Summary:

- UnitedHealth Group remains a solid buy-and-hold type of stock for the long-term dividend growth investor.

- Shares have recently touched a new all-time high; despite that, based on earnings growth going forward, the share price doesn’t look overvalued here.

- Consistent earnings beats could suggest that the shares are also on the cheaper end based on the fair value range, with a chance for double-digit dividend growth to continue.

Wolterk

Written by Nick Ackerman

It has been quite some time since we’ve taken a focused look at UnitedHealth Group (NYSE:UNH), a healthcare behemoth with a market cap of nearly $550 billion. Since our prior update, shares have performed fairly modestly relative to the broader market. That was just over two years ago, and I had a more neutral stance on the name, with a ‘Hold’ rating. These gains only came about more recently, too, as the share price started moving higher after their latest earnings.

UNH Performance Since Prior Update (Seeking Alpha)

For the most part, I view UNH as a solid buy-and-hold, but I will be a bit more picky about when I want to add. As long as the business isn’t falling apart, I’ll continue holding this name for its solid dividend growth. Despite recently touching a new 52-week high – in fact, touching an all-time high recently – shares of UNH have become more attractive as earnings have outpaced the stock price during this time.

2024 Challenges

UNH was facing a number of challenges throughout the spring and summer of 2024 and that helped to push the share price to an even more attractive level than currently.

That is often the case when there is uncertainty surrounding a business or even the overall economy – which we certainly have enough of thanks to a seemingly more unstable geopolitical situation in the last couple of years.

UNH’s biggest hit came from the cyberattack on the Change Healthcare subsidiary that UNH had acquired only in late 2022. In their last earnings call, they noted that it was going to hit adjusted EPS by $0.60 to $0.70 per share. This means it will be a sizeable hit, but ultimately, amounting to about 2.35% of EPS expectations for fiscal 2024. It also should be a one-time hit, assuming they put the right protections in place in the future.

UnitedHealth Group entered the second half of the year with continuing and broad-based growth momentum. As a result, we are affirming our full year adjusted earnings outlook even as we absorb $0.60 to $0.70 per share in business disruption impacts related to the cyberattack. These results come from the sustained focus of the 400,000 people of UnitedHealth Group on adding value for patients, consumers and customers through the fundamental execution of our key priorities.

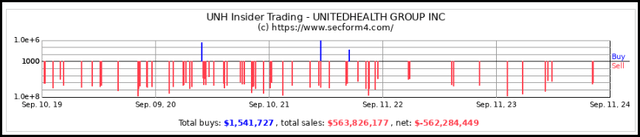

Then there was the DOJ announcing that it was launching an antitrust review of the company. An even worse look is that insiders were selling sizeable blocks of shares for several months before the announcement was made public. That said, the exes at UNH are highly compensated, and most transactions are sold transactions overall rather than insider buyers. In the last five years, insiders have sold over $560 million worth of stock while only buying about $1.5 million.

UNH Insider Buys/Sells (SECForm4)

While this isn’t an encouraging sign of confidence from the management team, it goes back to the old general guideline of there being a number of reasons why insiders might sell. Still, there is only one reason they buy, and that would be they expect to make money. So, selling shares isn’t necessarily a negative on its own, as they can become highly compensated by stocks and options and want to diversify out.

Finally, the other negative news that arrived, sending health insurers lower, was that the average payment increase from Medicare was only going to be 3.7%.

UNH Still Appears Attractive

However, all of these issues were eventually digested, and UNH shares have been heading higher, again, reaching near all-time highs. That would suggest that UNH isn’t as attractive as it was previously on an absolute basis, but on a relative basis, things have become more attractive for this name since our prior update.

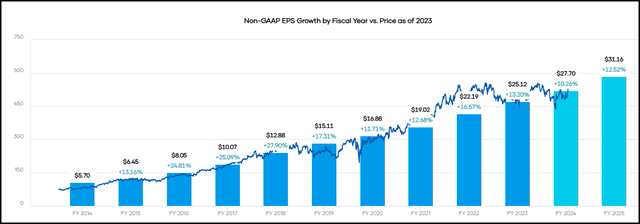

That is, even despite the share price being higher now than it was earlier this year, I wanted to touch on the name as it is still a solid high-growth dividend play worth considering. This primarily has to do with the fact that the earnings growth has outpaced the share price growth during the time since our prior update. During our last update, estimates for earnings for fiscal 2022 came in at $21.85 per share, and for fiscal 2023, it was estimated at $24.90. That would have been good for 14.86% and 13.99% earnings growth year-over-year in each respective year.

What we ended up getting was EPS of $22.19 and $25.12, YoY working out to 16.67% and 13.20%. The second year was lower in terms of percentage growth, but it was off of a higher base level. Beating earnings expectations isn’t something unusual for UNH at all either, they have put up an earnings beat 16 out of the last 16 quarters.

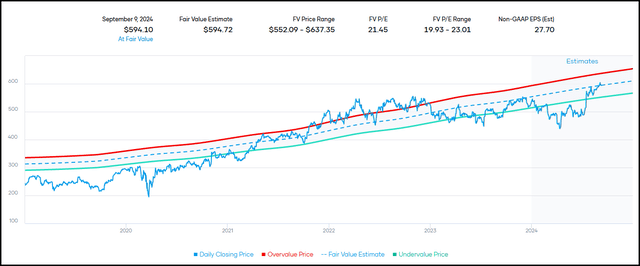

Even now, the share price hasn’t been pushed into an overly elevated valuation and remains within the fair value range. This would be primarily driven by the expectation for earnings to continue to grow at a healthy pace in the coming years. Over the next two years, analysts are expecting earnings growth to continue at just over a double-digit level. That’s even factoring in the cyberattack EPS hit for the year.

UNH Earnings History and Forward Estimates (Portfolio Insight)

What these earnings translate into is a forward P/E multiple of ~21.5x. That is roughly what the current market multiple is trading at, though primarily lifted by a few select mega-cap tech names. Though with such a solid earnings surprise record for shares of UNH, it actually wouldn’t be surprising at all to see them top these numbers, and that would mean shares are actually trading at a lower P/E.

Of course, that can never be guaranteed to keep happening. What we know for now is that for UNH, at this earnings multiple, it means we are trading right around its fair value at this current time. That puts it at a level where it isn’t necessarily cheap, but it also isn’t looking overvalued here, either.

The chart below also shows why I felt that UNH was getting a bit richly priced back in 2022 when it started to trade above its historical fair value range. As earnings increased over the last couple of years and are expected to continue to do so, we can see the range naturally moving in an upward trajectory.

UNH Fair Value Range (Portfolio Insight)

Now, if one suspects that the overall market is going to continue to be volatile, and we are going to get a hard landing, then UNH could be at the mercy of a weaker general market, too. However, with UNH, it is generally a more defensive stock. The volatility recently has come as the result of the mega-cap tech names that drove the market higher starting to come back down to more realistic valuations.

High Dividend Growth

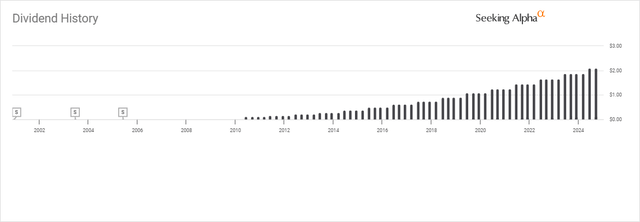

On a final note, one of the reasons that I believe UNH is still attractive for a long-term investor – and even when I was more neutral on the name a couple of years ago, why I didn’t mind continuing to hold-is that this is a solid dividend growth play. They’ve been lifting their dividend now consecutively for 15 years.

UNH Dividend History (Seeking Alpha)

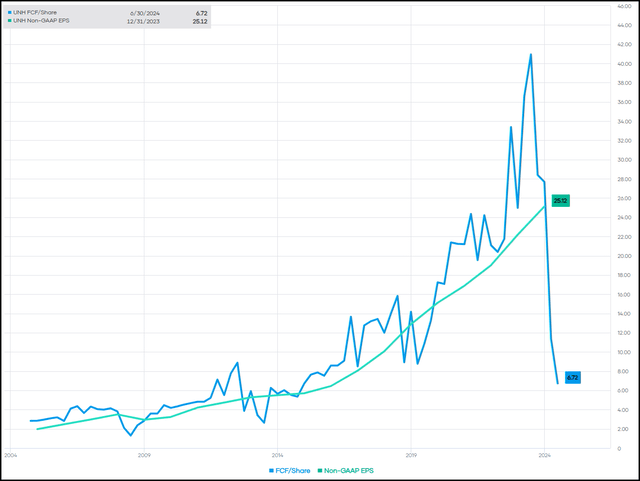

The pace of the dividend growth has slowed down a bit over the last few years, but it remains at a double-digit level still. Last year’s lift from $1.88 per quarter to $2.10 was an increase of 11.7%, which can be compared to the previous compounded annual growth rates.

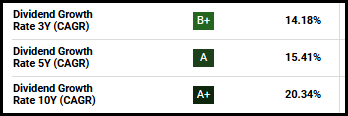

UNH Dividend CAGR (Seeking Alpha)

As we expect to see double-digit EPS growth going forward, it wouldn’t be too surprising if they continued to stick around the ~10% dividend increases for the coming years. However, with the cyberattack, they did take a fairly substantial hit in terms of free cash flow, and that’s ultimately what is used to pay dividends to investors is cash. The adjusted EPS helps to provide underlying profitability of the normal course of business, making it less volatile as it adjusts for one-time or unusual items.

So, the 30% dividend payout ratio based on next year’s EPS estimates isn’t elevated at all and suggests solid coverage. It is the FCF per share coming in at $6.72 that could be a bit concerning. Based on the $8.40 annual dividend, that would actually work out to a 125% FCF dividend payout.

That said, this should be a one-off event, and FCF per share should rebound next year. Historically, the FCF per share has trended higher along with the adjusted EPS figure. If that is the case, we should see anywhere from $27 to $30 or more in FCF per share next year. That’s where the adjusted EPS can give us better clarification on the underlying profitability when factoring out these sorts of disruptions.

UNH FCF And EPS (Portfolio Insight)

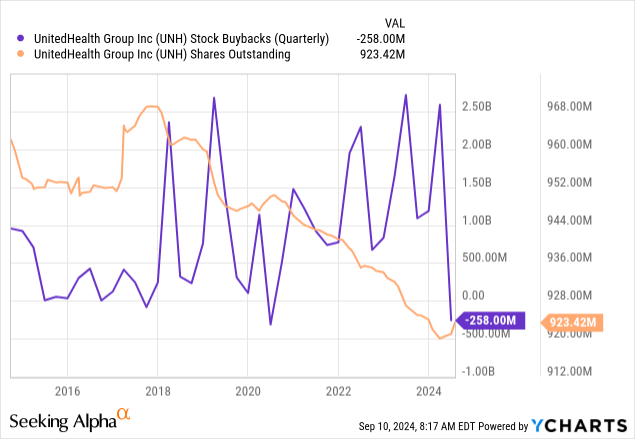

Along with the dividend, share repurchases are also important with UNH, as they’ve tended to be quite aggressive with buybacks. This was another area that the cyberattack damages impacted negatively, as they noted in their earnings call.

Cash flows from operations in the quarter were $6.7 billion, or 1.5 times net income, even with the accelerated funding for care providers. In June, our Board of Directors increased the dividend by 12%, marking the 15th consecutive year of double-digit dividend increases to shareholders. During the quarter, as I mentioned earlier, we prioritized devoting resources to support care providers in the wake of the cyberattack over some activities such as share repurchase. It was the right thing to do, devoting all our efforts to provide stability for the health system. Still, with our ongoing strong capital capacities and with support needs abating, we expect to achieve the full year repurchase objective we shared with you last November.

That resulted in the number of outstanding shares growing more recently.

Ycharts

Conclusion

UNH had been stumbling through the first half of 2024 with bad news after bad news. However, investors digested that news and the impact on the company is expected to be short-lived, with growth still remaining on track-which can translate into the high dividend growth also remaining in place. The stock has recently touched near all-time highs, but it doesn’t look to be too elevated overall. This all ultimately makes UNH still a long-term holding worth considering for dividend growth investors.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of UNH either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Interested in more income ideas?

Check out Cash Builder Opportunities, where we provide ideas about high-quality and reliable dividend growth ideas. These investments are designed to build growing income for investors. A special focus on investments that are leaders within their industry to provide stability and long-term wealth creation. Along with this, the service provides ideas for writing options to build investors’ income even further.

Join us today to have access to our portfolio, watchlist and live chat. Members get the first look at all publications and even exclusive articles not posted elsewhere.