Summary:

- For 3Q24, United Airlines generated $14.85 billion in revenues, representing a 2.48% year-on-year growth. Although EPS of $3.33 beat estimates, net income fell by 15.13% year-on-year.

- Expect the continued strength and demand in the airline industry to continue to serve as tailwinds for UAL. ACI expects passenger growth for 2024 will surge by 7% in North America.

- UAL is poised to expand its revenue through multiple initiatives such as expanding its international reach, increasing its fleet size, and enhancing other ancillary programs such as MileagePlus.

- Although the company is reluctant to give details, UAL’s plan to expand margins will be highly accretive to its bottom line and free cash flow.

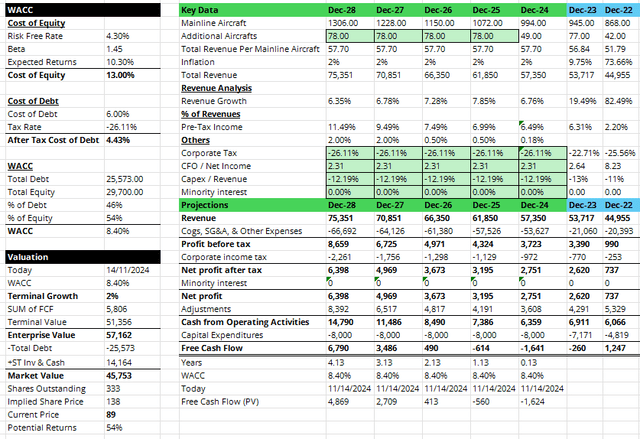

- Valuation analysis suggests a potential upside of more than 50% exists if UAL is able to successfully expand its fleet and expand its pre-tax net income margins.

Boarding1Now

Introduction

United Airlines (NASDAQ:UAL) is one of the largest airlines in the United States. Currently, the company employs approximately 104k full-time employees and has 945 mainline aircraft. Domestic flights are the biggest revenue contributor for UAL, representing more than 50% of the company’s total revenue; UAL also serves the Atlantic, Latin America, and Pacific markets.

Although UAL had surged more than 120% this year, my analysis suggests that there will be further upside potential of more than 50% for investors. UAL will not only benefit from the continued strength of the airline industry but also has multiple initiatives to ensure revenue capacity and margin expansion. In this report, I will demonstrate why investors should consider UAL in their portfolios.

Latest Developments

For 3Q24, UAL generated $14.85 billion in revenues, representing a 2.48% year-on-year growth and -0.95% sequential decline; additional UAL beat revenue estimates by $116.19. Gross margin improved due to relatively lower cost of goods; UAL’s gross margin improved to 64.02% as compared to 62.27% in the same period last year.

However, net margin deteriorated primarily due to higher operating expenses. As a percentage of revenues, SG&A for 3Q24 increased to 33% as compared to 30.59% in the same period last year. Total expenses as a percentage of revenues increased from 50.19% to 53.82%. On a year-on-year perspective, net income fell by 15.13%; however, UAL posted an EPS of $3.33, beating estimates by $0.16.

Strong Demand And Outlook Of The Air Travel Industry Will Continue Supporting UAL’s Growth

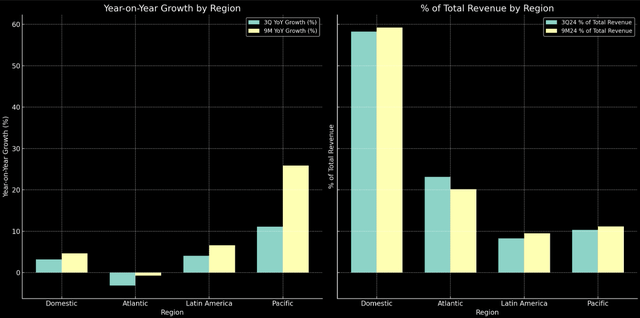

As of 3Q24, we continue to see strength and demand in UAL. UAL’s revenue from its domestic segment has surged 3.21% year-on-year. Other regions such as Latin America and the Pacific have shown similar strength, surging by 4.05% year-on-year and 11.10% year-on-year, respectively. Revenues from the Atlantic underperformed, declining 3.13% year-on-year.

UAL’s Revenue Breakdown (Company Filings, Author’s Illustration)

Looking forward, despite a deteriorated consumer environment, demand for UAL is likely to persist as air travel strength remains healthy. As of 11th November 2024, cumulative TSA checkpoint travel numbers in the United States have surged 4.99% year-on-year. Looking ahead, the Airports Council International (“ACI”) expects demand to be supported by global disinflation. ACI estimates that passenger growth for 2024 will surge by 7% year-on-year in North America, representing 107% of 2019 levels; across the globe, ACI expects a 10% year-on-year growth.

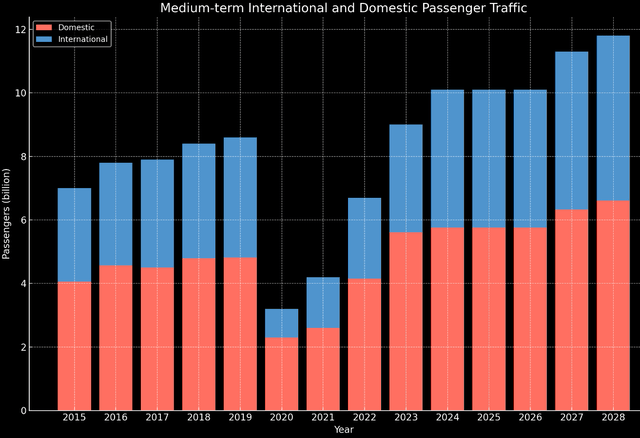

International & Domestic Passenger Outlook (ACI, Author’s Illustration)

More importantly, the outlook for air travel remains healthy and is likely to continue seeing growth. ACI expects global air travel will continue to grow at a CAGR of 5.57% through 2028. Total passengers will likely increase from 9.5B in 2024 to 11.8 billion by 2028. That being said, it will be important for us to closely monitor key risks such as geopolitical tensions, labor market disputes, and delays in aircraft deliveries; these are the major risk factors that may cause a dislocation in demand for air travel.

UAL Has Multiple Levers To Expand Revenues

Apart from industry-level tailwinds, UAL is poised to expand its revenue through multiple initiatives such as expanding its international reach, increasing its fleet size, and improving other ancillary programs to enhance demand and retain customers.

In terms of UAL’s international reach, the company plans to continue its international expansion. Recently, the company announced its largest international expansion in history. By mid-2025, UAL will add 8 new destinations covering Ulaanbaatar (Mongolia), Kaohsiung (Taiwan), Nuuk (Greenland), Palermo (Italy), and more. UAL will also offer new routes and connections such as Tokyo-Ulaanbaatar, Washington-Dakar, and Houston-Puerto Escondido. All of these indicate that UAL remains committed to expanding its revenue capacity.

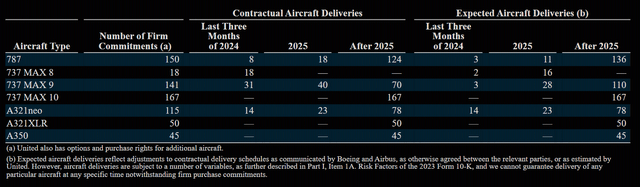

Expected Aircraft Deliveries (Company Filings)

Supporting its international expansion, UAL has committed to 676 new aircraft. Although deliveries from Boeing (BA) will be delayed, UAL still expects to receive another 22 aircraft for the rest of FY2024 and another 78 aircraft in 2025, bringing the total aircraft for FY2024 and FY2025 to approximately 994 and 1072. Utilizing FY2023 data, UAL had generated about 56 million per airplane; all else equal, and without factoring any inflation, this will translate to an additional $2.7 billion (+5.11% year-on-year) and $4.3 billion (+7.74% year-on-year) in revenues for FY2024 and FY2025, respectively.

To actively enhance demand and retain customers, UAL continues to work on its MileagePlus and Connected Media program, investing in critical technologies and enhancing program features. In relation to MileagePlus, UAL has included mile pooling, allowing members to pool miles including up to four people, including children. By Mid-2025, the program will also offer more ways to redeem points. Overall, revenues from MileagePlus have already increased by 11% while active membership was up 13%.

Potential Margin Expansion Will Be Highly Accretive To The Company’s Bottom Line

Apart from continuously driving growth and expanding revenue capacity, UAL’s current priority is also to expand their margins. Unfortunately, as of the latest earnings call, the management team had stated that they are not prepared to give guidance on margin expansion.

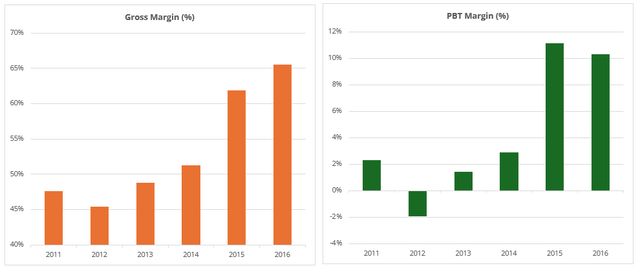

However, the management team did emphasize that UAL is at “an inflection point that would kick off a multiyear run that looked a lot like the 2012 to 2014 for airline earnings”. To put it into context, pre-tax profit margin was initially negative in 2012. Pre-tax profit margin continued to improve up to 2015, expanding significantly to approximately 11%; during this period, pre-tax profit margin expanded by about 436 bps annually.

UAL’s Margin Expansion 2011 to 2016 (Company Filings)

As a reference, in FY2023, 1% of revenues is approximately $537 million, representing at least 20% of net income. UAL does not need to expand its margins by 400 bps per year to generate significant value. Savings of merely 2% a year will be significant and highly accretive to the company’s bottom line and free cash flow.

Valuation Analysis Suggests Significant Upside Potential

Valuation Analysis (Author’s Projections)

Based on the following assumptions: (1) UAL to expand its fleet by 49 in FY2024 and approximately 78 per year through FY2028, (2) expand its pre-tax net income margins slightly by 0.18%, 0.50%, and 2% for FY2024, FY2025, and FY2026 to FY2028 respectively, and (3) a terminal growth rate of 2% and WACC of 8.40%, my DCF model suggests, UAL’s implied share price should be $138.

Closing Remarks

Overall, UAL remains an attractive opportunity despite its share price surging by more than 120% YTD. Apart from continued strength and demand in the industry, UAL is employing multiple initiatives to ensure revenue expansion. The company’s priority in expanding margins will also be highly beneficial to shareholders and the valuation of UAL. More importantly, upside potential exists. Based on my valuation analysis, there is an upside potential of 54%.

That being said, investors should closely monitor the developments surrounding BA. Aircraft delivery delays from BA will be the most important factor affecting UAL’s ability to expand its revenue meaningfully. Although BA’s worker strike has ended, the company is still struggling. BA had just recently decided to cut 10% of its workforce and may have liquidity issues. UAL expects 78 aircraft in 2025; if we assume that BA only delivers 45 per year through FY2025 and FY2028, the upside potential is merely 8%.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, but may initiate a beneficial Long position through a purchase of the stock, or the purchase of call options or similar derivatives in UAL over the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.