Summary:

- UnitedHealth has pricing power and is the number one healthcare provider in the U.S.

- Optum will help drive future revenue growth.

- Regulatory risk is the biggest risk for UnitedHealth.

- Currently, a hold based on a 13.5% annual return over the next five years.

jetcityimage

Investment Thesis

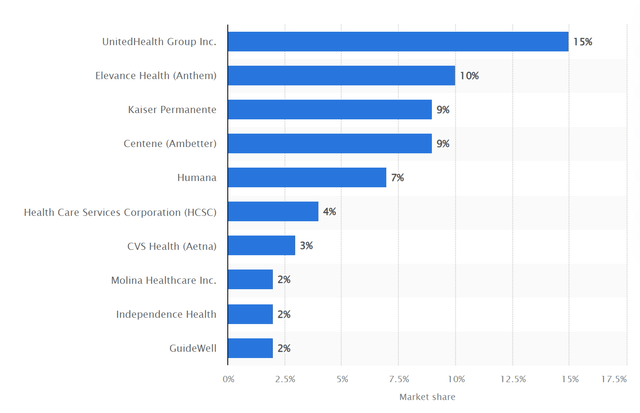

UnitedHealth (NYSE:UNH) currently holds a 15% market share within the U.S. healthcare industry making it the largest company within the healthcare sector. The industry itself is very top-heavy where the top five companies control over half of the market. This consequently has given UNH pricing power due to their scale which has led to increased revenue through the previous years. Its Optum segment, consisting of Optum Health, Optum Insight, and Optum Rx is expected to drive double-digit revenue growth. Despite the strong fundamentals, investors should keep an eye on regulatory risk given that UNH operates within a sensitive sector that concerns people’s health, meaning that pricing power tactics may be looked upon negatively by the government. I currently rate UNH as a hold on the basis of a 13.5% annual return supported by a DCF analysis.

Company Overview

I see UnitedHealth as the number one player in the U.S. healthcare industry. UnitedHealth has four business segments. The first is UnitedHealthcare, Optum Health, Optum Rx, and Optum Insight. UnitedHealthcare takes care of healthcare coverage and benefits while Optum side of the business specializes in technology-driven health services. Revenue for UnitedHealth comes from premiums, fees, services, and sales related to both insurance activities and health services where moving forward I expect this part of the business to grow about 7-8% per year. While the Optum side of the business should grow in the double digits. Key rivals include Elevance Health, Inc. (ELV) which offers health insurance services; CVS Health Corporation (CVS) now involved in health insurance after acquiring Aetna; Cigna Group (CI) a global healthcare service provider; and Humana Inc. (HUM) specializing in health insurance plans.

UnitedHealth is a Clear HealthCare Leader

The graph below represents the health insurance market share in the United States as of 2023. As we can see below, the market is highly consolidated with the five largest healthcare businesses making up over 50% of the total market share. UnitedHealth leads the way with a 15% market share showing its dominance within the U.S. healthcare sector. In second place is Anthem with a 10% market share, with businesses such as Kaiser Permanente, Centene (Ambetter), and Humana making up a large portion of the rest of the market. The reason for this narrow consolidation is due to the scale and pricing power that the larger healthcare providers have within the industry. The larger healthcare providers have better unit economics as they are able to spread business expenses amongst a higher number of customers, leading to better margins. The consolidation also gives pricing power, setting the U.S. healthcare sector as an oligopoly controlled by a few larger companies. This is key to UNH’s competitive advantage and sustainability for growth moving forward.

Optum to Help Drive Future Growth

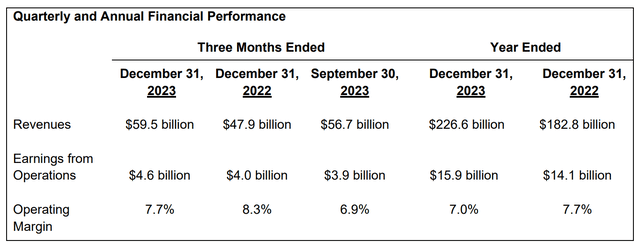

I believe Optum will be a key growth driver for UNH looking out over the next few years. Optum has three segments: Optum Health, Optum Insights, and Optum Rx. The combination of the three had revenue that grew 24% year over year reaching $226.6 billion in 2023.

Optum Health was the fastest-growing segment, which grew revenue by 33.9%. Moving forward UNH forecast that Optum Health will grow at a double-digit revenue growth rate and will attain operating margins of 8-10%. Optum Insight also grew at a fast pace. We saw a 29.8% increase in revenue as a result of a large backlog of revenue as well as increased billings facilitated. Management forecast doubt digit revenue growth moving forward and a healthy 18-22% operating margin. Optum Rx saw a 16.4% revenue growth driven by increased prescription spend. Optum Rx expects long-term revenue growth at an average annual rate of 5% to 8%, with operating margins in the 3% to 5% range. While this isn’t as fast as the other segments, this is still faster than the overall market.

Watch Out for Regulators

In my opinion, the biggest risk with U.S. Healthcare providers such as UNH is the risk of government intervention as a result of social issues that arise through a privatized healthcare system. While UNH is no doubt a very strong business and the largest in the U.S. Healthcare sector, this also leaves the company more in the limelight for potential regulations and government interference. Due to the pricing power that leading healthcare providers such as UnitedHealth have, we may see a crackdown on higher healthcare prices to make healthcare more affordable for the average person. This could potentially have a negative impact on the profitability of UNH if future crackdowns are harsh.

Financial Analysis

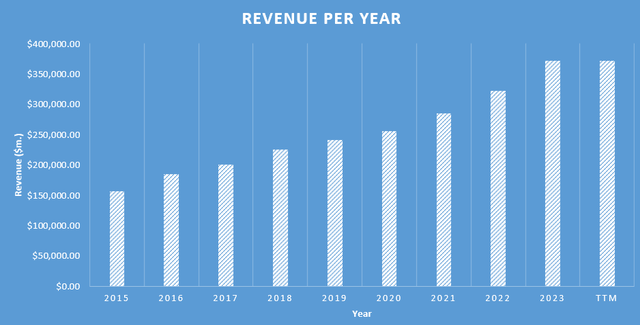

In my opinion UNH from 2018 to 2023 has shown strong revenue growth where it went from $224,871.00 million in 2018 to $371,622.00 million in the last twelve months representing a CAGR of about 10.5%. In my opinion, this shows that demand for the company’s healthcare services has increased over time.

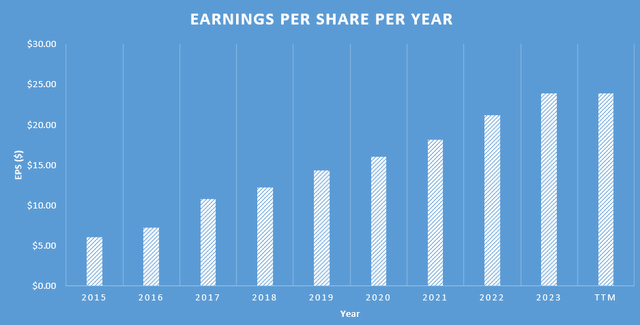

There was also an increase in earnings per share which increased from $12.19 to $23.86, a compounded annual growth rate of approximately 14.4%. This suggests that net income margin expansion occurred within the business, showing that over the last five years, the operations within UNH got more efficient.

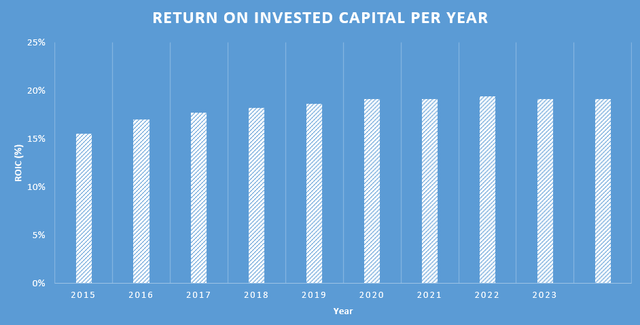

Through the last five years, the company’s share count was mostly flat showing that shareholders are not being diluted. In terms of book value UnitedHealth has produced a 5-year CAGR in shareholders’ equity per share of 11%, going from $55.26 in 2018 to $94.62 in the past twelve months. Regarding free cash flow, the company has compounded at a rate of 13.5%, increasing from $13,650.00 million in 2018 to $25,682.00 million in the past twelve months. This illustrates that the business is delivering significantly more cash for shareholders once accounting for capital expenditures when compared to half a decade ago. During the last half decade, UnitedHealth’s five-year median ROIC was 18%, hence this is an indication that the management team has well above average capabilities to drive future growth by investing profits into the business.

In consideration of the company’s financial health, the recent quarterly report reveals cash and cash equivalents amounting to $25,427.00 million. The total debt of the company stands at $58,263.00 million. Considering that the cash on the balance sheet covers 44 percent of the debt load and that total debt can be removed with 3 years’ worth of free cash flow, UNH has a relatively healthy balance sheet and debt is not an issue at the moment.

Valuation

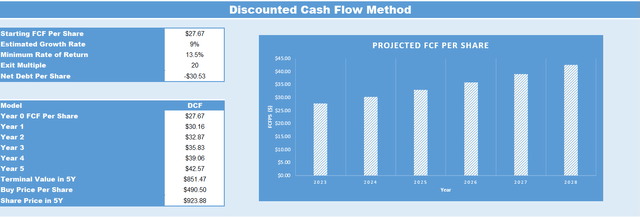

UNH’s current free cash flow per share as of Q4, 2023 is $27.67. Based on high single-digit growth within the UnitedHealthcare segment and a double-digit growth rate in the Optum segment, I believe that UNH’s free cash flow per share should grow conservatively at 9% annually for the next five years. Therefore, once factoring in the growth rate by Q4 2028 UNH’s free cash flow per share is expected to be $42.57. If we then apply an exit multiple of 20, which is based on UNH’s mean price to free cash flow ratio for the previous 10 years, this infers a price target in five years of $923.88. Therefore, based on these estimations, if you were to buy UNH at today’s share price of $490.82, this would result in a CAGR of 13.5% over the next five years.

Therefore, based on this DCF, I see UNH as a hold as I do not quite see adequate margin of safety in the valuation. To see adequate margin of safety, I would need an annual return of 15%, therefore I would prefer to see the share price fall further in order to justify a buy.

Conclusion

In conclusion, UnitedHealth should have a bright future as the business has shown consistent revenue growth as well as strong EPS growth in the double digits over the past five years. Despite being in the healthcare industry, the company also has manageable amounts of debt which can be repaid fully with three years’ worth of free cash flow. The future revenues of UNH should grow in the high single digits driven by double-digit growth in the Optum segment and high-single digit growth from the UnitedHealthcare segment. I currently believe UNH is a hold based on my DCF model as I expect an annual return of 13.5%. I would like to see the stock price fall a little further to provide an adequate margin of safety.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.