Summary:

- Management’s optimistic guidance is unrealistic given industry trends and the significant risk from PBM legislation impacting profitability.

- UnitedHealth’s growth expectations are unsustainable at scale, with market growth rates suggesting a much lower CAGR than management’s projections.

- Despite potential upside from Optum Insights and Optum Health, the risks outweigh the benefits, especially with major legislative and lawsuit challenges.

Luis Alvarez

I am initiating coverage on UnitedHealth Group (NYSE:UNH) (NEOE:UNH:CA) due to its rapid share price rise over the past three months.

UnitedHealth Group is an integrated healthcare company with two primary business units. UnitedHealthcare offers various health insurance plans to businesses, individuals, and government programs. Optum Health is a value-based healthcare organization with technology, integrated care, and Rx divisions.

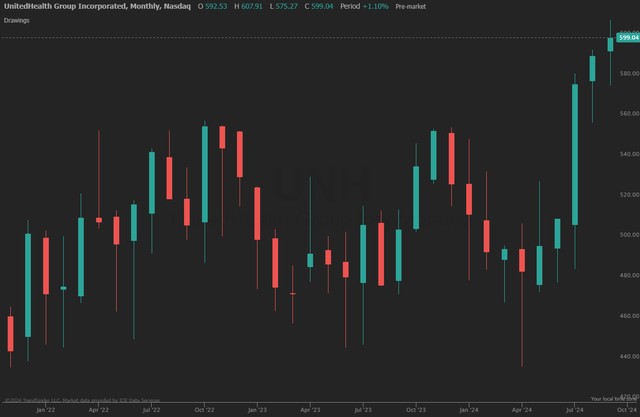

UnitedHealth Group is up nearly 25% this year, with most growth occurring between July and September following well-received Q2 results.

UNH Price Trend (TrendSpider)

I believe that much of this run-up in price was justified; however, UnitedHealth has now moved past its fair valuation. Based on my research, management guidance is overly optimistic relative to industry trends, especially in light of UnitedHealth’s existing scale.

In addition, the growing wave of Pharmacy Benefit Management (PBM) legislation represents a material risk to the business. While there is additional upside potential from the Optum Health and Insights business, as well as favorable seasonality in the upcoming quarter, this is outweighed by the industry risk.

I rate UnitedHealth Group a sell at a DCF-generated price target of $575.

Valuation

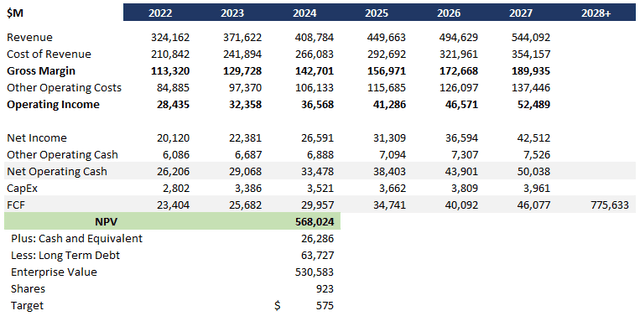

I ran a DCF analysis on UnitedHealth Group with the following overall assumptions:

- Growth rate half-way between management guidance and market growth (methodology detailed in Industry analysis below) with growth weighted more heavily towards earlier years based on scale.

- Slight margin expansion of 20 to 30 basis points per year based on management guidance.

- Discount rate of 7% based on estimated WACC.

This analysis generates a price target of $575, 4% downside from today’s pricing.

UNH Discounted Cash Flow Analysis (Data: Seeking Alpha; Analysis: Mike Dion)

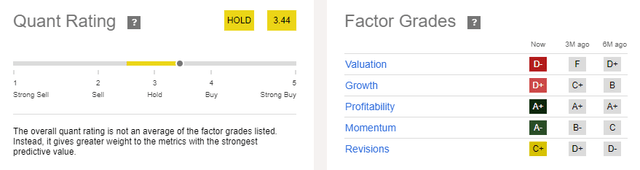

The quant rating is slightly more optimistic at a hold; however, this is giving large weight to the momentum in share price over the past few months. Excluding that, I would argue this drops closer to a sell given the unfavorable valuation and growth ratings.

UNH Quant Rating (Seeking Alpha)

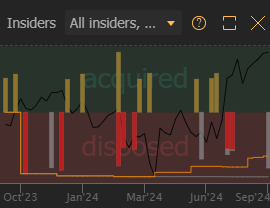

Insider activity is also largely unfavorable, suggesting a lack of confidence that the price can go much higher.

UNH Insider Activity (TrendSpider)

PBM Legislation Is Material Risk

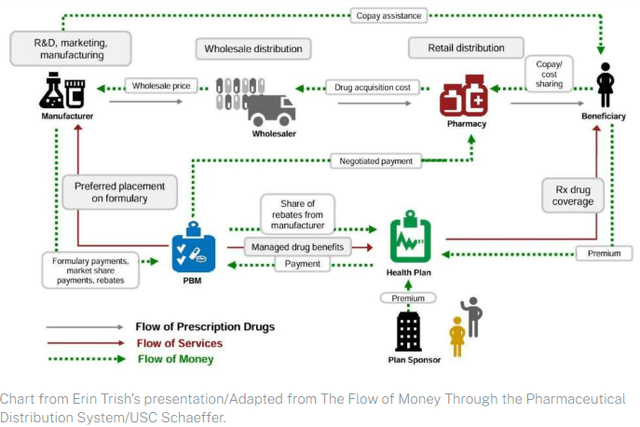

OptumRx operates as a pharmacy benefit manager (PBM) which is a middle man between health plans, pharmacies, and manufacturers. PBMs generate profit by negotiating formularies and rebates and retaining part of the premium. When blended with a health-plan such as Optum and UnitedHealthcare, they can find even more ways to widen profit margins.

Pharmacy Benefit Manager Model (Erin Trish Adapted From USC Schaeffer)

Ultimately, the profitability comes at the expense of consumers and health plan sponsors, who pay more at the pharmacy and more in premiums than many believe they should.

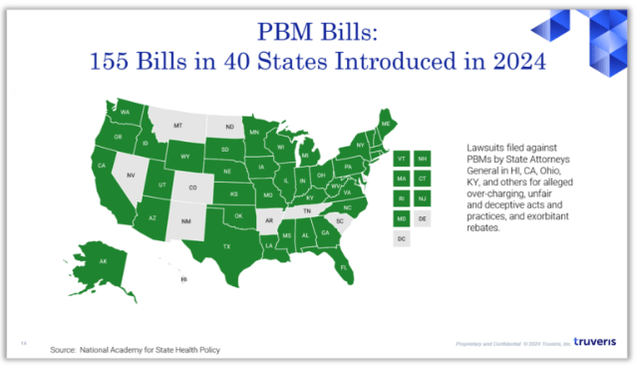

With that in mind, state attorneys have filed lawsuits against PBMs and state and federal legislatures have introduced more than 155 bills in the first half of 2024 alone targeting this business model.

PBM Legislation (Truveris)

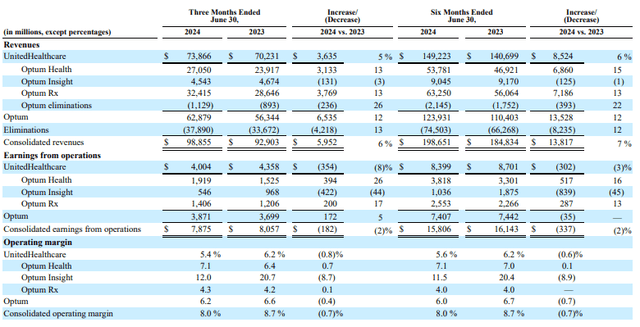

OptumRx represents roughly $5 billion in direct profit for UnitedHealth Group, not to mention any benefits flowing through to the bottom line of UnitedHealthcare. A change to this business model risks what is currently more than 15% of profitability

Revenue and Earnings By Business (UNH Investor Relations)

Management has guided 5 to 8% revenue growth with stable operating margins. I do not believe this is reasonable, given the amount of legislation and lawsuits in progress against the business model.

Industry Trends Don’t Support Growth Expectations

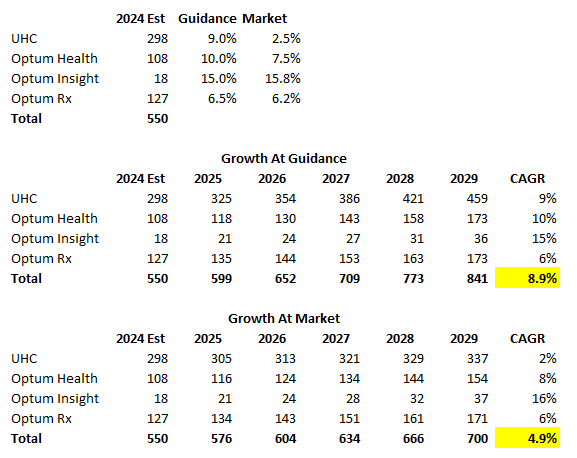

Beyond the PBM business model risk, I cannot support management’s guidance within the context of the overall industry. At a large scale, companies will struggle to grow ahead of the market for long periods of time, purely as a function of their scale and competition.

With that in mind, the overall market becomes somewhat of a ceiling on long-term growth potential. So let’s look at each industry in which UnitedHealth Group operates.

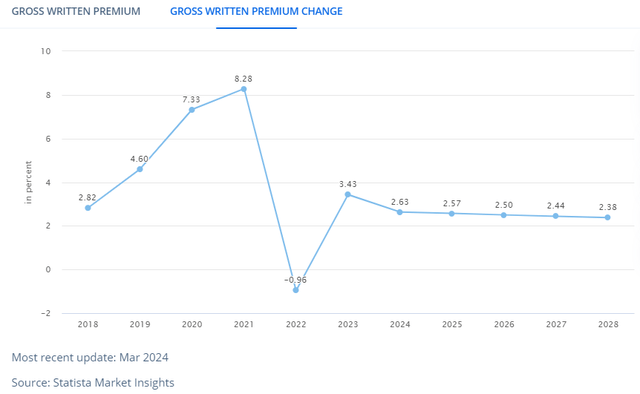

Overall health insurance premiums are expected to grow between 2 and 3% over the long run. This is UnitedHealthcare’s market.

Gross Written Premiums For Health Insurance (Statista)

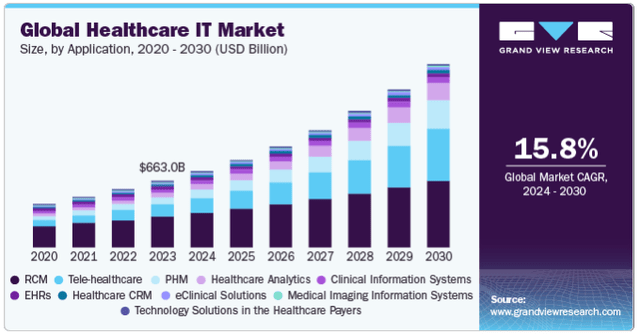

The healthcare technology market is the strongest, expected to grow at 15.8%. This is Optum Insight’s market.

Healthcare Technology CAGR (Grandview Research)

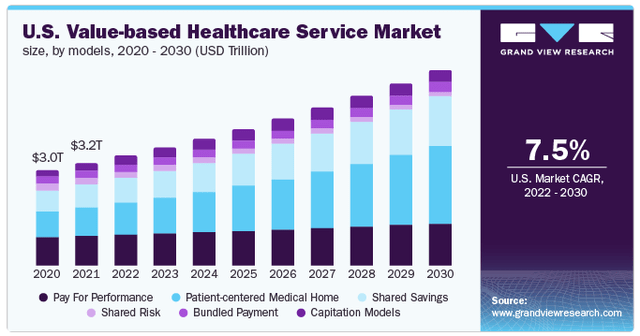

Value-based healthcare is expected to grow at 7.5%. This is Optum Health’s market.

Value-based Healthcare CAGR (Grandview Research)

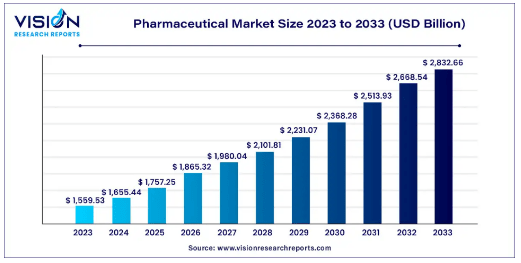

And pharmaceuticals are expected to grow at 6.2%, not accounting for any impacts from PBM legislation.

Pharmaceutical CAGR (Vision Research)

Blending this all together, market growth would suggest a CAGR of 4.9% versus the 8.9% CAGR implied by management guidance. Well short of what the company needs to drive upside in pricing.

UNH Growth By Business (Data: UNH Investor Relations; Analysis Mike Dion)

Alternate View

Optum Insights and Optum Health are the company’s best chance for breakout success. Given that the healthcare technology industry is extremely diversified, UnitedHealth’s scale could play to its advantage with breakout programs that drive network effects and grow faster than the market.

Optum Health could also create a network to compete with players like Kaiser Permanente and HCA that would not only drive growth but also drive synergy value for the health insurance group.

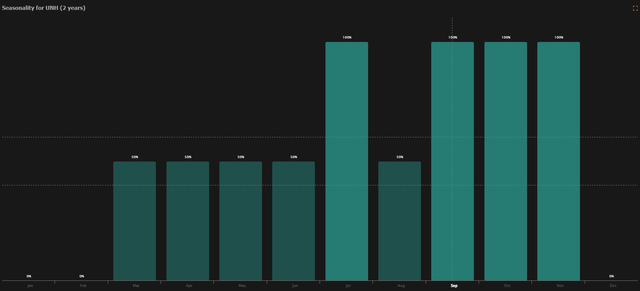

It is also worth noting that September to November has historically been the best performance for UnitedHealth Group.

UNH Seasonality (TrendSpider)

Verdict

In my opinion, UnitedHealth Group’s guidance is overly optimistic and assumes nearly everything goes right. Investors need to consider major legislation and lawsuits for PBMs, as well as industry growth rates that don’t support management aspirations, especially at scale.

While there are businesses that could drive upside, specifically Optum Insights and Optum Health, neither is showing breakout growth and any growth would be balanced against risks in the other businesses.

With a price target of $575, I rate UnitedHealth Group a sell.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.