Summary:

- UnitedHealth Group’s stock experienced a 6.5% drop following CFO John Rex’s outlook for higher medical costs, as care activity returns to normal post-pandemic.

- The Medical Care Ratio is expected to rise as patient utilization increases, but the overall impact on UnitedHealth Group’s future profits may not be significant.

- Despite the recent selloff, I maintain a Strong Buy rating for UnitedHealth Group, expecting the stock to recover to its average valuation soon.

Wolterk

It’s been four days since John Rex, UnitedHealth Group’s (NYSE:UNH) CFO, sent managed care players to a major selloff. Following his outlook for higher medical costs caused by the return to pre-pandemic behavior of insurers, UnitedHealth Group saw its stock plummet by 6.5%, one of the steepest one-day declines the stock has experienced in years.

As UNH stock trades 8.5% below its 5-year average multiples, the question that’s on investors’ minds is how significant is the impact of the projected higher medical costs on UnitedHealth Group’s future profits.

So, let’s quantify the impact of higher medical costs, and examine whether or not the selloff was justified.

Background

I started covering UnitedHealth Group on Seeking Alpha in February, with a Strong Buy rating. In my first article, I discussed my investment thesis and explained the company’s business model. In my second article, I focused on the valuation methodology I believe is the right one for the company and provided an updated financial model following the company’s Q1 earnings.

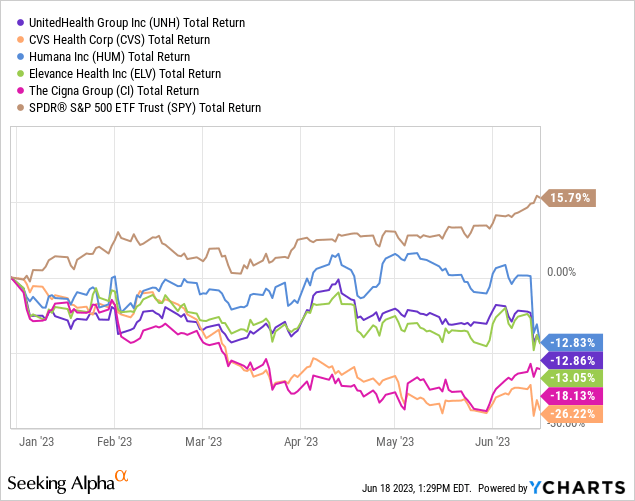

Unfortunately, so far, UnitedHealth Group has significantly underperformed, along with other managed care peers, as headwinds like regulation, star ratings, and higher medical costs, continue to pile up.

After a year of significant outperformance in 2022, the underperformance was inevitable, and in essence, it was a healthy correction that sent the sector to more reasonable valuations. However, after the John Rex selloff, UnitedHealth Group is now trading at a P/E multiple that it hadn’t seen in years.

The question is if the current earnings projections are still viable considering the outlook for higher medical costs. If they are, we have the opportunity to buy a company that grows EPS at a mid-teens pace, for what is a historically cheap price.

Medical Care Ratio Explained

Let’s begin with the basics of what is all the fuss about. Medical care ratio (MCR), also referred to as medical benefit ratio, or medical cost ratio, is used to measure the profitability of a health insurer. MCR is calculated by dividing the insurer’s care expenses by the premium revenues it collected. A high ratio reflects lower profit, and vice versa. Typically, MCR will be in the range of 80%-85%, as health insurers are regulatory obliged to pay out at least 80% of their premiums.

The main variable that determines the MCR trend is patient utilization. Especially in the U.S., the availability of care is not constraining the patient’s ability to utilize their coverage. Thus, when people are sicker, utilization goes up, just like what we saw with the flu spike in the first quarter.

Additionally, and more relevant to our discussion, when people feel safe going through more discretionary procedures, utilization increases, and consequentially, MCR will rise as well.

After three years of limited utilization caused by the pandemic, UnitedHealth’s CFO is indicating that people are now more comfortable going to the hospital, leaving their houses, and dealing with some lingering non-critical health issues.

Understanding The New Outlook

Let’s begin with understanding exactly what new information was provided in the Goldman Sachs conference, that resulted in the selloff. In other words, what did John Rex say?

We saw higher levels of outpatient care activity. Things like hips, knees, cardio. And the other place that we’ve seen stronger care activity is in our Optum health behavioral business. Looks like a little bit of pent up demand or delayed demand being satisfied. As you look at Q2, you would expect Q2 medical care ratio to be somewhere in the zone of probably the upper bound or moderately above the upper bound of our full year outlook. The full year would probably settle in, in the upper half of the existing range that we set up. We saw that as likely at some point post-pandemic, and the question was which quarter would you see that occur. As it came out to be, it’s not really impacting the ranges of the full year that we’ve set up, but more impacting what we’re seeing right now. We are super respectful of the trends that we’re seeing and not assuming that those abate right away, and that is the reason why we built it into our 2024 plan.

— John Rex, UnitedHealth Group CFO, Goldman Sachs Healthcare Conference [edited by the author]

So, in essence, what was a tailwind during the last few years is now becoming a headwind, as seniors are less afraid to go through some delayed procedures. It’s important to note that it was clarified that the higher medical costs are solely a result of pent-up demand, as opposed to higher unit costs or higher activity in acute care. All things considered, this was expected, and the impact for the year isn’t that significant, as reflected by the fact the initial guidance for the whole year was reaffirmed.

Quantifying The Impact On Future Profits

UnitedHealth Group has been providing Americans with health insurance for 6 decades. The company is the largest insurer in North America and one of the largest care providers in the world.

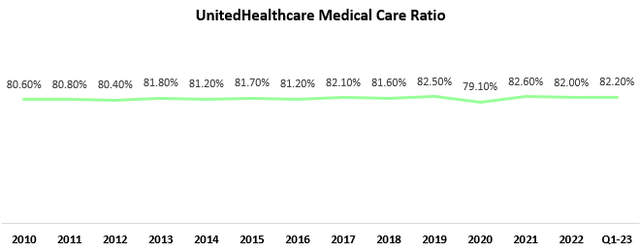

Created by the author using data from UnitedHealth Group financial reports (10-K)

Being one of the largest insurers in the world, the company’s MCR is quite stable in the 80.0%-83.0% range. We can expect to see MCR rise to around 82.8% in Q2, before declining back to the lower 82.0% for the rest of the year. On paper, this doesn’t seem that scary.

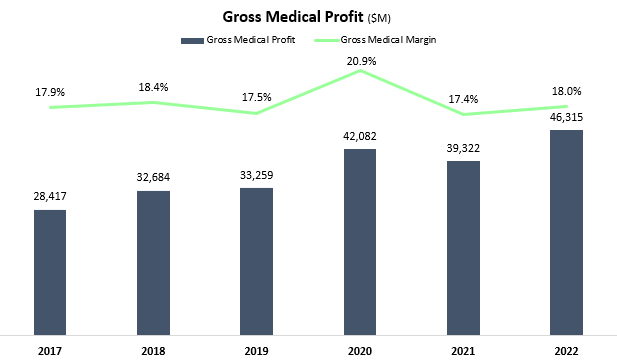

Created and calculated by the author using data from UnitedHealth Group financial reports (10-K); Gross Medical Profit is calculated by subtracting medical costs from total premium revenues.

Looking at the opposite side of MCR, we see just how extraordinary was 2020 for UNH’s insurance business, achieving a non-recurring record of 20.9% gross medical margin. In the foreseeable future, we should expect to see the group in the 17%-18% range. Considering the new outlook provided by the CFO, it’s reasonable to expect Q2-23 gross medical margin will be around 17.5%, after dropping to 17.8% in the first quarter. Additionally, the full year will end somewhere between Q1 and Q2, at around 17.6%.

So let’s put the increase in MCR into context. Had the company’s MCR in 2022 been 82.8%, which is the high end of expectations for what should be an elevated Q2, total operating profit would decrease by $2B or 7%. And what do you know, the stock dropped by approximately 7% since the announcement.

The Implications Of Higher Medical Costs On Valuation

In short, in my view, there should have been no implications. The higher medical costs were expected by UNH and other health insurers as well. The company’s guidance for the year is based on those higher levels and with its Optum businesses most of the medical cost impact should be offset. The only new information we really received was that Q2 should be the lower end of the trough.

Investors in health service companies have been flooded with bad news in 2023, seeing their outperformance in 2022 evaporate in front of a Big-Tech surge. Even though it has been a hard year, my investment thesis in UnitedHealth Group hasn’t changed. The company should be able to easily beat its $23.75 EPS guidance, which means it is currently trading at a forward P/E multiple which is significantly below its 5-year average.

Thus, I reiterate a Strong Buy rating and expect the stock to recover at least to its average valuation in the near future.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of UNH either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.