Summary:

- UnitedHealth Group will report second-quarter earnings this upcoming Tuesday, July 16th.

- The company is facing a long list of headwinds, including a cyberattack, rising medical costs, Medicaid redeterminations, and rising competition.

- Investors should focus on the long-term secular growth opportunity, as healthcare spending should continue to grow at a fast pace, and UNH is best positioned to capitalize.

Wolterk

UnitedHealth Group (NYSE:UNH) is set to report its second-quarter results next Tuesday, July 16, amid a tough year for managed care and the company.

Investors will closely monitor management’s ability to weather the hell-storm of the cyberattack, higher medical costs, declining Medicaid eligibility, competition, and regulatory scrutiny.

For a company that maintains a significant premium over its peers, this could either be a demonstration of extreme resiliency, which will strengthen the market’s view, or a potential break point.

With that, let’s discuss why I still view UnitedHealth as a key holding and an attractive investment, and dive into the key aspects to monitor in the report.

Introduction

I’ve been covering UNH on Seeking Alpha since February 2023, maintaining a bullish rating throughout the period. I have to admit, it has been a tough 16 months.

The company’s secular tailwinds remain solid, and I think it’s safe to say UNH clearly demonstrated its ability to capitalize and execute. However, so many temporary headwinds have piled up, and the stock’s performance clearly reflects that.

Long-Term View On Secular Tailwinds And Industry Leadership

Before we dive into the near-term catalysts, I want to start by briefly reviewing my long-term investment thesis in UnitedHealth.

Let’s start here:

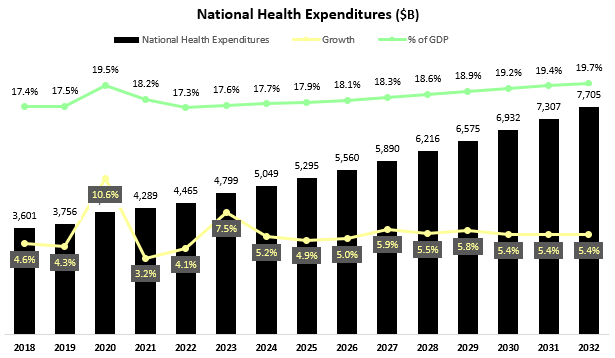

Created and calculated by the author based on CMS projections and data.

According to the CMS, domestic health expenditures are expected to grow at a 5.6% CAGR between 2022-2032, reaching nearly 20% of GDP by the end of the period. Breaking that into parts, Medicare and Medicaid expenditures are expected to grow by 7.4% and 5.2%, respectively, while physical & clinical services, private health insurance, and hospital spending, are all expected to grow around 5.6%.

There are plenty of businesses that should capture value from this trend, but I don’t think there’s a company that comes remotely close to UNH with its expansive presence across the entire value chain.

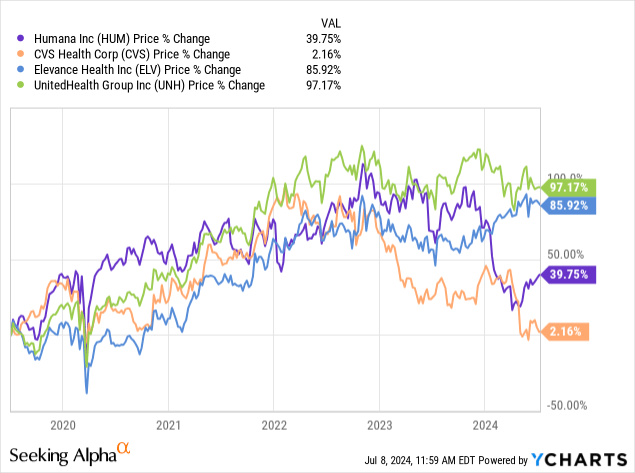

Many companies are trying to mimic the UNH model, but they are all quickly learning this is a very tough business. Competitors like CVS (CVS) and Humana (HUM) tried to win customers at all costs and were caught with their pants down as soon as medical costs rose.

Meanwhile, during this very tough period for the industry, UnitedHealth continues to execute according to its initial guidance, which many thought was too ambitious, and that’s despite having to deal with a major cyberattack.

The bottom line is, UnitedHealth is the clear leader of a resilient industry that should grow at a mid-to-high-single-digit pace. That’s a great baseline for a market-beating investment.

Healthcare As A Portfolio Balancer

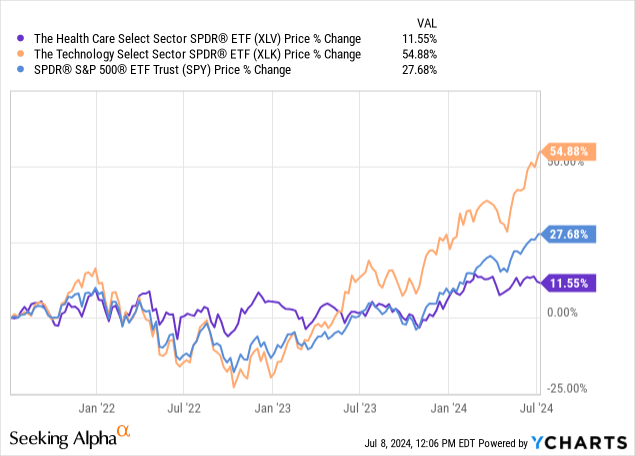

It is no secret that tech is the sector to be in right now. Led by strong results and generative AI enthusiasm, technology is leaving the rest of the stock market in the dust.

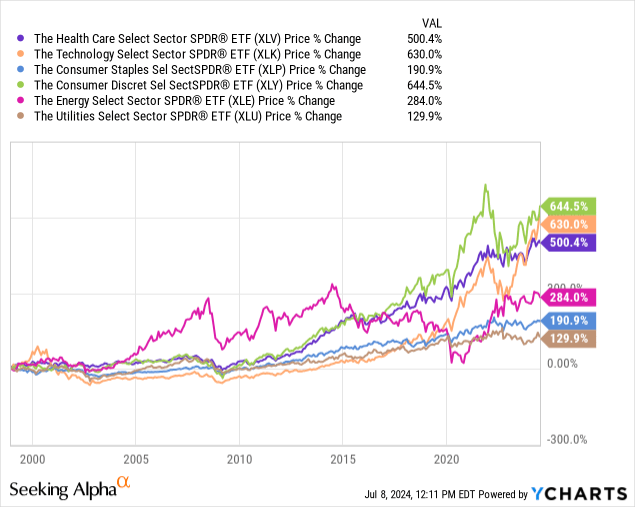

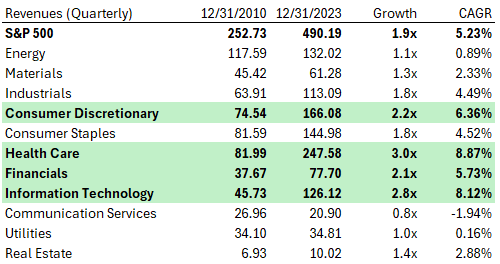

Over the past three years, the healthcare index (XLV) significantly lagged the S&P 500, which has a large exposure to technology. However, if we take a longer lens, healthcare is one of the best-performing sectors in the S&P 500.

This shouldn’t come as a surprise. We’ve already discussed the industry’s secular tailwinds. Interestingly, healthcare had the strongest revenue growth in the S&P 500 since 2010.

Created and calculated by the author using data from S&P Global

I expect UNH will continue to outpace the above-market growth of its industry. Therefore, it provides a great way to balance a portfolio with a non-tech name, that is still able to grow faster than the market average.

Now, let’s dive into the near-term situation.

Key Factors To Monitor In Q2

Coming into the first-quarter report, investors were very worried about a mix of headwinds, which primarily include higher medical costs and the Change cyberattack.

Numbers came in better than expected, and despite fears of a guidance downgrade, UNH maintained its targets for the year. This was effectively an upgrade, as the new guide included some cyberattack-related costs.

The stock surged to as high as $520 and then lost momentum after comments made by management on Medicaid headwinds, and another very strong tech rally.

In the second quarter, the number one thing to monitor will be the cyberattack. Management quantified its direct response costs at ~$1.1 billion, and revenue loss at ~$400 million. If they raise that, that would give a negative signal about their ability to take control of the situation, but I don’t expect that to happen.

Setting that aside, there will, of course, be the usual fundamental factors to monitor.

Medical Costs

UnitedHealth demonstrated it’s a level above the competition when it comes to understanding the healthcare industry, foreseeing what’s about to come, and having the ability to deal with fluctuations.

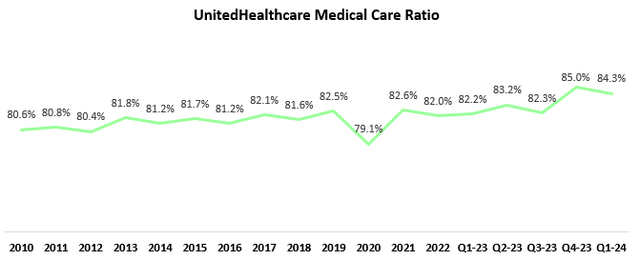

Created by the author using data from UnitedHealthcare Group reports.

As such, it is one of the few companies that weren’t caught off-guard by the rise in utilization trends. It didn’t have to cut guidance, and it didn’t approach the 90% levels of some of its competitors.

In Q2, MCR is expected to remain stable, and we should hope to hear this will be the case for the rest of the year.

Membership Growth

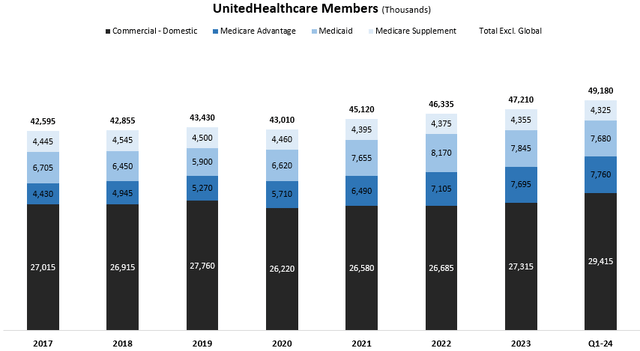

One of the problems with the new entrants in the industry is that they were quite aggressive with their benefit offerings, whereas UNH maintained a balanced approach. However, to achieve this, UNH had to sacrifice some growth.

Created by the author using data from UnitedHealthcare Group reports.

We can see that members are still growing, especially in the very important commercial cohort. However, Medicare and Medicaid lost some members.

It’ll be interesting to hear what management has to say about the fact that competitors are now talking about a margin focus, as UNH stands to benefit from their change in strategy.

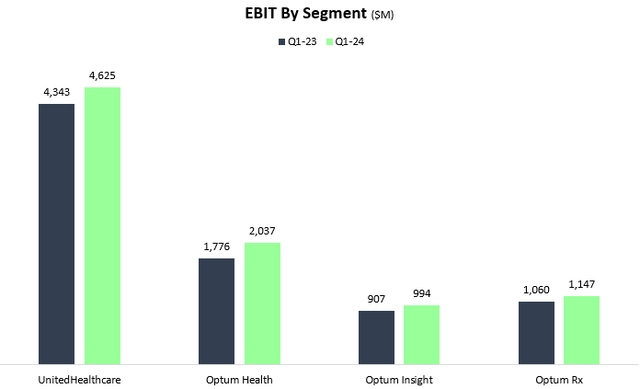

Optum Profitability & Growth

The Optum arm aggregates what makes UNH special. It is also the growth driver for both revenues and profits. Of the three Optum segments, Optum Health is by far the most important, as this is where the company’s long-term value-based strategy comes to bear.

Created by the author using data from UnitedHealthcare Group reports.

I expect margins in the Optum Health department to remain above the 20% threshold, and revenue growth to remain in the mid-teens. Commentary about continued progress in value-based penetration will also be crucial.

Valuation

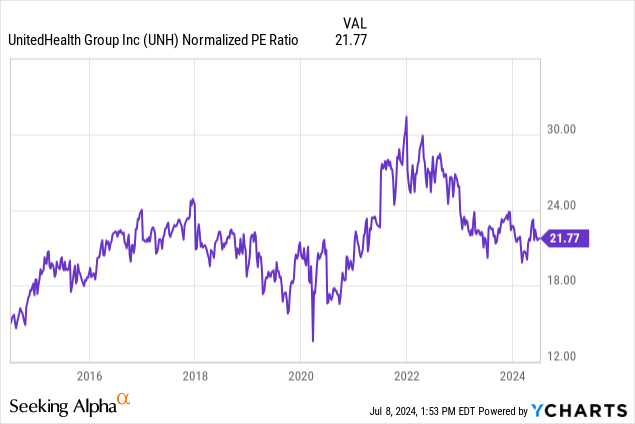

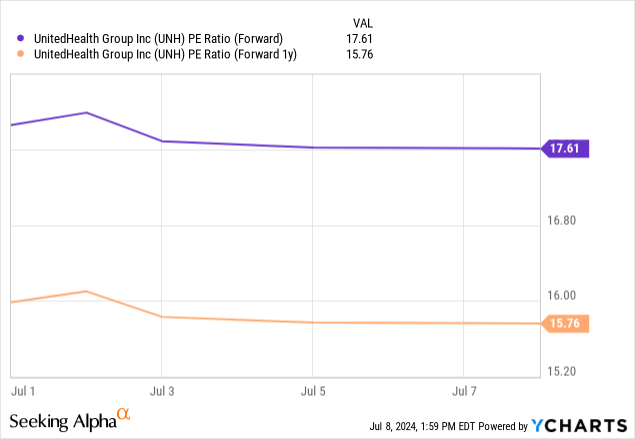

This will be pretty straightforward. Historically, UnitedHealth traded in the 18x-22x P/E range. During that period, revenues grew at a low-double-digit pace, while operating income and EPS grew in the mid-teens.

Looking ahead, UNH is still committed to mid-teens EPS growth, although more of it will come from buybacks, rather than net income. In addition, as the company reaches a larger scale, revenue growth should be in the high-single-digit range. On the contrary, it is more profitable today, and its leadership position in the industry, in my view, has never been clearer.

All in all, I think that an 18x multiple is a reasonable expectation, even slightly leaning too pessimistic.

That brings me to a price target of $550 a share by the end of 2024, based on consensus estimates for 2025. It’s worth noting that UNH beat estimates for 15 consecutive years, and I have higher expectations for 2025, but let’s leave it at that for now.

Conclusion

UnitedHealth is set to report its second-quarter results in a week, as investors once again seek reassurance that the company is weathering the storm of current headwinds.

I expect no surprises regarding the cyberattack and another quarter of better-than-expected results.

Therefore, I encourage investors to capitalize on the ongoing pessimism surrounding the company, as UNH’s secular growth trajectory remains intact.

Buy reiterated.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of UNH either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.