Summary:

- United Airlines exceeded expectations in Q1 earnings despite a $200 million cost headwind for the Boeing 737 MAX 9.

- Domestic and European markets show favorable conditions with increased yields, while Pacific and Latin American markets experience unit revenue normalization.

- United Airlines adjusted its fleet plan due to Boeing scrutiny, but still has confidence in Boeing 737 MAX 9. The airline expects strong Q2 earnings.

Laser1987

United Airlines (NASDAQ:UAL) posted first quarter earnings on the 16th of April, beating analyst estimates for earnings by $150 million on the top line and by $0.42 per share. Given that United Airlines faced a grounding of the Boeing 737 MAX 9 earlier this year and deliveries are not coming in as expected, the beat is even more surprising and investors seem to take that as indication of strong underlying performance. This also is embedded in today’s stock price reaction as United Airlines stock is flying more than 16% higher. In this report, I will be discussing the results, guidance for the second quarter, fleet plan update and provide an update to my price target and rating for United Airlines stock.

United Airlines Exceeds Expectation Despite $200 Million Boeing Headwind

United Airlines

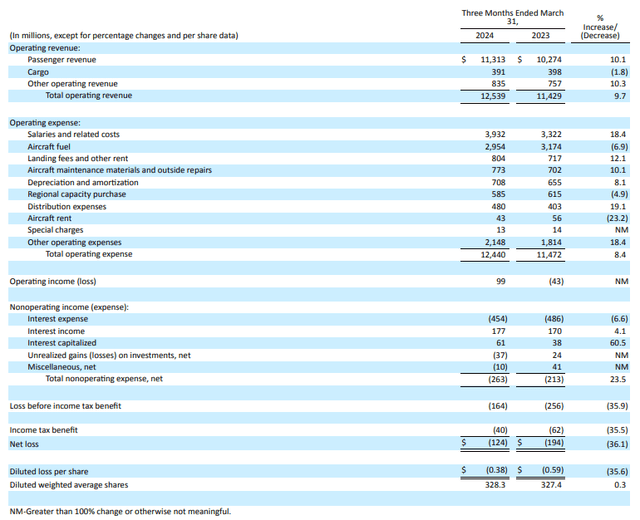

United Airlines grew its total revenues by almost 10% during the quarter. Cargo revenues were slightly lower as is to be expected with the continued normalization of freight rates while passenger revenues grew little over 10%. This growth was realized by a 9.1% increase in capacity, strong domestic load factors and a 1% increase in passenger unit revenues. In the domestic market, where United Airlines is facing pain due to the grounding of the Boeing 737 MAX 9 and a slower delivery rate, capacity grew just half a percent but load factors increased 2.8 points to 83.7% and unit revenues expanded roughly 6%, driving passenger revenues in the domestic market up by 6.6%. The European market also showed strength with capacity being flat year-on-year, but 12% higher unit revenues leading to 11.7% higher revenues in that geographic market. Pacific revenues grew 44% driven by a 65.8% increase in capacity partially offset by unit revenues weakening almost 13%. In the Latin American market we saw something similar where 9.6% revenue growth did not quite compare favorably to the 25.5% increase in capacity. In the Middle East/India/Africa, driven by the war in Israel, revenues plunged 23.2% on a capacity contraction of 27% partially offset by higher unit revenues.

Overall, we see that the domestic market and European market showed quite favorable conditions with yields being up. The Pacific and Latin American markets are seeing some unit revenue erosion as significant capacity growth is realized and I think that’s not a sign of weakness. In my view, the lower unit revenues point at a relative normalization of unit revenues as more and more capacity comes online. The figures for the Middle East are driven by the geopolitical situation, but despite significant revenue reductions in that end market, yield was up 9.2% year-on-year.

Total operating expenses grew 8.4% which does compare favorably to the capacity expansion. However, this was driven by a 13.5% lower average gallon cost for fuel. Unit costs excluding fuel rose 4.7%. In some way, we’re seeing that the cost basis continues to be challenge as unit costs excluding fuel continue to grow despite increases in capacity, which would normally allow for better cost absorption. Operating profit swung from a $43 million loss to a $99 million profit while pre-tax losses improved from $256 million to $164 million. The operating and pre-tax profit figures include a $200 million cost headwind from the Boeing 737 MAX 9 crisis. If we add these back, the operating margin would have been 2.4% with a breakeven to slightly positive EBIT margin.

So, United’s results overall do show strong revenue and yield management, but with the realities of higher recurring costs and the $200 million in non-recurring costs. Given that the first quarter is the toughest quarter for airlines to execute due to seasonality, being profitable on an adjusted basis is certainly a strong sign.

United Airlines To Take More Boeing 737 MAX 9s

United Airlines

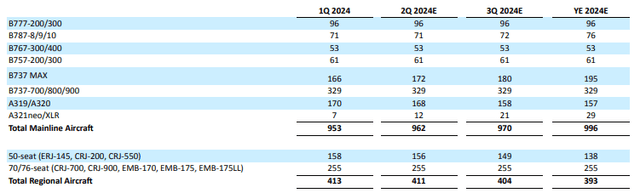

Due to increased scrutiny on Boeing, United Airlines also has made changes to its fleet plan and its order mix. The company earlier expected eight deliveries for the Boeing 787 in 2024, but that number has now been dialed back to five deliveries. For the Boeing 737 MAX, 157 deliveries were scheduled for 2024 but that number has been reduced to 36 providing a significant capacity gap for 2024 on the domestic market. A total of 26 Airbus A321neo deliveries was scheduled for delivery in 2024 and that number has been adjusted modestly to 25 deliveries. So, we’re clearly seeing the pressure that Boeing puts on United’s capacity plan.

To mitigate the risk of the Boeing 737 MAX 10 certification timeline sliding further, United Airlines has agreed with Boeing to convert a portion of its MAX 10 orders to orders for the MAX 8 and MAX 9 with deliveries scheduled from 2025 through 2027. To me it does show that despite the incident with the MAX 9, United Airlines still has confidence in the MAX 9 which might sound somewhat odd given that the open-ended certification timeline for the MAX 10 is in part driven by the MAX 9 incident. Furthermore, the company has a tentative agreement with two lessors to lease 35 Airbus A321neos with deliveries in 2026 and 2027. This puts on display rather well that Airbus single aisle delivery slots are hard to come by and articulates my view that Airbus’ ability to benefit from the problems at Boeing hinges on its own ability to expand production capacity as I recently discussed in a SA Analyst Roundtable discussing the next steps for Boeing.

United Airlines Expects Strong Second Quarter Earnings

United Airlines

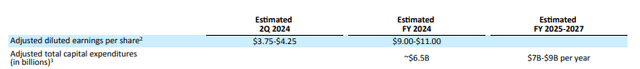

For the second quarter, United Airlines expects adjusted earnings per share between $3.75 and $4.25, which is looking about right given the $4.00 in core earnings per share that analysts expect United Airlines to report. Furthermore, the delivery delays have resulted in the CapEx estimate to be reduced to $6.5 billion from $9 billion with the full-year earnings per share estimate remaining unchanged. So, overall we are seeing that the problems at Boeing are resulting in lower capex for United this year with an uptick in the years after, while the company sees demand remaining robust and is sticking with its adjusted earnings guidance for the year.

Is United Airlines Stock Still A Buy?

The Aerospace Forum

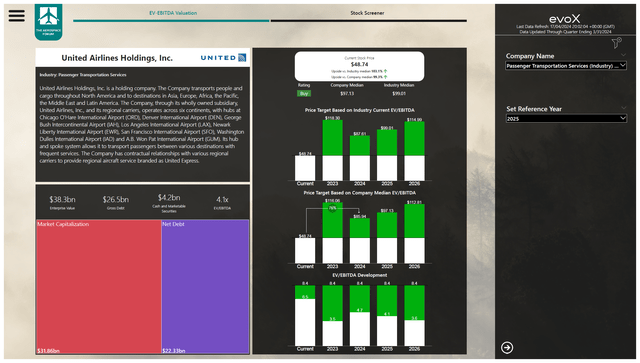

Since my previous report covering United Airlines, the stock has climbed 13.5% compared to the S&P 500 gaining less than three percent, while my buy call from October 2023 has shown a nearly 40% return compared to an 18% return for the S&P 500. So, despite the capacity issues caused by the Boeing 737 MAX production slowdown, UAL stock has done rather well. The big question of course is how much upside remains. The price targets driven by EV/EBITDA analysis, were previously $77 to $80 per share. And after implementing the most recent balance sheet data for United Airlines as well as the forward projections for EBITDA and cash flows, the targets have increased by $6 to $10 per share. Even if we apply a 50% discount to account for execution risk, the price target would be $67.40 which is roughly $5 higher than the Wall Street analyst price target for United Airlines stock. As a result, I’m maintaining my buy rating.

Conclusion: United Airlines Is Executing Well Despite Boeing Turmoil

I believe that the most recent quarterly earnings show that United Airlines is executing well on the top line managing its overall revenue growth with prudent capacity expansion. Just like other airlines, the company continues to see the consequences of increased costs such as salaries and landing and navigation fees rendering the company unable to reduce non-fuel unit costs despite significant capacity additions. However, the first quarter results which tend to be the weakest did show that United Airlines would have been profitable if it weren’t for the Boeing 737 MAX issues to hit the airline. Given that Q1 is the weakest quarter of the year, I believe this provides promising prospects for the summer season and after a quantitative analysis I’m maintaining my buy rating for the stock.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of BA, EADSF either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

If you want full access to all our reports, data and investing ideas, join The Aerospace Forum, the #1 aerospace, defense and airline investment research service on Seeking Alpha, with access to evoX Data Analytics, our in-house developed data analytics platform.