Summary:

- UnitedHealth Group is a dividend growth stock on its way to becoming a Dividend Aristocrat.

- The company delivered yet another double beat in the third quarter.

- UnitedHealth Group’s net debt to adjusted EBITDA ratio is just above 1, which supports an A+ credit rating from S&P on a stable outlook.

- Shares appear to be trading at a 1% discount to fair value.

- UnitedHealth Group could realistically generate 20%+ cumulative total returns through 2026.

UnitedHealthcare’s corporate headquarters in Minnetonka, Minnesota. JHVEPhoto

As an investor, there are no investments that I appreciate more than undeniable dividend growth plays. I seek dominant businesses operating in markets with secular growth catalysts. Outside of Big Tech, there are almost no markets that can match the promise of the global health insurance industry.

According to market research firm IMARC Group, the global health insurance market is expected to compound by 5.9% annually from $1.9 trillion in 2024 revenue to almost $3.5 trillion by 2033. That bright outlook is influenced by a few factors. These include a greater prevalence of chronic diseases, an aging population requiring more healthcare, and rising healthcare costs prompting higher health insurance adoption rates.

On the company-specific side, there’s nobody in the industry who comes even close to the scale of UnitedHealth Group (NYSE:UNH). The Minnesota-based juggernaut’s $552 billion market capitalization is nearly double the size of the next five biggest publicly traded peers combined. When I last covered UNH with a buy rating in August, I appreciated its status as a big fish in an even bigger pond. I also liked UNH’s fortress-like balance sheet. The dividend was easily covered by profits. The slight undervaluation was the variable that sealed the deal on my buy rating.

Today, I’m maintaining my buy rating. UNH’s third-quarter results released on October 15th were respectable. The company’s A+ credit rating from S&P is another source of strength. Profit and free cash flow generation continue to effortlessly fund a growing dividend. UNH’s valuation has become a bit more expensive than a few months ago. However, it’s still reasonable enough to warrant a marginal buy rating, considering its ability to routinely top Wall Street’s expectations.

Another Quarter Of Admirable Execution

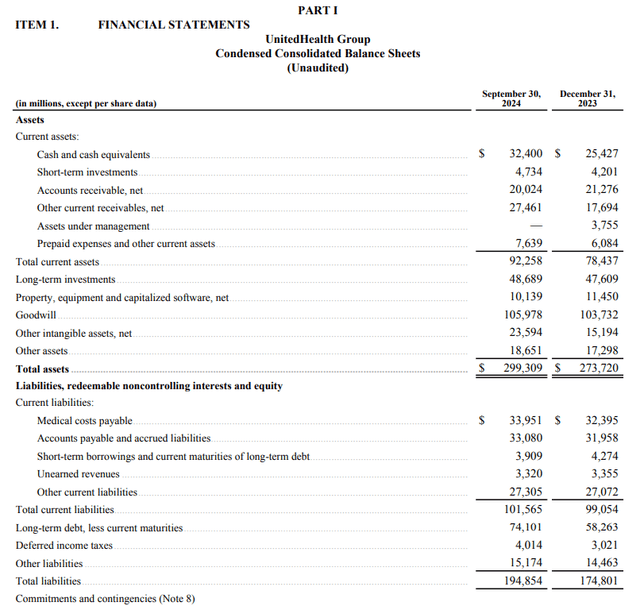

UNH Q3 2024 Earnings Press Release

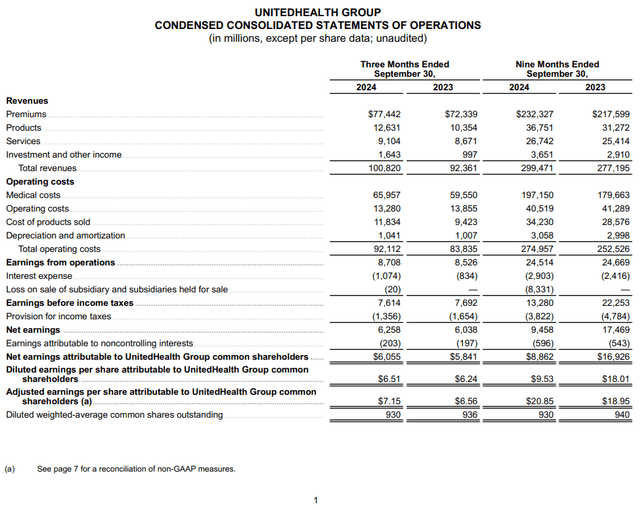

UNH didn’t disappoint in its third quarter. The company’s total revenue surged 9.2% higher over the year-ago period to $100.8 billion during the quarter. This marked the first quarter that UNH exceeded $100 billion in total revenue. Additionally, that was $1.5 billion greater than the Seeking Alpha analyst consensus for the quarter. This represented the 17th straight quarter that UNH beat the topline analyst consensus.

The company’s total medical membership dropped by 4% year-over-year to 50.7 million in the third quarter. As I noted in my prior article, though, this was only because of the divestiture of operations in Brazil. Taking this into consideration, UNH would have posted modest medical membership growth during the quarter. The company’s pricing hikes on health plans and services once again helped lead revenue higher for the quarter.

UNH’s adjusted diluted EPS rose by 9% over the year-ago period to $7.15 in the third quarter. That topped the analyst consensus during the quarter by $0.12. For more perspective, UNH has surpassed bottom-line expectations in all 20 out of the last 20 quarters.

Faster growth in total operating expenses (+9.9%) driven by higher medical costs pressured the company’s margins for the third quarter. This led UNH’s non-GAAP net profit margin to contract by five basis points to 6.6% in the quarter. That wasn’t quite offset by a 0.6% reduction in the outstanding diluted share count during the quarter. This is why UNH’s adjusted diluted EPS growth rate slightly trailed the total revenue growth rate for the quarter.

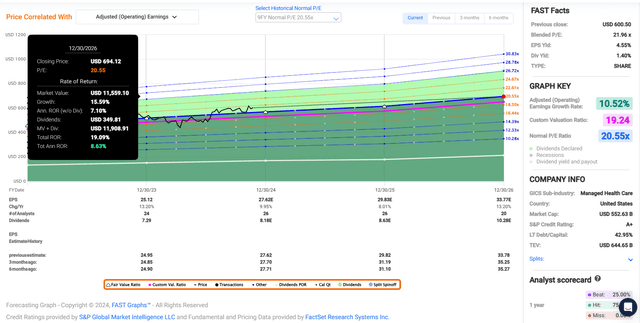

Looking beyond the 10% rise in adjusted diluted EPS to $27.62 in 2024, the company’s adjusted diluted EPS growth rate is expected to cool off a bit. The FAST Graphs analyst consensus is that diluted EPS will grow by 8% in 2025 to $29.83.

This is because of a couple of headwinds per CEO Andrew Witty’s remarks during the Q3 2024 Earning Call. That includes the timing of the second year of the CMS Medicare rate cuts and the most significant Inflation Reduction Act impacts into a single year. These are going to pressure results for 2025.

Fortunately, the initial star ratings for the plan year 2026 for consumers in four-star or better-rated plans are consistent with what UNH saw in its initial results last year. As the company adapts to a changing industry environment, it still believes it can generate 13% to 16% annual adjusted diluted EPS growth long term. That’s expected to come from a mix of high-single-digit annual revenue growth, marginal gains in its operating cost ratio, share repurchases, and bolt-on acquisitions.

Analysts are confident that UNH can return to its growth of the recent past. This is evidenced by the FAST Graphs analyst consensus of a 13.2% jump in adjusted diluted EPS to $33.77 in 2026.

Financially, UNH is as strong as ever. The company’s net debt balance as of September 30th was $40.9 billion. Compared to the $36.8 billion in annualized adjusted EBITDA, the company’s net debt-to-adjusted EBITDA ratio was 1.1. This is what backs up S&P’s A+ credit rating on a stable outlook for UNH (unless otherwise sourced, all details in this subhead were according to UNH’s Q3 2024 Earnings Press Release and UNH’s Q3 2024 10-Q Filing).

Shares Are Fairly Valued Around $600 Each

In the last three and a half months, shares of UNH have gained 6%. Along with sector-wide near-term pressures in 2025 resulting in a lower analyst consensus, that has pushed the stock’s forward P/E ratio to 20.1. This is just below the nine-year normal P/E ratio of 20.6 per FAST Graphs.

Moving forward, I believe that UNH’s fair value multiple should continue to be right around 20.6. This is because, beyond 2025, the company anticipates that it will return to its targeted annual adjusted diluted EPS growth rate of between 13% and 16%. That’s reflected in the analyst consensus growth estimate of 13.2%. This suggests that UNH’s growth profile remains intact versus prior years.

The calendar year 2024 is about 90% complete. That leaves another 10% of 2024 and 90% of 2025 yet to come in the next 12 months. This is how I get a 12-month forward adjusted diluted EPS input of $29.62.

Using my fair value P/E ratio of 20.6, I compute a fair value of $609 a share. Relative to the $601 share price (as of November 21st, 2024), this is a 1% discount to fair value. If UNH meets the growth consensus and returns to my fair value multiple, it could post 9% annual total returns in the next couple of years. At a glance, this isn’t all that inspiring. However, it’s important to note that UNH’s knack for exceeding expectations is likely to boost this to 10% or more. As it returns to targeted growth, total returns could be a bit stronger beyond 2026.

More Double-Digit Dividend Growth Ahead

The Dividend Kings’ Zen Research Terminal

UNH’s 1.4% forward dividend yield is just below the healthcare sector median forward yield of 1.5%. As was the case in August, this is enough to earn C+ grades from Seeking Alpha’s Quant System for both forward dividend yield and overall dividend yield.

UNH continues to be a world-class dividend grower, with a three-year compound annual growth rate of 13.8%. For context, that’s more than double the healthcare sector median of 6.5%. The most recent 11.7% raise also wasn’t that much below this growth rate. The Quant System anticipates that this level of growth will persist in the years ahead, with the expectation of 12.1% forward annual dividend growth. That would be almost triple the sector median figure of 4.6%.

Aside from UNH’s solid earnings growth outlook, the other factor behind the Quant System’s expectations for strong future dividend growth is the payout ratio. UNH’s adjusted diluted EPS and free cash flow payout ratios are both poised to be in the high-20% range in 2024. That’s well below the 60% payout ratio that rating agencies like to see from the industry, per The Dividend Kings’ Zen Research Terminal. This is why dividend growth at least in line with adjusted diluted EPS growth is likely to persist for the foreseeable future. It also explains the Quant System’s A+ grade for overall dividend safety.

Barring a black swan event, these factors give UNH a clear runway to extend its 14-year dividend growth streak well into the 2030s. That would help the stock to join the vaunted Dividend Aristocrats group. In the meantime, the present dividend growth streak dwarfs the sector median of 2.2 years. That supports an A- grade for overall dividend consistency from the Quant System.

Risks To Consider

UNH is a top-notch company, but some unknowns could impact the investment thesis.

One particularly important risk to the company is its reliance on the Centers for Medicare and Medicaid Services. The federal agency is UNH’s biggest customer, accounting for 40% of the company’s premium revenue in 2023 (page 7 of 82 of UNH’s 10-K Filing). The newest layer of risk is the uncertainty that goes along with any changes at the government agency. That’s because the agency’s $2.6 trillion annual budget is quite consequential for many companies, including UNH.

Earlier this week, President-elect Donald Trump announced that he had chosen Dr. Mehmet Oz to serve as the administrator of CMS. As the confirmation process plays out, we’ll learn more about the direction the new administration will take.

In the meantime, we do know that Trump himself has advocated for the expansion of Medicare Advantage plans in the past. That could improve demand for UNH’s plans, which could be a modest growth catalyst. On the other hand, it’s anticipated that Trump will let federal subsidies for Medicaid end after next year. This could offset the benefit of an expanded Medicare Advantage program.

Another risk to UNH is that its industry-leading status makes it a target of attempted cyber breaches. If any are more successful than the Change Healthcare breach earlier this year, that could be damaging to the company’s reputation. This could also open it up to potential legal settlements, which would have at least some impact on its balance sheet.

Summary: I’m Glad To Own UNH As A Core Holding In My Portfolio

Comprising approximately 2% of my portfolio, UNH is my 13th-biggest investment holding. My confidence to go 2x overweight versus its S&P 500 index (SP500) weighting is arguably well-founded. UNH’s growth picture looks to be intact overall. The balance sheet remains in excellent condition. UNH has plenty of room to keep hiking the dividend. Not to mention that the valuation looks fair based on current expectations for the business, which will probably prove a bit conservative. That’s why I’m standing by my buy rating.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of UNH either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.