Summary:

- As the years progress, phenomenal dividend growers are making up more of my portfolio.

- UnitedHealth Group posted another double beat during the first quarter.

- The company had just shy of $41 billion in net debt as of March 31, 2024, which is very manageable for its size and scale.

- The managed care behemoth could be priced 12% below fair value.

- UNH could generate at least 40% cumulative total returns through 2026.

A pharmacist assists a customer. Morsa Images/DigitalVision via Getty Images

I have plenty of time to let compounding work wonders for me. After all, I just turned 27 years old last month.

In investing, my youth wasn’t always something that I was fully utilizing, though. Over the years, I have made the mistake of buying a couple of yield traps.

The full realization of my youth in recent years has radically transformed my investment strategy. I still deploy capital into more sustainable yielders from time to time, including Enterprise Products Partners (EPD) and Philip Morris International (PM).

However, I have been focusing more of my efforts on what I believe to be long-term dividend growth compounders. For clarity, I consider these to be leading businesses operating in growing industries.

With a market capitalization larger than all of its publicly listed competitors combined, nobody is bigger or stronger than UnitedHealth Group Incorporated (NYSE:UNH) in the health insurance industry.

This is an industry that I view as having a very encouraging long-term growth outlook. After all, an aging global population and growing rates of chronic diseases are helping to lift the demand for health insurance. That’s why IMARC Group anticipates that the global health insurance market will compound by 6.2% annually from $1.8 trillion in 2024 to $3.2 trillion by 2032.

Since I last covered UNH with a buy rating in February, I upped my position by 66.7% in April at $451 a share. Now, my weighting is 2.1% of my portfolio and the stock is my eighth-biggest holding.

At the time, I appreciated the company’s leadership in a steadily growing industry. I also liked the A-rated balance sheet. Shares were also modestly undervalued.

When UNH shared its financial results for the first quarter on April 16, my buy rating was only reinforced. As great companies tend to do, the company posted yet another double-beat. UNH’s financial positioning remains strong. Thanks to the passage of time and business outperformance, I believe shares are now an even better value proposition.

The Growth Story Is Alive And Well

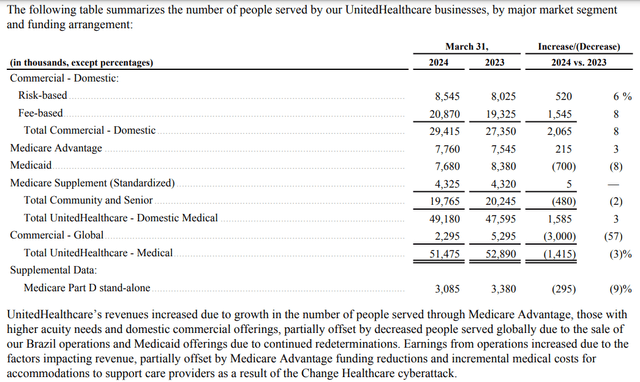

UNH Q1 2024 Earnings Press Release

Heading into first-quarter earnings, UNH had a remarkable track record of consistently exceeding the analyst consensus for revenue and non-GAAP EPS. In 17 of the 19 quarters leading up to Q1 2024, the company’s revenue came in ahead of the analyst consensus per Seeking Alpha. More impressively, in all 19 quarters preceding Q1 2024, UNH surpassed the non-GAAP EPS analyst consensus according to Seeking Alpha.

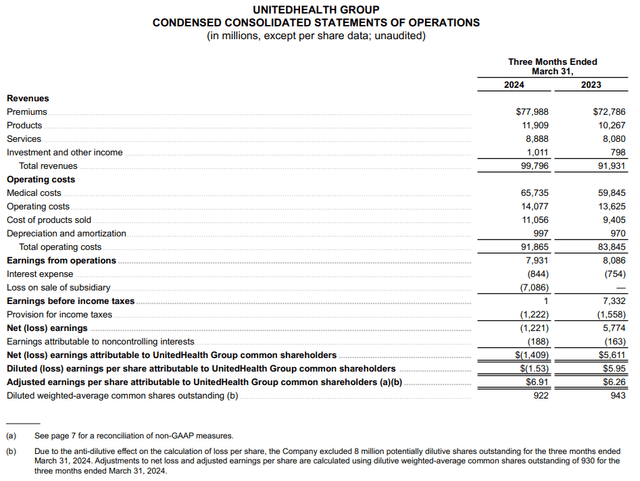

The managed care giant juggernaut kept up its string of phenomenal earnings with the release of Q1 earnings last month. UNH’s total revenue grew by 8.6% year-over-year to $99.8 billion during the first quarter. For context, that was $490 million better than Seeking Alpha’s analyst consensus.

The formula that has led to UNH’s revenue beats in past quarters was similar in the first quarter.

At a glance, the company’s 2.7% decline in total medical membership to 51.5 million for the first quarter doesn’t seem to be encouraging. However, there is another layer of details to analyze hidden beneath the surface of these results.

For one, it’s worth mentioning that the driving force behind the membership decline was nothing alarming. In February, UNH completed the sale of its Brazil operations. Having these operations on the books at the end of Q1 2023 provided a higher hurdle to clear for the end of Q1 2024 when they were no longer included.

Secondly, in his remarks during the Q1 2024 Earnings Call, UnitedHealthcare Employer & Individual CEO Dan Kueter pointed to more re-determinations emerging into 2024 than in the final portions of 2023. This also weighed on the company’s medical membership during the first quarter.

These headwinds were partially offset by 2.1 million new domestic commercial members in the first quarter per President and CFO John Rex’s opening remarks during the Q1 2024 Earnings Call. Medicare Advantage membership also edged higher by 2.8% to 7.8 million for the quarter. Adding in a 1% growth rate in Optum Health customers served to 104 million and higher premiums, this is how the topline still grew at a healthy rate during the quarter.

Moving down the income statement, UNH posted a net loss per share of $1.53 in the first quarter. This was due to the ~$7.1 billion charge from the sale of its Brazil operations, which was the result of foreign currency translation losses. Included in this was another $593 million of direct response costs to the Change Healthcare cyberattack and $279 million in business disruption impacts from the incident.

Factoring these elements out of the equation, UNH posted $6.91 in adjusted diluted EPS for the first quarter – – up 10.4% over the year-ago period. That was $0.29 greater than the Seeking Alpha analyst consensus.

Careful cost management helped UNH’s non-GAAP net margin to expand by 2 basis points to just above 6.4% during the first quarter. Combined with a 2.2% reduction in the diluted share count from share buybacks, this is how adjusted diluted EPS growth outpaced revenue growth in the quarter.

Looking ahead over the next few years, UNH’s growth prospects remain sound. The consensus is that adjusted diluted EPS will rise by 10.5% in 2024 to $27.75.

I believe this is a sensible estimate. That’s because it includes assumptions that revenue growth will come in at a high-single-digit rate for the remainder of the year. Couple that with steady margins and share buybacks, and this provides a path to such a growth rate.

The same can be said for the 2025 and 2026 growth forecasts. In the former year, UNH’s adjusted diluted EPS is anticipated to climb by 12.3% to $31.17. In the latter year, adjusted diluted EPS could surge 13.2% to $35.27.

UNH’s financial health is also stable. The company’s interest coverage ratio was 9.4 in the first quarter. UNH also had just $40.9 billion of net debt as of March 31. For a company of its size, that’s a sustainable debt load (unless otherwise noted or hyperlinked, all details in this subhead were sourced from UNH’s Q1 2024 Earnings Press Release and UNH’s Q1 10-Q Filing).

Fair Value Is Approaching $590 A Share

Since my buy rating in February, shares of UNH have retreated by 1%, as the S&P 500 (SP500) has gained 6%. In my view, this makes the stock a more appealing buy now than it was three months ago.

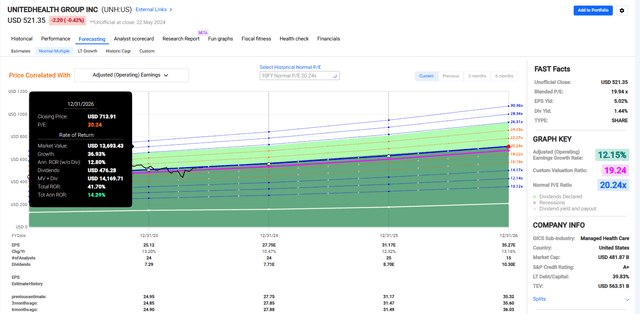

UNH’s shares are trading at a current-year P/E ratio of 18.6. This is a bit lower than the 10-year normal P/E ratio of 20.2 per FAST Graphs.

For my money, I think UNH is worthy of such a valuation multiple in the years to come as well. This is because the company’s annual growth consensus is 12.2% for the next three years. That’s a bit of a deceleration from the 10-year compound annual growth rate of 15.8%. But this is understandable for a company with a market cap of around $500 billion.

Judging by UNH’s forward PEG ratio of 1.8, shares could even be fairly valued around a multiple as high as 22. So, that’s why I think a multiple just above 20 is within reason.

There is about 59.6% of 2024 left and 40.4% of 2025 that lies ahead in the next 12 months. That is how I’m accounting for the respective FAST Graphs 2024 and 2025 adjusted diluted EPS predictions of $27.75 and $31.17. Thus, I arrive at a 12-month earnings input of $29.13.

Plugging this earnings input into a valuation multiple of 20.2, I get a fair value of $588 a share. Against the current $517 share price (as of May 23, 2024), that is a 12% discount to fair value. If UNH returned to fair value and grew as anticipated, it could produce 40%+ cumulative total returns by the end of 2026.

Robust Dividend Growth Can Persist

The Dividend Kings’ Zen Research Terminal

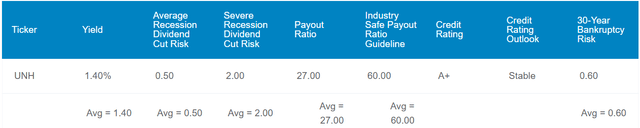

UNH’s 1.5% forward dividend yield (rounded up) seems pedestrian compared to the 1.5% median forward dividend yield of the healthcare sector. This earns it a C+ grade from Seeking Alpha’s Quant System for forward dividend yield.

But an investment in UNH has never been about starting yield as much as it has been about future growth. That remains the case today. The company’s five-year compound annual growth rate of the dividend is 15.9% per Seeking Alpha. That’s more than double the sector median of 6.6%, which earns it an A grade on that respective metric.

Looking ahead to the raise that should be on deck next month, my guess is: UNH will announce a 13.3% boost in its quarterly dividend per share to $2.13. That’s because the company’s 27% EPS payout ratio is firmly better than the 60% EPS payout ratio that rating agencies prefer from the industry.

If my hunch is right, UNH will pay $8.27 in dividends per share in 2024. Compared to the $27.75 adjusted diluted EPS consensus, that would be a 29.8% adjusted diluted EPS payout ratio. That’s still very viable to support both business growth and dividend growth, which is at least as fast as earnings growth.

Risks To Consider

UNH’s fundamentals may make it seem like it can’t succumb to any obstacles. However, all businesses have risks that could harm or destroy the investment thesis. UNH is no exception.

As was the case in my prior article, the biggest risk is likely the concentration of its business mix. In 2023, 40% of the company’s total revenue came from premium revenue from the Centers for Medicare and Medicaid Services.

Much of UNH’s future success depends on successfully maintaining a great relationship with the CMS. If the company can’t do so, the growth story could be shattered.

Another risk to UNH is the potential for cyberattacks to adversely impact the business. It appears as though the Change Healthcare hacks in February will have a minimal impact on UNH’s financial results. Management estimates that the impact for the full-year 2024 EPS will be between $1.15 and $1.35. That will probably almost entirely dissipate as the year progresses and the company enters into 2025.

However, if another cyber breach were to happen, there’s no guarantee that the result would be as immaterial. In a worst-case scenario, it could come with more harmful consequences for UNH’s growth prospects.

Summary: An Undervalued Dividend Growth Powerhouse

UNH is a business that I’m very pleased to own within my portfolio. The company’s growth potential is healthy. UNH’s balance sheet is A-rated. The dividend should keep quickly growing. Lastly, shares of UNH are moderately undervalued. This is why I’m reiterating my buy rating.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of UNH, EPD, PM either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.