Summary:

- When I make investments, I look for best-of-breed businesses operating in industries with lengthy growth runways.

- UnitedHealth Group Incorporated revenue and adjusted diluted EPS climbed higher in Q4.

- The health insurer enjoys an A+ credit rating from S&P on a stable outlook.

- Shares of UnitedHealth Group could be undervalued by 7%.

- The stock could be poised to meaningfully outperform the S&P over the next 10 years.

An ATM dispenses U.S. banknotes. webphotographeer

As a dividend growth investor, my job is to ensure that I build a portfolio that can deliver healthy dividend growth year in and year out. Why is this important?

Well, I eventually plan to live off dividends. Or at least, I would like to have that option. Thus, it is pivotal that the passive income growth my portfolio generates can keep up with inflation, or preferably, stay ahead of inflation.

I plan on achieving this objective by focusing on buying world-class businesses (e.g., established leaders within their respective industries) at sensible valuations.

Not only that, but I desire the industry in which they operate to have long-term growth tailwinds. I believe that UnitedHealth Group Incorporated (NYSE:UNH) is one such business that fits squarely within these parameters. Presently, the company makes up 1.4% of my portfolio’s total value. Over time, I wouldn’t mind getting this weighting up to between 2% and 2.5%.

Today, I will be reviewing UnitedHealth’s fundamentals and valuation for the first time since October to highlight why I am reiterating my buy rating.

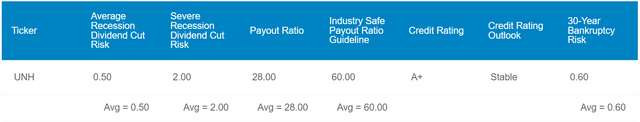

Dividend Kings Zen Research Terminal

Compared to the S&P 500 Index’s (SP500) 1.4% yield, UnitedHealth’s 1.5% dividend yield doesn’t stand out on paper. But as I will expand on as the article progresses, the company has been and will likely continue to be an absolute dividend growth machine.

UnitedHealth’s 28% EPS payout ratio remains at less than half of the 60% payout ratio that rating agencies have established as the industry-safe guideline. As I’ll discuss later, the company’s financial position is also vigorous. As a result, UnitedHealth’s long-term debt is rated A+ on a stable outlook by S&P. This implies the 30-year risk of bankruptcy is merely 0.6%, according to data from rating agencies.

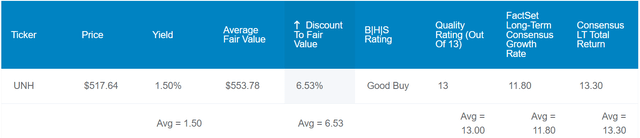

Dividend Kings Zen Research Terminal

UnitedHealth’s positive fundamentals are just one side of the coin on why I remain bullish. On the valuation front, the stock looks to also be interesting here. Based on the 10-year and 25-year dividend yields and P/E ratios, UnitedHealth could be fairly valued at $554 a share. Stacked against the current $517 share price (as of February 15, 2024), that would mean shares are trading 7% below fair value.

If UnitedHealth’s valuation reverts to the mean and it can meet the growth consensus, here are the total returns that it could generate in the coming 10 years:

- 1.5% yield + 11.8% FactSet Research annual growth consensus + 0.7% annual valuation multiple upside = 14% annual total return potential or a 271% 10-year cumulative total return versus the 10% annual total return potential of the S&P or a 159% 10-year cumulative total return

Revenue And Earnings Are Moving On Up

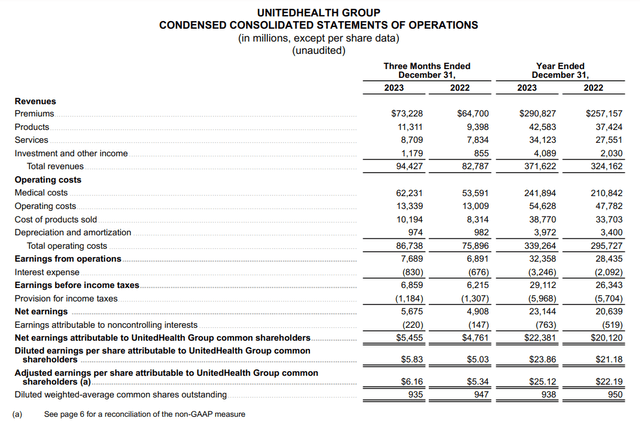

UnitedHealth Q4 2023 Earnings Press Release

In the fourth quarter that ended Dec. 31, it was business as usual for UnitedHealth. By that, I mean the company put up another excellent quarter of results for its shareholders. UnitedHealth’s total revenue grew by 14.1% year-over-year to $94.4 billion during the quarter. For more color, this was $2.2 billion better than the analyst revenue consensus.

Several elements led to this impressive top line growth rate for the mega cap for the fourth quarter.

First, UnitedHealth’s total medical membership edged 2% higher over the year-ago period to 52.8 million as of Dec. 31. The company’s strong brand recognition coupled with growing demand for health insurance plans, were the drivers of this membership growth.

Secondly, UnitedHealth’s Optum Health customer base expanded by 1% year-over-year to 103 million as of Dec. 31. Like its growth in medical membership, secular industry growth and its status as the leading provider of services were the variables that fueled this growth.

Finally, UnitedHealth’s trusted reputation and the essential nature of its health plans and services translated into pricing power. That is how the company grew its member and customer base while also hiking service prices and insurance premiums.

UnitedHealth’s adjusted diluted EPS surged 15.4% over the year-ago period to $6.16 in the fourth quarter. That came in ahead of the non-GAAP EPS analyst consensus by $0.17. Due to a faster growth rate in total operating costs (14.3%) than revenue growth, the company’s non-GAAP net profit margin contracted by two basis points to 6.1% during the quarter. This modest dip in profitability was more than countered by a 1.3% reduction in UnitedHealth’s diluted share count via its share repurchase program. That is how the company’s adjusted diluted EPS growth slightly outpaced revenue growth for the quarter.

Looking ahead, UnitedHealth anticipates more of the same growth. On page 7 of 7 of its Investor Conference PDF, the company maintained its long-term outlook for earnings per share growth of 13% to 16% annually. The blueprint for this level of growth is what the company has already done for countless years now.

For one, low-single-digit annual member and customer growth. I believe this can continue to be achieved via the secular growth trends in the industry (e.g., increased adoption of health insurance around the world) and maintaining its reputation.

Mid- to high-single-digit annual premium and services growth also seems to be sustainable. That’s because, thanks to the growing necessity of UnitedHealth Group’s products and services, there should be minimal pushback from members and customers. Along with bolt-on acquisitions, this alone can power high single-digit to low double-digit annual revenue growth. Combined with share repurchases, I believe these factors can generate the aforementioned earnings growth.

UnitedHealth is also a financially sound business. The company’s interest coverage ratio was 10 in 2023. As of Dec. 31, UnitedHealth also had just $32.9 billion in net debt (cash and short-term investments minus short-term borrowings and current maturities of long-term debt). Against the $36.3 billion in EBITDA generated in 2023, that’s a net debt-to-EBITDA ratio of just 0.9. This also suggests that UnitedHealth’s debt load is more than manageable relative to its size (unless otherwise noted, all details in this subhead were sourced from UnitedHealth’s Q4 2023 Earnings Press Release).

Dividend Growth Potential Remains Sizable

As I noted in my previous article, UnitedHealth’s quarterly dividend per share has more than doubled since 2019 to the current rate of $1.88.

Aside from the company’s enviable financial position and robust growth outlook, free cash flow generation is another reason I believe another doubling of the dividend could be ahead. UnitedHealth posted $25.7 billion in free cash flow in 2023. Compared to the $6.8 billion in dividends paid for the year, that equates to a 26.3% free cash flow payout ratio. Even with the $8 billion in share repurchases executed during the year and $10.1 billion of acquisitions, the company still had excess cash (info also according to UnitedHealth’s Q4 2023 Earnings Press Release).

Simply put, UnitedHealth is a business that can afford generous dividend growth, a decent amount of share repurchases, and bolt-on acquisitions.

Risks To Consider

UnitedHealth is a phenomenal business. Just like any business, though, it isn’t free from risk.

One of the more significant risks is the company’s reliance on the Centers for Medicare and Medicaid Services or CMS. As of 2022, premiums received from the CMS contributed to 38% of UnitedHealth’s total consolidated revenue (page 8 of 88 of UnitedHealth’s 10-K filing). If the company’s working relationship with the CMS were to deteriorate, its fundamentals could be harmed.

Another risk to UnitedHealth is the potential for large-scale emergencies (i.e., pandemics and natural disasters) to increase its operating costs. Such costs could be greater than the premiums that the company receives from its customers, which would negatively impact financial results.

Summary: A Superb Company With Market-Beating Potential

UnitedHealth is an investment that has everything, I desire. The company’s growth prospects are in the double digits, which is attractive. The yield is respectable and well-covered, with ample room for high growth moving forward. Not to mention that UnitedHealth’s balance sheet is secure, with an A+ rating from S&P. Lastly, the stock behind the company itself appears to be marginally undervalued. Any discount for a business of this caliber is often enough to get my attention. Thus, I plan on meaningfully upping my UnitedHealth Group Incorporated position soon.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of UNH either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.