Summary:

- UNH has an impressive compounding track record, with being up around 650% over the last 10 years.

- With high-quality companies like UNH, it can be difficult to find a suitable and attractive entry point.

- With being down around 13% from highs in October and still a bright future ahead, the company appears to be at exactly such an attractive entry point.

FatCamera

High quality companies like UnitedHealth Group (NYSE:UNH) rarely trade at fair value and they are even less likely to offer a good entry point for investments, providing a solid margin of safety when buying. However, with the company being almost flat over the last year and a solid growth guidance from management of above 10% over the next years, the company appears to be exactly at such an extremely rare entry point.

Company Overview

UnitedHealth Group Inc., with its headquarters in Minnetonka, Minnesota, is a major participant both domestically and internationally in the health care industry. Based on overall revenue, it ranks highly among the Fortune 500 corporations and is the largest health insurance provider in the US.

UnitedHealth Group runs its business using two main segments:

UnitedHealthcare: Health insurance benefits are offered by UnitedHealthcare’s division to various groups. Employers – from small enterprises to large corporations – individuals, active-duty and retired military personnel, and their families are among them. A complete range of health benefit packages, including Medicare, Medicaid, employer-sponsored, individual, and military health insurances, are offered by UnitedHealthcare.

Optum: This segment offers a range of health services to payers, providers, employers, governments, life sciences firms, and consumers in the larger health care industry. It functions primarily in the OptumHealth, OptumInsight, and OptumRx sectors.

OptumHealth offers wellness and preventative programs, care coordination and delivery, and health management services to people and their employers.

To stakeholders in the healthcare sector, OptumInsight offers software and information products, advisory consulting services, and business process outsourcing.

More than one billion medications are supported yearly by OptumRx, a company that provides pharmacy care services and promotes affordability and improved health outcomes.

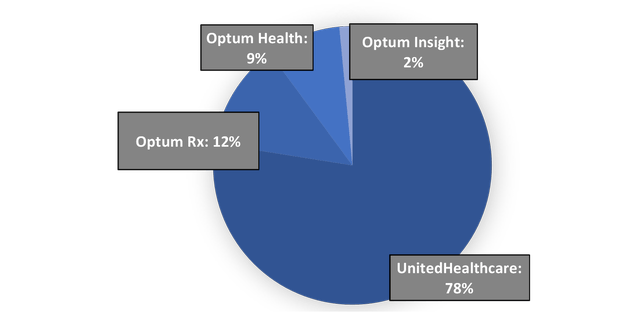

The revenue distribution between these segments, can be seen here:

Revenue Distribution UNH’s segments (Data: marketscreener.com)

UnitedHealth Group hopes to improve the efficiency of the healthcare system, as well as the health and wellbeing of individuals, by merging various business areas.

The UnitedHealth Group has made a commitment to ongoing innovation and the use of cutting-edge technologies and data analytics. It employs data-driven insights to increase customer experience, lower costs, and improve service quality. Additionally, it is enhancing its digital capabilities, including as telemedicine services, which are being used more frequently as a result of the COVID-19 epidemic.

SWOT Analysis

To get a feeling for the business model of UNH with its potential risks and opportunities, I conducted a small SWOT analysis:

Strengths:

- Scale: Due to its size, UnitedHealth Group is able to serve a wide spectrum of clients by providing a variety of healthcare goods and services. This indicates that they are in a good position to react to shifting market trends and needs.

- Market positioning as market leader: Being the market leader that they are, UnitedHealth Group enjoys a competitive advantage in the healthcare sector thanks to their well-known brand and devoted clientele.

- Financial strength: With UnitedHealth Group’s strong financial performance, they are able to make investments in new technologies, acquisitions, and organic expansion, which strengthens their position in the market.

- Innovation through Optum: The UnitedHealth Group firm, Optum, uses data and technology to spur innovation, improving healthcare outcomes, streamlining business processes, and improving patient experiences.

Weaknesses:

- Regulatory control: The issues UnitedHealth Group faces as it operates in a highly regulated sector could have an effect on its operations and profitability.

- High competition: With so many businesses providing comparable services in the healthcare sector, there may be pressure on UnitedHealth Group’s market share and pricing power.

- Focus on the US: UnitedHealth Group may be vulnerable to any downturns or regulatory changes in just one area given that the majority of their company is located in the US.

- Potential health care reforms: UnitedHealth Group’s business model could be significantly impacted by changes in health care regulations and reforms, which could have an impact on their income and profitability.

Opportunities:

- Growing demand for health care services: The aging population and increasing health awareness can boost demand for UNH services, allowing them to expand their customer base and increase revenue.

- Global expansion: The UnitedHealth Group has a lot of room to grow in underserved international countries, which might diversify their revenue sources and lessen their reliance on the US market.

- Digital transformation in their segment: UnitedHealth Group might enhance service delivery, operational effectiveness, and customer experience by adopting digital transformation.

Threats:

- Regulatory changes: Healthcare law and regulation changes may result in higher operational expenses, more stringent compliance requirements, and restrictions on the company’s ability to operate in particular areas.

- Economic uncertainties: Customers’ capacity to pay for healthcare services may be impacted by economic downturns or uncertainty, which may have an effect on UnitedHealth Group’s profitability.

- Cyber security threats: In a time of growing cyber-threats, UnitedHealth Group may be vulnerable to assaults that disrupt their business and harm their reputation, especially when considering that UNH plans to expand their digital operations.

Guidance and Outlook

With an expected earnings per share growth rate of 13%–16%, UnitedHealth Group predicts ongoing growth. It anticipates Optum’s long-term revenue growth to be in the double digits and UnitedHealthcare’s growth to be between 8% and 10%. The corporation anticipates that as a result of the expansion of government programs, the ratio of medical care would gradually rise. The company wants to enhance its operating cost ratio by 20 to 40 basis points annually and long-term targets an operating margin in the mid-single digits. It plans to keep investing money in mergers, dividends, and share repurchases, adding 3-5 percentage points to yearly earnings growth. It also aims for a return on equity of 20% or more and a return on invested capital of at least 14%.

Their latest top and bottom line as well as their expected metrics can be seen here:

Expected Top And Bottom Line Of UNH (Data: marketscreener.com)

Outlook

There are currently several factors, that I think could positively impact UNH’s business in the future:

Aging Population: It is anticipated that demand for healthcare services would increase dramatically as the population ages, particularly in wealthy nations. This covers the requirement for long-term care services, preventive healthcare, and chronic illness management. Businesses with a wide range of health services, like UNH, are well-positioned to address this rising demand.

Technology and Digital Health: The healthcare sector is embracing digital technologies like blockchain, AI, machine learning, and telemedicine more and more. With remote patient monitoring, individualized care, and more effective record management, these technologies are transforming the way healthcare is provided. UNH expects to benefit from this trend thanks to its Optum sector, which focuses on technology and information-enabled health services.

Increasing Healthcare Awareness: More people are seeking early and preventative healthcare treatments as a result of growing health and wellness awareness especially due to Covid-19. The number of persons utilizing healthcare services will probably climb as a result of this trend and the rise in health insurance coverage.

Chronic Disease Prevalence: The rise in chronic diseases such as diabetes, heart disease, and obesity also increases the demand for healthcare services. Companies that provide comprehensive healthcare services will be in a prime position to cater to this demand.

With all these points mentioned, I think UNH is in a prominent position to capitalize from these trends and further expand its market position. The anticipated revenue growth rate for UNH of >10% seems therefore more than justified.

Valuation

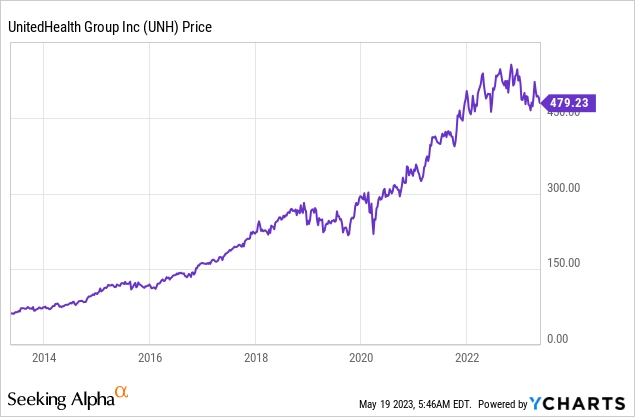

I believe we can all agree that UNH is a premier business recognized for its great performance and quality. This becomes especially apparent if we look at it’s stock performance over the last 10 years, with being up around 660%.

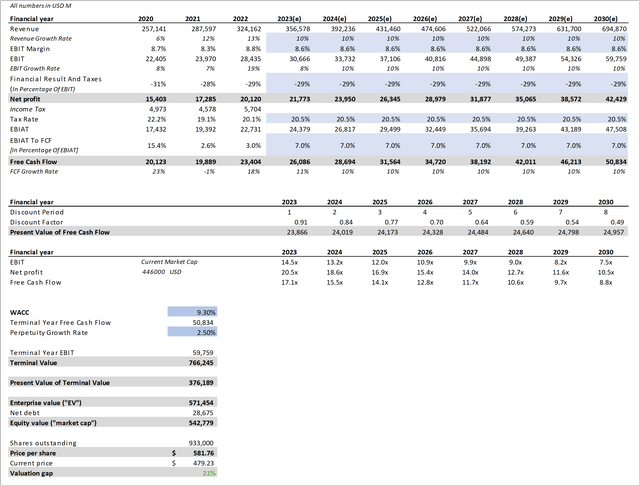

Such high quality “compounders” rarely trade at an attractive entry point due to their high quality. Given this context, I conducted a Discounted Cash Flow Analysis (DCF), to properly predict a suitable share price for UNH. The metrics stated below are relatively conservative to gain another margin of safety. The analysis’s blue cells show the presumptions that were used to valuate UNH.

- Revenue: The revenues were predicted with using a 10% revenue CAGR till 2030. This resembles pretty much management’s guidance, with them stating that Optum’s revenue will grow with double digits and UnitedHealth will grow annually with 8% to 10%.

- EBIT Margin: For the EBIT margin I used the average of the last 3 years and anticipated that it will stay flat at 8.6% for the next 8 years.

- Financial Result And Taxes: I averaged the values of the last three years and therefore used 7% to calculate the Net Profit for the years 2023 to 2030.

- Tax Rate: Sadly, I couldn’t find a Tax-Guidance from management. That’s why I also averaged out the last 3 years and arrived at a tax rate of 20.5% for this DCF.

- Free Cash Flow: I calculated the EBIAT using the aforementioned tax rate and then attempted to estimate an appropriate EBIAT to FCF ratio. In that situation, 7% – the average of 15.4% in 2020, 2.6% in 2021 and 3.0% in 2022 – seems realistic.

- WACC: I used the high end of UNH’s WACC for this DCF, which is 9.3%

- Perpetuity Growth Rate: The perpetuity growth rate assumed for the analysis is 2.5%.

Data: seekingalpha.com, unitedhealthgroup.com

This analysis gives us a target share price of $581.76. With considering this and assuming UNH’s business will develop like we predicted, there is currently a potential upside of ~20%. Note that this DCF doesn’t include potential margin improvements mentioned by the management or an improvement in WACC, which further expands our margin of safety.

Conclusion

Based on our reasonable conservative Discounted Cash Flow analysis we arrive at a price target of $580, which gives us an margin of safety of around 20%.

With keeping in mind that UNH is a very high-quality company, with a very bright outlook and a growing TAM, I currently rate the company as a ‘Strong Buy’ and I’m happy to further expand my existing position in this healthcare juggernaut at these attractive prices.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of UNH either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.