Summary:

- UnitedHealth Group is set to report its fourth quarter earnings, setting the tone for the healthcare sector’s recovery in 2024.

- UnitedHealth’s performance in 2023 was below expectations, but historical trends suggest it may outperform in an election year.

- Expectations are high for positive commentary on UnitedHealthcare’s investor day targets, particularly in the Medicare Advantage space.

- Investors should closely monitor members growth, utilization, and Optum’s balance between growth and margins.

- Trading below its historical valuation, I reiterate UNH stock as a Buy ahead of earnings.

jetcityimage

UnitedHealth Group Incorporated (NYSE:UNH), the largest healthcare company in the world in terms of market cap, is set to report its fourth-quarter earnings this upcoming Friday, January 12th, before market open.

A little over a month has passed since the company’s investor conference, which drew mixed reactions. On the one hand, UNH reassured investors its industry-leading trajectory of continued mid-teens growth remains unchanged. On the other hand, the company’s outlook for 2024 was pretty much in line with somewhat conservative expectations.

With its unique positioning across the healthcare value chain, UnitedHealth will set the tone for a sector that wants to recover from significant underperformance in 2023, and we’re here to prepare for the anticipated print.

Goodbye 2023, Hello 2024

Before we dive into our expectations and focus points for the fourth-quarter results, it’s important to provide a little background for 2024, a year of elections, potential rate cuts, and hopefully, better results for healthcare investors.

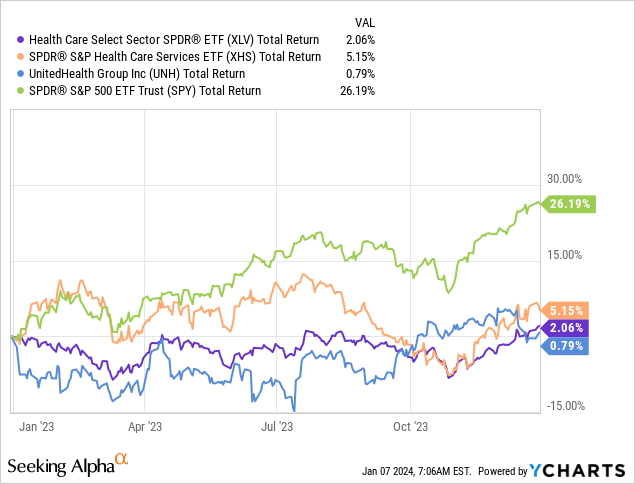

Let’s begin with a look back on 2023:

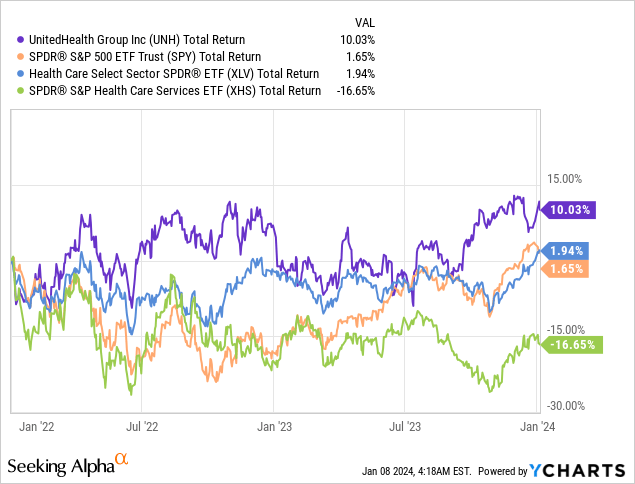

As we can see, the healthcare services industry struggled to keep up with the tech-driven market rally, with UnitedHealth Group unusually underperforming both the SPDR® S&P 500 ETF Trust (SPY) and the sector’s indexes. Notably, UNH materially outperformed in 2023, and on the 2-year stack, the company outperformed both the market and the sector.

Generally, the healthcare sector is portrayed as a safe haven at times of uncertain economic environments and rate increases, during which it typically outperforms. However, that advantage during risk-off environments turns into a disadvantage when markets are searching for higher risk and higher growth opportunities.

Ahead of 2024, investors will lean on the fact that historically, healthcare outperforms the market following a year of underperformance. UnitedHealth investors will look for history to repeat itself, relying on the company’s unique positioning and strength to capitalize on such recovery.

An Election Year

Bear with me for a little more macro commentary, as we have to discuss the impact of an important theme that will accompany us throughout the year, the presidential elections.

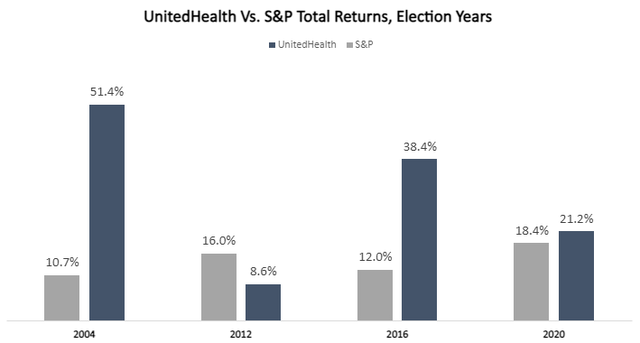

According to Morgan Stanley research, managed care companies declined a median of 31% during the past six election cycles. However, after the ballot, managed care outperformed the S&P 500 (SP500) by a median of 12% and 20% over the following six and 12 months, respectively.

Putting aside social aspects and market sentiment fluctuations during elections, some sectors are directly and fundamentally impacted by changes in political agendas. While healthcare isn’t as sensitive as sectors like infrastructure and green energy, it is impacted nonetheless.

Specifically, when it comes to UnitedHealth, nearly 30% of its insurance customers come from government-funded programs in Medicaid and Medicare, which means a material change in eligibility criteria could affect the business. In addition, the company’s PBM business is subject to increased scrutiny under Biden’s administration, and although it’s not the most significant part of the company, some kind of relief on that front will be positive news.

Compiled by the author based on Seeking Alpha data; 2008 was excluded due to the financial crisis impact.

We can see that in previous election years, UNH outperformed the S&P 500 in three out of the last four campaigns, excluding the 2008 elections which occurred during the financial crisis.

Following a year of underperformance in 2023, the stage seems set for another election-year beat by the healthcare giant. So, let’s discuss the most important drivers for success in 2024 and what we’re expecting to hear from the company on Friday.

My Expectations Are High Heading Into UnitedHealth’s Q4 Earnings

A month after the company’s investor conference, investors should not expect big surprises in Friday’s release. However, my expectations are high for positive commentary about some of the targets the company provided.

UnitedHealthcare Insurance Members

CVS Health (CVS), a direct competitor of UnitedHealthcare, primarily through its Aetna health insurance business, held its own investor conference last December, a week after UnitedHealth. In an SEC filing published three days ago, the company said Medicare Advantage enrollments are exceeding expectations, citing market share gains as the main reason for its better-than-expected numbers.

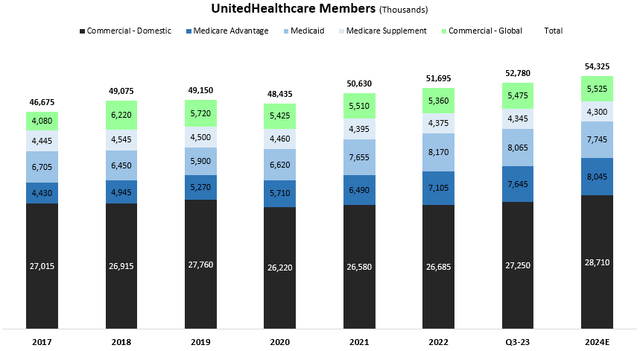

CVS said it now expects to add at least 800,000 Medicare Advantage members in 2024, whereas, UnitedHealth provided a target of 350,000 for the year. Notably, UNH is more than twice as large as Aetna in the Medicare Advantage space, and this is a business that’s based on annual enrollments.

CVS’s comments could mean that UNH is losing share in MA, but it could also mean that the overall pie is growing better than expected or that other competitors are the ones that are losing share. Reportedly, some large players, including Cigna (CI), are looking to exit the market, making a stronger case that it’s not UNH that’s losing share.

Created by the author using data from UnitedHealth Group financial reports; 2024 numbers are based on mid-point targets provided during the company’s Investor Conference.

As we can see, despite the below-consensus targets, UnitedHealthcare still expects to accelerate its member growth significantly in 2024.

Membership commentary will be a key aspect to monitor on Friday, especially as this was the primary disappointment for investors following the November conference.

Utilization Trends

One of the most-watched figures on the company’s release will be its medical care costs, which are becoming increasingly heavy on health insurers’ margins.

Created by the author using data from UnitedHealth Group financial reports; 2024 numbers are based on mid-point targets provided during the company’s investor conference.

If you’ve been following UNH for a while, then you should remember the major June 2023 selloff caused by the CFO’s commentary about growing utilization. Based on management’s targets, not only do they not expect an easing on that front, but they’re guiding for a record-high MCR in 2024.

UnitedHealth remains an industry leader in terms of MCR efficiency, driven by its vertical integration across the healthcare delivery chain and scale. Importantly, management sounded quite confident in its 83.5%-84.5% range, which leads me to believe there’s room for upside on that front.

Based on expectations for $303 billion in insurance revenues for the year, a 50 bps swing in MCR results in a $1.5 billion (or 4%) swing in operating income. The company’s MCR will be on close watch, as the importance of the metric cannot be exaggerated.

Optum

There’s a reason UnitedHealth is an industry leader in terms of MCR and operating margins in general, and that reason is Optum. With Optum, any drag on the insurance business that’s coming from increased utilization becomes a tailwind, as the company delivers more care, and more prescriptions, and sees growing demand for its Insight solutions.

As we discussed in previous articles, the company’s primary focus with Optum is growth over margins, although it is sustaining very impressive combined operating margin levels in the 7.5% range, whilst growing at a high-teens pace.

Based on management’s targets, the balance between growth and margins is expected to shift a little toward margins in 2024. The company is expecting growth to decelerate across Health, Insight, and Rx, but margins are all expected to improve.

Although decelerating from 30% to 20% isn’t all that bad considering the scale Optum Health and Insight achieved so quickly, investors will look to hear more about the reasons for the deceleration and will seek reassurance on the margin front.

Concerning Optum Rx, the main consideration will continue to be the regulatory front and the company’s thoughts about potential material changes in the industry.

UNH Stock Valuation

With no major updates to the financial model I provided ahead of the third quarter, I thought it would be fitting to tackle valuation from a simpler angle.

The beginning of a new year is always a confusing time in the market. Many stocks that appear fairly valued based on a shallow P/E multiple analysis become seemingly undervalued the day after they report earnings as their TTM P/E drops. In UNH’s case, it will drop from the 23.3x we’re seeing above to an expected 21.5x, which means it will drop from 7% above the historical average to 1% below.

Although it’s hard to believe the markets are so short-sighted, sometimes it does turn out to be the case.

Looking at UnitedHealth’s EPS outlook for 2024, the stock is currently trading at a 19.2x P/E, compared to the historical 20.2x average, reflecting a 5% discount.

Historically, UnitedHealth typically upgrades its investor-day guidance in the first quarter of the year and then narrows its range in the following quarters. This year’s guidance is more prudent than usual, amid several uncertainties, the most important of which are utilization trends, and rate cuts.

Taking all of that into account, I strongly believe UNH will surprise to the upside. Ahead of another year with even the bearish scenarios reflecting double-digit EPS growth, I expect the stock to grow back to its historical multiple, and in line with EPS growth, reflecting at least 12% one-year upside from current levels, or a $602 price target.

Conclusion

UnitedHealth Group is coming into Friday’s report with a favorable setting. The stock has trailed both the market and its sector, despite a great year fundamentally, with profitable growth across all segments.

With that in mind, investors will look for additional clarity about the company’s targets for 2024, specifically with regard to insurance members, utilization trends, and business dynamics in Optum. A change in tone, either positive or negative, will set the direction the stock is heading for the first part of the year.

Historically, UnitedHealth recovers quickly from underperforming years, and it outperforms the market during election cycles. I believe the current valuation provides an attractive entry point, which leads me to reiterate a Buy rating.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of UNH either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.