Summary:

- UnitedHealth Group is set to report Q2 results amid a challenging year for managed care companies due to Medicaid redeterminations, PBM scrutiny, higher utilization trends, and shifting market preferences.

- The company’s CFO, John Rex, previously warned of increased utilization rates leading to higher medical costs in upcoming quarters; the Q2 report will reveal if this trend has materialized.

- Other key factors to watch in the report include the impact of post-Covid coverage losses, the effect of an updated risk adjustment model, and the performance of UnitedHealth’s Optum businesses.

Wolterk

UnitedHealth Group (NYSE:UNH) is set to report second-quarter results, a month after CFO John Rex’s remarks sent the industry into a spiral. So far, 2023 has been a terrible year for managed care companies, triggered by Medicaid redeterminations, PBM scrutiny, higher utilization trends, and shifting market preferences.

As the largest operator in the industry and one of the first to announce its Q2 results, UnitedHealth Group’s report could decide where we go from here, and with the company trading below historical valuation, a decent report could mean significant near-term upside.

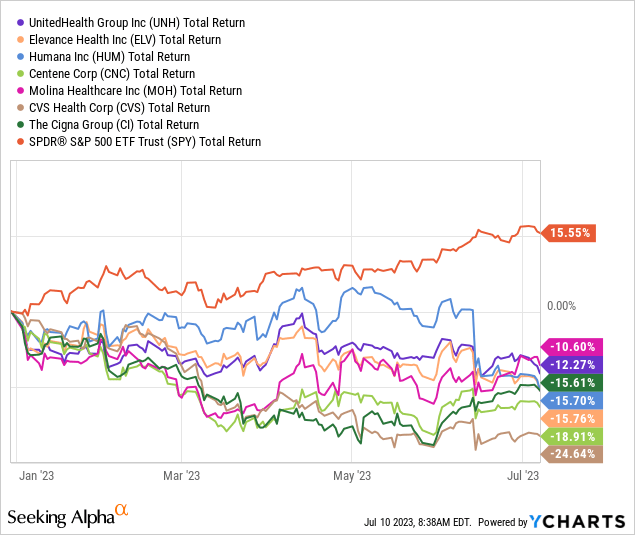

Underperformance Year-to-Date

Healthcare is the third worst-performing sector in the benchmark index YTD, fueled by double-digit declines in every major managed care provider. The bad news continues to pile up, and the industry is experiencing consensus downgrades, with UnitedHealth specifically seeing 17 downward revisions ahead of its second-quarter results.

As we all know, the stock market tends to overexaggerate in both directions, and the question is whether the sell-off has gone too far. The answer to this question will become much clearer as soon as Friday, when UnitedHealth Group reports before the bell. Let’s discuss the key factors to watch for in the report.

Utilization Trends

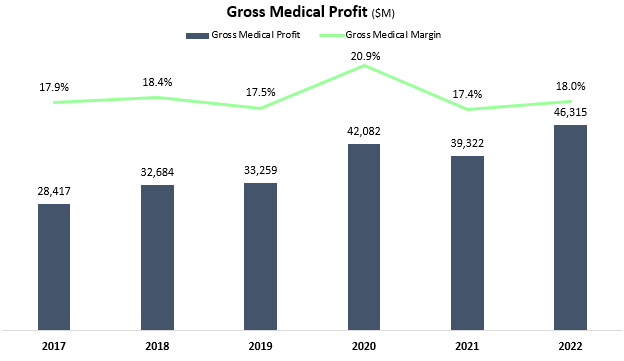

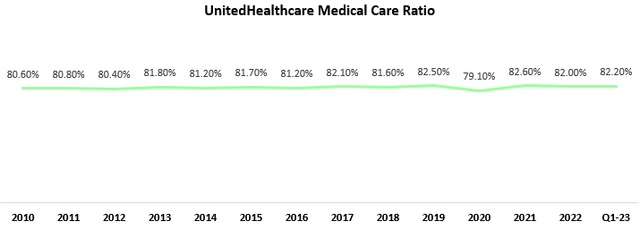

Covid-19 proved to be advantageous for health insurers, and UnitedHealth is no exception. The pandemic-induced reluctance of people to leave their homes and visit hospitals resulted in a significant decrease in outpatient care, particularly non-acute care. The reason behind this being a tailwind is straightforward: If individuals are eligible for $85 coverage from their insurer but only utilize $80, instead of the usual $82 historically, then the insurer retains an additional $2. This trend was precisely the story in 2020, leading UnitedHealthcare to achieve a historically low Medical Care Ratio (MCR), and consequently a remarkably high gross margin.

Created and calculated by the author using data from UnitedHealth Group financial reports (10-K).

Health insurer stocks experienced a notable decline in early June, primarily driven by the remarks made by John Rex regarding rising utilization rates. These remarks indicated an anticipated increase in medical costs in the upcoming quarters, contributing to the downward pressure on the stocks.

We saw higher levels of outpatient care activity. Things like hips, knees, cardio. And the other place that we’ve seen stronger care activity is in our Optum health behavioral business. Looks like a little bit of pent up demand or delayed demand being satisfied. As you look at Q2, you would expect Q2 medical care ratio to be somewhere in the zone of probably the upper bound or moderately above the upper bound of our full year outlook. The full year would probably settle in, in the upper half of the existing range that we set up. We saw that as likely at some point post-pandemic, and the question was which quarter would you see that occur. As it came out to be, it’s not really impacting the ranges of the full year that we’ve set up, but more impacting what we’re seeing right now. We are super respectful of the trends that we’re seeing and not assuming that those abate right away, and that is the reason why we built it into our 2024 plan.

— John Rex, UnitedHealth Group CFO, Goldman Sachs Healthcare Conference [edited by the author]

Multiple surveys have coherently indicated a positive trend in hospital revenues in 2023, thereby providing reassurance regarding the CFO’s commentary. Accordingly, one of the crucial metrics to closely analyze in UnitedHealthcare’s report is MCR.

Created and calculated by the author using data from UnitedHealth Group financial reports (10-K).

According to the CFO’s remarks, the MCR is anticipated to exceed the full-year range previously incorporated into the guidance. However, it is expected to gradually decrease over the course of the year and end within the guidance range. Based on this information, I anticipate an MCR of approximately 82.8% for the quarter. If the MCR surpasses this threshold, it is likely that the company will be forced to revise its initial guidance downward. This scenario, which has not occurred in years, would mean bad news for the stock.

Post-Covid Coverage Losses

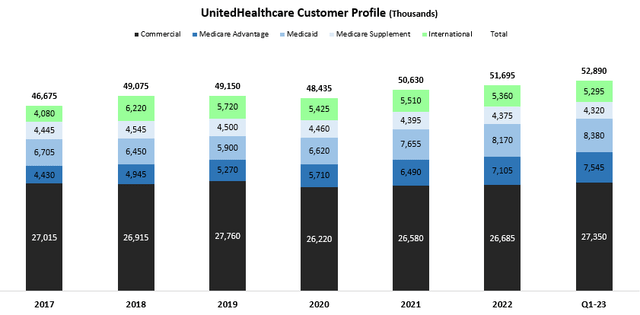

As we examine the aftermath of the pandemic, it is estimated that a considerable number of Americans, up to 15 million, may see their Medicaid coverage discontinued due to redeterminations taking place within the 12-month period starting from last March. While utilization trends primarily impact margins, post-Covid coverage losses are pressuring UnitedHealthcare’s topline.

Created by the author using data from UnitedHealth Group financial reports.

Prior to the commencement of the rollout period, UnitedHealthcare provided coverage to 8.4 million Medicaid members, indicating a remarkable 42.5% growth compared to Q1-20. In evaluating the company’s ability to counter the loss of Covid-based members with alternative programs, investors will closely monitor two important figures: the number of Medicaid members and the total customer count. These metrics will enable investors to gauge UnitedHealthcare’s capacity to sustain topline growth despite setbacks stemming from Covid-based Medicaid losses.

Updated Risk Model Commentary

Another factor that could negatively impact UnitedHealthcare’s top-line performance is the recently updated risk adjustment model, which was finalized by the Centers for Medicare & Medicaid Services (CMS) in early April. During the previous quarter’s earnings call, CEO Andrew Witty expressed concerns about the implications of the new model. In response to Witty’s comments, the stock experienced an immediate decline, highlighting the market’s sensitivity to this issue.

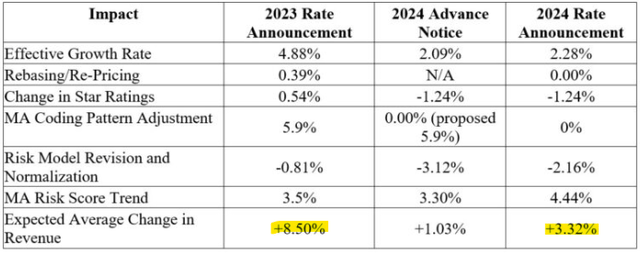

To provide a comprehensive overview, here is a reconciliation table illustrating the CMS rate announcement:

CMS Final Risk Adjustment Model Rate Announcement, April 5, 2023.

A notable observation from the CMS rate announcement is a significant deceleration in expected average revenue growth, declining from 8.50% in 2023 to 3.32%. This represents a substantial decrease, indicating a noteworthy change in growth momentum. Initially, the plan outlined by CMS would have resulted in an even lower growth rate of 1.03%. However, in response to pressures from managed care entities, CMS decided to implement the new model gradually over a three-year period.

According to CMS estimates, the new model is projected to reduce Medicare insurer revenue by $7.6 billion in 2024 alone. Therefore, any remarks regarding the specific impact on UnitedHealth should be closely monitored, as they will provide valuable insights into the company’s challenges resulting from these changes.

Optum

This is where the strength of the group truly shines. UnitedHealth Group’s unique positioning within the health value chain positions it to weather many of the insurance headwinds, as those transform into tailwinds for the Optum businesses. As the demand for health-related activities rises, Optum stands to gain and capitalize on the increased demand for its non-insurance health services.

Optum Rx

Shifting our focus to UnitedHealth Group’s first non-insurance business, Optum Rx, it is expected to experience positive effects from the growing demand for pharmacy care services amidst the overall increase in health activity. The segment displayed an impressive 14.7% growth in the first quarter, while maintaining steady margins at 3.9%. Investors should closely monitor the segment’s profitability, which has the potential to improve even further with the entry of multiple biosimilars into the market.

Regulation is a crucial topic to consider, particularly as Pharmacy Benefit Managers (PBMs) face heightened scrutiny from the Biden administration. So far, it’s only been headlines and no change has materialized. Still, around 50% of the segment’s operations are comprised of PBM activities, and we will have to pay close attention to updates regarding ongoing investigations, as well as any new insights regarding potential changes in the industry.

Optum Health

Optum Health, following a remarkable 37.9% growth in the first quarter, is expected to be a significant driver of both top and bottom-line growth as its customer base of 103 million returns to pre-pandemic behavior.

While assessing Optum Health’s performance, an essential metric to monitor is its margins. In the first quarter, margins dipped to 7.7% after consistently hovering around the 8.5% threshold for three years. Management has a long-term target of achieving a 9.0% margin, but the current focus appears to be primarily on growth. Therefore, understanding the margin trends will be crucial in evaluating the company’s ability to balance growth and profitability effectively.

Optum Insight

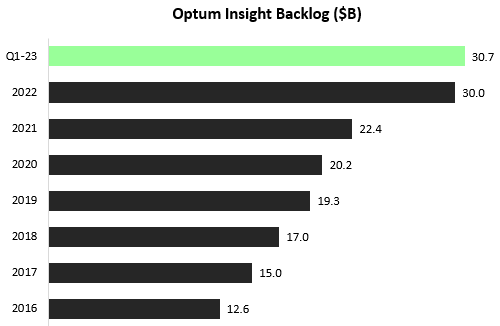

UnitedHealth Group’s crown jewel, Optum Insight, continues to shine with its impressive performance. Notably, the segment achieved margins exceeding 20% and outstanding revenue growth of nearly 40% in the first quarter. And with Optum Insight, the key indicator for strength is its backlog.

Created by the author using data from UnitedHealth Group financial reports.

Optum Insight’s products have experienced tremendous demand, even during challenging periods for healthcare providers. With the overall increase in health activity, the demand for Optum Insight’s offerings is expected to further intensify.

In addition to monitoring the backlog, investors will be keenly observing the margins of the Optum Insight segment. In the previous quarter, the margins declined to the low twenties. It’s worth noting that the long-term target set by management is 20.0%, which indicates their emphasis on gaining market share rather than focusing solely on short-term profits. Despite this focus, it’s important to highlight that Optum Insight remains the most profitable segment within the group. While contributing less than 4.9% of the total revenues, it generates over 11.2% of the operating profit.

M&A Activity

The health services market is currently witnessing a wave of consolidation driven by increased merger and acquisition (M&A) activity. Numerous insurers have taken note of UnitedHealth’s success as a vertically-integrated operator and are striving to adopt a similar model. Building scale in terms of geographic presence takes considerable time and money, and customers face significant switching costs. Think about a person whose been seeing the same caregiver for 30 years, and what it takes to incentivize him to switch. This highlights why M&A is often the preferred method for expanding capabilities in this industry.

While UnitedHealth already participates in almost every aspect of the health value chain, the company continues to expand its reach through smaller M&A deals to further enhance its presence. In February, the group successfully completed the acquisition of LHC Group for $5.4 billion. LHC Group offers care services in homes, hospices, facilities, and the community. Investors are eager to receive updates on how this merger is contributing to growth, both within Optum Health and through cross-selling opportunities with other segments.

UnitedHealth is clearly focused on expanding its presence in the home-health segment, as evidenced by its offer to acquire another provider, Amedisys (AMED), for approximately $3.8 billion.

UnitedHealth is expected to offer further insight into its home-health ambitions and long-term strategy, which represents another crucial focus point for investors.

Valuation & Long-Term Growth Drivers

So far, we have looked into the factors that should determine the near-term narrative for UnitedHealth and the health services industry. However, with a high-quality compounder like UnitedHealth Group, it’s important to remain focused on the long-term underlying fundamentals, which will drive its long-term potential and has been instrumental in shaping the company into the remarkable business it is today.

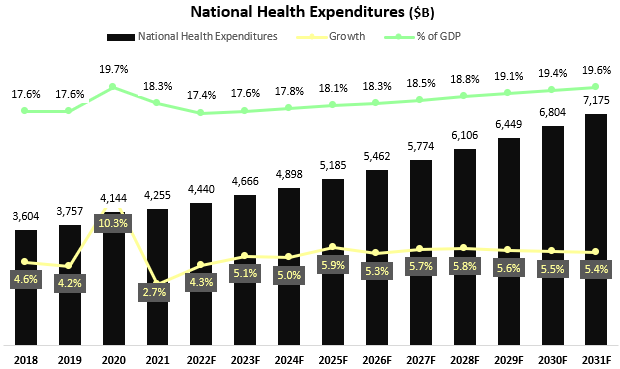

Created and calculated by the author based on CMS projections and data.

Based on the latest CMS projections, National Health Expenditures (NHE) will exceed $7 trillion by 2031, accounting for approximately 19.6% of the GDP. These projections indicate that NHE will continue to experience mid-single-digit growth for the foreseeable future. With UnitedHealth having significant exposure to almost every segment included in the NHE, the strength and resiliency of the demand is clear.

When considering valuation, UnitedHealth is currently trading at a forward P/E ratio of 19.6x, which stands 7.5% below its average over the past five years. Moreover, during the latest earnings call, management reaffirmed their long-term growth model, targeting 13%-16% annual earnings per share growth. I find this target to be highly achievable, as Optum becomes a larger portion of the group’s operations, and the company continues to rely on its unparalleled offerings to gain share across every segment.

Thus, I estimate investors can expect at least a 20% upside in the near term, through multiple expansion, EPS growth, and dividends.

Conclusion

UnitedHealth Group is scheduled to announce its second-quarter results on Friday before the market opens. The report could determine the direction in which the health services industry will go in the upcoming months, as increased care activity, enhanced regulatory scrutiny, and post-pandemic determinations drive a mixture of headwinds and tailwinds. Investors should watch for UnitedHealth’s ability to weather the storm, focusing on key factors including utilization trends, membership growth, CMS changes, M&A, and Optum’s ability to offset insurance headwinds.

Amidst the near-term volatility driven by these factors, UnitedHealth Group’s current trading price reflects a discount compared to its fair valuation. The company’s long-term fundamentals remain robust and intact. Therefore, I reaffirm a Strong Buy rating ahead of the earnings announcement.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of UNH either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.