Summary:

- Despite trading at higher valuation multiples than its peers, the stock’s fair value is between $529 and $720 per share, which is a 10% to 50% upside from current levels.

- Current economic uncertainty will propel investors to defensive, countercyclical stocks that consistently pay dividends, like UNH. Strong M&A activity in the field in 2023 is a growth catalyst.

- An increase in Medicare Advantage enrollment numbers as states resume enrollment eligibility operations will increase revenues. Recovery is expected in the Commercial & Government units.

- The population is rapidly aging and will result in an increased demand for healthcare. AI investment has the potential of greatly reducing costs.

jetcityimage

Business Description

UnitedHealth Group (NYSE:UNH) is a diversified healthcare provider that offers a wide range of healthcare products and services to individuals, employers, and government agencies. The company consists of two business platforms: UnitedHealthcare, which accounts for 77% of the business (in terms of 2022 revenues), and Optum, which accounts for the remaining 23%. UnitedHealthcare provides healthcare benefits globally to individuals and employers, including a large number of Medicare and Medicaid beneficiaries, whereas Optum is a technology-enabled health services business that serves the broader healthcare market, including consumers and healthcare providers such as pharmacies, hospitals, and physicians. Within these two business platforms are the following sub-segments:

- United Healthcare has four subdivisions: Medicare and Retirement; Employment and individual; Community and State; and International. Overall, the segment provides healthcare services to individuals aged 65 years old or older, employer-sponsored health insurance plans for employees, individual insurance, and managed-care solutions and insurance coverage to Medicaid beneficiaries.

- Optum RX: is responsible for the processing and payment of prescription drug claims of its clients.

- Optum Health: offers various health services to individuals, businesses, and government customers.

- Optum Insight: provides software products, data, research, analytics, and technology services for professionals in the healthcare industry.

UNH has a market cap of over $460 billion, making it the largest healthcare company in the world. It has the largest and most diverse membership base in the managed-care organization market, which provides it with significant competitive advantages. Its current main strategy is facilitating the integration between the medical care provided by Optum with UnitedHealthcare’s insurance products to help cross-sell its products and services, in addition to expanding both platforms to improve client reach and boost growth.

Overview

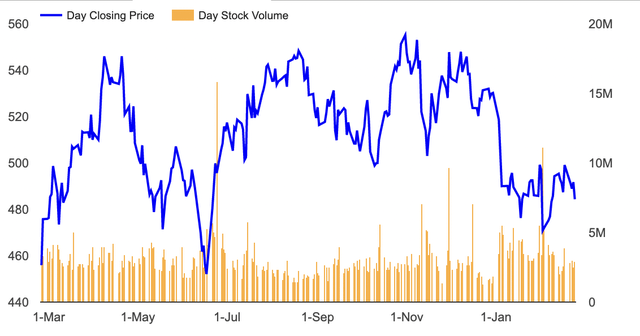

In 2022, UNH was a beneficiary of uncertain economic conditions that propelled investors to more defensive stocks like healthcare. UNH stock went up 5.58% in 2022, and The Health Care Sector SPDR (XLV), a portfolio of the healthcare stocks in the S&P 500, has returned 2.0%, compared to -19.44% for the S&P 500 (SPY). UNH has a beta of 0.68, which is an indicator of a defensive stock. Interesting for UNH is the fact that its earnings per share grows at an annual rate of 14%, almost similar to the historical annualized return for the stock, which stands at 16%, which indicates that the share price reacts in line with EPS, making EPS growth and business performance a good indicator of stock performance.

We believe 2023 should prove to be a good year for healthcare stocks given the inelastic demand for their products and services and investors’ propensity for defensive stocks in times of market turmoil and high volatility. Due to the restrictive monetary policy to combat inflation, most economists and banks expect an economic slowdown that would trigger a “shallow” recession. Given this outlook, defensive stocks that performed well last year should continue to outperform the market, at least in the first half of the year. During the second half of the year, the market may begin to price in the possibility an economic recovery by the end of the year, and thus give more growth-oriented stocks within the healthcare sector, like biotechnology and medical devices, a boost. If inflation persists longer than anticipated or the recession is deeper than expected, then defensive stocks like UNH should continue to perform the broader market even in the second half. Regardless, UNH, as a fundamentally strong, established player in the market, stands to benefit from a list of emerging trends and catalysts that will shape the healthcare industry in 2023 and beyond.

Industry Analysis

UnitedHealth Group operates in the healthcare sector, and more specifically, in the Managed Healthcare industry. The healthcare industry is one of the largest and fastest-growing industries in the world, with global healthcare spending expected to reach $18.28 trillion by 2040, according to the World Health Organization (WHO). Growth in spending will mainly be driven by an aging population, rising chronic diseases, technological advancements, and government initiatives to improve healthcare access and quality. In the US, the healthcare industry accounts for nearly 18% of GDP, reaching $4.3 trillion in 2021, making it one of the most important industries in the country to analyze.

The healthcare industry can be segmented into several sub-sectors, including health insurance, pharmaceuticals, medical devices, and healthcare services. UnitedHealth Group operates primarily in the health insurance and healthcare services segments. Other major players in these segments include Anthem, Cigna, Humana, and Aetna. Using the Porter’s Five Forces framework, we analyzed the industry and UNH’s competitive advantage based on the threat of new entrants, bargaining power of suppliers and buyers, the threat of substitutes, and the intensity of competitive rivalry.

Threat of New Entrants:

The healthcare industry is heavily regulated and requires a significant amount of capital to enter, making it difficult for new players to enter the market. UnitedHealth Group’s size and scale create a barrier to entry for new competitors, as the company has strong brand recognition and established economies of scale. By consistently innovating new products and services, UNH not only attracts new customers, but also provides existing customers with a reason to continue using them. UNH is the one that regularly defines the standards in the industry and thus makes it difficult for new players to gain any ground.

Bargaining Power of Suppliers:

Suppliers in the healthcare industry include medical device manufacturers, pharmaceutical companies, and healthcare service providers. These suppliers have some bargaining power due to their ability to offer unique products and services. However, UnitedHealth Group’s size and scale allow it to negotiate favorable terms with suppliers and reduce their bargaining power. Healthcare companies require highly skilled healthcare specialists, including doctors and staff, to provide their services. According to Mann (2017), the demand for doctors in the US is expected to exceed the supply by 100,000 doctors by 2030, which is a problem that strengthens the bargaining power of suppliers. At the same time, suppliers do not pose a credible threat for forward integration into the industry, and so this weakens their powers.

Bargaining Power of Buyers:

The bargaining power of buyers in the healthcare industry is relatively high, as patients and employers have the ability to shop around for healthcare plans and services. However, UnitedHealth Group’s strong brand recognition, network of providers, and range of services provide a competitive advantage, reducing the bargaining power of buyers. UNH has built a large base of customers and has recently introduced a new rewards program where members can earn up to $1,000 per year by completing a set of health-based activities in an effort to preserve their loyalty.

Threat of Substitutes:

The threat of substitutes in the healthcare industry is low, as healthcare is a necessity and there are few viable substitutes. At the same time, UnitedHealth Group is diversified enough through its various business segments, namely Optum, and offers a wide range of healthcare services and products, which allows it to differentiate itself from competitors and reduce the threat of substitutes. In fact, diversifying and creating the Optum division may have been the best decision the company made because it reduced UNH’s dependency on premium revenue and enhanced the insurer’s relationship with other payers and providers in the industry.

Intensity of Competitive Rivalry:

The healthcare industry is highly competitive, with numerous players offering similar products and services. UnitedHealth Group faces intense competition from other health insurance companies, as well as healthcare services providers like CVS Health and Walgreens Boots Alliance. However, UnitedHealth is the largest health insurer in the U.S. and owns Optum, a double-digit growing segment with double-digit EBIT margins providing it with a large-scale health provider network in a time where competitors are only now beginning to diversify into this area. The competition in the industry will be explored further down in this analysis, showcasing in detail why UNH is the favored to remain reigned in as the leader of industry, as well as why the company is a solid buy going forward.

Catalysts

This section will discuss a set of five catalysts in the near future that will justify our long recommendation for UNH:

1. As a defensive stock, UNH is well-poised to outperform in periods with rising interest rates and when inflation expectations are coming down, which is the case this year. Non-cyclical companies like UNH tend to perform relatively well during economic downturns because they have a history of maintaining earnings resilience. Usually during difficult times, bonds of cyclical companies have higher spreads, but they seem to be trading in line with non-cyclical companies, which is yet another reason why non-cyclical stocks are the better bet to outperform this year.

- During periods of lower-than-average historical market returns, dividend returns account for about 71% of all market returns, as compared to the average of 41% during normal times. As such, companies that have a solid record of maintaining or increasing their dividend payments, while also having reasonable, fair valuations and relatively low volatility, tend to do well in these times. UNH has a solid history of paying out dividends to shareholders, with an average dividend yield of 1.34% and a 30% payout ratio. Its 10-year dividend CAGR is 23.11%, which is higher than the sector median of 7.44%. As a result, UNH could be relied upon to consistently deliver dividends to shareholder as a sign of confidence from management that the company has balance sheet strength, and it is another reason why a stock like UNH could outperform during times of market downturns.

2. M&A activity is expected to be strong in 2023 as management looks for new areas to diversify and consolidate. A rising interest rate environment can be the perfect breeding ground for strong M&A activity, especially as companies with stable earnings like UNH seek to consolidate and cut costs. UNH has recently completed the acquisition of Change Healthcare for $13 billion after the DOJ lost its suit seeking to block the deal. The merger of these two companies seeks to simplify and make more efficient the payment and administrative processes providers and payers depend on to better serve patients, helping lower costs in the process and provide a better experience for stakeholders in the healthcare industry.

- UNH has also agreed to a vertical integration-type acquisition with home-care provider LHC group for $5.4 billion, which has only recently formally closed. LHC offers medical care to people in homes, hospices, and other facilities. This deal serves to reduce costs as hospital spending is now 6% and rising of GDP, according to the Centers for Medicare and Medicaid. With the over-65 population expected to double by 2060, having older patients get home healthcare instead of from hospitals lowers insurers’ costs. LHC is a top provider for more than 400 hospitals and reaches 60% of the elderly U.S. population, so this deal provides UNH with even more reach, and thus helps it maintain its competitive advantages. The full extent of this and the Change Healthcare deal has not yet fully materialized in earnings, but they are expected to be accretive.

- UNH is looking at achieving industry-wide consolidation to enhance its competitive position and strengthen its grip on the supply chain to manage costs, and overall M&A seems to be at the heart of the company’s long-term growth strategy, and especially this year, with CEO Andrew Witty saying “UnitedHealth plans to actively pursue M&A across the board in 2023” in the most recent Q4 Earnings Call. Of course, there is always the risk that heightened M&A activity could spark hostile takeover efforts and regulatory scrutiny that would send share prices lower in the short-term. Overestimating synergies and overpaying for companies without fundamentally changing operations could also be a destructive problem. However, given UNH’s experience and long history of reigning as the market leader in the healthcare sector, this risk should not present a serious concern to investors. M&A accounts for nearly 40% of UNH’s intangible asset holdings, and while that does not say anything to the company’s quality of M&A deals, UNH has a strong and high ROA compared to its peers, which is a reassurance of the company’s deal-making quality.

3. Recovery in the Commercial Business is expected to happen in 2023 as the business reverses the decline in membership the company experienced in the commercial business as a result of the coronavirus-induced weakness in the U.S. economy. The commercial business accounts for nearly 50-55% of UNH’s total medical membership. It experienced a turnaround in 2021 due to business expansion, and the trend continued in 2022 with membership growth of 0.4% year-over-year. The number of people served with domestic commercial benefit insurance offerings has increased by 275,000 in the past nine months, indicating that the upward trend in the number of members continues to be positive for the insurer going forward.

- An increase in the Government Business, which consists of Medicaid and Medicare Advantage (MA), is also expected to be a major growth driver for UNH in 2023. In 2021, UNH grew its Medicare enrollment the most since 2016, and 2022 showed another year of solid growth. UNH’s target of adding 800,000 Medicare Advantage members has already been met, and growth in individual MA is anticipated with strong earnings from its Medicare group. UNH currently aims to expand Medicare service to 95% of consumers in the United States this year, and it is expected for 2023 to be another year of above average growth in membership enrollment, mainly due to the anticipation of resuming routine eligibility operations by states in early Q2 2023 following Congress’s recently-passed Consolidated Appropriations Act.

4. Artificial Intelligence in the Healthcare sector is expected to grow at a CAGR of 47.6% from now until 2028, and UNH is the most aptly positioned in the industry to capitalize on that and massively reduce costs, owing to its experience and status as a market leader. UNH has already proven itself to be a leader in AI, having developed a centralized data platform to improve patient outcomes and decrease cost of care11. Optum Insight is the segment responsible for data collection and management, and I predict the greater focus this year will be on growing this segment and materializing the synergies from the newly acquired Change Healthcare. Focus will now shift on using “AI with an ROI”, as management put it, in a way that the company could use AI to not only predict patient outcomes, but to also improve the detection of illnesses and be able to step in and improve the course of treatment. More improvements are also expected in the way the business manages data. Data right now is the most important thing in fueling decisions and lowering costs, but managing said data and turning them into actionable insight is even more important. If data management becomes more efficient and insightful, then Optum should continue to grow and even trickle down to help the UnitedHealthcare segment.

- Optum has contributed almost 50% of operating earnings in 2022 compared to around 25% in 2014, according to 10-K filings. While the government is always looking to lower healthcare costs which could impact UNH’s insurance business, this could be counteracted by improvements in Optum in a way that would reduce costs by more or at least as much as the potential revenue decreases. Management has already pledged plans to accelerate investments in healthcare technology, and Optum Health is planning to make significant investments in its clinical network, care coordination, home capabilities and more. Optum Health saw its revenue per customer serve increase by 29% in 2022, owing to an ongoing shift toward outpatient procedures and improvement in value-based care, which is a key trend going into 2023.

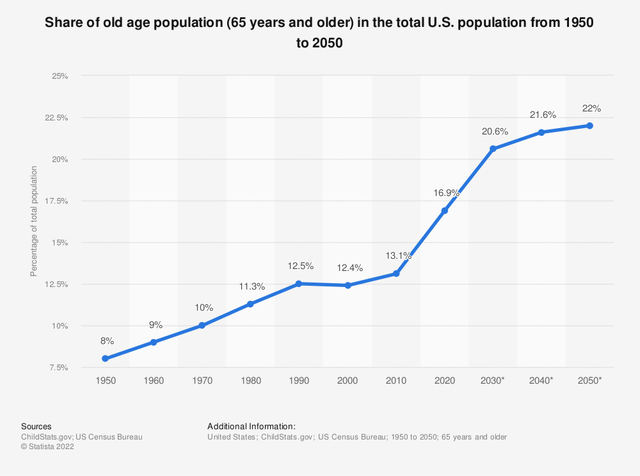

5. The aging population is increasing demand for healthcare services, particularly among those aged 65 and above, who account for a significant portion of healthcare spending. According to the Centers for Medicare & Medicaid Services (CMS), individuals spend around 60% of their lifetime healthcare expenditures after the age of 65. As can be seen in the figure on the right, the aging population is accelerating, particularly in these next ten years, and UnitedHealth Group is well-positioned to benefit from this trend due to its diversified healthcare services and its focus on providing comprehensive and integrated healthcare solutions. UnitedHealth Group’s Medicare Advantage plans, for example, provide health coverage to seniors who are eligible for Medicare, and the company’s Optum business offers specialized care for seniors with complex medical needs. Healthcare is going to forever remain in high demand, but now more so than ever given this fact, hence another reason UNH is expected to continue profiting into the future.

Financial Analysis

UnitedHealth Group had a strong performance in 2022, ending the year with its fourth consecutive quarter of double-digit revenue growth, achieving quarterly revenues of $82.79 billion, a 12.3% growth year-over-year, and exceeding analyst expectations of $82.48 billion. Adjusted net earnings attributable to UNH common shareholders came in at $5.34 per share, up 19.2% year-over-year. The company’s quarterly performance was driven by growth in its UnitedHealthcare business and strong expansion in its Optum Health segment. However, higher operating costs have partly offset this growth, which explains the narrow earnings beat.

Revenues from the UnitedHealthcare segment reported revenues of $63 billion in Q4 2022, up from $56.4 billion a year prior, as well as earnings from operations of $2.9 billion, up from $2.1 billion a year before. Operating margin rose by 0.9% to 4.7%, owing to strong membership growth and a reduction in medical and operating costs. Overall membership grew by about 2%, with Medicare Advantage and Medicaid members growing the most at 9.5% and 7%, respectively.

Revenues from the Optum segment amounted to $47.9 billion, which improved from $41.1 billion a year ago, although the number has narrowly missed estimates of $48 billion. Optum Health was the major driver of Optum’s revenue growth as it improved its care delivery services and attracted more people to its business. Optum Insight and Optum Rx were also solid performers in the fourth quarter, as Optum Insight expanded with the addition of the newly acquired Change Healthcare, while Optum Rx was bolstered from wider-reaching pharmacy care services. Overall, the Optum segment grew its earnings from operations by 17.6% year-over-year to $4 billion, keeping operating margins steady at 8.3%. Optum is proving to be a fast-growing valuable segment to UNH, helping it, more so than anything else, with its diversification efforts. Optum has contributed almost 50% of operating earnings in 2022 compared to around 25% in 2014, which is in part due to years of investments made into this segment through several acquisitions, innovations, and adoptions of advanced technologies with the aim of improving modern care delivery using market-leading, data-driven health analytics. Improvement in these areas is still a long way to go, offering Optum with a lot of untapped areas to grow in.

In 2022, the operating cost ratio slightly decreased to 14.7% from 14.8% a year ago, attributed to productivity gains. However, operating costs increased 11.3% year-over-year to $75.9 billion due to higher medical costs, operating expenses, and continued investments to pursue growth opportunities. UNH still faces rising costs in the future, specifically in its labor force, but expects an increase in revenues as an offset.

UNH is a solid company when it comes to revenue growth, having witnessed a CAGR of 10.9% from 2015 to 2022. Both of its segments, UnitedHealthcare and Optum, have produced double-digit growth year-over-year with promising growth potential, specifically in Optum. When a company is as big and established as UNH, the main driver of growth is expansion through a programmatic M&A approach, which has been studied to be the way to go to deliver the highest value with the least risk, and which UNH seems to recognize and succeed in capitalizing on.

Valuation

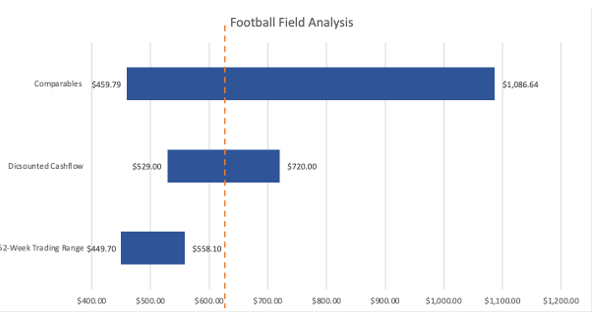

Given these revenue drivers and catalysts, we have modeled out revenue projections for the next 5 years, with 2022 as the base year, using conservative, base-case, and optimistic assumptions, to come up with the intrinsic value of UNH through a discounted cash flow model and then later through a relative valuation model. All three cases of the DCF and the relative valuation produced outcomes that suggest upside potential for UNH.

DCF Method: For the base case, we averaged out revenue growth over the past 5 years to get an average future revenue growth of 9.4% that would fall down to 2% as a Terminal Growth rate. This averaging process is done only for the base case scenario and with the assumption that UNH is a mature, established company that will accordingly not experience much deviation in growth from the average. The EBIT margin will fall down from 8.77% to 8.32%. CAPX remains constant at 0.86% of revenue, and D&A at 1.09% of sales. Assuming the risk-free rate of 3.93% will increase to 4.06% by the end of the year, the WACC was calculated to be 6.82%. With an average tax rate of 23.6%, the DCF produced an Enterprise Value of $616B and an equity value of $586B. With 950 million shares outstanding, the resulting equity value per share turned out to be $617.21 which is a 29% increase from $478.57 at the time of writing.

For the best-case scenario, we assumed revenues will continue growing at double digits, averaging out at 11% from now till 2027, then growing at 2% till perpetuity. EBIT margin would stay constant at 8.77%, and the WACC falls down to 6.48%. This would produce an Enterprise Value of $714B and an Equity Value of $684B, which amounts to a per share price of $720.82, a 50% increase from the current share price. The key assumption that UNH could grow in double digits till 2027 can be justified by the fact that the company’s size and strength allow it to pressure vendors and healthcare providers to manage high healthcare costs. Additionally, UnitedHealth’s OptumRx division, which is one of the three major pharmacy benefit managers, is expected to gain more market share from smaller competitors as the company recaptures its self-insured employer clients. Furthermore, OptumInsight, the higher-margin business, is well-positioned to address the data, technology, and revenue management needs of healthcare providers, health plans, governments, and life science companies. This combination of health insurance and health services businesses positions UNH for future growth and the potential for double-digit earnings growth through scale, share buybacks, and strategic acquisitions.

For the most conservative scenario, we assumed revenue growth would fall down to single digits, going down from 12.71% in 2022, to 7.5% in 2027, with a 2% Terminal Growth rate. EBIT margins would fall down to 8%, and, due to an increase in the cost of debt and cost of equity, the WACC was conservatively calculated to be 7.15%. With that, the Enterprise Value would go down to $532B, and the Equity Value would be $502B. The resulting per share price would be $529.44, which is still an 10% upside from current prices levels.

Given this, UNH is undervalued across every valuation scenario, suggesting a strong implied value between $529 and $720 per share.

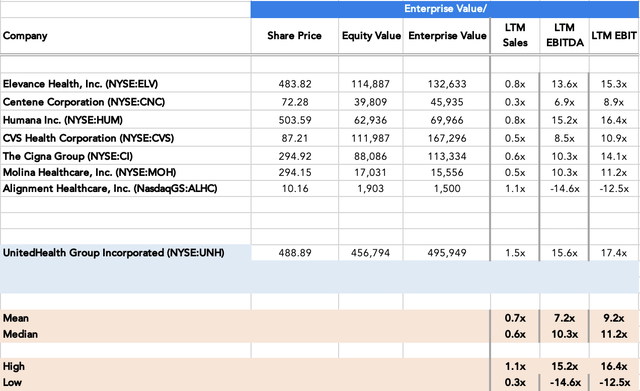

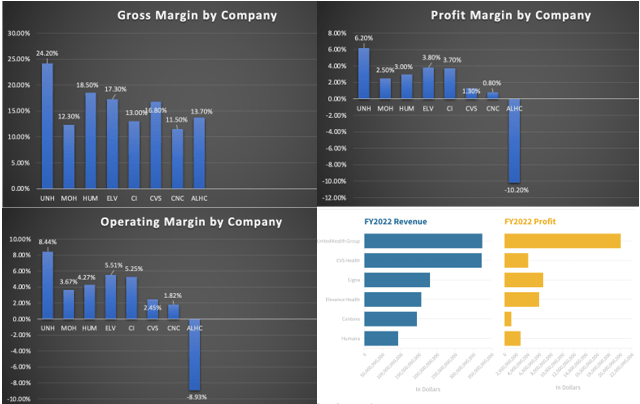

Relative valuation: For the Comparable Company analysis, we have chosen a set of companies most similar to UNH and most likely to be considered competitors. The companies chosen ended up being Elevance Health, Inc. (ELV), Centene Corporation (CNC), Humana Inc. (HUM), CVS Health Corporation (CVS), The Cigna Group (CI), Molina Healthcare, Inc. (MOH), and Alignment Healthcare, Inc. (ALHC). With the exception of MOH and ALHC, all companies have market caps of above $30 billion.

We calculated the Enterprise Value (EV) divided by Last Twelve-Month EBITDA for each of the companies and got the mean EV/LTM EBITDA to be 7.2x, with the median standing at 10.3x. Mean Price over LTM EPS (P/EPS) was 18.2x, and the median 21.7x. In comparison, UNH’s EV/EBITDA and P/EPS are 15.6x and 23.1x, respectively. While both are higher than the median, implying UNH trades at a higher valuation compared to peers, this could be easily justified by UNH’s superior profitability, margins, market position, and growth prospects, explained below.

Own work (M. Abelkhaleq) from data from CapitalIQ |

UNH has a trailing PE ratio of 22.03x and a lower forward PE of 17.39x, where the lower forward PE ratio indicates expectations of future earnings growth. This is higher than the Managed Healthcare industry’s average of 19.98x, also indicating (at first glance) overvaluation. Over the past five years, UNH has traded as high as 26.63x earnings and as low as 11.43x earnings, with a 5-year median of 18.58x. This makes it obvious that the PE values are on the high end of the historical range, which is unsurprising given the evolution of UNH and how it combined health insurance (UnitedHealthcare), data analytics (OptumInsight), pharmacy services (Optum RX), and medical care facilities (Optum Health).

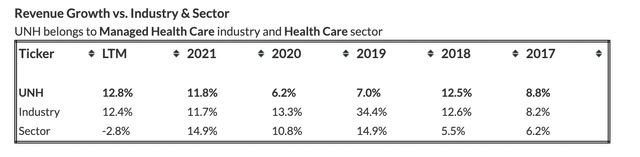

When a company trades at higher multiples than peers, it is easy to think it is overvalued and thus avoid investing in it. However, each case is unique, and UNH’s numbers and other ratios, presented below, will showcase why the company’s trading at higher levels is justified. UNH has almost the highest ROE of all companies in the healthcare sector, standing at 26.6% compared to the industry median of 15.55%. A high ROE shoes profitability from an investor’s point of view, but a historical trend of steady, high ROE can be a sign of a lasting competitive advantage. For UNH, the ROE YoY growth is 5.09%, compared to the sector median of -9%, and it is forecast to reach 47.68% within the next three years. UNH also has the highest ROA in the industry at 8.6% with a forecast of 14.65% in the next three years. It has LTM revenue growth ahead of both the Managed Healthcare industry and the Healthcare sector specifically, as shown in Figure 4. It has the highest gross margin at about 24.2%, the highest profit margin at 6.2%, and the second highest operating margin at 8.44% (the first one being a small cap stock, and thus irrelevant to our analysis), as shown in Figure 5. It also had the highest earnings year-over-year growth of 26.9% and 5-year earnings growth of 18.16%. Given this superiority, it is not a surprise to learn that the stock has had the highest 10-year market return of all its competitors at about 936%, more than 300% than the industry average.

Data from trefis.com |

Own work (M. Abedelkhaleq) from data from CapitalIQ (Financial charts)

Therefore, for the relative valuation model, using a 50% mid-multiple assumption and a 25% variance from the mid, the valuation range came up to be between a low of $459.79, a 4.6% downside, and a maximum high of $1,086.64, a 125% upside. Figure 6 shows the football field analysis showing the expected valuation range based on the DCF and Comparable Company analysis.

Own work, M. Abdelkhaleq (Football field analysis)

Risk Assessment

There are various risks associated with this investment that could hinder UNH’s growth prospects; however, all are either mitigable or do not present serious threats to valuation. The first one is Medicare Advantage rate decreases in 2024. It was recently announced that Medicare Advantage would decrease rates by 2.27% in 2024, which was a stark contrast to the expectations set around 1-2% increases. This news was the reason healthcare stocks including UNH experienced a sell-off at the beginning of the year, with UNH going down by as much as 9% from the year-start. This should not be viewed as an alarming sign, especially for UNH, given its substantial 29.17% market share. Having a high market share means the insurer is less vulnerable to uniform price changes. Additionally, while rates are going down, this is coming after a year of major increases in 2022, so this decrease was inevitable. Medicare Advantage enrollment, as previously mentioned, is also expected to increase this year, returning to normal, pre-pandemic levels. UNH makes up 55% of new enrollments, with Humana following making up only 23%. Also, even if premium prices appear to be at a cyclical peak, the fact that UNH has Optum means that valuable synergies and cross-selling are possible that would contribute to top-line revenue. UNH’s key competitive advantage, in fact, comes from its very fast-growing Optum division, which management still sees untapped potential in.

Another risk for UNH is the constantly changing regulatory landscape in the healthcare industry. Changes in regulations can impact coverage, benefits, and revenue trends. UNH has had to pay $600 million in fines for more than 300 offenses in the past. While a large sum, it is lower than what other competitors like Centene Corporation had to pay, which reached $1.1 billion one time. Still, to mitigate this risk, UNH has established a robust compliance program that is focused on ensuring that the company adheres to all relevant laws and regulations. Additionally, UNH invests heavily in lobbying efforts to influence regulatory changes and to ensure that the company’s interests are represented.

Also, the healthcare industry is highly dependent on government policies and regulations, and changes in healthcare policy can have a significant impact on UNH’s business. To mitigate this risk, UNH closely monitors policy changes and engages with policymakers to influence policy decisions. Additionally, the company has diversified its business to reduce its reliance on any one segment of the healthcare industry, which helps to mitigate the impact of policy changes. Stringent regulations, like price control, in the U.S. seem less likely now that Congress is split between the two parties, so that is one less thing to worry about.

Of course, there are also competitive pressures, especially from managed care startups that have recently gone public. However, UNH has focused on expanding its offerings and increasing its scale through mergers and acquisitions and investing in new technologies to improve its healthcare services in order to stay ahead of the competition. As we saw before, UNH is at very solid market position, but it should be careful to stay ahead of the trends and disruptions occurring in the industry. There are also labor market challenges. The company faces a tight labor market and challenges in attracting and retaining talented employees, especially medical professionals and sales personnel—one of the most competitive labor markets in the US. As said previously, it is expected that a shortage in the supply of medical professionals would happen, but UNH is already tackling this problem by investing $100 million over 10 years to help build its workforce. It also offers competitive compensation and benefits packages to its employees to retain them, including medical and retirement benefits, as well as career development opportunities.

At worst, these risks, if not addressed or mitigated, could send UNH’s valuation closer to the lower end of the valuation range. The worst-case scenario is if investors abandon and sell defensive stocks and rack up on riskier stocks near the end of the year to price in the possibility of an economic recovery. However, UNH is a fundamentally very solid company with an undervalued intrinsic value and there is little reason to expect the stock to continue trending lower.

Conclusion

To conclude, we recommend investors go long on UNH, with an expected valuation range of $529 and $720 and an upside/downside ratio of 6.67x. With the expectations of a recovery in the commercial and government businesses, an increase in Medicare Advantage enrollment, Optum’s continued double-digit growth, strong M&A activity, and investments in new cost-cutting innovations, UNH stands to be a beneficiary from a number of catalysts and trends shaping up the industry in 2023. While UNH trades at higher valuation multiples than its peers, the above catalysts alongside superior profitability, margins, and market position make UNH an undervalued pick for this year and beyond. UNH shares have trended downward in recent days and so this is may present a good buying opportunity. UNH stock tends to grow at the same annualized rate as its earnings per share growth, and given the strength of the company and its ability to continue generating double-digit revenue and EPS growth, UNH is a stock that could be considered a Sleep-Well-At-Night or SWAN stock to be added to portfolios.

We would like to thank M. Abdelkhaleq for this piece.

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.