Summary:

- United Airlines has seen an impressive price appreciation of more than 50% since its bottom in early August.

- Spirit’s likely bankruptcy and the continued strength of U.S. consumer are both tailwinds that could take the stock higher.

- However, even if the company recovers its historic Price to Earnings Ratio of 8x, the 30% upside is likely insufficient given the risks that airlines face.

- If risks materialize, United could see its stock price be back at $40. With a Risk-Reward like this, I believe United is a Hold for now.

John M. Chase

United Airlines (NASDAQ:UAL) is on a great streak lately, gaining more than 50% since its recent bottom on August 5 at $37.88. It closed last Friday at almost $60, which is close to its post-pandemic high of $60.77 in March 2021. That has come after news that Spirit Airlines (SAVE) may file for bankruptcy soon, making the markets forget somewhat about the recent spike in oil prices.

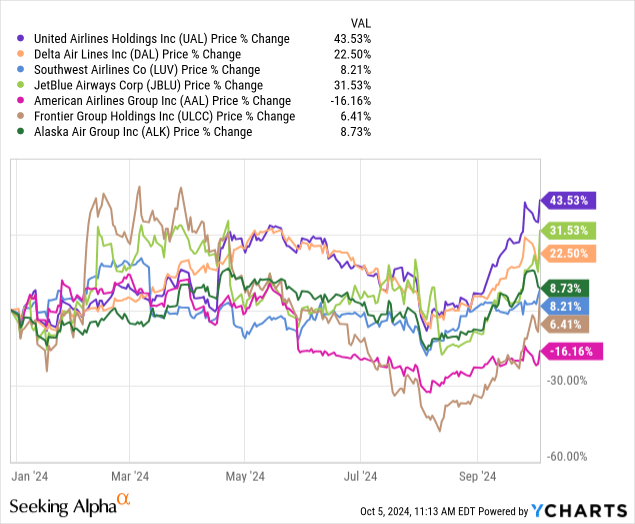

United Airlines is usually mentioned alongside Delta Air Lines (DAL), Southwest Airlines (LUV) and American Airlines (AAL), which form the Big 4 in terms of market share for the U.S. domestic market. Interestingly, as can be seen from the year-to-date chart below, these four airlines haven’t performed in a similar fashion recently, despite all being punished throughout the summer due to weak pricing.

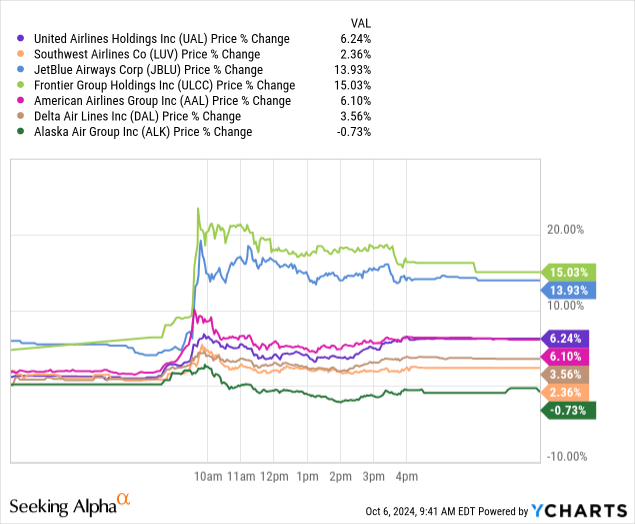

I’ve also included JetBlue (JBLU), Frontier Holdings (ULCC) and Alaska Air (ALK) to see how the stock of each airline responded to Spirit’s news. It’s no surprise that the market appointed JetBlue and Frontier as the clear winners, with gains of +14.24% and +16.43%, respectively, last Friday. What may be a surprise is that within the Big 4, the market seems to have chosen United Airlines as the winner, gaining +6.47% — although American Airlines stock also responded very positively.

In this article, I’ll confirm the view that United Airlines can benefit significantly from Spirit’s bankruptcy while also improving on operational metrics. However, the recent stock price run seems to have moved United Airlines out of the “bargain sector”. Airlines are very sensitive to business cycles, and any shock is enough to wipe out investors’ gains. Therefore, I’ll start my assessment of United Airlines with a Hold.

Gaining Share Through Spirit’s Bankruptcy

Below is the share price gain from last Friday after reports that Spirit may be flirting with bankruptcy and the release of a strong jobs report. It’s definitely possible that the strong economy has a lot to do with the good performance of the airlines – a rising tide lifts all boats. However, since not all had the same behavior, we should look into the Spirit bankruptcy possibility to differentiate the airlines.

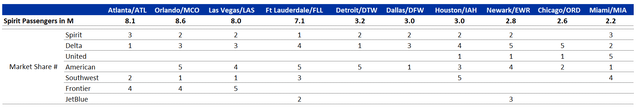

So what I went to search for was how these airlines overlap with Spirit’s operations and who may be able to grab some market share in the process. The table below shows Spirit’s passengers in millions in each of their main airports, as well as the Market Share position of each airline within that airport. Note that Spirit’s passengers may be double counted as a flight between Atlanta-ATL and Orlando-MCO would count in each of the airports. I have also ignored the regional carriers like SkyWest Airlines (SKYW).

Spirit’s Passengers in Million per Operational Hub and Market Share Position of Each Airline (U.S. Department of Transit, Wikipedia.com)

Let’s now try to match this data with the price movement from last Friday. JetBlue and Frontier were chosen as the primary winners with both gaining close to 15%. The likely reason for this is that in all four of Spirit’s major markets (ATL, MCO, LAS and FLL) these two carriers have important operations, with Frontier in three and JetBlue in one. It makes sense to think that Spirit customers would tend to flock first to Frontier, JetBlue and Southwest instead of Delta, American and United. In these four markets I mentioned, United doesn’t have a significant presence in any of them, while they are important for Delta (ATL, MCO and LAS) and American (MCO, LAS).

The remaining airports have a significantly lower number of passengers for Spirit, but are still important nonetheless. While Delta may have an opportunity in Detroit and American in Dallas, Miami is kind of split between a lot of players (although American has the highest share by far). What’s left is Houston, Newark and Chicago, all three significant hubs for United Airlines and without an important presence of Southwest, Frontier and JetBlue. That’s not to say that these airlines couldn’t expand into these markets if the opportunity comes, but they are more likely to focus on Atlanta, Orlando, Las Vegas and Fort Lauderdale where they already have a good position.

This leaves United with a significant opportunity to grab share in these three markets. Spirit transported close to 10 million passengers in Houston, Newark and Chicago, while United transports a little more than 160 million passengers each year. So this market share gain could definitely support some incremental growth in the coming years for United, and it would not only mean more volume, but also a better pricing position.

Financials

I’ll refrain from performing any complicated estimates of discounted cash flow for United Airlines as I learned a hard lesson on Spirit’s recent debacle. Airlines should be assessed on their near-term earnings power and its position in the business cycle.

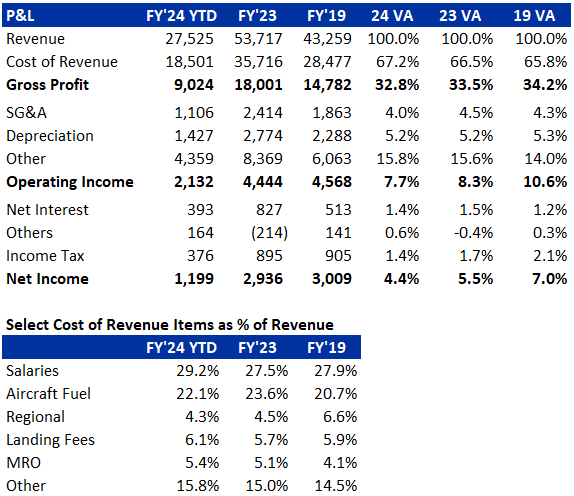

When reviewing the latest United’s financials, it’s interesting to compare FY’19, FY’23 and FY’24 YTD. As can be seen from the P&L below, the major gap in profitability compared to FY’19 is driven by Cost Of Revenue, with Aircraft Fuel playing an important role in FY’23 and decreasing in FY’24 YTD while Salaries has picked up in FY’24 due to the new salary agreement with pilots.

United Airlines P&L in FY’19, FY’23 and FY’24 YTD plus Specific Cost of Revenue Items as % of Revenue (United IR)

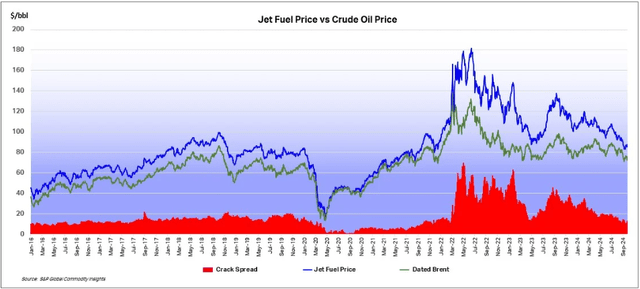

So there is still work to be done at United to recover pre-pandemic profitability, and the weak pricing mentioned before during the summer didn’t help. However, improvement in Aircraft Fuel both from a receding Jet Fuel price and a significant fleet renewal should continue to help the company further. Also, the increase in salaries should have its hardest hit this year with an increase of ~15% and the remaining years somewhere between 3% to 5%.

Jet Fuel Price, Crude Oil Price and Crack Spread between 2016 and September 2024 (IATA, S&P Global Commodity Insights)

The fact that United’s profitability is still far from 2019 and has even taken a hit during 2024 due to salary increases might sound incoherent when contrasted with its more than 43% price appreciation year-to-date. However, this means that the market is anticipating some overdue improvements in United’s financials in the coming quarters. That’s why I started saying that I believe United isn’t a bargain anymore. That definitely doesn’t mean it doesn’t have room to appreciate more, just that it probably passed from being at the bottom of the cycle to being at the midpoint.

Upcoming Earnings and Valuation

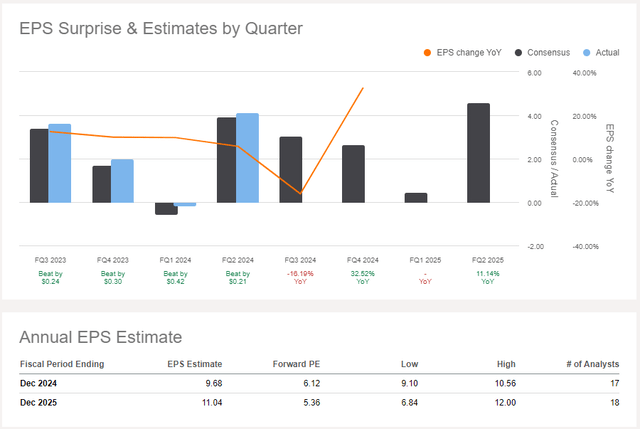

United is expected to report Q3’24 earnings on October 16th and judging by its latest track record, it would be no surprise if it overcomes consensus EPS again. Note the comparison quarter-over-quarter: although Q3’24 is expected to be lower than Q3’23, analysts seem to expect improvements in future quarters compared to prior periods.

EPS Estimate and Forward PE (Seeking Alpha)

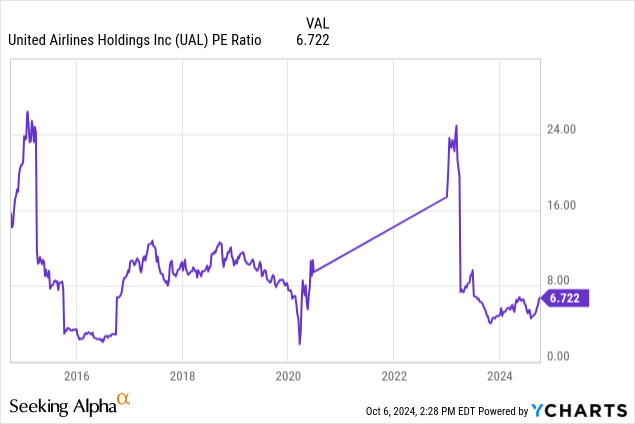

There is also the fact that the average of estimates points to United generating close to $10 EPS in FY’24 and more than $11 in FY’25, which would translate to a Forward Price to Earnings of 6.12 in FY’24 and 5.36 in FY’25. Airlines’ Price to Earnings (PE) can be very volatile, but 6x Forward PE is definitely not a stretch. By taking a look at United’s 10-year PE Ratio history, it’s noticeable that it spent the majority of the time between 2014 and 2019 above the 8x Forward PE threshold.

This is why I believe that United Airlines at a price close to $60 and with a Forward PE of 6 is a Hold and not a Buy. If the market revalues the company to 8x Forward PE, this is a ~30% upside to the current price. Although good, it may not be enough for an Airline given the risks that always exist and can wipe out any gains. Investors who would like to buy this company may have to wait for a pullback that brings the share price below $50 or just pass it entirely.

Risks

Airlines face the same risks as normal companies, but with an exponential impact. There are two major risks right now: the possibility of an oil shock due to escalating tensions in the Middle East and any weakness in U.S. consumer spending that could trigger or indicate a recession. With razor-thin margins like 4.4% YTD after the incremental salaries negotiated with pilots, any negative impact coming from rising Jet Fuel prices or even lower pricing power could turn the company in negative territory. This would definitely lead to a revaluation of United’s multiple and impact investors returns. There is no reason why United wouldn’t be back below $40 in this scenario, so that’s why I do not believe the company is a Buy at $60.

Final Remarks

As you’ll see below in my disclaimers, I currently own shares of UAL, which I bought in November of 2023. At $40 it seemed to me a good value proposition and I continue to believe that United’s share price when below $50 presents a Buy opportunity. Although I don’t expect to sell now, any further weakness in the economy or a major shock in Jet Fuel prices may lead me to sell. If all goes well, I do expect to ride this stock until it recovers its Price to Earnings ratio of 8x.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of UAL, DAL, LUV, JBLU, SAVE either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.