Summary:

- My investment strategy involves buying stocks with good growth prospects and clean balance sheets when they trade below their mean valuation, and selling them when overvalued.

- UnitedHealth Group is a solid business with lower than average growth prospects, but its current valuation is unhealthy, limiting upside potential.

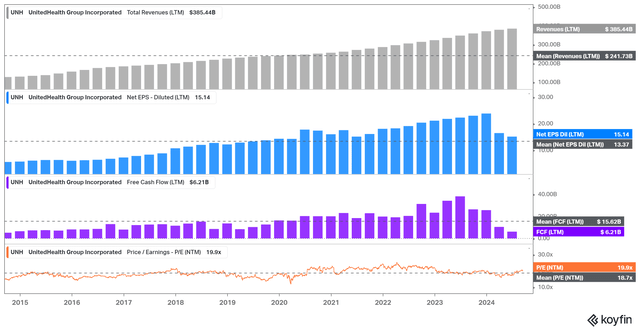

- While growth prospects are below their average, the valuation is above its average. The same applies to financial data, such as free cash flow.

- UNH’s potential returns are rather uninspired and could decline further if analysts revise their estimates downward.

Wolterk

Thesis

My investment strategy is simple: buy stocks that have good growth prospects, clean balance sheets, and a (long-) established business model when they trade below their mean valuation, and hold them as long as they stay below or at their fair valuation. If the growth prospects deteriorate or the valuation reaches unhealthy levels, I sell them and put them on my watchlist to buy them again when the valuation drops below the mean again. I followed this approach with UnitedHealth Group (NYSE:UNH) – I avoided it during 2021, 2022, and 2023 (even though I liked the business) and bought it in April 2024 when the valuation dropped sharply, below the mean and fair valuation. Now I am selling it again.

UNH is still a great business, and its growth prospects are far from bad. However, due to recent increases in stock price, the valuation is at unhealthy levels again, increasing the downside risk and limiting upside potential.

United Health Group – A quick company overview

I won’t go into too much detail in the company overview since this article is meant to be more of a valuation and potential return update rather than a fundamental analysis of the company.

UNH is a leading American health care and well-being company that provides diversified health care services. Headquartered in Minnetonka, Minnesota, UnitedHealth Group operates through two primary platforms:

UnitedHealthcare: This division offers health care coverage and benefits services, providing health benefit plans for individuals and groups, including commercial, government (Medicare and Medicaid), and international markets. UnitedHealthcare is one of the largest health insurers in the United States.

Optum: This division focuses on health care services, technology, and information. Optum is divided into three sub-segments: OptumHealth (health care delivery and wellness programs), OptumInsight (data analytics, technology services, and consulting), and OptumRx (pharmacy care services). Optum’s data provides innovative solutions to improve health outcomes and the quality of care while lowering costs.

Market Position: UnitedHealth Group is a Fortune 500 company and the largest health care company in the world by revenue. It operates in all 50 states in the U.S. and around the globe, covering over 150 million individuals worldwide. The company continues to expand its services through acquisitions, partnerships, and investments in digital health solutions.

Recent Earnings

In the most recent quarter, UnitedHealth Group reported earnings that exceeded Wall Street expectations:

Revenue: The company reported revenue of $98.86 billion, a 6.41% increase YoY. This growth was driven by the expansion of both UnitedHealthcare and Optum segments. UnitedHealthcare’s revenue increased due to growth in members served and premium increases, while Optum benefited from growth in its care delivery and pharmacy services.

Earnings per share (EPS): UnitedHealth Group reported an adjusted EPS of $6.80, exceeding analyst expectations. The stronger than expected earnings were attributed to increased membership in its Medicare Advantage plans, higher premiums, and cost management initiatives.

Operating Margin: The operating margin remained stable at around 8.5%, reflecting effective cost controls despite rising medical costs and ongoing investments in technology and infrastructure.

Guidance: The company raised its full-year earnings outlook, citing continued growth in its key business segments and operational efficiencies.

I can recommend this article by Yuval Rotem. He provides more detail and presents an investment thesis for 2025, which looks further into the future than my rather short-term article/view of the company.

Current valuation

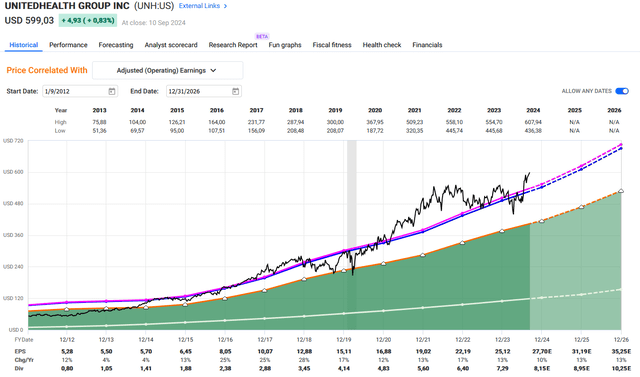

Looking at the current valuation, UNH is trading significantly above its historical mean of the last ten years.

Price vs Historical P/E (FAST Graphs)

As shown in the FAST Graphs chart, a rapid recovery in the stock price quickly moved it from undervaluation to overvaluation. Looking at the next twelve months (NTM) using analysts’ projections, the valuation appears a bit better:

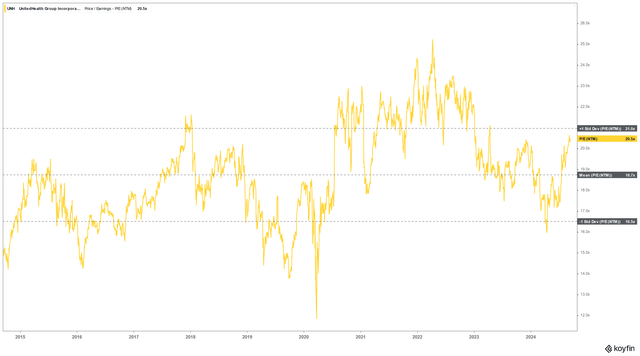

NTM valuation against mean – UNH (koyfin.com)

Here, you can see the 10-year chart of the NTM P/E valuation. The 20.5x NTM P/E is below the current P/E of 22.3x, which implies that analysts expect higher earnings. However, the mean of the last ten years for the NTM P/E is 18.7x, which makes the current valuation almost 10% above the mean. Except for one instance in 2018 and the period from 2021 to 2023, UNH could have been bought cheaper at any other time.

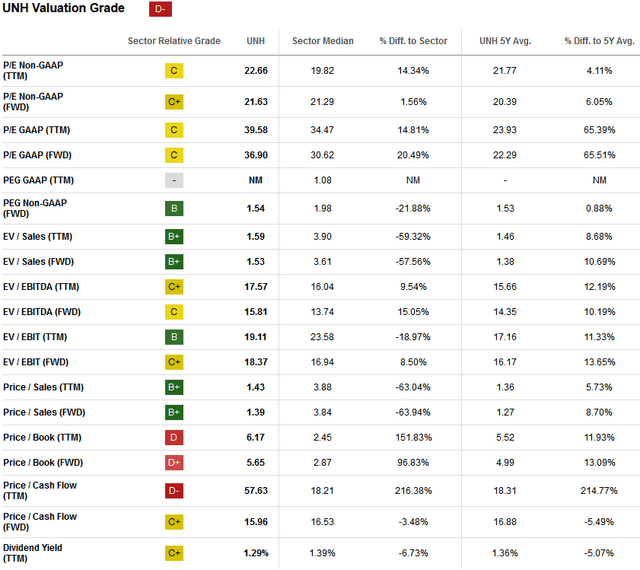

The valuation section on Seeking Alpha also reflects this:

valuation metrics (seekingalpha.com)

With a few exceptions, UNH’s current valuation metrics exceed both its own historical averages and the sector averages.

Comparing the valuation to the fundamentals

Valuation alone isn’t sufficient to assess whether a stock is overvalued. Let’s compare it to the fundamentals to determine if a higher valuation is justified:

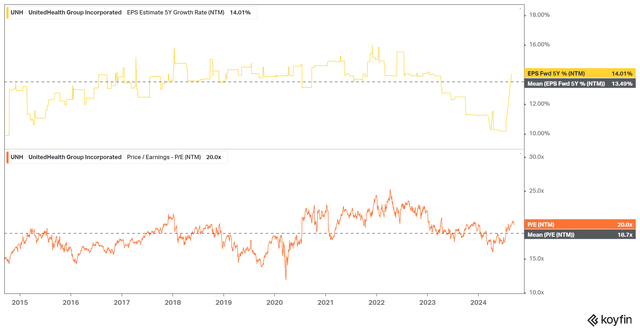

Valuation against the 5-year estimated growth rate of EPS (koyfin.com)

The estimated 5-year growth rate is 3.7% above the mean of the last 10 years, while the NTM valuation is 7% above the 10-year mean. This indicates that it is somewhat overvalued, but not dramatically so.

Revenue, EPS, FCF against valuation (koyfin.com)

Looking at the financials, we see that only the free cash flow is significantly below the mean. Compared to the valuation, this is not a good sign, as free cash flow is an indicator of operational health.

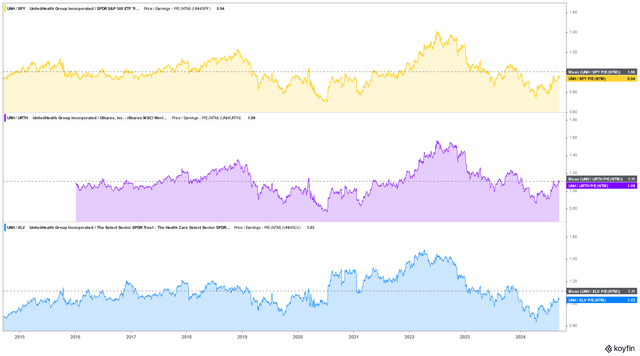

UNH relative valuation (koyfin.com)

In the chart above, you can see the valuation of UNH compared to the S&P 500 (yellow), MSCI World (violet), and the healthcare sector (blue). Over the last ten years, UNH has traded at the same valuation as the S&P 500 on average. Currently, it sits slightly below the average at 0.94x. This suggests that UNH is fairly valued compared to its historical average, but we must consider that the S&P 500 currently has a P/E of 28.2 against a ten-year average of 23.9x, which makes it overvalued itself. Looking at the MSCI World, UNH sits at a 1.09x valuation, compared to an average of 1.11x. Against the healthcare sector, UNH had an average valuation of 1.11x and currently sits at 1.03x. These numbers suggest that UNH isn’t more expensive than the market or sector, but we must consider that the overall market is quite expensive right now.

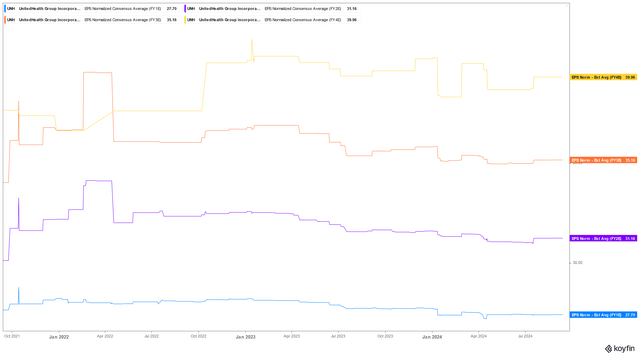

Analyst’s predictions

UNH analyst’s predictions (koyfin.com)

Apart from the fourth forward year, analysts have continuously lowered their expectations for EPS since 2022. In terms of year-over-year (YoY) growth, analysts expect 10% growth in 2024 and 13% growth in 2025 and 2026.

UNH YoY EPS growth (FAST Graphs)

A growth rate of 10-13% is on the lower end of the past EPS growth range. There have been worse years with negative growth or low growth of just 4%, but there have also been significantly better years. I believe the future growth predictions are rather uninspiring and too low given the current valuation.

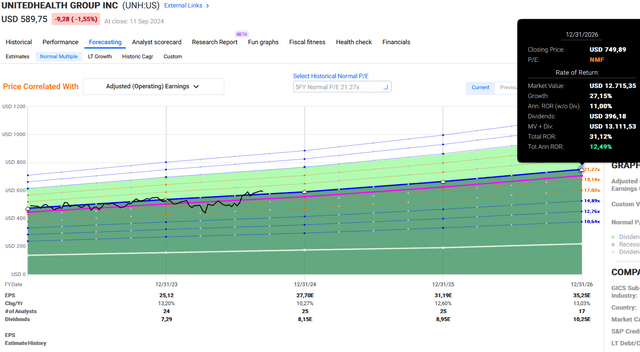

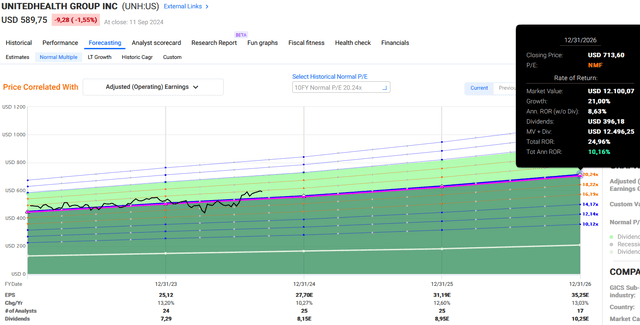

Potential returns

I prefer to assess potential returns by using FAST Graphs, which combines P/E averages with analysts’ estimates to provide a potential total return. Using the adjusted EPS average of the last five years and multiplying it by analysts’ EPS consensus gives us a potential annual total return of 12.5% until the end of 2026.

UNH potential total return with five year average (FAST Graphs)

Using the average of the last ten years (which I find more plausible) results in an annual total return of just 10.2% over the same period:

UNH potential total return with ten year average (FAST Graphs)

In my opinion, both returns are rather uninspiring. For such returns, you could also invest in an MSCI World ETF with significantly less risk and less time commitment.

Even if we assume that UNH would exceed expectations by 10%, potential returns remain limited. According to the data, analysts were correct 75% of the time with one-year forward predictions and 67% accurate with two-year predictions:

Analyst scorecard (FAST Graphs)

A price around $500 would position the stock slightly below its mean valuation, providing an upside of over 20% by the end of 2026. This suggests that UNH is not a stock that needs to be bought at a deep discount, but it should at least be slightly below or at its mean/fair valuation.

Conclusion

Given that UNH is not a high-growth stock, buying at a good valuation is crucial. The current valuation of UNH seems somewhat undeserved, considering the growth prospects and the state of the market. Historically, investors who bought the stock above its mean valuation did not fare well, whereas buying it below the mean/fair valuation consistently resulted in strong performance.

Buying at current prices provides no margin of safety, meaning that slight adjustments in analysts’ consensus or management guidance could trigger a revaluation, driving the stock lower. Moreover, the projected total returns are rather low, offering no compensation for that risk. An investment in the general market could potentially yield similar results with less risk.

Since UNH is not a bad company and valuation is my primary concern at this point, I rate it as a ‘hold’.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.