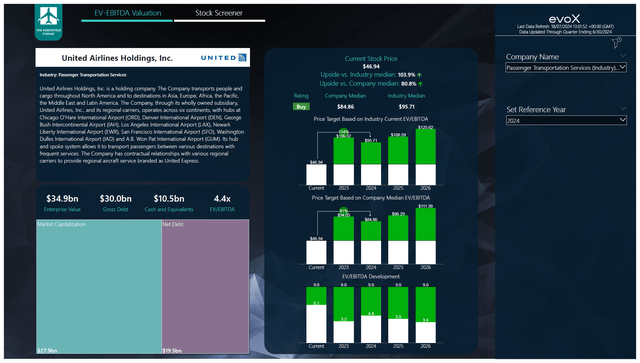

The Aerospace Forum

For the 2023-2025 timeframe, EBITDA estimates have come down by 2% in total. Free cash flow could see some upside as capital expenditures are tapering due to delivery delays of new commercial airplanes, and we could also see some deferrals if the current market conditions continue to weaken. Either way for 2024, EBITDA estimates have come down by 3% and 2% for 2025, so there’s some pressure.

However, there’s potential for the stock price to double, as the current EV/EBITDA of 6.1x falls short of the industry median. Forward projections of earnings would put the EV/EBITDA on 4.2x. Even if we only would allow half of the upside to materialize, we would get a $65.90 price target, representing 40% upside.

Conclusion: United Airlines Has Potential Despite Demand Pressure

There’s little doubt that airlines are seeing demand weakening and that provides pressure on margins as well as sentiment regarding investment in the airline industry. However, in my view, United Airlines stock is already so undervalued that even with pressure on demand, its current share price does not in any way or form reflect its performance or the softer performance that is anticipated. As a result, I’m maintaining my buy rating for the stock.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

If you want full access to all our reports, data and investing ideas, join The Aerospace Forum, the #1 aerospace, defense and airline investment research service on Seeking Alpha, with access to evoX Data Analytics, our in-house developed data analytics platform.