Summary:

- UnitedHealth Group’s stock is rated a Hold, due to its fair valuation and political risks.

- UNH’s revenue and earnings have grown significantly over time, driven by diversification into non-insurance sectors and strategic M&A activities.

- Key growth areas include Value-Based Care, Health Technology, and Pharmacy Services, leveraging their extensive network and AI advancements.

- Political and regulatory risks, particularly around monopolization and healthcare policies, necessitate a cautious approach and a lower P/E for a margin of safety.

JHVEPhoto

UnitedHealth Group (NYSE:UNH) (NEOE:UNH:CA) is the largest health insurance provider in the country. With the very recent assassination of UnitedHealth CEO Brian Thompson, I suspect the market will be repricing this stock in reaction to the developing situation for some time.

UNH 5D Price History (Seeking Alpha)

So far, the price is down more than 9% in reaction to this news.

I wanted to look at the business itself and pin down a fair value for the long term, whatever reflexes the market has news events like this. I determined that UNH is probably fairly valued at best with a forward P/E of 21 and that the political environment requires a better margin safety. For now, it’s just a Hold.

Financial History

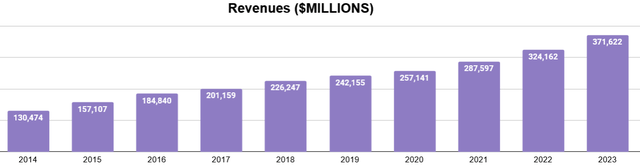

UNH boasts a very impressive financial record over the last decade of full-year results.

Revenue almost tripled between 2014 and 2023. Tripling or even doubling revenue over time is its own is an achievement, but doing so as a company that was already collecting more than $100B in revenue at the start of the period is something else.

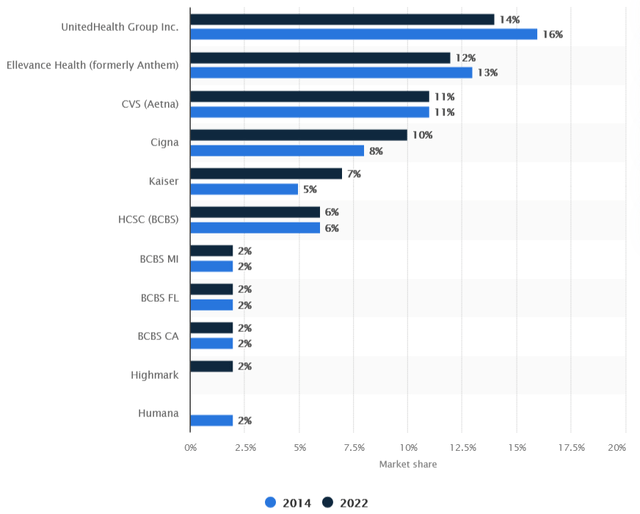

According to the American Medical Association, UNH stands as the biggest player in insurance. In 2023, they led the commercial insurance market, with 14% market share, while also possessing 42% of the Medicare Advantage market.

According to Statista, market share (measured in enrollments instead of dollars) did not change much between 2014 and 2022. This makes the revenue growth they accomplished interesting.

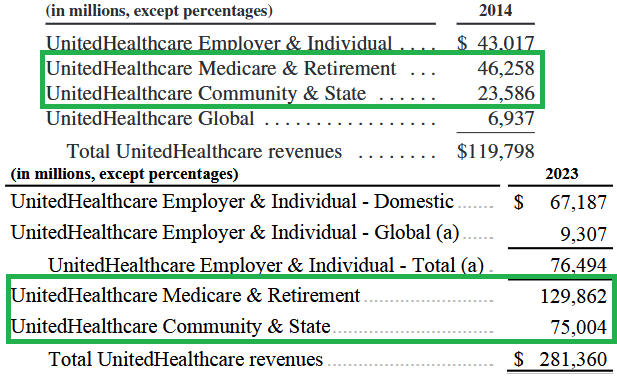

2014 and 2023 Forms 10K

While folks often look to the commercial market when determining the largest players, the image above shows how much revenue was grown by UNH successfully penetrating other insurance markets. “Medicare & Retirement” and “Community & State” account for nearly all of the gains in their insurance business.

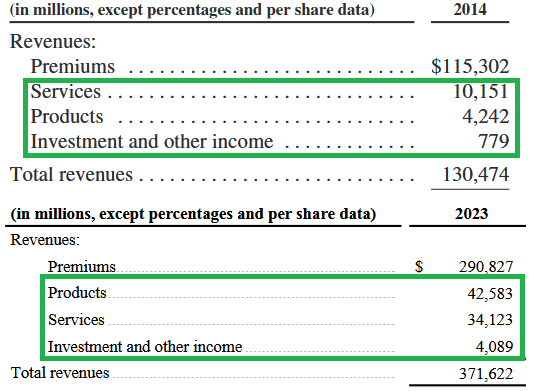

Revenue Breakdowns (2014 and 2023 Forms 10K)

Yet, we don’t want to overlook their non-insurance revenue. This includes what Optum (their provider, pharmacy, and data business) earns, along with portfolio income. The image above shows non-insurance revenue up by more than 5x during this period, accounting for more than a fifth of 2023’s revenues.

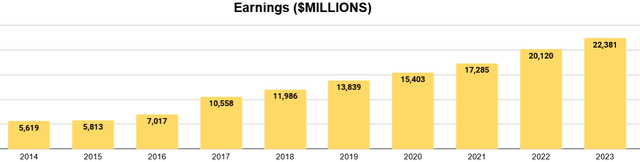

Unsurprisingly, earnings growth is almost 4x over the period. Usually, earnings of a business will grow at a faster rate than revenue, as long margins are stable.

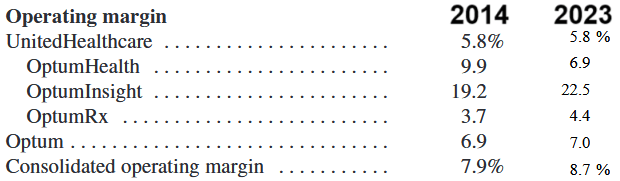

Operating Margin Comparisons (2014 and 2023 Forms 10K)

Seen above, the non-insurance business, being higher-margin than insurance, naturally fed into this earnings growth as it became a larger share of the revenue picture.

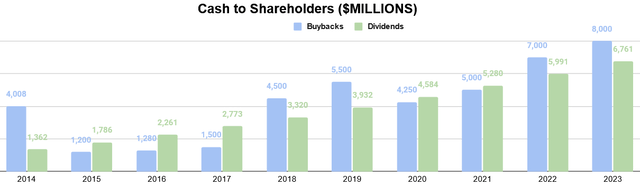

Throughout this time, most of the earnings have been returned to shareholders by way of buybacks and dividends. While the dividends are grown at a steady rate, buybacks seem to fluctuate depending on that individual year but are otherwise comparable to the dividends, with $42B spent on buybacks and $38B distributed as dividends during this period.

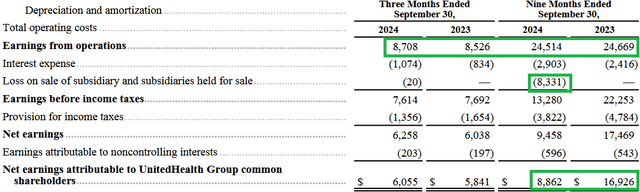

Income Statement (Q3 2024 Form 10Q)

YTD performance show somewhat flat operating results, with the primary hit to earnings being the write-off of assets sold at a loss, a non-cash item.

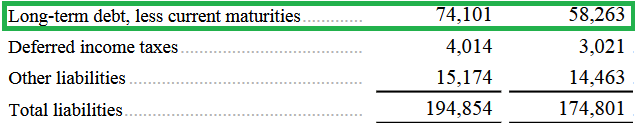

Balance Sheet (Q3 2024 Form 10Q)

Long-term debt, however, grew about $16B, year-over-year. As UNH has spent over $11B on M&A this year, it’s not surprising.

Overall, I think the financial history tells the story of what happened after UnitedHealth’s and Optum’s merger in 2011. It formed something of an ecosystem between insurance and provider, which gave the company more opportunities to expand into new markets, introduce new business lines, and realize efficiencies.

Future Outlook

The question, then, is: How much can this continue? Already a titanic company a decade ago, a company of this size has its work cut out for it if it hopes to achieve similar earnings growth. In his remarks during the Q3 earnings call in October, CEO Andrew Witty stated:

As we look to 2025, and I will address this shortly, we remain in a dynamic period for the healthcare sector. Amid this, it’s important that we continue to invest in the durable value creating capabilities of this company that support our 13% to 16% long-term growth objective.

He believes growth can at least continue in the mid-double digits over the long run. Even before the recent news story of Thompson’s assassination, his stress was on UNH’s long-term returns.

Management highlighted what their priorities are for strategic growth.

Of the five they identified, I’m going to focus on the three that, I believe, will most likely move the needle favorably for earnings growth:

- Value-Based Care

- Health Technology

- Pharmacy Services

Value-Based Care refers to emphasis on long-term care and maintaining or improving health, as opposed to responding to health problems. Because of how much they have grown their network between insurance and care, I think they are eminently capable of accomplishing this. I also think the thing they’ve shown that they can capture new business opportunities, and if they can take the lead in value-based care, this should provide strong revenue growth over time.

Health Technology is basically benefiting from the AI boom. An advantage of the kind of internal network they have is that enjoy larger pools of data and can come up with more uses of the insights formed by them. I think the most immediate and obvious benefit will be cost-cutting, something that has already begun to occur and was noted in the earnings call:

Our advanced practice clinicians use AI to summarize lengthy patient histories, freeing up hundreds of hours that can be better spent caring for people. Our nurses use Generative AI to review documentation more efficiently, saving time and improving patient service.

What wasn’t mentioned but what, I believe, will ultimately come to fruition is that better risk models with the data will allow them more flexibility in the insurance underwriting. This could therefore be another source of revenue growth.

Pharmacy Services will likely depend on their ability to leverage these advantages into cost-cutting for medicine by negotiating with pharmaceutical companies. As medication has become notorious for its rising costs over time, this will be very important.

Risks

I believe the primary risks for UNH are regulatory and political in nature. This is largely because healthcare is something too basic to become irrelevant. It’s not something people will be eager to drop when cost-cutting, like they would the family vacation.

By comparison, the Biden Administration sued to prevent UNH’s acquisition of a senior home and hospice care business. Attorney General Merrick Garland characterized accordingly:

The Justice Department will not hesitate to check unlawful consolidation and monopolization in the healthcare market that threatens to harm vulnerable patients, their families, and health care workers.

This represents an example of the expansion they can make into a new line of business, either organically or through M&A. As large as they are, I expect M&A will have to be their more usual route. With $299B in assets, $106B of that is goodwill, so clearly they haven’t shied away from it.

The bigger they get, however, the more that monopolization becomes a concern, and the more likely it is that future M&A will be blocked or that the company may even be broken up.

With Trump returning to the White House in January, such moves may become less common, as the Republican Party is generally known for being less interventionist. Yet, as management is encouraging us to think long-term about growth, we should do that about risks too. Trump will be only President for four years, and if healthcare is a major issue in the 2028 election (like it was in 2016), its outcome could affect UNH negatively.

One more immediate change could be the decisions of the Department of Health and Human Services under Robert F. Kennedy, Jr. Currently, I expect that he will focus more on Big Pharma than insurance and providers. This may help UNH, given what I said before about cutting costs of medicine. If HHS makes that task easier, all the better. There is a possibility, however, that HHS will make drastic changes that UNH is not expecting, such as bans on a large number of medicines and other practices, which may impact revenues for Optum.

Valuation

Management’s long-term growth guidance therefore depends on them not being heavily disrupted by things on the political and regulatory side. I think a margin of safety is deserved for this reason, but then we need to value UNH to do that.

For that, I think using the PEG Ratio as a guide for valuation of this company is apt.

For that margin of safety, I think a P/E of 10 (for a PEG of at least 0.77) is needed before this becomes a Buy. Using PEG, we usually want the ratio to be 1 or less, but I want this to be substantially less, and I suspect 10 is about low, as we could hope to see such a stock go. That’s looking at a price of about $265 and a market cap of about $255B.

Seeking Alpha

As currently the market has priced forward P/E of about 20 for this company, long-term growth guidance being 13% to 16% gives us a PEG of 1.25 to 1.54.

I emphasize how much I want to price in the risks. Even if the P/E were something like 15, the spectre of the next election poses a need for caution for the long term.

Conclusion

Brian Thompson’s assassination isn’t a game-changer in the long term. I believe UNH has the right DNA to continue to spawn new business opportunities and adapt to changes in consumer demand and technology very favorably.

That this news event has taken such public interest likely derives from how much healthcare remains a key political issue for many Americans, who may want more regulation and trust-busting. While it wasn’t a focus of the 2024 election, investors are in it for the long run, and we know that more elections are to come. I think we need a much lower P/E to give us some margin of safety against that long-term risk. For that reason, I remain watchful of UNH, but cautiously rate it a Hold.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.