Summary:

- UnitedHealth Group has done a great job diversifying its business into managed care.

- Optum Health and Optum Insight should be the biggest growth drivers going forward.

- Recent news of a monopoly probe of the managed-care industry reveals regulatory risks for the Optum segment.

- With UNH’s underlying markets growing around 7%, I rate UNH stock a buy at the current valuation.

Wolterk

Introduction

After publishing my first article on Humana Inc. (NYSE:HUM) titled “Humana: Recent Selloff Might Present A Buying Opportunity“, this will be the second article of my three-part series where I want to start coverage of three big health insurance providers in the U.S.: Humana Inc., UnitedHealth Group (NYSE:UNH) and Cigna Group (NYSE:CI). This article will be dedicated to UnitedHealth Group.

I highly suggest checking out my article on Humana because that article covered quite some ground regarding the health insurance market and I will refer to that article several times throughout this article.

I will structure this article just like the first one on Humana:

- Business and segment overview

- Financials

- Growth prospects

- Valuation

- Risks

- Conclusion

Business and segment overview

To start, let me quote UNH from the FY2022 10-K report:

UnitedHealth Group Incorporated is a health care and well-being company with a mission to help people live healthier lives and help make the health system work better for everyone. Our two distinct, yet complementary business platforms — Optum and UnitedHealthcare — are working to help build a modern, high-performing health system through improved access, affordability, outcomes and experiences for the individuals and organizations we are privileged to serve.

Source: UNH 10-K – Item 1. Business

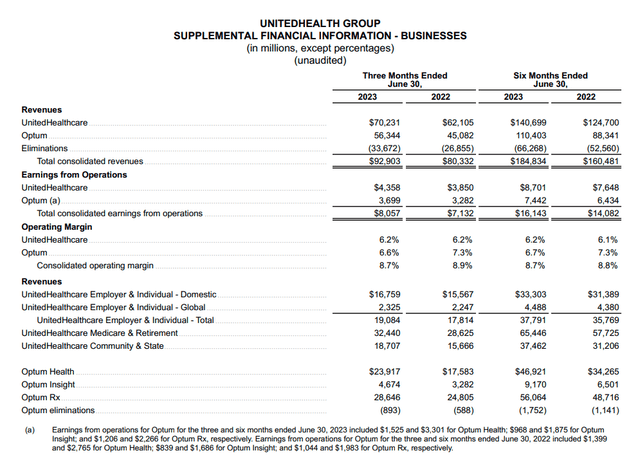

This is how UNH describes itself, a health care and well-being company. They also mention the two business platforms aka segments: UnitedHealthcare and Optum. The following slide from the most recent Q2 2023 earnings release shows how UNH reports earnings:

UNH Q2 2023 Earnings (Q2 2023 Earnings release)

I have to say that this way of reporting is mediocre and I will show you why. Take a look at the “Eliminations” row. This is where the revenue between the business units is eliminated in the consolidation process. This means that the $70,231 million (UnitedHealthcare) and $56,344 million (Optum) revenues are unconsolidated numbers. The problem is that this slide doesn’t show which segment bills services to the other so we can’t see how much external revenue both segments generate. Additionally, this slide doesn’t tell us how much revenue the three different subsegments of Optum (Optum Health, Optum Insight and Optum Ex) generate.

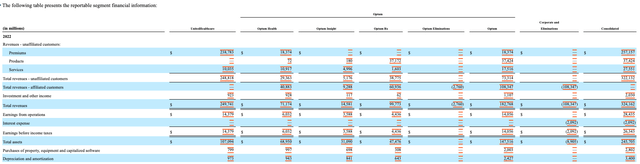

Luckily, UNH does report all of the things I mentioned above in the 10-K/10-Q filings. Let me show you while using the last 10-K filing as an example:

UNH 10-K – 14. Segment Financial Information (UNH 10-K filing)

Here we can see the revenues from “affiliated customers” aka revenue billed inside UNH and from “unaffiliated customers” aka external revenue. The first thing that stands out is that UnitedHealthcare bills zero services to Optum. In my last article on Humana, I pointed out the same. Here is what I wrote:

I want to turn your attention to the intersegment revenue and the “Eliminations”. Total FY2022 revenue from the CenterWell segment amounted to $17,307 million (unconsolidated). $13,373 million were eliminated in the consolidation process because it is revenue billed to the insurance segment. So approximately 77% of CenterWell’s revenue was internal, with only 23% ($3,926 million) being external revenue. If we assume that the Insurance segment billed close to zero revenue and caused close to zero operating costs to the CenterWell segment (which seems reasonable in my opinion), CenterWell made around $500 million in GAAP pre-tax profits off of $3,926 million in revenue.

Source: Author’s article on Humana Inc.

Back then, I assumed that insurance doesn’t bill anything to CenterWell (Humana’s healthcare services segment). In the case of UNH, the reporting shows that this assumption is true for UnitedHealthcare and Optum.

We can also see that total revenue (unconsolidated) and external revenue differ immensely for Optum (for FY2022, numbers in $million):

| Segment | Total revenue | External revenue | Difference |

| Optum Health | 71,174 | 30,291 | 40,883 |

| Optum Insight | 14,581 | 5,293 | 9,288 |

| Optum Rx | 99,773 | 38,837 | 60,936 |

| Total Optum | 185,528 | 74,421 | 111,107 |

Only 40% of Optum’s total revenue is actual external revenue. I addressed the benefits of these interconnections between the business segments in my article on Humana and the same holds here so I will just quote myself again:

What does Humana get out of all these interconnections between their two business segments? I think a good comparison is what Nike (NYSE:NKE) has been doing in the past: cutting out parts of the value chain from how a product goes until it reaches the consumer. If Nike sells shoes directly to the consumer, it cuts out the margin that an intermediary like a retail outlet would take if it were to sell these shoes in Nike’s place. Humana basically does the same. By offering the needed healthcare services itself and cutting out the margins of healthcare service providers, it can either (a) lower prices for premiums, ultimately making the main insurance products more attractive to the consumer or (b) keep the premiums unchanged and improve margins.

Source: Author’s article on Humana Inc.

UNH also reports EBIT for every single subsegment of Optum so that we can calculate the margins for each of the four segments (UnitedHealthcare, Optum Health, Optum Insight and Optum Rx). I will come back to this later.

I will now go over each of the four segments separately.

UnitedHealthcare

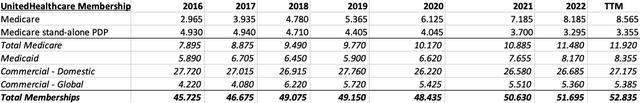

UnitedHealthcare is UNH’s health insurance segment. Health insurance contributes a bit over 50% of consolidated EBIT with Optum (all three segments together) contributing the remaining 50%. I will start with a table showing UNH’s membership structure (numbers in thousands):

UNH medical membership structure (Company reports – compiled by Author)

Please note that around 18.6 million domestic commercial memberships are fee-based with the rest being risk-based. Quick reminder: Fee-based refers to UNH only doing administrative services like handling claims while risk-based means that UNH assumes the risk of both medical and administrative costs for its customers.

As we can see, the biggest membership growth driver (6.4% CAGR from 2016-2022) over the past few years was Medicare (mainly Medicare Advantage). This has also been the case for Humana. Since Medicare will be important later in this article, here is what I wrote in my most recent article:

I want to talk a bit about Medicare because it is the fastest-growing segment for Humana. Medicare is the federal health insurance program for people 65 or older or with disabilities. Medicare is split up into four parts.

Parts A and B are also called original Medicare. Part A is the hospital insurance (that covers most expenses regarding hospital visits/stays) and Part B is the medical insurance. The medical insurance covers doctor’s visits/services, ambulance and preventive care (besides some other things).

Part D is a stand-alone prescription drug coverage plan. You can get prescription drug coverage by signing up for a Part D plan or by signing up for a Medicare Advantage plan. Medicare Advantage is also called Part C. Part C includes Parts A and B (Original Medicare) and additional benefits. These additional benefits can include Part D and special coverage like dental, vision or hearing. So in conclusion, Medicare Advantage (Part C) is the premium version of Medicare.

Source: Author’s article on Humana Inc.

The second largest growth driver was Medicaid (5.6% CAGR) followed by Commercial Global (4.1% CAGR). Commercial Domestic memberships are flat compared to 2016.

A key takeaway is that UNH has better diversification than other health insurance providers. While Humana for example is much more focused on Medicare Advantage, or Molina Healthcare (NYSE:MOH) on Medicaid, UNH has a well-balanced membership profile made up of Medicare, Medicaid, Fee-based Commercial, risk-based Commercial and global Commercial. This might be a reason for UNH’s valuation premium compared to peers.

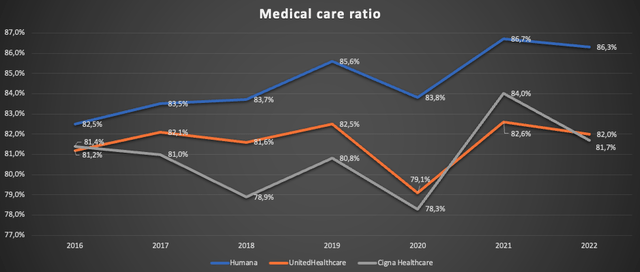

Now I want to turn to the medical expense ratio and I will just use the chart I used in my recent article:

Medical care ratios FY16-FY22 (Company reports – compiled by Author)

This ratio describes the relationship of medical costs for the insured members to the paid premiums. So the lower this ratio is, the better.

Health insurers are required to spend at least 80% of earned premiums on clinical care and quality improvements. This percentage increases to 85% for the large group market (51+ employees). So in conclusion, the sweet spot for efficiency is somewhere above but close to 80%. We can see that UNH managed to stay right in the range of this sweet spot (while showing less volatility than Cigna Healthcare). This shows me that UNH has been doing a very good job managing costs and I have no reason to doubt that they will be able to keep doing so going forward.

Optum Health

Optum Health offers healthcare services through clinical sites, in-home and virtual. The offering includes (besides other things):

- Primary care

- Surgical care

- Urgent care

- Post-acute planning services

- Remote patient monitoring

Optum Health also offers what they call “fully accountable value-based arrangements” where they take responsibility for health care costs in exchange for a monthly premium. This is where we can see a direct connection to the offerings of UnitedHealthcare I described above (risk-based commercial memberships). The same is true for the fee-based commercial memberships I described above because Optum Health also offers administrative fee arrangements where they manage and administer products and services for a monthly fee without taking responsibility for the health care costs.

Lastly, Optum Health offers financial services including health savings accounts. At the end of FY2022, assets under management stood at $20 billion. They charge fees and earn investment income on managed funds.

Optum Health has an incredible track record of growth over the past decade with external revenue growing from $2,644 million in FY2012 to $30,291 million in FY2022 (CAGR: 27.6%) while EBIT has grown from $538 million to $6,032 million (CAGR: 27.3%). I want to highlight that this has been steady growth, not some kind of lumpy growth due to UNH growing through huge M&A deals.

Optum Insight

In my opinion, this is UNH’s crown jewel. Here is how UNH describes this business:

Optum Insight connects the health care system with services, analytics and platforms that make clinical, administrative and financial processes simpler and more efficient for all participants in the health care system. Hospital systems, physicians, health plans, public entities, life sciences companies and other organizations comprising the health care industry depend on Optum Insight to help them improve performance and reduce costs through administrative efficiency and payment simplification, advance care quality through evidence-based standards built directly into clinical workflows, meet compliance mandates and modernize their core operating systems to meet the changing needs of the health system.

Source: UNH 10-K FY2022 – Item 1. Business – Optum Insight

Here is a screenshot from Optum’s website showing the different solutions they are offering:

The total number of offered solutions amounts to 269. I cannot assess the quality of these offerings, but I can say that Optum Insight has been an incredible success story over the past decade. Over the past decade, external revenue grew from $1,894 million to $5,293 million (CAGR: 10.8%). This pales in comparison to the aforementioned numbers from Optum Health but Optum Insight was able to improve margins by a lot. EBIT grew from $656 million to $3,588 million in the aforementioned ten-year timeframe.

FY2022 EBIT margin for Optum Insight came in at 67.8%(!). Take a moment to let that sink in. If Optum Insight would be a separately listed company, growing revenue at low double digits while expanding margins, I could easily see it trading at 30-40 times earnings.

Optum Rx

Optum Rx is basically a pharmacy benefit manager “PBM” (UNH calls it pharmacy care services). A PBM administers your pharmacy plan, negotiates with drug companies for the best medication prices and processes pharmacy claims. Optum Rx operates through its network of more than 67,000 retail pharmacies while also offering home delivery.

In 2022, Optum Rx managed $124 billion in pharmaceutical spending. According to this study from the American Society of Health-System Pharmacists, overall pharmaceutical spending in the US grew to $633.5 billion in 2022. This would put UNH at around 20% market share.

I think that this is a pretty straightforward segment. In my most recent article, I outlined that the elderly population (the ones who should make up the largest part of pharmacy spending) in the US is expected to grow with a CAGR of 3.6% until 2030. Additionally, I guessed that the pricing power for such non-discretionary spending should allow for price increases a bit above GDP growth at around 4%. This would result in around 7.6% growth in the future. Interestingly, this is exactly the kind of growth Optum Rx has been able to achieve over the past five years. External revenue grew from $26,801 million in 2017 to $38,837 million in 2022 (CAGR: 7.7%). The ten-year growth CAGR is distorted because Optum Rx made a huge acquisition in 2015 when they bought Catamaran Corp. for $12.8 billion.

I think Optum Rx is a solid segment but nothing to be too excited about. A growth CAGR in the range of 7-8%, assuming a stable market share, seems reasonable.

Financials

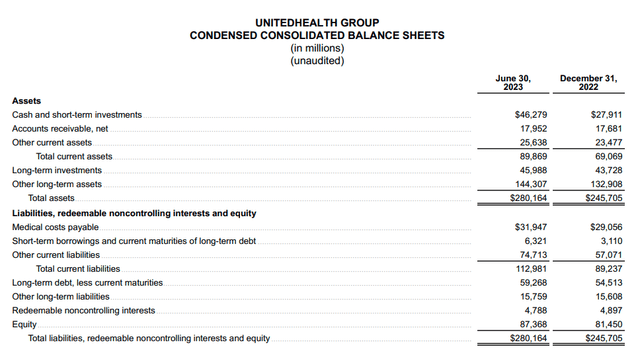

I want to start this chapter by taking a look at UNH’s balance sheet:

Q2 2023 Balance sheet (Q2 2023 Earnings release)

This is not a detailed balance sheet as is reported in the 10-Q filings but it will suffice for our purpose. With $46.3 billion cash and equivalents, $6.3 billion short-term and $59.3 billion long-term debt, UNH’s net debt position currently stands at around $19.3 billion. With TTM adjusted net income (only adjusted for amortization of intangible assets) of $22.2 billion, net debt is less than one year of earnings. This is not as good as Humana (Humana has $2 billion net cash) but still very good.

One thing that I have to highlight negatively is the massive goodwill UNH carries on the balance sheet. In Q1 2023, goodwill amounted to $100.4 billion. That is more than the $87.4 billion of equity at the end of Q2 2023. The goodwill increased a lot over the past decade because UNH has been building up the Optum segment with M&A activity. Now I will show you that this was a good capital allocation.

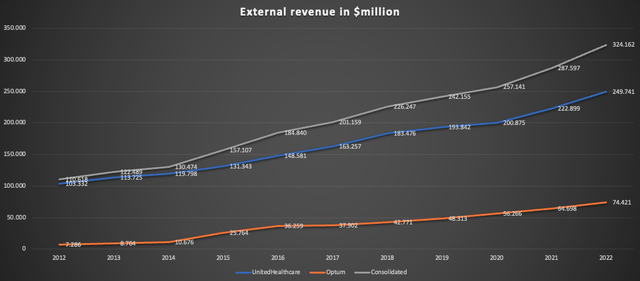

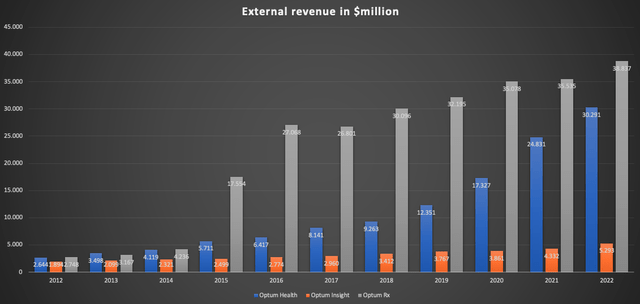

I want to look at two of the most important earnings metrics: External revenue and EBIT. I will start with two simple charts:

UNH External revenue (Company reports – compiled by Author)

Here we can see that UnitedHealthcare revenue grew by 2.5x while Optum’s external revenue grew by 10x over the past decade. Optum started from a small base though. Still, Optum’s growth rate in recent years has been mid-double-digits while UnitedHealthcare “only” grew in the high single-digits.

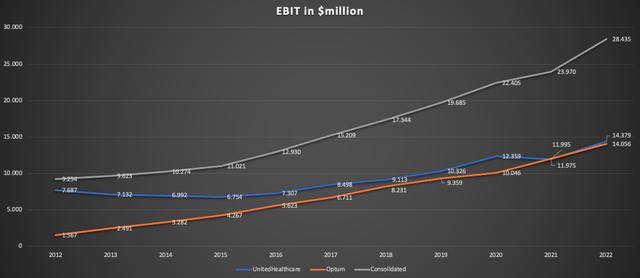

UNH EBIT composition (Company reports – compiled by Author)

This is where it gets interesting. Since UnitedHealthcare is naturally a low-margin business, Optum matches its EBIT despite “only” contributing a bit above 20% to revenues. While UnitedHealthcare margins hover above 5%, Optum’s margins have been a bit under 20% in recent years. If we combine this with Optum’s higher growth rate, it becomes clear that Optum should be the main growth driver going forward (I will address this in more detail later).

I want to continue by taking a closer look at the numbers for Optum’s segments. Here is a chart showing external revenue per Optum segment:

Optum revenue composition (Company reports – compiled by Author)

Here we can see that Optum Rx had two big YoY growth spikes in 2015 and 2016 due to the aforementioned M&A activity. As I outlined earlier, I think that we will see moderate growth rates for Optum Rx going forward.

Optum Insight “only” achieved nearly tripling revenue over the past decade. Due to the very high margins of this segment, this was still a meaningful driver of bottom-line growth.

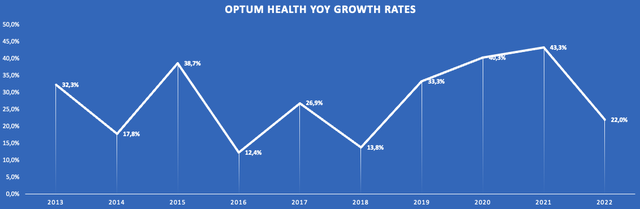

The most important thing is Optum Health’s incredibly consistent growth rate. Here is a chart showing the segment’s YoY growth rate since 2013:

Optum Health YoY revenue growth (Company reports – compiled by Author)

At the lowest, growth rates were in the low double digits.

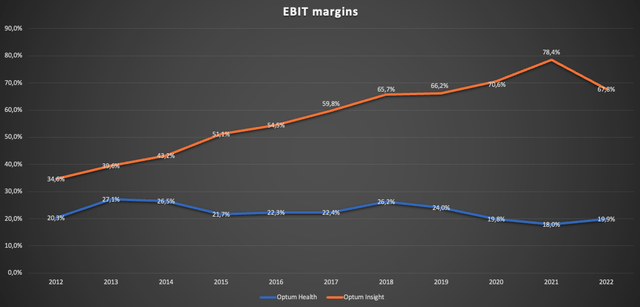

Now I want to turn to margins. I will leave out Optum Rx because margins were pretty consistent at a bit above 10%. Here is the margin development for Optum Health and Optum Insight over the past decade:

Optum Health & Insight EBIT margins (Company reports – compiled by Author)

There are two key takeaways here: (1) While declining a bit over recent years, Optum Health margins are pretty stable so future top-line growth in ranges like shown above should drive earnings meaningfully and (2) the sky-high margin profile of Optum Insight makes every incremental $ of revenue very valuable.

In conclusion, past financial performance was exceptional, especially for a company of this size. The management did a very good job of diversifying the business and expanding into other areas that are interconnected with the main health insurance offerings.

I like to quote from Philip A. Fisher’s book “Common Stocks And Uncommon Profits” when I see something like this:

The investor usually obtains the best results in companies whose engineering or research is to a considerable extent devoted to products having some business relationship to those already within the scope of company activities. This does not mean that a desirable company may not have a number of divisions, some of which have product lines quite different from others. It does mean that a company with research centered around each of these divisions, like a cluster of trees each growing additional branches from its own trunk, will usually do much better than a company working on a number of unrelated new products which, if successful, will land it in several new industries unrelated to its existing business.

Philip A. Fisher – Common Stocks And Uncommon Profits

Lastly, I want to make some comments on business quality. As I mentioned in my prior article, I usually use return on capital employed (ROCE) to gauge business quality. Because UNH has a big insurance business, we can also look at the return on equity (ROE). UNH’s ROE stood at 25% in FY2022 (and also stands at 25% for the TTM), up from 20% in FY2016. This is a decent number but not as good as for more capital-light businesses. In the comment section of my prior article, one of my readers pointed out that ROE in the mid-double-digit percentage range is very good. I agree. This also becomes obvious by looking at the peer group. I will save this for another day though.

Growth prospects

Since I already outlined my thoughts on Optum Rx earlier in this article, I will focus on the other three segments: (1) UnitedHealthcare, (2) Optum Health and (3) Optum Insight.

(1) UnitedHealthcare

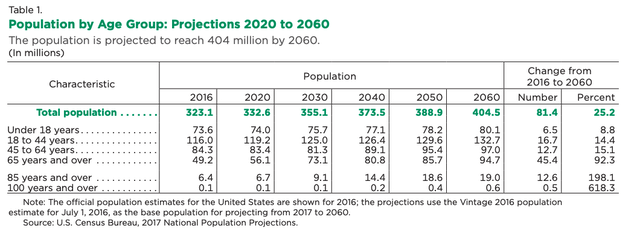

Most of what I wrote in my prior article on Humana also holds for UNH so I will keep this short. As Humana has big exposure to Medicare Advantage, I argued that organic growth excluding pricing power should be at least equal to the growth rate of the population aged 65+. UNH is much more diversified so insurance membership growth has to be gauged at a broader scale. Since UNH caters to all age ranges, I think population growth in the age ranges 18-85 might be reasonable (basically the U.S. working force plus the Medicare-eligible population). Here is a table showing estimates for U.S. population growth by age range (Source Link):

U.S. Population projection by age group (U.S. Census Bureau)

If we only take the age ranges 18-44, 45-64 and 65-85, the CAGR from 2020 to 2030 is a meager 0.71%. Nothing to be excited about. Taking into account that Medicare has been UNH’s fastest-growing segment, we might be able to project organic growth excluding price increases of around 2% (assuming zero market share gains/losses).

Regarding pricing power, I will again assume that price increases a bit above GDP growth seems reasonable. With GDP growth around 2-3%, 4% growth through price increases seems reasonable to me. Combined with the aforementioned 2% TAM growth, I think 6% organic growth seems reasonable and conservative (again: all of this assumes zero market share gains/losses). This is below the 9% growth rate we have seen over the past decade.

(2) Optum Health

At the 2022 Investor Conference, UNH described the growth outlook for Optum Health as followed:

Our comprehensive care platform strongly positions us for consistent growth, across geographies and populations, over the next decade. As we accelerate the shift to fully accountable arrangements, we expect to deliver double-digit revenue growth on average and continued long-term operating margin profile in the 8% to 10% range going forward.

Note that the 8-10% margin profile was calculated by using total revenue instead of external revenue as the denominator. So UNH expects double-digit revenue growth with unchanged margins.

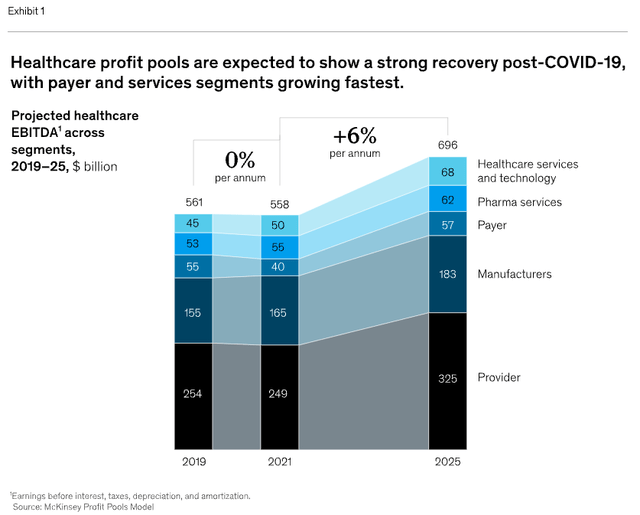

The following chart from this McKinsey article (July 19, 2022) shows projected healthcare EBITDA from 2019 to 2025 by segments:

Projected healthcare EBITDA 2019-25 (McKinsey)

Healthcare provider EBITDA was projected to increase from $249 billion in 2021 to $325 billion in 2025. This would be a CAGR of around 7% which is far below the growth rates Optum Health has shown over the past decade. In conclusion, a meaningful amount of Optum Health’s growth must have been a result of M&A activity.

According to this article, Optum closed a $5.4 billion deal for LHC Group, a company offering home and community-based care, this February. Another recent deal is the acquisition of Amedisys Inc., another company that provides healthcare services.

The main question will be if UNH can continue this shopping spree. According to this Seeking Alpha news article, the Justice Department recently started a monopoly probe of the managed-care industry. This will be something to look out for. However, even with higher hurdles regarding M&A activity, a low double-digit growth rate for Optum Health seems reasonable since the underlying industry is already growing at 7% per year.

(3) Optum Insight

Let us again begin with UNH’s statement regarding Optum Insights’ growth outlook at the 2022 Investor Conference:

Even as Optum Insight continues to invest in advanced technologies and more comprehensive services, we expect to average double-digit revenue growth over the long term. Our current products and solutions, competitive positioning and diverse capabilities contribute to continued growth in our sales pipeline and revenue backlog, which is the demand for Optum Insight’s products and services. We target operating margins of 18% to 22%, as our customers look to us for more comprehensive solutions.

Again: The 18-22% margins were calculated by using total revenue instead of external revenue as the denominator. A 20% margin should be equivalent to a 50-55% margin using external revenue as the denominator. Over the past decade, Optum Insight achieved a low double-digit CAGR. If we take a look at the projected EBITDA growth from the McKinsey chart earlier (Healthcare services and technology), the projected CAGR from 2021 to 2025 was 8%. So again, UNH seems to factor in M&A activity. In October 2022, Optum made an $8 billion deal by buying Change Healthcare, a company that provides data and analytics-driven solutions. With the underlying market growing at 8%, UNH’s target of double-digit revenue growth seems achievable if they can keep making smaller deals in the future.

One thing to keep in mind though is that Optum Insight’s growth is, due to the high margins, very high-quality growth.

Valuation

With 940 million shares outstanding (Q2 2023 diluted) at the current price of $502.91 per share, UNH’s market cap amounts to $472.7 billion. I will use adjusted net earnings because the only adjustment that is made to GAAP earnings is the addition of the amortization of intangible assets and the associated tax effect. Adjusted net earnings came in at $22.2 billion for the trailing twelve months [TTM]. So UNH is currently trading at around 21 times TTM earnings.

TTM free cash flow [FCF] amounted to $37.2 billion. This isn’t representative though because over the past couple of years, UNH’s cash conversion hovered a bit above 100%. Assuming a normalized cash conversion of 100% in line with the past, UNH currently trades at a normalized FCF yield of 4.7%.

As I always say, long-term return potential excluding valuation changes should be the sum of the FCF yield and the estimated future growth rate. We need to exclude effects from M&A activity since it is an effect of capital allocation and lowers FCF to shareholders (what the company can pay out to us). By excluding M&A activity, any merger or acquisition would pose a possible upside to our investment case.

Now we need to gauge a growth rate. Here is what I outlined throughout this article regarding possible top-line growth of the segments:

- UnitedHealthcare: Around 6%

- Optum Health: 7%

- Optum Insight: 8%

- Optum Rx: 7-8%

The fact that Optum should grow a bit faster than UnitedHealthcare offers some room for margin expansion since Optum margins are higher. Let’s just assume a conservative growth rate of 7%, quite below the 10-11% achieved in the past. In this scenario, long-term return potential should be close to 12% (7% organic growth + 4.7% FCF yield).

As this assumes no changes in valuation, we need to perform a supplemental DCF valuation to gauge the possible effects of valuation changes.

DCF Valuation

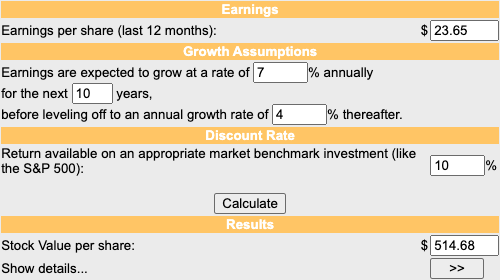

TTM adjusted earnings per share stand at $23.65. As we assumed 100% cash conversion, we can use the same number as FCF per share. Here is a simple DCF calculation assuming $23.65 FCF per share, 7% growth over the next 10 years, 4% growth into perpetuity and a 10% discount rate:

DCF Calculation (moneychimp.com)

With the aforementioned assumptions, UNH seems to be slightly undervalued at the current price of $502.91 per share.

Risks

I want to address risks for UnitedHealthcare and Optum separately.

(1) UnitedHealthcare

I outlined risks for the health insurance providers in detail in my Humana article so I will just sum it up for your convenience. There are three types of risks for this segment and they are all related to regulations:

(a) Drug price regulation: Lower drug prices will naturally lead to lower premiums. This would mean lower revenue, lower earnings and lower margins.

(b) Healthcare system change: A switch to a single-payer model.

(c) Medical care ratio regulation: Health insurance providers get forced to spend a bigger percentage of premiums (currently at least 80%) on clinical care and quality improvements. This would cause be disastrous to the bottom line of all health insurance companies.

However, I rate these risks low because of the high political hurdles to bring any of these regulations.

(2) Optum (especially Optum Health and Optum Insight)

The risks for Optum are all connected to M&A activity. As I outlined in the “growth prospects” chapter, Optum Health and Optum Insight will only be able to achieve the targeted growth rates if they (a) can find good acquisition opportunities and (b) are allowed to do these deals.

(a) is a question for UNH’s management. As they have a tremendous track record, I rate this risk rather low.

(b) is again a regulatory risk. The recent news that the Justice Department is already looking at the managed-care industry might be a warning. As I outlined earlier, Optum Rx for example seems to have around 20% market share in the pharmacy services segment (which is huge when we consider that pharmaceutical spending is around $633.5 billion). This shows the kind of scale UNH has already achieved and makes it a perfect target for any kind of monopoly probe. I do rate this risk as high so this is something that should be monitored.

Conclusion

Since this is a three-part series, I want to make some comments regarding the comparison to Humana. The main differences are risks and diversification. Humana is highly concentrated on Medicare Advantage, the fastest-growing health insurance market segment, while UNH is much more diversified over several healthcare market segments. Regulatory risks for health insurance operations, which I rate low, are the same for both companies. What makes UNH a riskier investment is possible regulation regarding M&A activity for the Optum segment. This is due to UNH being such a big player in the managed-care industry.

However, even without any M&A activity, UNH’s served markets are supposed to grow in the 7% range (on a consolidated level) with possible upside through M&A and margin expansion on the consolidated level.

Should you own one or both? I tend to favor Humana due to the better balance sheet, less regulatory risk, and cheaper valuation. Personally, I have a position in both companies (of the same size).

To conclude this article, I rate UNH a buy.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of UNH, HUM either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Any material in this article should not be relied on as a formal investment recommendation. Never buy a stock without doing your own thorough research.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.