Summary:

- UnitedHealth Group boasts a track record of vigorous shareholder returns.

- The managed care behemoth operates as the undisputed leader of an industry with considerable trends on its side.

- UnitedHealth Group possesses a sound investment-grade credit rating.

- I believe the company is only marginally discounted, but it is worth buying a bit now and waiting for a better valuation later.

- Even near fair value, UnitedHealth Group could deliver 14% annual total returns over the next decade in my view – much better than the 10% annual total returns of the S&P.

A senior couple walking on the beach. dmbaker

As a predominantly dividend growth-focused investor, I believe in buying best-of-breed businesses at or below fair value. That is because buying top-notch companies at reasonable valuations tends to work out very well in the long run.

Readers can look no further than UnitedHealth Group (NYSE:UNH) as evidence of this argument. A $10,000 investment in the stock made 10 years ago would now be worth $90,000 with dividends reinvested – – a market-beating 24.6% compound annual growth rate. For perspective, that is far superior to the $29,000 that the same investment in the SPDR S&P 500 ETF (SPY) would be valued at today – – an 11.2% CAGR.

The law of large numbers suggests that UnitedHealth Group won’t be able to match these returns moving forward. Otherwise, its market capitalization would be around $4 trillion in 2033. Yet, the stock doesn’t have to do nearly as well to still be one of the best investments in my portfolio or yours. For the first time in almost two years, let’s investigate why I like UnitedHealth right now and would love it on a pullback from current levels.

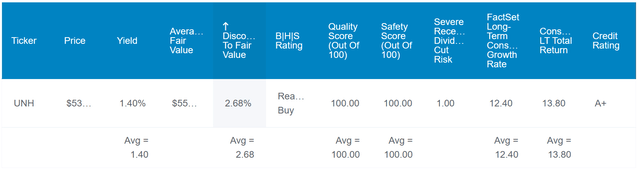

In this current rate environment especially, UnitedHealth’s 1.4% dividend yield probably isn’t going to draw fanfare from income investors. As I’ll discuss, however, the company is an excellent pick for dividend growth investors. This is because UnitedHealth’s EPS payout ratio stands at just 28%. That leaves a substantial buffer versus the 60% payout ratio that credit rating agencies desire from health insurers.

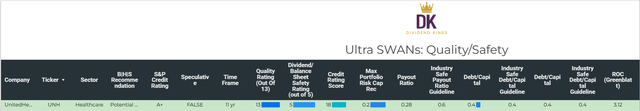

Adding to its appeal, UnitedHealth is also a financially robust company. The health insurer enjoys an A+ credit rating from S&P, which puts it at an estimated 30-year bankruptcy risk of just 0.6%. That means in 166 out of 167 scenarios, UnitedHealth won’t be going out of business by 2053. Considering these factors, that is why the company earns a perfect 5/5 rating for dividend and balance sheet safety.

Though not trading at a bargain right now, UnitedHealth is 6% undervalued at the current $524 share price (as of October 23, 2023).

- 1.4% yield + 12.4% FactSet Research annual earnings growth consensus + a 0.6% boost from annual valuation multiple reversion = 14.4% annual total returns for the next 10 years > ~10% annual total returns expected from the S&P 500

The Titan Of Its Industry

Working with governments, employers, and providers around the world, UnitedHealth Group cares for 152 million people. The company consists of its UnitedHealthcare health insurance plans business and its Optum healthcare technology and data business. UnitedHealth’s huge customer base explains how the company is the most dominant player in its industry, with a nearly $500 billion market value.

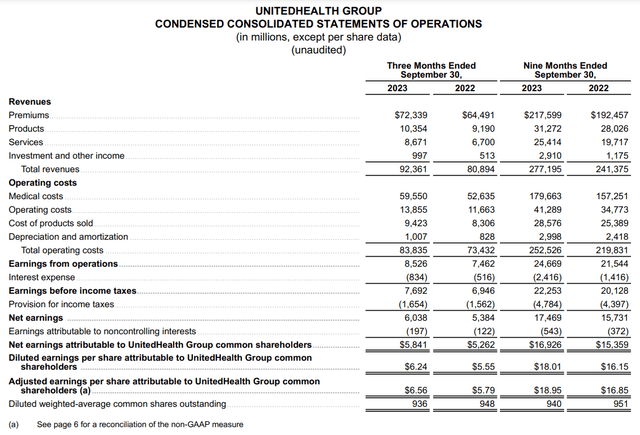

UnitedHealth Q3 2023 Earnings Press Release

UnitedHealth’s total revenue surged 14.8% higher year-over-year to $277.2 billion through the first nine months of 2023. For context, if the company were its own economy, its $370 billion in annualized revenue would be comfortably in the top 50 economies by GDP. What factors were behind these amazing results?

For one, the company’s total medical membership edged 2.8% higher over the year-ago period to 52.8 million as of September 30. Demographic trends that are raising the overall demand for health insurance plans were responsible for this membership growth. Thanks to the name recognition and high customer satisfaction rate, UnitedHealth’s Optum Health consumers served grew by 2% year-over-year to 103 million as of September 30. Combined with premium rate hikes, these variables explain the company’s healthy topline growth rate so far in 2023.

UnitedHealth Group’s adjusted diluted EPS rose by 12.8% over the year-ago period to $18.95 during the first nine months of the year. A higher total revenue base and a lower share count from share repurchases were slightly offset by a downtick in profitability. This was due to an uptick in total operating expenses.

Moving forward, adjusted diluted EPS growth should be similar to what UnitedHealth has delivered to shareholders to date this year. Thanks to the forecast of rising health insurance demand, FactSet Research believes that the company’s earnings will compound by 12.4% annually over the long haul.

UnitedHealth’s notably strong balance sheet could aid in those growth prospects as well. The company’s debt-to-capital ratio of 0.4 registers in line with what rating agencies consider safe, which is why it could execute bolt-on acquisitions to strengthen its business. UnitedHealth’s financial positioning is what earns it an A+ credit rating from S&P on a stable outlook (all info sourced from UnitedHealth Q2 2023 earnings press release and DK Research Terminal).

A Free Cash Flow Machine With Robust Dividend Growth Potential

What UnitedHealth lacks in immediate income relative to the S&P’s 1.6% yield, it makes up in dividend safety and growth. The company’s quarterly dividend per share of $1.88 has soared nearly 109% in the last five years alone – good enough for a 15.9% annual growth rate.

As demonstrated by its free cash flow, there is ample reason to believe this kind of dividend growth can continue for a while longer. UnitedHealth generated an unbelievable $31.8 billion in free cash flow for the first nine months of 2023. Against the $5 billion in dividends paid during that time, this comes out to a payout ratio of merely 15.8%. Such remarkable coverage of its dividend with free cash flow can easily sustain an annual dividend growth rate in the teens from my perspective.

Risks To Consider

As measured by fundamentals, I believe UnitedHealth is one of the most formidable businesses on this planet. It’s one of a select few companies that are as close to invincible as it gets in the investing business in my view. However, it still has risks.

As you’d expect from a health insurer, UnitedHealth’s prospects depend on its ability to appropriately price its insurance policies. The company’s medical care ratios routinely in the low-80% range (anything under 100% is profitable) illustrate just how competent it is at pricing its products. If that were to change, though, UnitedHealth’s profits could be hurt.

Due to the treasure trove of sensitive information the company has on its customers, it is a common target among hackers. Thus far, UnitedHealth has stayed ahead of these seedy characters, but one slipup could be costly. The company’s operations could be disrupted, and its reputation could be harmed by a major cyber breach.

Finally, UnitedHealth’s participation in multiple governmental programs (e.g., local, federal, and state) has risks. A delay in government funding or the termination of a contract could weigh on the company’s operating results at any time (a comprehensive discussion of risk factors can be found on pages 10-20 of UnitedHealth’s 10-K filing).

Summary: A Fair Buy Now But I’d Like A Greater Margin Of Safety Before I Add

UnitedHealth’s operating fundamentals and fortress-like balance sheet make it a 13/13 ultra SWAN. This is precisely why the stock is the 15th most valuable holding in my portfolio, comprising 1.4% of its total value.

Relative to its fair value, UnitedHealth isn’t a table-pounding buy right now. However, it’s a respectable buy at 6% below fair value. That is because, from the current share price, investors are set up for annual total returns of around 14%. Each $1 invested in UnitedHealth could turn into $3.84 by 2033 if things go as expected. That is far better than the $2.59 that the same $1 invested in the S&P could be worth by that time.

Because I already have a healthy position in UnitedHealth, I am going to wait for a selloff to around $500 a share before I add more. But investors looking for an entry point in the stock should consider buying now and potentially adding more on the way down if that happens.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of UNH either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.