Summary:

- UnitedHealth Group’s recent price pullback presents a buying opportunity for long-term dividend growth investors, despite the CEO’s death and short-term volatility.

- Strong fundamentals: Q3 earnings beat estimates with EPS of $7.15 and revenue at $100.8 billion, showing robust top and bottom line growth.

- Sustainable dividend growth: Dividend increased by 11.70%, supported by strong cash flows and a solid balance sheet with $32.4 billion in cash.

- Attractive valuation: Forward P/E of 17.57x offers 24% upside potential, making UNH a compelling buy with a long-term price target of $602.

Wolterk

Introduction

By now, I’m sure everyone is aware of UnitedHealth Group (NYSE:UNH) (NEOE:UNH:CA) CEO’s death earlier this month, so I won’t continue on about it. And although the loss of life is never something I like or want to hear about, the steep pullback in price is a buying opportunity for long-term dividend growth investors.

One of the biggest lessons I’ve learned in investing is to detach myself emotionally from my stocks. And although this can be harder than it seems, when quality dividend growth stocks such as UNH experience a sell-off, investors should take the opportunity and consider buying.

In this article, I discuss the company’s latest earnings, fundamentals, dividend safety, and why the stock is a buy for those looking for solid dividend growth over the long term.

Previous Buy Rating

It’s been awhile since I last covered UnitedHealth, almost one year, actually. At the time, the stock was down slightly over 2% on the year due to headwinds in the healthcare sector.

And due to recent and unexpected news regarding their CEO, the stock is down 7.71% in comparison to the S&P who is up 26.51%. I discussed the healthcare giant’s strong cash flow growth that enabled them to grow their dividend from $0.75 to $1.88.

And despite their cash from operations declining year-over-year from $8.7 billion to $6.9 billion during their Q3 ’23, in totality, cash from operations grew double-digits from $30.7 billion to $34.3 billion over the same period.

At that time, the healthcare giant had only paid out 13% of their cash flows in the form of dividends. Moreover, with a forward P/E of 21.94x, I thought the stock was undervalued and offered significant upside. Using the Dividend Discount Model, I had a price target of $656 which I’ll touch more on later in the article.

Strong Top & Bottom Line Growth

During the company’s latest earnings, announced before recent news broke, UnitedHealth Group’s third quarter earnings report was another strong one, beating on both their top and bottom line estimates.

EPS of $7.15 beat by an impressive $0.12 while revenue beat estimates by $1.52 billion, coming in at $100.8 billion. Year-over-year revenue rose a solid 7% from $92.4 billion, while earnings per share increased roughly 9% from $6.56 over the same period. And this was a result of their robust expansion in people served at Optum as well as UnitedHealthcare.

For comparison purposes, peer Elevance Health (ELV) saw their bottom line decrease roughly 6.9% over the same period from $8.99 to $8.37. Their revenue growth was also less, albeit up 5.17% compared to 7% for UnitedHealth Group.

So, from a fundamental standpoint, UNH is continuing to operate efficiently and successfully, although their price pullback was subsequent to quarter’s end.

|

Q3’24 |

Q3’23 |

|

|

UNH |

$7.15 |

$6.56 |

|

$100.8B |

$92.4B |

|

|

ELV |

$8.37 |

$8.99 |

|

$44.7B |

$42.5B |

Sustainable Dividend Growth

Over the last year, UnitedHealth Group’s dividend has grown 11.70% from $1.88 to their current run rate of $2.10 per share, last raising it by double-digits for their 15th consecutive increase this past June. And this is supported by strong growth in the company’s cash flows.

Year-over-year cash from operations doubled from $6.9 billion in Q3’23 to $14 billion in Q3 of this year, also likely a result of their strong expansion in people served, which grew by 7.5 million from the previous quarter.

The healthcare giant returned a total of $9.6 billion to its shareholders through buybacks and dividends over the first 9 months, while cash from operations amounted to $21.8 billion over the same period.

And while this declined from $34.261 billion in the first 9 months of 2023, their dividend was well-covered, only paying out $5.6 billion in dividends this year. This ensures that the healthcare conglomerate is likely to continue growing its dividend at a healthy rate for the foreseeable future.

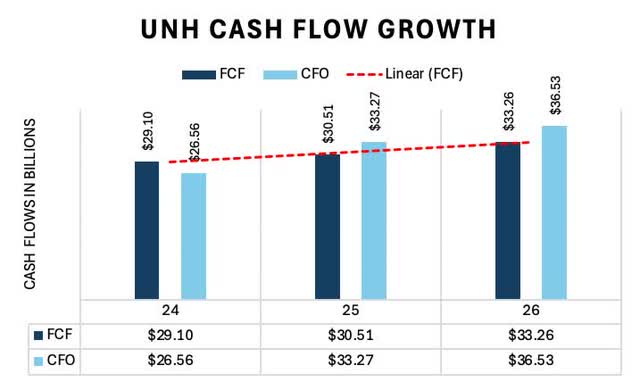

In the chart below, you can see UnitedHealth Group’s expected cash flow growth over the next 2 years. Cash from operations is expected to grow a robust 37.53% over the next 2 years, while free cash flow is also projected to grow double-digits by 14.29% over the same period.

Balance Sheet Supports Strong Dividend Growth

The company’s balance sheet also supports and enables the company to continue growing their dividend. At the end of Q3, UnitedHealth Group’s long-term debt stood at $74.1 billion, relatively small in comparison to their market cap of $458.76 billion at the time of writing.

Their cash position was strong with $32.4 billion in cash & cash equivalents, enough to comfortably satisfy their short-term debt and maturities of $3.9 billion.

This is a further testament to the company’s balance sheet strength, which will likely allow them to continue to significantly grow the dividend at a high single digit to double-digit rate.

Potential Downside Risks

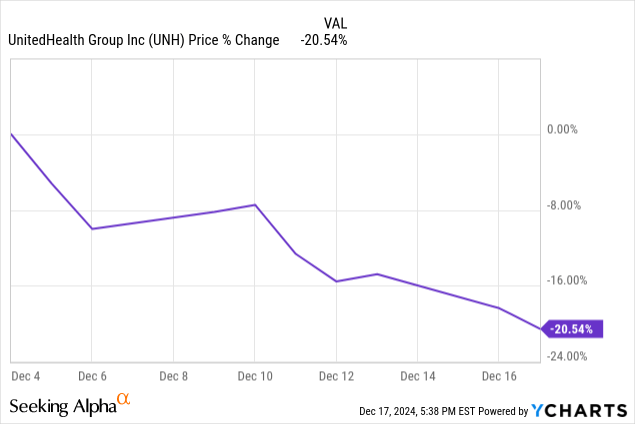

Since the news broke on December 4th, UnitedHealth Group’s share price has continued to slide, down over 20% in the past week and a half. And recently, their share price took another blow due to comments made by President-elect Trump regarding high drug prices.

As a healthcare stock, I suspect UNH’s share price could see further downside from here and is likely to see increased volatility, at least for the short term. But from a fundamental and dividend safety standpoint, the stock remains attractive.

24% Upside Potential

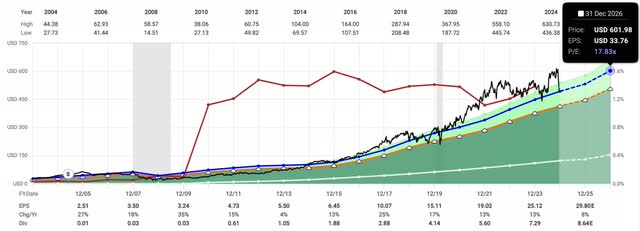

Using management’s guidance midpoint of $27.625, this gives UnitedHealth Group a forward P/E of 17.57x. With the pullback from above $600 a share, this now gives them a lower multiple than their 5-year average of 23.29x, making them attractive for long-term investors.

Even with the steep pullback, UNH still trades above peers Elevance Health and Humana Inc. (HUM) whose forward P/E’s stood at 11.10x and 14.62x. This is also a testament to the former’s strong fundamentals and growth projections.

You can see with the share price decline that the stock is now trading near its fair value. Using their current multiple, UnitedHealth offers compelling upside of roughly 24% over the next two years.

Bottom Line

UnitedHealth Group’s recent pullback is an attractive buying opportunity, especially for long-term dividend growth investors. Moreover, the stock offers strong upside of nearly 24% with a long-term price target of $602 a share despite headwinds and potential downside risks.

UNH’s cash flow growth projections enable the company to continue growing their dividend at a high single-digit, or double-digit rate going forward. As a result of their fundamentals remaining intact despite recent headwinds, dividend safety, and upside potential, I am upgrading UnitedHealth Group from a buy to a strong buy.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.