Summary:

- UnitedHealth Group has the potential to be a standout investment in 2024 due to its solid financials, outlook, and potential.

- UNH is a defensive company in the healthcare industry, serving millions of individuals through its UnitedHealthcare and Optum businesses.

- UNH has a strong balance sheet, low debt, and has consistently grown its revenue, net income, and free cash flow over the past decade.

PM Images

2023 is coming to an end, and I am looking for positions that have a lot of potential going into 2024. A mistake that some investors make is letting share price determine what they will invest in. In some cases, investors would rather acquire 100 shares of a $10 stock than starting a position in a $100 with 10 shares. Even though both investments would cost $1,000, sometimes investors get caught up in purchasing more shares rather than looking at things from a percentage aspect. If a $10 stock goes to $12 or a $100 stock goes to $120, the ROI is 20%, and it really doesn’t matter if you owned 100 shares or the $10 stock or 10 shares of the $100 stock. Share price is just one of many components, but sometimes investing in a stock that is several hundred dollars per share can be intimidating or an outright deterrent. UnitedHealth Group (NYSE:UNH) is trading for $526.71, and while its share price is considerably higher than many other companies, the share price shouldn’t be the determining factor, but rather the company’s financials, outlook, and potential. When I look at UNH, I see a company that has sat out of the rally as its declined by -1.06% over the past year but has the potential to be a standout investment in 2024. UNH has a solid balance sheet, a manageable debt level, strong cash flows, strong dividend growth, and is trading at an attractive valuation. As capital flows back into the market, I can see UNH being a flight to safety that outperforms in 2024.

Why I like Healthcare and what UNH does

Healthcare is a necessity, and as the population ages, there will be an increased need for all healthcare services. It’s similar to my outlook on consumer staples companies, they may not grab headlines and be as attractive as big tech, but they’re essential to everyday life. UNH is comprised of UnitedHealthcare and Optum, which work together to deliver health benefits, health technology, financial services, pharmacy care, and care delivery. Optum Health serves roughly 103 million unique customers, has an administrative and clinical solution business that focuses on delivering revenue cycle optimization and software to its clients, and operates a $158 billion integrated pharmacy through Optum RX. The UnitedHealthcare business serves 27.2 million people in the United States through employed and individual plans, 13.7 million people through Medicare plans, and 8.1 million people through Medicaid and dual special needs plans.

I see UNH as a defensive company, as it would be incredibly challenging to disrupt their operations. Optum Health serves communities nationwide as it provides primary, specialty, and ambulatory surgical care while providing comprehensive care solutions to individuals at every stage of their life. In addition to the 103 million unique individuals served, there are roughly 130,000 physicians and advanced practice clinicians within Optum Health through 2,700 sites that are accessed by more than 100 health plan partners. The RX business serves 62 million consumers through 770 community and infusion pharmacies. The Optum Insight business has facilitated $23 billion in electronic transactions, and is responsible for roughly $140 billion in annual billings for its revenue cycle customers. Unless there is an overhaul in healthcare across the United States, I believe that UNH will continue to get bigger as the UnitedHealthcare network serves more than 52 million consumers through a network of more than 1.7 million physicians and care professionals and over 7,000 hospitals and care facilities nationwide.

Going through the underlying financials and determining if UNH is a company that I would be interested in

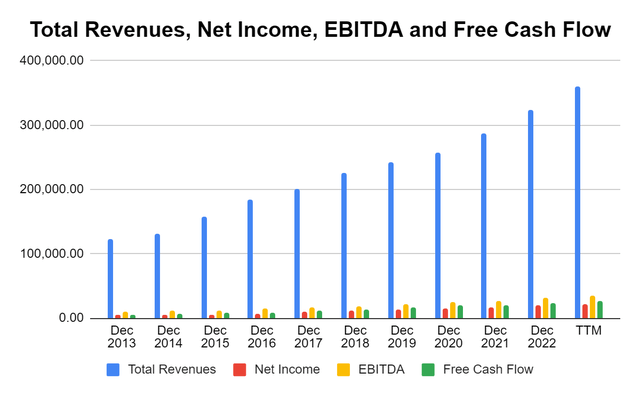

I feel that UNH has a moat around its business as it would be too costly to build a company from the ground up to compete with them or their peers. Unlike enterprise software, where anyone can raise capital and hire the best engineers, there are hurdles from every direction, including regulatory to for new competitors. This is one of the reasons why UNH has been a powerhouse, as its profitability continues to expand. Over the past decade, UNH has increased its revenue by 193.89% to $359.98 billion while increasing its net income by 285.55% to 21.69 billion, its free cash flow (FCF) by 365.08% to $26.44 billion, and its EBITDA by 226.25% to $34.54 billion. While some may consider a 6% profit margin a low-margin business, UNH generates tens of billions in pure profits, is growing, and rewards investors through dividends and buybacks.

Steven Fiorillo, Seeking Alpha

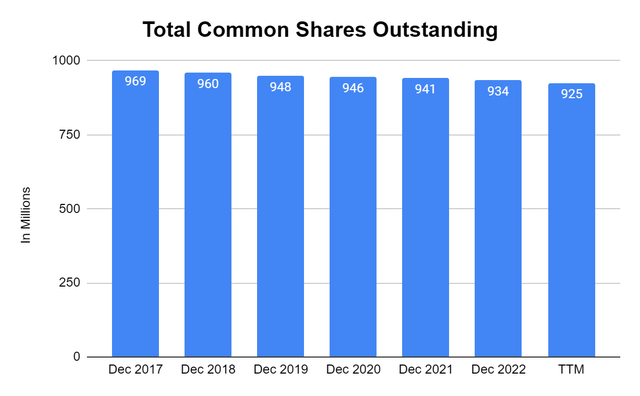

When I look through the balance sheet, it looks like a fortress. UNH has $50.66 billion in total investments on hand, with another $38.92 billion in cash. There is $58 billion in long-term debt, which is covered by the liquidity on UNH’s balance sheet. UNH has a total debt position of $63.37 billion, and when the cash is allocated against the total debt, UNH is left with a net debt position of $24.45 billion. In the TTM, UNH generated $34.54 billion in EBITDA, placing its net debt to EBITDA ratio at 0.71, which indicates UNH is a low levered company. The balance sheet has $93.98 billion of equity on it, and I am not seeing red flags anywhere. Since 2017, UNH has also rewarded shareholders with annualized buybacks as they have repurchased 4.54% of the shares outstanding.

Steven Fiorillo, Seeking Alpha

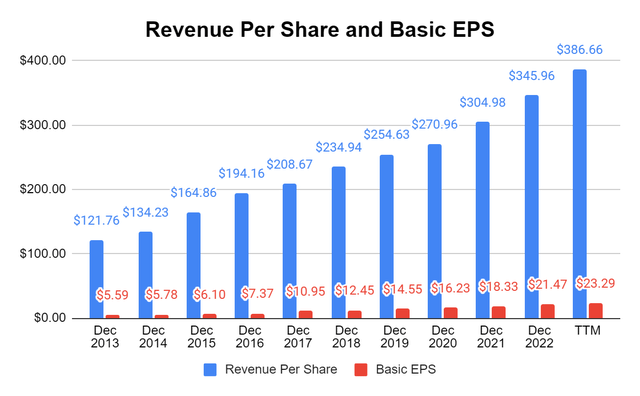

After looking through the financials, UNH is a powerhouse that generates billions in profits and has a fortress balance sheet. On a per-share basis, UNH has increased the amount of revenue and EPS it generates on an annualized basis over the past decade. UNH may not be classified as an exciting tech company, but they continue to grow their top and bottom line as if they are. Going into 2024, I think investors are going to be looking for a combination of things, and UNH checks off all the boxes from the financials to YoY growth. Looking at the analyst’s consensus estimates, UNH is expected to generate double-digit YoY EPS growth through 2027 while continuing to expand its revenue growth in the high single digit range.

Steven Fiorillo, Seeking Alpha

I like the valuation and even better, I like getting paid to wait for an investment thesis to play out

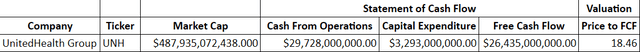

I like UNH’s overall business and the financials, but now I need to see if I like the valuation. UNH has a market cap of $487.94 billion and generated $26.44 billion of FCF in the TTM. This places its price to FCF at 18.46x, which is well under the level I look for with established companies. I am not opposed to paying between 20 and 24x an established company’s FCF, especially if it’s still growing. UNH at 18.46x its FCF, looks a bit undervalued to me as the entire market cap will be generated in FCF in under 20 years based on the TTM numbers. This leaves a lot of room for UNH to capitalize on opportunities in the future while rewarding investors through dividends and buybacks.

Steven Fiorillo, Seeking Alpha

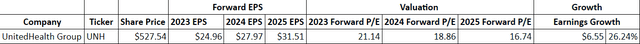

From an EPS standpoint, UNH is projected to grow at double-digit growth rates over the next several years. Based on the 2023 consensus estimates for EPS, UNH trades at a forward P/E of 21.14x. Over the next 2-years, UNH is expected to grow its EPS by $6.55 or 26.24%, which places its 2024 forward P/E at 18.86x and its 2025 forward P/E at 16.74x. I think that these are low multiples to pay for an established company that is still growing at these rates.

Steven Fiorillo, Seeking Alpha

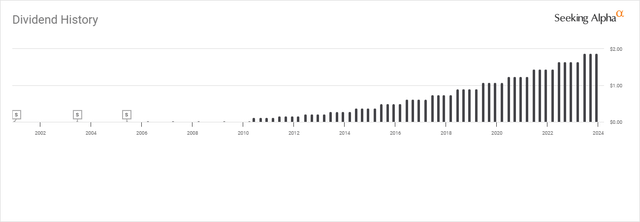

In addition to the low valuation, UNH is paying a dividend of $7.52 per share. While the yield is on the lower end at 1.44%, the dividend has 14 years of consecutive dividend increases and is 30.13% of its 2023 projected earnings. The dividend has grown at a 16.14% growth rate over the past 5-years, and there is more than enough room in the tank for future increases. I think that UNH is an undervalued company, and investors are being rewarded through a growing dividend and ongoing buybacks while they wait for UNH to break out of its sideways trend.

Investing in UNH has risks despite how profitable it’s become

UNH depends on impeccable data as this is used as the framework in which UNH serves its members and healthcare professionals. If the data in the future is inaccurate or unreliable, they could experience failures in across their different business lines. There is always uncertain and ongoing evolving federal, state, and international laws and regulations related to health data and the health information technology market that could negatively impact UNH. Cyber breaches have been on the rise, and UNH is one of the largest holdings of client data, making it an ongoing target for cyber attacks. UNH also has competition risks from Fortune 50 global enterprises, in addition to a changing healthcare landscape.

Conclusion

Going into 2024, I am looking for companies that look undervalued and haven’t performed well in 2023. I think it’s going to be a stock pickers market in 2024 as sector rotations occur and capital flows into the market from the sidelines as the risk-free rate of return declines. UNH looks undervalued from a valuation standpoint, but continues to buy back shares and grow the dividend. With double-digit EPS growth on the horizon over the next several years, a P/E of 18.83x 2024 earnings, and paying a modest dividend, I think UNH is positioned to outperform in 2024. I am not a shareholder yet, but I plan on starting a position in the future.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Disclaimer: I am not an investment advisor or professional. This article is my own personal opinion and is not meant to be a recommendation of the purchase or sale of stock. The investments and strategies discussed within this article are solely my personal opinions and commentary on the subject. This article has been written for research and educational purposes only. Anything written in this article does not take into account the reader’s particular investment objectives, financial situation, needs, or personal circumstances and is not intended to be specific to you. Investors should conduct their own research before investing to see if the companies discussed in this article fit into their portfolio parameters. Just because something may be an enticing investment for myself or someone else, it may not be the correct investment for you.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.