Summary:

- UnitedHealth Group makes quality earnings and is a free cash flow machine.

- It only yields ~1.4%. So, investors should focus on growth (i.e., stock price appreciation). Something to look forward to. The stock is set to increase its dividend next month.

- The company is more leveraged than a year ago, but it’s still awarded an S&P credit rating of A+.

- The growth stock appears to be undervalued and could deliver ~13% per year over the next 5 years.

ipopba/iStock via Getty Images

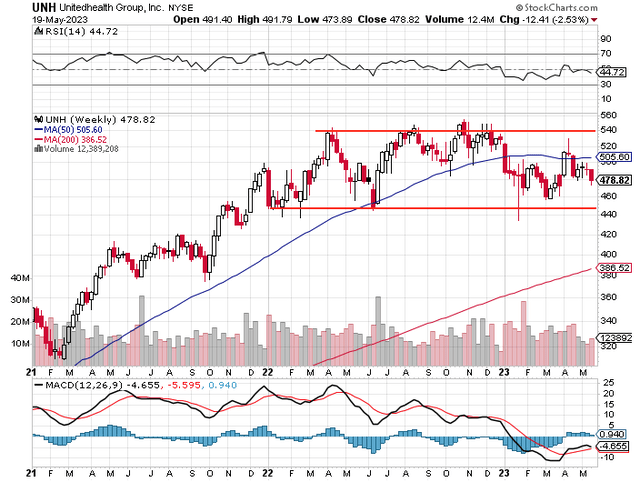

Finally, this may be the entry point investors have been waiting for in UnitedHealth Group (NYSE:UNH). The stock has been stagnant, essentially trading at a sideways channel between about $440 to $540 since 2022. The midpoint of that range is $490. At writing, the growth stock trades at about $478 per share.

Stockcharts (with author-drawn lines)

Dividend Stock with Good Growth

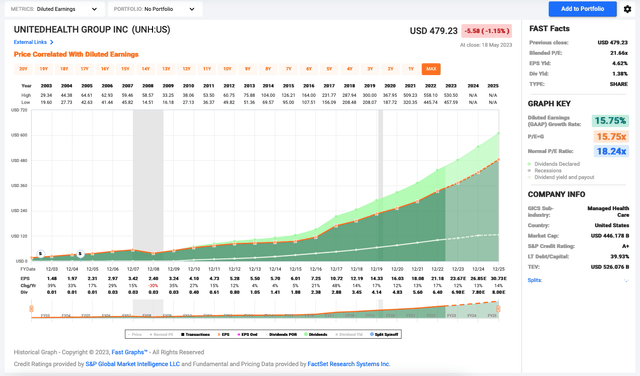

UnitedHealth is a dividend stock, but it’s more like a growth stock. Investors are better looking at it as a growth stock, as the large private health insurance company increased its adjusted earnings per share (“EPS”) by 15.4% per year in the past decade. The compound annual growth rate (“CAGR”) of its diluted EPS of 14.9% is close to that rate and impressive as well.

The earnings growth translated to magnificent dividend growth of approximately 24% in the period. Of course, over time, its payout ratio has edged higher as the dividend increased at a faster pace than earnings. However, UnitedHealth still has excellent coverage of its dividend. Its 2022 payout ratio was about 30% of diluted earnings, 23% of operating cash flow, and 26% of free cash flow (“FCF”) last year.

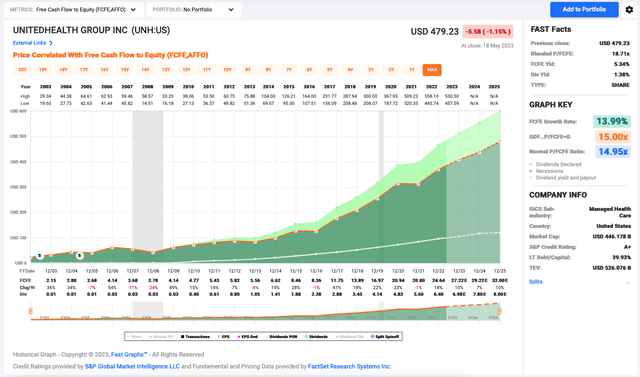

For reference, over the past 10 years, UnitedHealth increased its operating cash flow per share and FCF per share by 15% and 15.5%, respectively. These were solid growth rates of earnings and cash flow that led to healthy dividend growth.

Notably, UnitedHealth is a fairly low-capex business. In the past four years, it only used up 10.5% of its operating cash flow as capital investments, leaving ample free cash flow for other uses (such as dividend raises). Last year, it generated a record FCF of $23.4 billion (versus paying just under $6 billion in dividends.)

Past results can be indicative of future results.

Recent Results

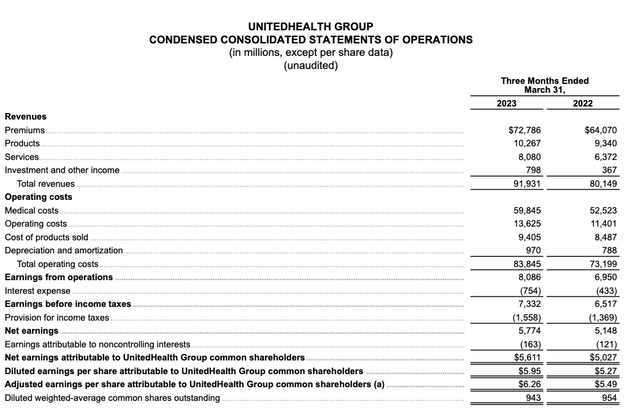

UnitedHealth reported its first-quarter (“Q1”) results last month. Revenues climbed 15% to $91.9 billion versus Q1 2022, while operating earnings rose 16% to $8.1 billion, improving the operating margin slightly to 8.8% (versus 8.7%).

79% of the revenues came from Premiums. This core revenue saw growth of 13.6% year over year. 11% of revenues came from Products, which saw growth of 10%. Under 9% came from services, which jumped 27%.

UnitedHealth Group

Investors should note that double-digit revenue growth occurred at both of its business segments — Optum and UnitedHealthcare.

Optum provides healthcare services to its customers. It serves payers, care providers, employers, governments, life sciences companies, and consumers. It has three operations: Optum Health, Optum Rx, and Optum Insight that cover medical and pharmaceutical benefits, outpatient care, and analytics. For the quarter, the Optum segment saw revenue and operating earnings rising 25% and 19%, respectively, year over year.

UnitedHealthcare offers a full range of health benefits, including UnitedHealthcare Employer & Individual (that serves employers ranging from sole proprietorships to large, multi-site and national employers, public sector employers, and individual consumers), UnitedHealthcare Medicare & Retirement (that delivers health and well-being benefits for Medicare beneficiaries and retirees), and UnitedHealthcare Community & State (that manages health care benefit programs on behalf of state Medicaid and community programs and their participants). For Q1, the UnitedHealthcare segment witnessed revenue and operating earnings rising 13% and 14%, respectively, year over year.

2023 Guidance and Valuation

Management increased its 2023 net earnings outlook to $23.25 to $23.75 per share and adjusted EPS to $24.50 to $25.00. Based on the midpoint of its adjusted EPS range of $24.75, which equates to a forward price-to-earnings ratio (P/E) of about 19.3 at roughly $478 per share at writing.

It’s estimated UnitedHealth Group could increase its EPS by about 13% per year over the next three to five years. UNH’s blended P/E is about 20.6, which leads to a reasonable PEG ratio of about 1.58.

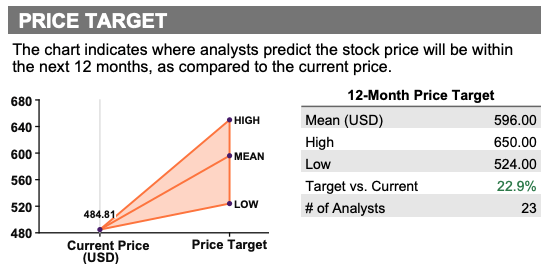

Thomson Reuters

Analysts believe the stock trades at a discount of 20% from the consensus 12-month price target of $596 per share, which also suggests a near-term upside potential of close to 25%. Analysts generally think the stock is undervalued, but it could certainly take longer, perhaps a couple of years, to arrive at close to $600 per share.

Assuming a target P/E of 19 and an adjusted EPS growth rate of 13%, the stock can deliver annualized returns of close to 13% over the next five years.

Investor Takeaway

UnitedHealth Group makes quality earnings and is a free cash flow machine. In a higher interest rate environment, it’s not surprising that the company is more leveraged than it was in Q1 2022, but it’s still awarded an S&P credit rating of A+. (Its debt-to-equity ratio was 2.25x at the end of Q1 2023 versus 1.89x a year ago, while its debt-to-asset ratio was 68% versus 65% a year ago.)

F.A.S.T. Graphs – P/E

F.A.S.T. Graphs – Price to Free Cash Flow

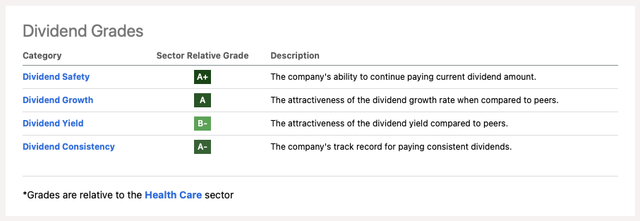

Seeking Alpha gives quality ratings for UNH’s dividend, which we believe is set to increase by about 13% next month.

Seeking Alpha

Because UNH only yields about 1.4% (a forward yield of ~1.6%), investors should focus on total returns in the stock.

Seeking Alpha

UNH stock could potentially deliver total returns of roughly 13% per year over the next five years. So, we rate it as a “buy”. This recommendation matches with other analysts on Seeking Alpha and Wall Street.

References

Analyst’s Disclosure: I/we have a beneficial long position in the shares of UNH either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

We own shares in the CDR shares on the NEO Exchange. Disclaimer: This article consists of my opinions and is for informational purposes only. Please do your own research and due diligence and consult a financial advisor and or tax professional if necessary before making any investment decisions.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.