Summary:

- United Airlines has transformed itself into a profitable airline, rivaling Delta Air Lines after nearly two decades of restructuring.

- UAL stock faces challenges due to macroeconomic fears and overcapacity in the U.S. airline industry as well as operational challenges and higher labor costs.

- United Airlines has focused on rational international capacity management, slowing fleet acquisitions, and improving customer service to enhance profitability.

United Airlines highest local market revenue hub is at Newark. Niall_Majury

United Airlines (NASDAQ:UAL) is capping nearly a two-decade long transformation from being just one of the U.S.’ poorly run airline businesses to one that is now vying with Delta Air Lines (DAL) as the most profitable U.S. airline. United has learned much from its own past as well as other airline’s successes and failures and has put in place a number of strategies that are bearing real fruit.

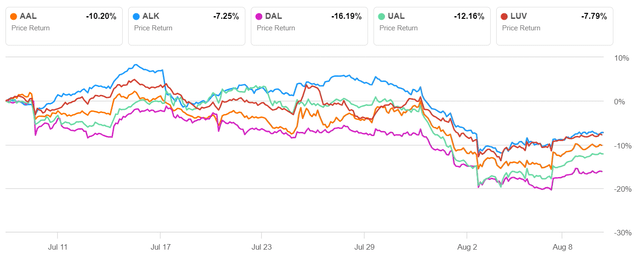

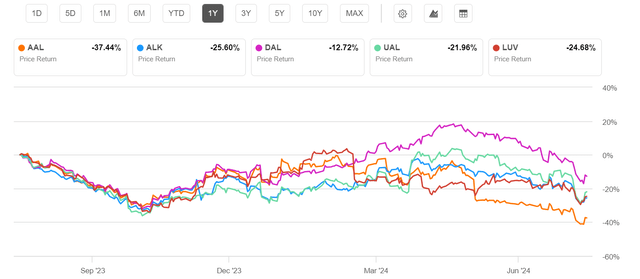

The reset that has swept across U.S. stock markets over the past couple weeks has been costly for U.S. airline stocks including for UAL which saw a healthy 6% gain on Thursday August 8 but still is down 11% over the past month. UAL stock is down 25% in the past year and is flat year to date and for the past six months. Macroeconomic fears continue to pressure consumer-related stocks amid fears that high interest rates and economic weakness is impacting consumer ability to keep the U.S. economy strong. However, there is strong belief that consumers at the lower end of the economic spectrum are trimming their spending at a faster rate than wealthier consumers. United, like Delta, is focusing its business model around delivering high-value services across a global network which is demonstrating greater strength than the domestic market.

big 4 US airline 1 month chart (Seeking Alpha)

I noted several months ago that U.S. airline stocks have a history of falling in the summer and that has been validated to be the case for 2024 over the past month. Multiple airlines stated during their second quarter earnings announcements that there is overcapacity in the U.S. airline industry which is pressuring domestic fares, pushing down airline stocks during the last 30 days even before the tech-led market reset and the airline industry’s own operational problems related to the CrowdStrike (CRWD)-induced IT failure.

In this article, we will look at United Airlines’ second quarter earnings, its accomplishments over the past two decades, and the outlook for the company to continue to improve its stock performance.

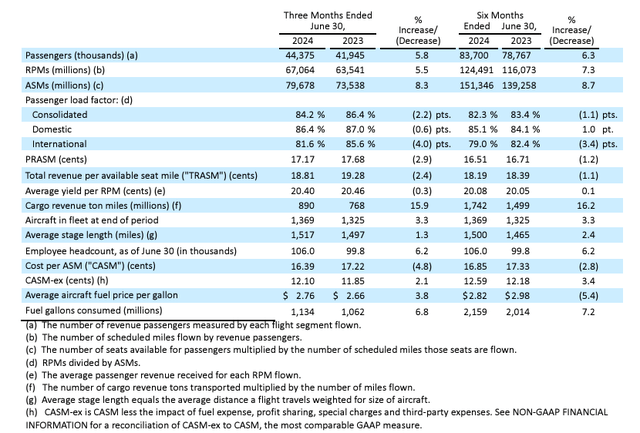

Solid Second Quarter Performance

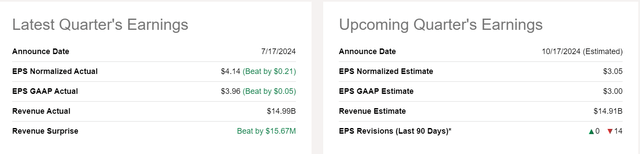

UAL reported its second quarter 2024 results on July 17 with a slight beat on both revenue and earnings, chalking up GAAP earnings per share of $3.96 and just under $15 billion in revenue. UAL was and typically is the second airline to report after Delta Air Lines (DAL); DAL’s commentary regarding overcapacity negatively impacted airline stocks after DAL’s report, allowing UAL stock to not be as negatively impacted since investors and industry analysts expected the same trend for UAL. Indeed, UAL and DAL reported very similar results with UAL nudging past DAL on net income primarily because of non-operational expenses such as losses on DAL’s equity investments. DAL and UAL’s operating results were very similar and highlights that the two are financially better matched as competitors than any two airlines in the U.S. airline sector.

UAL earnings 2Q2024 (Seeking Alpha)

Two Decades of Restructuring

United is one of the big 3 U.S. airlines alongside American (AAL) and DAL. UAL has operated for over 90 years and traces its roots to the early days of U.S. commercial aviation when United was one of the beneficiaries of government favor during the regulated era of aviation. Originally a subsidiary of Boeing (BA), federal regulations required airframe manufacturers to divest their airline operations and United built its route network across the northern tier and western parts of the U.S. until the U.S. airline industry was deregulated in 1978.

The three primary distinctives that mark the United of today are its network, its customer service, and its fleet growth plans.

Like most legacy airlines, United struggled during the first two decades of domestic airline deregulation, unable to effectively compete with low-cost carriers including Southwest (LUV) that were becoming an increasingly potent force in U.S. aviation. In order to find market outside of the U.S. domestic market, United acquired Pan Am’s Pacific network in 1985 and its London Heathrow routes in the early 90s followed by Pan Am’s Miami-based Latin America operation as the legendary blue-ball airline succumbed to decades of inability to adapt to a competitive marketplace. While United’s Miami-based Latin America hub failed at the hands of American’s intense defense of its own Latin America presence, United’s Pacific network has grown to become the largest of any airline, regardless of nationality, while United continues to trade places with Delta as the largest airline to Europe; the latter acquired Pan Am’s continental European network.

The 1990s saw heady growth for United esp. with the strength of the tech and dot com sector in Northern California where United is the largest airline. The dot bust of the late 90s followed by 9/11 was particularly difficult for United which ended up in the longest and most costly bankruptcy restructuring in U.S. airline history but the company emerged as one of the remaining half dozen legacy airlines. United’s bankruptcy finally ended the Employee Stock Ownership structure that had attempted to give United employees a stake in the future of the airline during the 90s but failed due to repeated conflicts between union demands and management.

The number of legacy carriers shrunk over the decade following 9/11 to the current three global U.S. megacarriers with the United-Continental megamerger. Continental, also a legacy carrier, had been transformed through a couple of difficult decades post deregulation but emerged with a coveted hub at Newark airport, the largest in the New York City area at the time, a large presence in Texas esp. to Central America and western S. America, and a disproportionately larger international network than other legacy carriers. All of those factors plus United’s own separate independent international growth – both organically and through asset acquisitions – helped define United as it is now including its distinctive international size which has been a huge driver of United’s financial transformation.

Rational International Capacity Management

In the decade prior to covid, United acted aggressively to gain the position as the largest carrier across the Pacific, a title that was held by Northwest for years and then Delta when the two merged in 2009. However, Northwest’s transpacific operation was breakeven at best and Delta spent much of the decade after the Northwest merger taking apart its Tokyo-based Pacific operation, leaving an opening for United. In the years right before covid, United’s own Pacific network had a small negative profit margin as it vied for market share over profits. Post covid, United has once again aggressively added capacity to the Pacific in the midst of a strong pricing environment. Transpacific revenue strength is being driven by substantial reductions in capacity between the U.S. and China due to Chinese government restrictions during covid and the subsequent geopolitical tensions that have decimated demand to and from China, also reducing the number of seats that Chinese carriers were offering between the U.S. and destinations in Asia other than China. In the winter of 2023-24, United aggressively added capacity to the S. Pacific resulting in poor traffic results and losses even as Delta reported profits in the region according to DOT data.

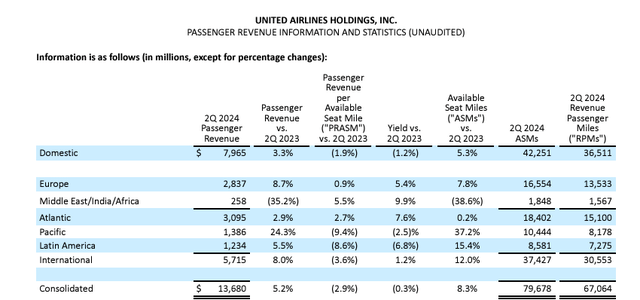

UAL 2Q2024 revenue by region (ir.united.com)

United has apparently learned from its mistakes over the Pacific post-covid and has dramatically reduced service in the region for the winter of 2024-25. While United is still handedly the largest carrier across the Pacific, they appear to be moving to a much more cautious approach to capacity which will help their financial results. For the second quarter, United still grew its Pacific capacity by healthy double-digit percentages but seems to be willing to not fly much of that capacity during the winter when pricing becomes softer.

United’s capacity additions over the Pacific were related to its strategy during the covid era of not retiring older aircraft, a strategy which airlines frequently use during deep crises to reduce capacity and modernize their fleets given that they almost always have new aircraft on order. United added back capacity aggressively over the Atlantic given that Europe was the first major global region to see demand return post covid and has been strong for U.S. airlines ever since. The fare environment over the Atlantic has been strong because a number of transatlantic low-cost carriers failed during the pandemic which seemingly provide a strong environment for growth for United. However, DOT data for 2023 shows that United made just half of the profit that Delta made flying the Atlantic indicating that United’s high growth strategy has not born financial fruit as the company expected. For the second quarter of 2024, United didn’t grow its year over year transatlantic capacity in order to restore higher profitability.

It is certain that United’s focus on international market share over profit maximization was a big reason for its underperformance relative to Delta. United’s more prudent deployment of capacity in international markets is certain to have an outsized impact on improving the company’s bottom line financial results.

Slowing Fleet Acquisitions

The second distinctive of United’s recent strategies is its aggressive fleet growth which is related to a number of its network strategies. As a heavily internationally focused airline, Continental operated a high percentage of domestic routes on regional jets; United continued with that philosophy for years after the merger of the two airlines. In fact, pre-covid, United had more domestic flights operated by regional airline partners than on United’s own large jet aircraft (those made by Airbus – EADSY – or Boeing – BA). For a number of reasons, United has realized that not having a robust domestic network has been costly to the company relative to competitors. In reality, the domestic market has consistently been more profitable for U.S. airlines than has been the international marketplace. In addition, lucrative credit card agreements are heavily tied to the size of an airline’s domestic network. United has been fourth out of the big 4 airlines (including LUV) in size in the domestic market and recognizes that the ability to grow its non-transportation revenue including from its loyalty and credit card programs – requires a larger domestic network.

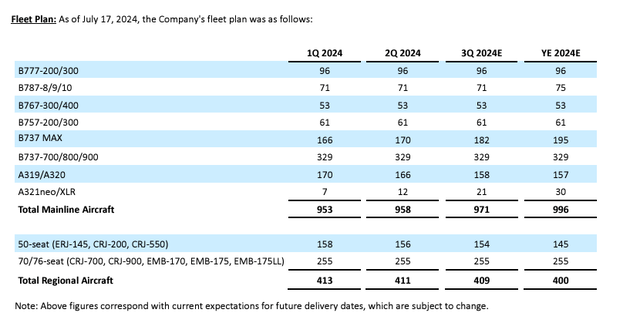

UAL fleet plan 17July2024 (ir.united.com)

The combination of its need for increased domestic revenue and an above average rate of fleet replacement led the airline to place one of the largest orders for new aircraft heavily built around the Boeing 737 MAX and the 787. United became an outsized customer for the MAX 10 including adding more orders during covid even though the MAX 10 was not certified – and still is not. Boeing’s production and quality control issues have been well-documented but the result has been that United’s plan which envisioned rapid fleet growth has not taken place as originally expected. UAL also ordered the Airbus A321NEO and has sought to acquire more of that model but has had limited success, acquiring only three dozen additional A321NEOs, far less than the shortfall that Boeing’s MAX delays have caused.

United’s intention to replace regional jets with larger mainline aircraft also explains why the company has repeatedly spoken negatively about the ultra-low fare carrier segment of the U.S. airline industry. United has stated that it needs to fill more low fare seats as it replaces regional jets with larger mainline aircraft. The current overcapacity in the U.S. domestic market is heavily related to excessive growth by ultra-low cost carriers such as Spirit (SAVE) and Frontier (ULCC) but also by low cost carriers such as LUV and JetBlue (JBLU). While United was hoping to be able to fill discount seats as it upsized to larger aircraft, delivery delays from Boeing have come as a blessing to United’s bottom line as the company has been unable to add the capacity it wanted even as multiple airlines struggle financially and are reducing capacity on their own which will bolster the pricing environment for all carriers including UAL. While United’s growth rate will be closer to industry-average rather than well above it, the reduced capacity will not only provide for a stronger pricing environment and stronger domestic profits over time but will also aid United’s balance sheet; its aggressive fleet spending was set to involve multiple years of $8 billion plus in capex, well above the company’s ability to spend without taking on debt. While United’s medium to long term fleet plan remains uncertain, it is likely that the company has learned from the benefits of slower growth than it planned and of organically taking more market share rather than aggressively trying to wrestle it from financially weaker carriers. In addition, United operates the oldest fleet among the large jet U.S. airlines. United will have to devote higher percentages of its fleet spending to aircraft replacement as the cost of keeping older aircraft in service becomes prohibitively high relative to the cost of new aircraft and the improved economics they offer, esp. for longhaul international aircraft.

UAL statistical summary 2Q2024 (ir.united.com)

Improving Customer Service

The third major component of United’s transformation is its customer service. United, like many airlines, had a reputation for its bad customer service. That reputation was rooted in the labor-management conflict that is present at many airlines and was particularly magnified by the failed ESOP plan that the United of the 1990s hoped would connect employees with management and improve customer service. All of that came to a head in 2017 in a highly publicized event when a United passenger, Dr. Dao, was forcibly removed from a United Express flight at the gate in Chicago due to the need to put a non-working crew on the flight, resulting in an overbooking situation. At United’s request, security personnel for the City of Chicago’s Aviation department physically removed the passenger after he refused to give up his confirmed seat. The passenger was bloodied and the event was recorded on cell phone video, going viral around the world. Then-United CEO Oscar Munoz at first defended the action but backtracked. The result was a recognition by United that its customer service was lacking, providing an opportunity for the Chicago-based company to soften its approach with all passengers.

Although Munoz’ tenure was short-lived at United, ex-America West, USAirways, and American executives led by Scott Kirby took over the helm of United and tried to continue the work Munoz started of making United more customer and employee friendly. Over the past five years, United’s on-time performance and operational reliability has improved even as its executives have decided to copy JetBlue and Delta in adding customer-desired seatback audio/video on-demand systems to its domestic aircraft, a feature that customers have indicated often make aircraft feel younger and provide distraction to the challenges of air travel. While United is still subject to the same operational challenges that face all airlines, it is succeeding at creating a higher level of customer service than it did in the past, helping it win higher value customers. Nonetheless, United still ranks low in several customer service metrics by both government and private sector industry sources.

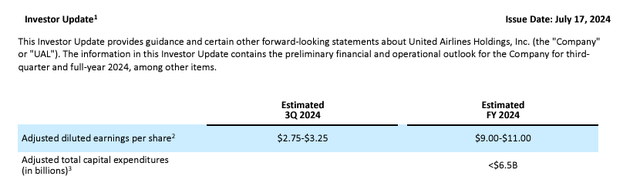

big 4 guidance 3Q2024 (ir.united.com)

United Faces a Plethora of Risks

United’s recent improvement in financial results comes with risks. Most notable is that UAL’s business model results in more seasonal earnings cyclicality than several of its competitors because United has a relatively small position in Florida which helps the revenue results of its competitors in the winter. While transatlantic and transpacific peak season demand is extending across a longer period of time than it historically has which helps to spread peak earnings into the first and fourth calendar quarters for many airlines, Florida travel remains a large revenue and earnings boost for airlines in the winter and yet United has a smaller presence in Florida than a number of much smaller airlines such as JetBlue, let alone more direct competitors American, Delta and Southwest.

United said it would have been profitable in the first quarter of 2024 had it not been for the MAX 9 grounding but UAL’s profit in that quarter would have been a fraction of what it made in the second quarter or expects to make in the third quarter. Its full year guidance indicates a more robust fourth quarter profit than in the first quarter but UAL’s network still produces a higher proportion of earnings in the second and third quarters than other carriers.

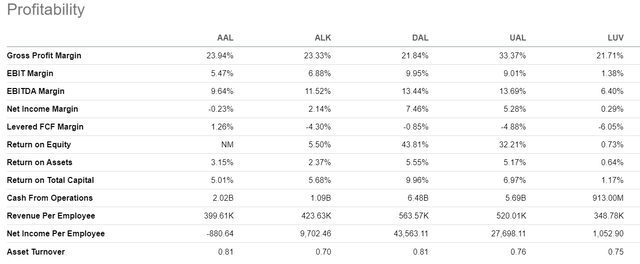

big 4 profitability 10Aug2024 (Seeking Alpha)

One of the greatest threats to United’s medium-term profitability is its continued stated desire to grow its domestic presence which could result in significant downward pressure on its own fares. UAL will certainly add more routes as it replaces smaller regional jets with mainline jets such as the A321NEO and B737 MAX but it will use more of the capacity from those larger jets to grow domestic capacity, including with seats that will command lower fares. United is not as likely to gain a great deal more high value passengers since they are carrying those even on their regional jet flights that will be upgauged to larger mainline aircraft.

United execs have made many statements about the lack of viability of several U.S. ultra-low cost airlines; it is true that they are struggling more than legacy airlines in large part because full-service airlines are able to sell higher priced fares with amenities and services which a growing number of passengers are buying. However, UAL’s plan to upgauge many of its flights from regional jets to larger mainline aircraft requires taking market share from other airlines, esp. lower cost carriers. While there is a disproportionate amount of capacity that has been removed from the low cost and ultra-low cost segments of the airline industry because of the Pratt and Whitney (RTX) engine problems, UAL is not likely to be able to grow its capacity above industry average rates before many of those aircraft return to service during the next two to three years. Thus, UAL’s plans to add industry capacity are likely not viable in the next two to three years because UAL is not likely to be able to grow any faster than the competition because of Boeing’s MAX delivery delays. If United tries to gain share in the 2026-2027 period and beyond, it will likely find that the low cost and ultra-low cost carriers have stabilized their financial performance and UAL’s addition of capacity will depress its own fares. Further, American, Delta and Southwest are certain to aggressively protect their own domestic market positions.

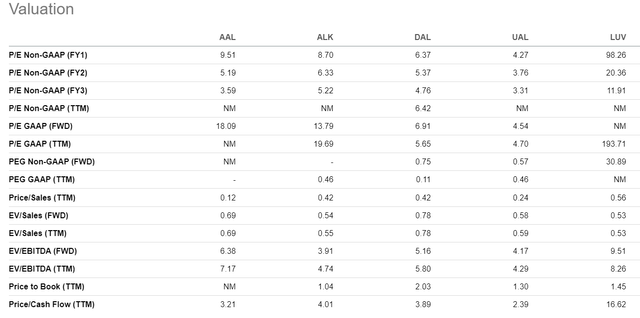

big 4 valuation 10Aug2024 (Seeking Alpha)

Labor cost increases have been a major source of reduced profits for U.S. airlines. United led the U.S. airline industry in trying to settle a post-covid contract with its pilots but that first attempt was roundly rejected by its pilots in contract voting. Delta ended up leading the big 4 with a rich contract for its pilots which was followed with wage improvements for most of the rest of its non-union personnel. The result has been two years of increasing industry labor costs and reduced industry productivity which has become a significant drag on profitability. Among the big 4, Southwest has now completed the post-covid process of settling labor contracts with all of its workgroups but American and United have yet to settle with their flight attendants. Since these flight attendant contracts come (or will come) more than two years after the industry returned to “normal” levels of profitability, American and United’s flight attendant unions are going to have to deliver costly contracts to their members. American’s union has negotiated a tentative agreement which may or may not pass a membership vote (Southwest’s first attempt at a flight attendant contract was also voted down) while United has yet to reach a tentative contract with its flight attendants. In addition, unions are going to want to recover the lost wages through retroactive increases, resulting in large payments by American and United. The big 3 airlines have approximately 60% more flight attendants than pilots and each paid out nearly three-quarters of a billion dollars in retro pay and that was over a year ago. Double digit increases in pay on top of retro payments that could easily match if not exceed what was given to pilots at the same airline will reduce earnings and drain cash.

The final risk to United’s profitability is the operational challenges that United and the entire U.S. airline industry faces. While much of the operational focus of the airline industry has been on the CrowdStrike-induced IT meltdown which most impacted Delta, weather and air traffic control delays have been extensive throughout the industry since May when Texas was negatively impacted by bad weather. Private sector data shows that UAL cancelled 3.5% of its flights in July compared to 5.2% for DAL; year to date, American and United have still cancelled more flights than Delta. In addition to the Texas storms in May, UAL’s cancellations spiked because of the MAX 9 grounding in January. This summer has been marked by repeated rounds of bad weather that have impacted operations in the Northeast and esp. New York City. United operates its largest hub by revenue at Newark airport which has seen markedly reduced levels of operations. In addition to weather, the Federal Aviation Administration has reworked airspace in the Northeast, assigning air traffic control responsibility for parts of Newark’s operations to Philadelphia. Based on public data, the results have been challenging but United has not criticized the FAA as it did after United’s operation had significant operational problems in June 2023 due to overscheduling at Newark. The FAA has requested that airlines at LaGuardia and JFK airports reduce their operations through 2025; Newark is no longer slot-restricted after United underutilized its Newark slots in the last decade. There appears to be no end in sight to ATC issues in the Northeast which will negatively impact United’s ability to deliver revenue at Newark as well as Washington Dulles, home of its second largest transatlantic operation.

big 4 1 yr chart 10Aug2024 (Seeking Alpha)

An Increasingly Well-Run Business

Despite the challenges, United has worked hard during the post covid period to build a stronger business and is beginning to be a contender to Delta’s earnings leadership of the industry. While United’s earnings are expected to trail Delta’s on an annual basis, UAL appears to be cutting many of the money-losing strategies that have pulled down its earnings in the winter.

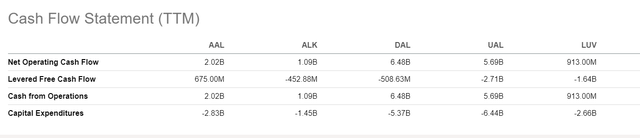

big 4 cash flow 10Aug2024 (Seeking Alpha)

United’s increased earnings have supported its aggressive fleet acquisition, the most expensive among U.S. airlines. Boeing’s delivery delays have cut UAL’s capex for 2024 by as much as $2 billion, highlighting that its current earnings can support its current capex without increasing debt although even higher capex could lead to higher debt. As a counterpoint, United has the largest amount of cash and cash equivalents among U.S. airlines so it is in a position to burn down some of that cash when capex accelerates. United’s long-term debt remains midway between AAL’s on the high end and DAL on the low end among the big 3. Southwest maintains negative net debt.

The fall in airline stock prices over the past month has cut UAL’s market cap to under $14 billion but the ratio to DAL’s market cap remains at 55%. That ratio should probably improve in UAL’s favor as UAL’s earnings continue to close the gap with DAL and UAL demonstrates that it can induct industry-high numbers of new aircraft without increasing debt.

Based on recent movement in UAL stock and its improvement in its current and forecast earnings and balance sheet, United Airlines stock is a buy.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.