Summary:

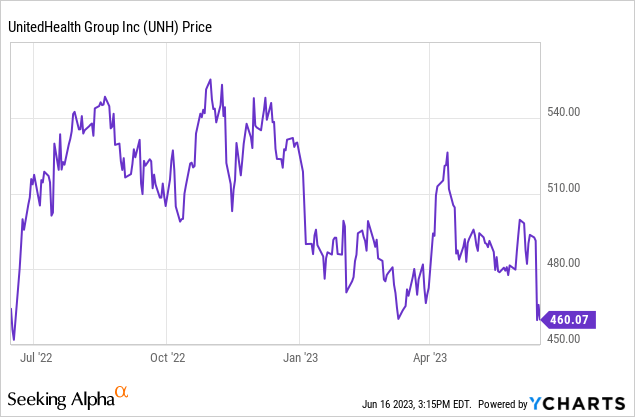

- UnitedHealth has declined nearly 20% from its all-time high, as the market is worried about rising medical costs.

- Rising medical cost is a potential near-term headwind, but it should not have any meaningful impact in the long run.

- The proposed acquisition of Amedisys should vastly increase the company’s presence in the healthcare services industry.

- The AI solutions from Change Healthcare should also help reduce the company’s operating costs.

JHVEPhoto

Investment Thesis

UnitedHealth Group’s (NYSE:UNH) share price has been very weak lately due to the worry about rising medical costs, and I believe this presents a great buying opportunity. While the rising medical costs may be a headwind in the near term, the expansion of Optum should continue to drive growth.

The potential combination of Optum, LHC Group, and Amedisys could become a strong force in the healthcare services industry, which vastly expands the company’s market opportunities. The AI solutions from Change Healthcare should also reduce the company’s operating costs, which can help offset the impacts of rising medical costs. The company is shaping up to become a behemoth in the US healthcare industry and the temporary headwinds should not impact its long-term prospects.

Ongoing Expansion Of Optum

UnitedHealth Group is continuing to expand the size of Optum through M&A (merger and acquisitions), as the company aims to further diversify its revenue from the legacy UnitedHealthcare segment. Optum recently announced its offer to acquire Amedisys (AMED) with an all-cash offer at $100 per share, or $3.7 billion. Amedisys is a healthcare services company that specializes in home health, hospice, and high-acuity care. It operates in 37 states and provides care services across 511 locations.

Patrick Conway, Optum’s CEO, on acquiring Amedisys:

Amedisys’ commitment to quality and care innovation within the home, and the patient-first culture of its people, combined with Optum’s deep value-based care expertise can drive meaningful improvement in the health outcomes and experiences of more patients at lower costs, leading to continued growth.

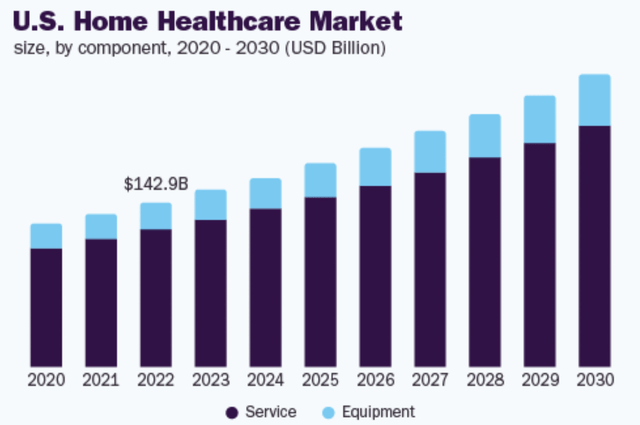

This alongside the $5.4 billion acquisition of LHC Group last year seems to signal the company’s ambition to dominate the massive and fast-growing home healthcare market. According to Grand View Research, the US market size of home healthcare is forecasted to grow from $152.9 billion in 2023 to $253.4 billion in 2030, representing a great CAGR (compounded annual growth rate) of 7.5%. Optum is targeting this market due to its fragmented nature, which allows them to avoid anti-trust issues and easily grab market shares. According to the company, no organizations currently have a market share above single digits.

The combination of Optum, LHC Group, and Amedisys should create a meaningful presence in the healthcare service industry, especially in the fast-growing home healthcare market. For instance, UnitedHealth’s service revenue currently accounts for only 8.8% of total revenue. I believe the emerging healthcare service segment presents massive expansion opportunities and should become a major growth driver for the company moving forward.

Benefiting From AI In Healthcare

This may be surprising to some investors, but I believe UnitedHealth Group should also be a major beneficiary of the rapid development of AI. Through the acquisition of Change Healthcare in 2021, the company brought on one of the leading AI solutions in the healthcare industry.

For instance, Change Healthcare’s natural language processing (NLP) technology can extract and analyze both structured and unstructured data from EMRs (electronic medical records) and other medical documents. It can then proceed to run auto reviews and audits, or risk adjustments according to the data. It also provides other solutions such as clinical decision support, which helps with denial prediction, payment forecasting, and claims processing.

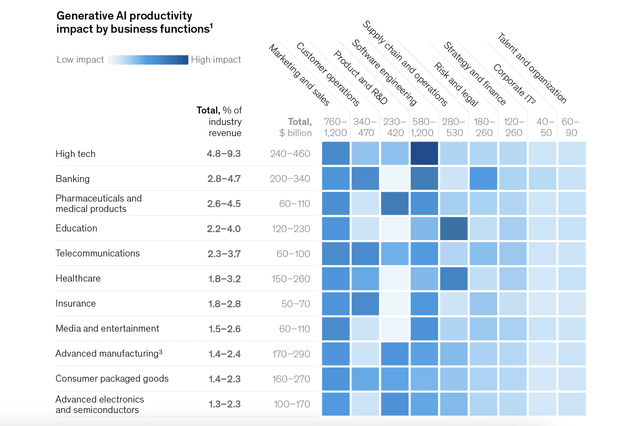

According to McKinsey, AI could unlock around $150 billion to $260 billion worth of productivity gains in the healthcare industry. By leveraging Change Healthcare’s AI technologies, I believe UnitedHealth Group should see vast improvements in costs, workflow management, and operating efficiencies.

Excellent Dividend Growth

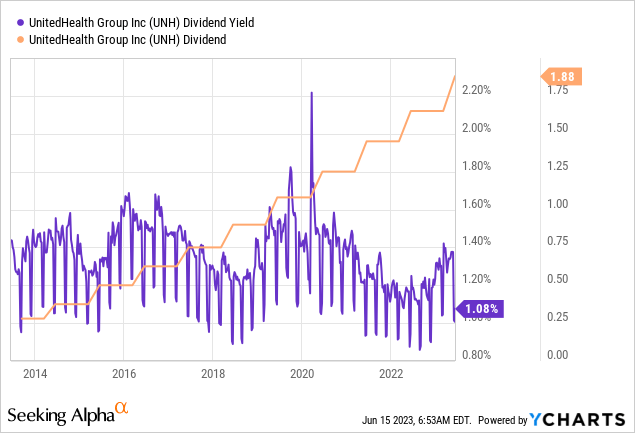

UnitedHealth Group recently raised its quarterly dividend by 13.9% from $1.65 to $1.88, marking its 14th consecutive annual increase since 2010. This translates to a forward dividend yield of 1.64% at the current price. While this is still pretty modest compared to other dividend stocks, the forward yield is now back at the high end of its own 10-year historical range.

The dividend has also been growing rapidly in the past decade. As shown in the chart below, the quarterly payout increased from $0.28 in 2013 to $1.88 currently, representing an extremely strong CAGR (compounded annual growth rate) of 21%. Considering the current payout ratio of just 28.8%, I believe double-digit increases should be sustainable in the long run.

Investors Takeaway

I really like the proposed acquisition of Amedisys. While the legacy insurance business is very consistent, it is hard to accelerate the growth of the segment. Healthcare service on the other hand is seeing much stronger momentum. For instance, revenue from premiums grew 13.6% in the latest quarter while revenue from services grew 26.8%. The addition of Amedisys and LHC Group should vastly expand the company’s presence in the healthcare service industry, particularly within the fragmented home health segment.

The AI solutions from Change Healthcare may also be an unexpected catalyst that drives operating costs down in the long run, as it continues to improve workflow and operating efficiencies. The company is facing rising medical costs due to the rising number of surgeries but this is largely caused by pent-up demand from the pandemic and should not be a long-term impact. I believe the recent decline in share price seems exaggerated and should present a great buying opportunity for long-term investors.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.