Summary:

- United Airlines’ stock is undervalued at 4.6X forward earnings, with a potential upside of 30% if it re-rates to a 6X EPS multiple.

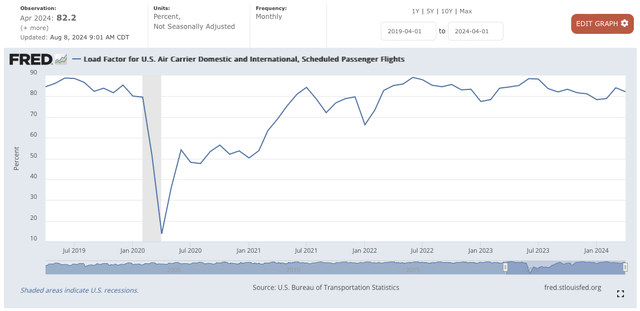

- Profitability has been strong due to capacity limitations, but load factors have started falling.

- Consumer sentiment has softened, but lower oil prices could help United meet its earnings guidance of $9-$11 per share.

- Key risks include further deterioration in consumer confidence and volatile oil prices, which could impact load factors and profit margins.

aapsky

Executive Summary

United Airlines (NASDAQ:UAL) is probably not the lowest-cost airline however its stock price is cheap. Very cheap considering that the airline industry is fundamentally sound and not becoming obsolete.

While our natural tendency is to seek business with strong competitive advantages, it is quite challenging to maintain an edge in this fiercely competitive and cyclical industry.

We focus our analysis on potential cyclical swings as well as overall industry trends when evaluating the attractiveness of companies, as we do not believe that a long-term buy-and-hold is a viable strategy for this industry.

Airlines have been one of the worst-performing market sectors over the last 5 years, as many of the stocks still have not recovered after the turbulent post-Covid period.

We believe that United Airlines finally has a chance to break out and recover some of its value, due to the currently favourable macro backdrop.

Cost increases have troubled United and the larger industry

One of the main reasons for the slow airline recovery after COVID-19 was the cost escalation. The most significant costs for airlines are labour and fuel, both of these appreciated considerably.

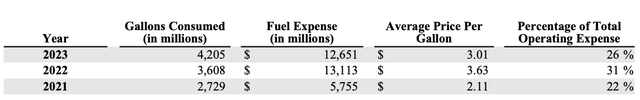

Jet fuel costs increased as the oil markets recovered, resulting in a considerable cost uplift.

The average price per gallon has increased from about $2 in 2019 to $3 at the end of FY2023. Overall, the fuel bill of United has increased from $ 9 billion in 2019 to $12.6 billion in 2023. This difference is higher than the overall earnings of the business last year.

Fuel Expense (United Airlines)

Fuel was not the only cost item to go up since 2019. Salaries and related costs have also increased by $2.7 billion. Overall, the cost per available seat mile increased by 24% between 2019 and 2023.

Some of the increase in costs has been passed on to consumers in higher ticket prices, but not all. United was able to pass on most of these cost increases, as revenue per available seat mile has grown by 21% during the same period.

More importantly, airfares have a negative price elasticity, meaning that as higher prices are passed on – fewer people fly. Some estimate the elasticity of leisure travel to be as low as -2, meaning that once ticket prices rise 10%, demand for those tickets declines by 20%.

As fares were raised to compensate for higher costs, overall industry demand must have reduced considerably.

The cost reductions, such as a decline in the price of jet fuel, not only provide airlines with additional yield, it also create additional demand, which results in higher load factors. This partly explains the strong industry performance in 2019.

Capacity reduction enabled fare increases after COVID

Covid has resulted in unprecedented disruptions for the airline industry as a large share of the planes have been grounded for an extended period, and many of the staff have been let go. As demand for travel picked up once again, airlines have initially struggled to meet surging demand. The lack of capacity has resulted in stronger pricing.

The latest data suggest that now the capacity has been built back up to pre-Covid levels. Even though the overall number of scheduled flights is still below, the per-flight capacity has increased. It would seem that going forward, it will become more challenging for the airlines to maintain their pricing power.

The load factors have started declining again from about July 2023, as more capacity was being added. As more seats compete for the same passenger, it will be more difficult to pass on cost increases.

The declining load factors are now starting to have an impact on prices. In the second quarter of 2024, United’s revenue per seat mile has declined by 2.4%. On a positive note, the costs have also stopped increasing rapidly as in the second quarter, the adjusted operating cost, excluding fuel, increased by merely 2% as compared to last year.

Lower cost appreciation has helped United to protect profit margins even in a more adverse pricing environment. However, if inflation picks up again, United will most likely struggle to pass on the costs if the spare industry capacity is higher.

Consumer confidence has softened

For the time being, inflation does not seem to be a threat through. Quite the contrary, the economy seems to be softening.

A significant share of the industry is discretionary leisure travel, which could be negatively affected if the economic situation further deteriorates. On the other hand, lower fuel prices will help the industry maintain some of the profitability, and could potentially stimulate demand.

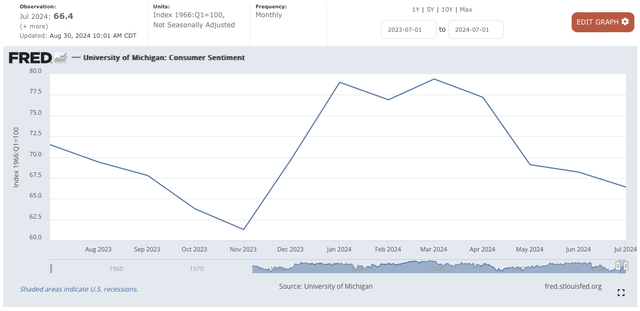

From about March of 2024, consumer sentiment has started falling but apparently bounced back most recently. Weaker sentiment would no doubt be negative for leisure travel.

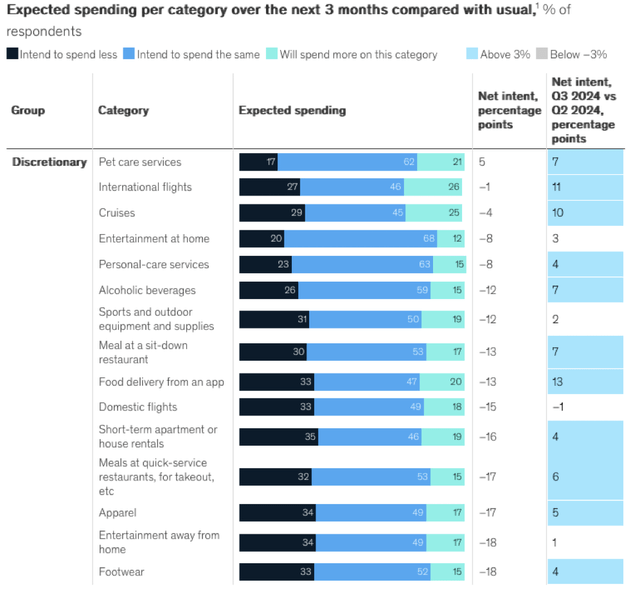

In a recent consumer sentiment survey, McKinsey discovered that 33% of respondents intend to spend less on domestic flights over the next 3 months. The net intent for the category is little changed from the last year though.

Overall, consumer sentiment does seem to be deteriorating, however, no definitive conclusions can be reached just yet as it is still early in the cycle and some data already point towards recovery.

Increasing capacity paired with reduced demand would spell issues for United.

Oil prices are starting to moderate

In a positive recent development for the aviation industry, oil prices have started falling. As we write this article. U.S. crude price has fallen below $70 per barrel, the lowest level in 9 months. The price weakness is not driven by U.S. consumption but rather by Chinese demand outlook and Opec+ production.

Saudi Arabia as well as the broader cartel is currently tapering production, but they intend to gradually increase output. OPEC+ has plans to start increasing oil production in October, but these plans are now being reconsidered due to the weak demand outlook, especially in China.

Chinese oil inventories have been on the rise, despite softening import volumes, due to lower refinery throughput. The volume of oil processed by Chinese refiners was 14.19 million bpd in June, down by 3.7% as compared to the same period last year.

There are a lot of moving parts in the oil industry, as ever and it is not easy to predict oil prices. What we do see today, however, is a picture of weakness. Even though the Opec+ is tapering and Middle Eastern production and transportation risks are escalating, the oil price is still weak.

The core driver of the oil market presently is the poor demand outlook, which does not seem likely to recover soon. China especially has been experiencing weakness and we see no signs of it bouncing back soon.

We believe it is very likely that until the remainder of the year, oil prices will stay weak. Such a development should help United to achieve their profit targets for the full year.

United Airlines is trading outside the valuation range

During their latest earnings call, United has provided an earnings guidance of $9-$11 per share.

Most of the analysts, polled by Seeking Alpha, expect the company to achieve a lower bound estimate of $9.5 per share, and continue growing earnings thereafter.

It is not very often that we come across structurally sound companies, with realistic growth prospects trading at 4.6X forward earnings.

As we have noted previously, labour and other operating costs have already stopped growing rapidly, and consumer spending has weakened somewhat but still appears to be robust. On top of this, oil prices are expected to remain weak for the remainder of the year. Ticket prices should moderate only gradually and the costs could trend down or stay flat once lower oil prices are included.

This environment should provide an opportunity for United to achieve their earnings guidance. The current earnings multiple seems to suggest that a lot of the market participants assume that United will not be able to hold on to this higher level of profitability. Now it seems increasingly likely that they will be able to achieve their targets.

As we write this the stock price of United has increased by 4% as U.S. oil has fallen below $70 per barrel. Oil is the main factor that seems to be tilting the odds in favour of United.

Airlines is a cyclical and capital-intensive industry, and it would not be reasonable to expect the sector to fetch market average valuation multiples. On the other hand, 4.6X is quite low even for a challenging industry.

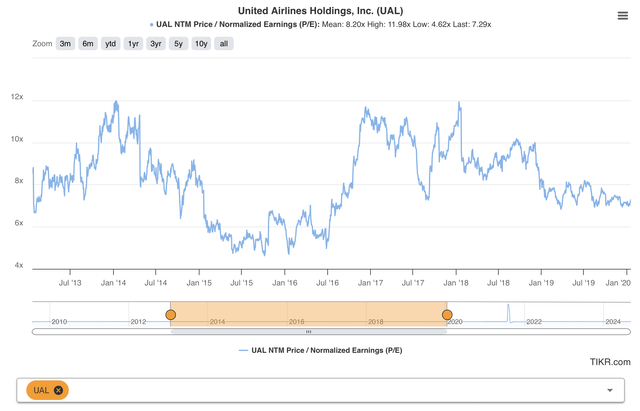

Before COVID-19, United has traded in the range of 6x to 12x earnings. The current valuation multiple falls outside of their historic valuation range.

Valuation Multiples (TIKR terminal)

We therefore conclude that given the current valuation as well as the macro backdrop, United stock seems to have some upside potential. There would be a 30% upside if the stock would re-rate back to a 6X EPS multiple.

The key risks

Several factors could invalidate this bullish thesis though:

- Consumers’ confidence in the U.S. could deteriorate further, forcing the airlines to cut fares aggressively to maintain reasonable load factors. Resulting margin contraction could lower profit margins and make it difficult to meet earnings expectations.

- Oil prices are inherently volatile. Even though the sentiment appears to be bearish at the moment, unexpected events can lead to rapid reversion.

The Bottom Line

United Airlines is one of the largest carriers in the country and is currently selling at a particularly attractive earnings multiple.

Covid has wreaked havoc on the airline industry, resulting in cost increases and capacity limitations later on. The pricing has been firm, however, and allowed airlines to pass on higher costs and protect their profit margins.

It would seem that now the load factors have started declining as capacity has returned to pre-COVID levels and consumer sentiment deteriorated.

Markets seem to be concerned about the ability of United to achieve its earnings guidance, and that is why the stock is trading at a particularly low valuation multiple.

We believe that the latest macro developments have been positive for United and the sector in general. Consumer sentiment has moderated in August while the oil prices continue weakening.

With the current macro backdrop, United is increasingly likely to meet its earnings guidance and the stock should have an upside of at least 30%, as it returns to a longer-term valuation range.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.