Summary:

- UnitedHealth Group is expected to report Q3 results on Friday, October 13th.

- Analysts have revised EPS estimates downwards but revenue estimates upwards, suggesting higher expenses.

- UNH has a history of beating estimates, but recent beats have been small and/or deteriorating.

- Given the company’s long-term potential, this may not be a bad time to initiate a position in its stock, especially if the Q3 report causes a sell-off.

jetcityimage

UnitedHealth Group Incorporated (NYSE:UNH) is expected to report its Q3 results pre-market on Friday, October 13th. I am not the most superstitious but that gave me a chuckle. Friday, the 13th in the Halloween month. That naturally begets the question, will UnitedHealth’s earnings spook the market?

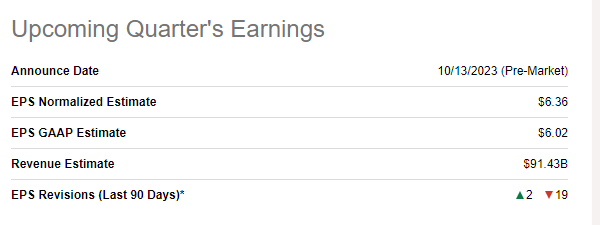

UNH Earnings Preview (Seekingalpha.com)

My most recent coverage on UNH was in May, previewing the company’s then upcoming dividend increase. I showered the company with adulation in that article as it had one of the best dividend coverages I’ve seen in my 10+ years of analyzing dividend stocks. Hence, when UnitedHealth announced a handy 14% increase to its dividend in June, it was hardly a surprise.

Let’s now turn our attention back to the upcoming earnings report by looking at (1) expectations going into the quarter (2) the company’s earnings surprise history (3) things to look forward to in the Q3 report (4) stock valuation as we head into earnings and (5) the technical set up heading into earnings.

Earnings Revision – A Dichotomy

Going into the Q3 report, UNH has one of the strangest revisions in history I’ve seen. 19/21 EPS revisions have been to the downside while 12/15 revenue revisions have been to the upside. This clearly suggests that analysts expect the company to have higher expenses than usual. One of the reasons could be the proposed deal to acquire Amedisys (NASDAQ:AMED), in addition to the fact that the company openly issued concerns about costs in general back in June.

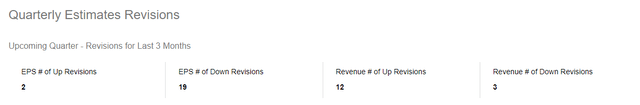

It may not be a bad thing to go into earnings with lower expectations, especially when the questions are around industry-wide cost and not the company’s ability to sell. Overall, since June, Q3’s EPS estimate has come down from $6.51 to $6.36 or about 2.30%. This is not earth-shattering at the moment but something to keep an eye on as covered below.

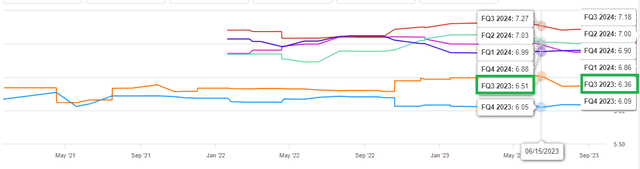

UNH Q3 Revisions (Seekingalpha.com) UNH Q3 EPS Trend (Seekingalpha.com)

Beat or Miss? I Say Small Beat, Backed By History

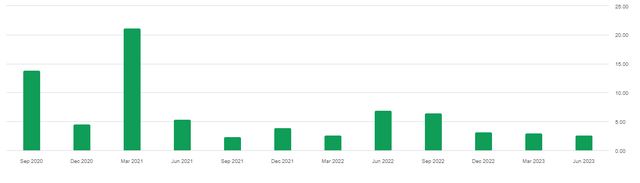

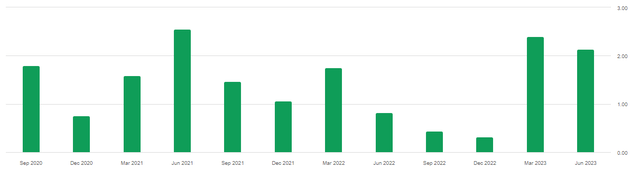

I mentioned above that going into earnings with lower expectations is not such a bad thing in general. This gets accentuated when the company has a rich history of beating estimates. UNH has beaten both EPS and revenue estimates in each of the last 12 quarters at least, although the margin of beats has been small and/or deteriorating. Recent history suggests that revenue is likely to come in around $93 billion (2% beat) while EPS is likely to come in around $6.50 (2% to 3% beat).

UNH EPS Beat History (Seekingalpha.com) UNH Revenue Beat History (Seekingalpha.com)

What To Look Forward To?

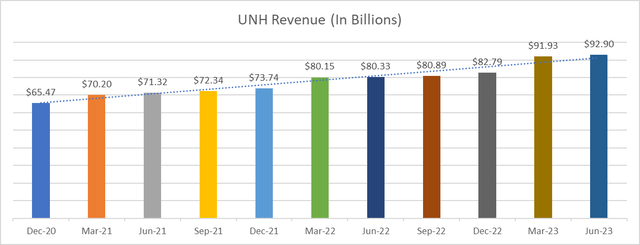

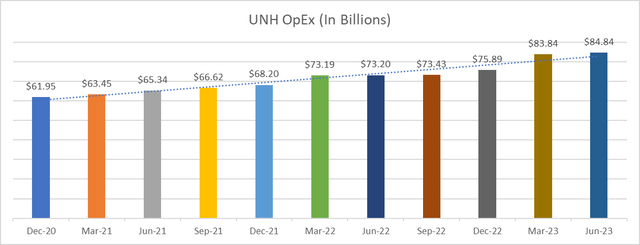

- UnitedHealth’s revenue and operating expenses have both been increasing QoQ at least for the last 11 quarters. More interesting is the tight range within which the revenue and expenses have come in as OpEx has been between 90% and 94% of the revenue. With the company warning us about increasing costs, it will be interesting to see if OpEx goes up as a percentage of revenue in Q3.

UNH Revenue (Author) UNH OpEx (Author)

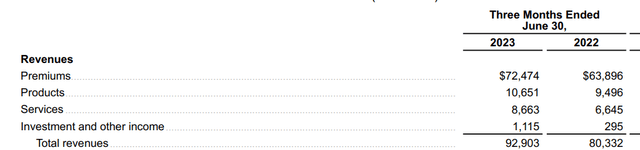

- Premiums are still the bread and butter of the company but it is encouraging that products and services cumulatively showed higher YoY growth in Q2 than premiums. I expect this to continue in Q3 as well as the insurers are well aware of the constant threat of rising healthcare premiums.

UNH Rev Mix (unitedhealthgroup.com)

- The expected improvements in products and services do not mean premiums are slowing anytime soon. UNH reported $64.50 billion in premiums in Q2 2022 and I expect it to be close to $75 billion this quarter given the surge in premiums with more expected in 2024.

Valuation

As I wrote in my May article, UnitedHealth stock’s valuation was pretty reasonable at that time considering its expected growth rate. This is still the case as the stock’s current forward multiple of 20 and expected 5-year earnings growth rate of 12.78% give the stock a price-earnings/growth [PEG] ratio of 1.56. Add the slightly low but well-covered and increasing dividends, UnitedHealth stock offers the right blend of current income, future income growth potential, and capital growth potential.

I fully agree with this upgrade from Bernstein as the stock’s long-term potential makes it more attractive during phases of relative underperformance like this year. The stock’s median price target of $564 from 24 analysts is nearly 12% away, excluding dividends.

Technical Strength

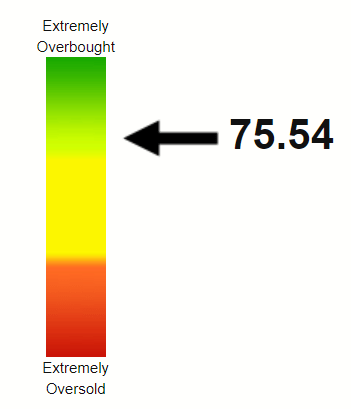

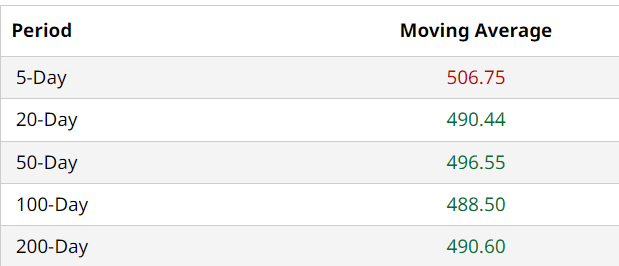

UnitedHealth’s stock has underperformed the market YTD as it is down about 3% compared to the S&P’s ~ 12% gain. However, the stock may have turned around technically as it is trading above both the 100-Day and 200-Day moving averages. UNH has a Relative Strength Index [RSI] of 75, which suggests the stock is gaining some momentum as we head into earnings season.

UNH RSI (stockrsi.com) UNH Moving Avg (Barchart.com)

Conclusion

It is pretty easy to make the long-term case for UnitedHealth Group’s stock. There are many things in favor of the company including its brand name, pricing power and most importantly, the US demographics. As an example of the demographics tailwind, between 1920 and 2020, the US population aged 65 and over grew nearly 5 times faster than the total population. I don’t mean to get political here but despite some well-known politicians pushing for universal healthcare for many years, the system is too deep-rooted at this point to have tectonic shifts. In short, I expect insurers to rake in money for many decades, sometimes unfortunately at the expense of the general public.

Getting back to Q3 earnings, I expect the company to continue its impressive streak of beating on both EPS and revenue. However, should the rising costs cause enough damage for UNH to report below expectations and should the stock lose ground, consider it a good opportunity to buy a market leader on sale.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.