Summary:

- UnitedHealth Group Incorporated faces substantial long-term risks, including public pressure for high claim denial rates and potential policy changes towards a single-payer healthcare system.

- The U.S. government is enacting policies like ending Balance Billing and allowing Medicare to negotiate drug prices, which could impact UnitedHealth Group’s business model.

- Despite strong financial performance, UnitedHealth Group’s P/E ratio of nearly 20x and 5% earnings yield do not justify its current valuation without significant growth.

- Given the growing support for “Medicare for All” and potential regulatory changes, UNH stock is viewed as a poor investment at this time.

Wolterk

UnitedHealth Group Incorporated (NYSE:UNH) is the largest U.S. healthcare insurer, with a market capitalization of more than $500 billion. The company trades at a P/E of almost 20x based on its most recent earnings, and given the questions that are being raised, has substantial long-term risks. That could hurt future shareholder return potential.

Healthcare Spending

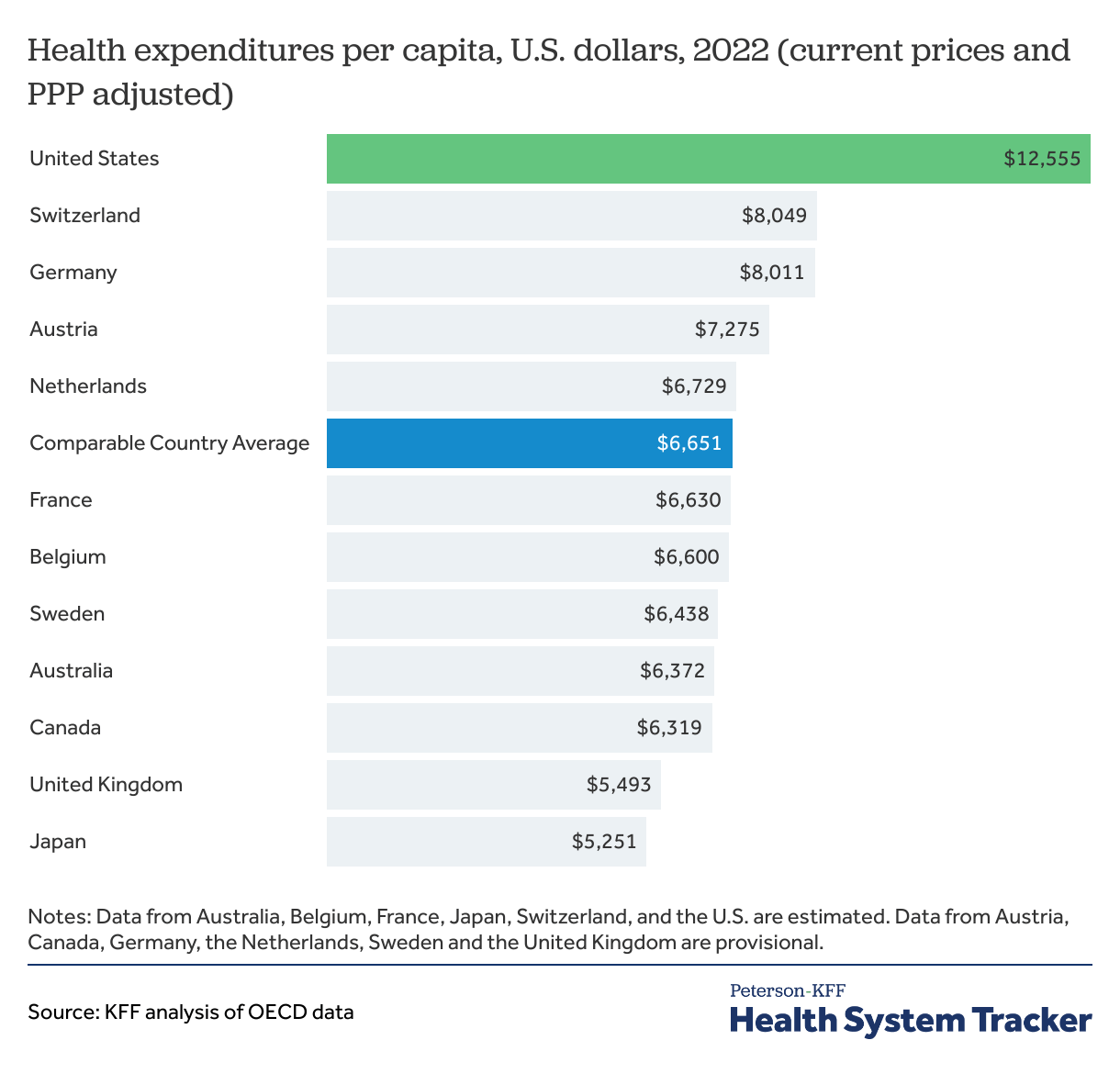

The U.S. is famous for spending more on healthcare than virtually very other developed country.

How does health spending in the U.S. compare to other countries? – Peterson-KFF Health System Tracker

This is on a PPP basis, even though the U.S. consistently has worse outcomes. The country’s spending is 50% more than Switzerland and almost double the comparable country average. That massive spending is partially due to the country not having a single-payer healthcare system. With it unrealistic for people to save up for something like cancer, it has a big impact.

Another way to look at this is to look at medical bankruptcy rates, which is 67% in the U.S., versus 8% in the UK and 19% in Canada. This spending has increased the push internal to the U.S. to a single-payer healthcare system. Public support for Medicare for All, as it’s called, is increasing.

UnitedHealth Group Claim Denials

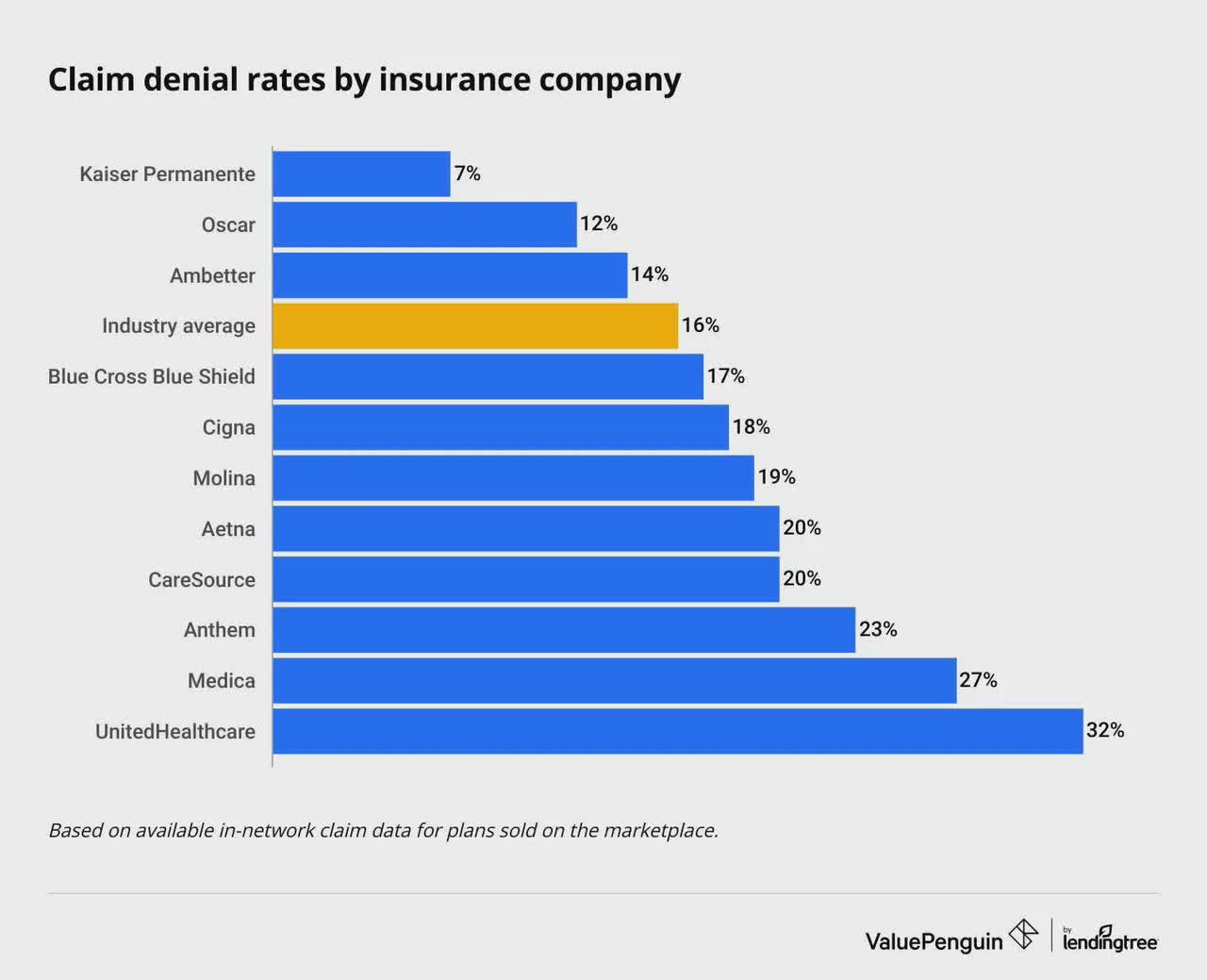

At the same time, UnitedHealth Group has faced public pressure for elevated denial rates.

Claim Denial Rates by U.S. Insurance Company : r/interestingasfuck

UnitedHealth Group has the highest denial rates in the industry at more than 30%. The shooting of UnitedHealthcare’s CEO raises tough questions around people sharing their claim denials. Discussion around the lack of sympathy for the shooting center around people who have missed out on vital healthcare as a result of UnitedHealthcare claim’s process.

UnitedHealthcare has seen dramatic growth in claim denials following the usage of artificial intelligence to review claims. To be clear, UnitedHealthcare isn’t unique in claim denial or patient-unfriendly processes. Anthem of Elevance Health (ELV) recently walked back a plan to limit anesthesia coverage time during surgeries, after substantial criticism.

U.S. Government Action

It’s clear that individuals are concerned, and those concerns are being raised to those in charge. Under the Biden administration, the U.S. government has made several policies to change the status quo and improve healthcare billing.

The “No Surprises Act” passed in 2022, ends Balance Billing, an incredibly consumer-unfriendly practice where non in-network consumers in an emergency situation could be charged virtually unlimited amounts of money for their care. That closes out a major loophole in people receiving affordable care, and moves emergency care towards a “spread the costs” model.

The second is the “Inflation Reduction Act” and its provision to allow Medicare to negotiate directly with companies over drug prices. Threatening to not allow those companies to be a part of Medicare at all pushes the companies to the table most of the time. This provision is already under lawsuits, but could save the use $10s of billions / year.

These two decisions show the U.S. government is moving towards spreading the risks of healthcare costs and changing things up. With 116 co-sponsors in Congress for a “Medicare for All” Act (~25% of Congress) the approval and support could present an existential threat for UnitedHealthcare.

UnitedHealth Group Earnings

Financially, UnitedHealthcare Group has continued to expand.

The company had $100.8 billion in revenue in the most recent quarter, ~9% YoY growth with annualized EPS at $29 / share not counting Cyberattack impacts. That puts the company at a P/E of just under 20, or an earnings yield of ~5%. The company’s two businesses maintain a mid-single digit earnings margin, with no substantial margin impact in recent quarters.

At a P/E of just under 20x, the company is cheaper than the overall S&P 500 (SP500). However, an earnings yield of 5% doesn’t justify investing. As a result, the company still needs growth over the long term to justify its valuation.

Thesis Risk

The largest risk to our thesis is that UnitedHealthcare is well positioned in an important industry. Healthcare expenditures can be expected to continue growing as the population ages and the company has economies of scale. Growth for the company could enable continued long-term shareholder returns.

Conclusion

UnitedHealth Group saw its CEO murdered.

In the wake of the murder, questions are being raised about healthcare policies he was responsible for in a country that spends more on healthcare per-capita than any other major developed nation.

Already after his death, Anthem rolled back a policy to limit anesthesia coverage for patients in surgery. There was clear pushback on a decision that obviously punished patients, how can a patient be financially responsible for how long they’re kept under anesthesia by. At the same time, under the Biden administration, balance billing and drug price restrictions have come in force.

There is a growing movement in the United States towards “Medicare for All” type plans. Such a plan would potentially put major companies such as UnitedHealth Group out of business. Combined with a relatively lofty valuation, a P/E of just under 20, and the growth required, and we view UnitedHealth Group as a poor investment at this time.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

You Only Get 1 Chance To Retire, Join The #1 Retirement Service

The Retirement Forum provides actionable ideals, a high-yield safe retirement portfolio, and macroeconomic outlooks, all to help you maximize your capital and your income. We search the entire market to help you maximize returns.

Recommendations from a top 0.2% TipRanks author!

Retirement is complicated and you only get once chance to do it right. Don’t miss out because you didn’t know what was out there.

We provide:

- Model portfolios to generate high retirement cash flow.

- Deep-dive actionable research.

- Recommendation spreadsheets and option strategies.