Summary:

- UnitedHealth Group’s first-quarter report beat expectations, providing relief to investors.

- The healthcare powerhouse has faced challenges such as regulatory scrutiny and a cyber attack, but remains a strong business with exceptional growth opportunities.

- The stock has historically experienced sharp rises following periods of underperformance, and its current valuation suggests potential for market-beating returns.

jetcityimage

UnitedHealth Group (NYSE:UNH) investors can breathe a sigh of relief after a highly anticipated first-quarter report that beat expectations.

Viewed by many as a sleep-well-at-night investment, the healthcare powerhouse was everything but that over the past several months.

A mixed bag of elevated utilization trends, regulatory scrutiny, DOJ probe, cyber attack, and a disappointing CMS rate, sent the stock into a spiral, but they are seemingly not enough to stop this healthcare empire from marching forward.

UnitedHealth remains a very strong business with robust growth opportunities, and it’s historically undervalued.

Let’s dive in.

Background

I’ve been covering UnitedHealth on Seeking Alpha for quite some time, and boy, what a roller coaster ride it’s been. Naive as I was, I thought I was going to cover an easy-going health insurer that should provide a slightly better-than-market return for the long term, and in reality, I couldn’t be more wrong.

In my coverage, I started by explaining the unique synergies between UNH’s segments, which are second to none when it comes to presence in the health services value chain. I went over how I believe the company should be evaluated and discussed increasing medical care costs exiting the pandemic.

So far, our Buy rating was wrong, as UNH significantly underperformed the market. As we’ll see, I remain bullish.

Being An Important Healthcare Company Is A Double-Edged Sword

Many people are frustrated with the United States’ healthcare system. From complex market structures in pharma to unclear insurance benefits and high medical costs, it’s hard for an individual to navigate.

While many blame UNH for being part of the problem, I believe that at the end of the day, without companies like UNH, the situation would be severely worse.

The company has the largest number of members under its insurance arm, one of the largest physician networks, and plenty of other businesses that are irreplaceable in the healthcare value chain.

Being such an integral part of the U.S. healthcare system is a double-edged sword. On the one hand, this is a market with unparalleled resiliency and an extremely strong secular growth trend. On the other hand, the regulator is constantly watching over everything you do, and politicians look for easy gains at your expense.

This means that more often than not, you’ll see a negative headline regarding UNH, or one of its businesses. Whether it’s PBM investigations, bearish CMS reforms, or just worse-than-expected flu seasons, there’s always something to worry about.

During gloomy times, it’s important to remember that healthcare is one of the only categories that consistently gains more share of GDP, and UNH is very well positioned to capitalize on this trend.

Historically, The Stock Experiences Sharp Rises Following Extended Underperformance

UnitedHealth has quite an ambitious EPS growth target of 13%-16%. There are many doubters, but the company continues to silence them, with a 15.8% 10-year CAGR, 14.4% 5-year CAGR, and 14.2% 3-year CAGR.

The reason the company can achieve such extraordinary growth rates is due to the secular growth trends we discussed above, combined with its unparalleled presence across the value chain.

Moreover, UNH is a cash printer, with cash conversion rates that are always higher than 1x. This allows UNH to buy back shares at a rapid pace while providing a fast-growing dividend.

Here’s a not-so-bold take. If UNH meets even the low end of its target range over the next decade, or even if it comes a bit below, the stock will provide market-beating returns. When the S&P average is mid-single-digits, the path to beat it is clear.

However, there are periods, sometimes extended periods, when the negative headlines overshadow the underlying fundamentals, and put significant pressure on the stock.

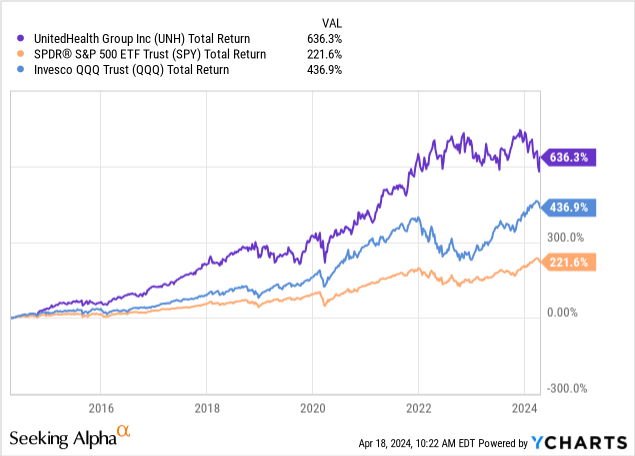

Let’s take a look at the above graph. We can see that between 2015 and H1-16, the stock trod water, while the S&P was up. This period was followed by a very sharp upswing, which lasted between H2-16 and 2019 with almost no interruptions. Then, another long year of underperformance came, which was again followed by a remarkable 2.5-year period of a sharp rise.

Today, we’re standing somewhere above the bottom of a two-year stretch of stagnation and a selloff. Once again, it’s mostly a result of a convergence between several temporary headwinds.

In my view, we’re at the cusp of the next upswing, and there are plenty of fundamental reasons to back that up.

Valuation & The Makings Of The Next Upswing

Despite the extremely negative backdrop, UnitedHealth was able to achieve 8.5% revenue growth, and 10.3% adjusted EPS growth, which could have been even higher if they excluded business disruption impacts from the cyber attack.

Furthermore, unlike what many investors expected, UNH reaffirmed its 2024 adj. EPS guidance range of $27.5-$28.0 (which excludes direct impacts from the cyber attack, amortization, and a loss on sale of a subsidiary, but includes business disruption impacts).

Essentially, UNH upgraded its guidance, while other companies in the sector have already lowered their guidance several times as they were unprepared for higher utilization, mispriced their benefit plans, and are struggling to generate internal cost savings to offset their mistakes.

The company also reiterated its long-term growth targets, and sounded much less worried about the CMS final rate, unlike its frustrated competitors.

This is a clear testament to UnitedHealth Group’s unparalleled strength in the sector and a showcase as to why it receives a higher multiple than its peers.

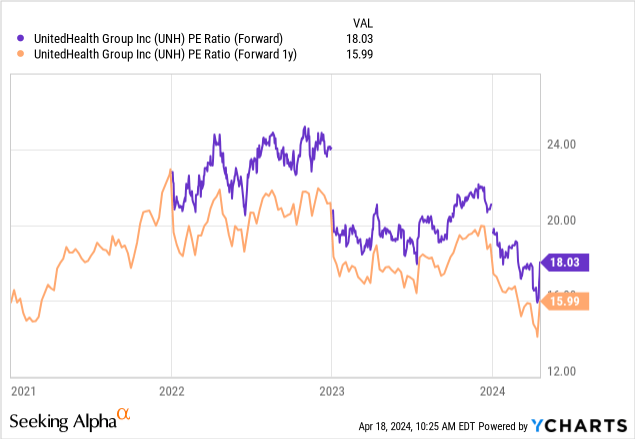

So, based on the reaffirmed guidance, which is in line with consensus estimates, UNH is trading at an 18.0x P/E.

Remember, the EPS projections for the year are weighed down by direct business disruption caused by the cyber attack, and it’s also important to understand that it took a lot of focus from management, which must have affected results indirectly in some way as well.

On next year’s projections, which are much more reflective, the stock is trading at 16x.

Let’s see where that puts us from a historical standpoint.

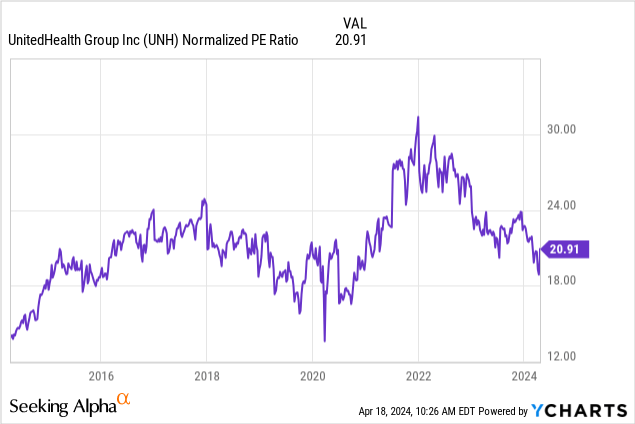

As we can see, aside from a short period during COVID-19, an 18x P/E is the lowest level we’ve seen in the last decade, and the average is around 20x.

With the company’s underlying growth prospects and fundamentals unchanged, I place a price target of $550 for the end of 2024, which reflects a 20x P/E over this year’s EPS, and an 18x P/E over 2025 earnings.

In simple words, I expect UnitedHealth Group to recover back to its average valuation by the end of this year, as we get further away from the cyberattack, utilization trends normalize, and the overwhelming pessimism about the company fades.

Conclusion

To say UnitedHealth Group had a rough stretch would be an understatement. The company had to deal with multiple headwinds, which took a lot of management’s focus and pressured the stock.

Still, they managed to grow revenues at a high-single-digit pace and reaffirm their guidance, while competitors (who didn’t have to manage a cyber attack) aren’t able to achieve a similar feat.

This speaks to the strength of UNH’s unique company, and to the unparalleled quality of its management.

I believe the first-quarter results provided enough confidence for investors to leave those headwinds behind and focus on the company’s fundamentals, which remain intact.

As such, I expect the stock will recover to historical levels, and rate it a Buy.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of UNH either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.