Summary:

- UNH’s sideways trade remains a gift after the regulatory probe/ cyberattack, with things remaining uncertain through 2025.

- Despite near-term challenges, the management reports double beat FQ1’24 earnings, offered an optimistic FY2024 guidance, and raises dividend by +11.7%.

- With UNH still trading near to its 10Y P/E mean, the stock remains a compelling Buy here, with great upside potential and expanded forward dividend yields.

- Assuming that it can counter these near-term headwinds, we believe that the health care company may emerge much stronger by 2025, aided by the Brazil divestiture.

- We will also be highlighting a few metrics to look out for in the upcoming FQ2’24 earnings call on July 16, 2024, with it underscoring the health of UNH’s businesses along with near-term prospects.

RapidEye

We previously covered UnitedHealth Group (NYSE:UNH) in March 2024, discussing why it was an even more attractive Buy after the regulatory probe/cyberattack, as the discounted valuations and stock pullback offered expanded upside potential and dividend yields for an improved margin of safety.

While there might be near-term headwinds ahead, attributed to the potential regulatory fines, lawsuits, and increased spending on cybersecurity, we maintained our belief that these issues were likely to be temporal, posing little challenges to its long-term prospects.

Since then, UNH has traded sideways at -1.5% compared to the wider market at +4.1%, with the stock still moderately impacted from the ongoing headwinds observed in the managed health care sector.

Even so, we are reiterating our Buy rating here, since the health care company continues to report double beat FQ1’24 earnings call while offering an optimistic FY2024 guidance, despite the slight impact from the cyberattack.

At the same time, we will be highlighting a few metrics to look out for in the upcoming FQ2’24 earnings call on July 16, 2024, with it underscoring the health of its businesses along with near-term prospects.

FQ2’24 Preview – Things To Note

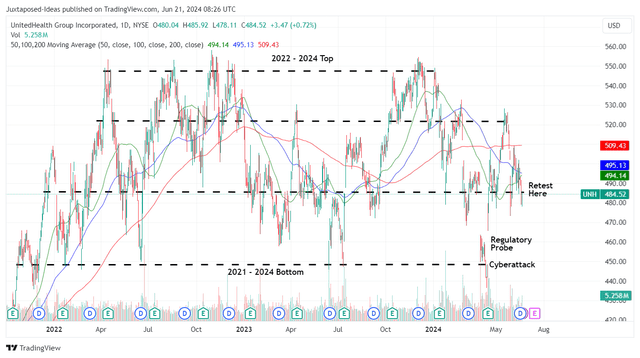

UNH 2Y Stock Price

Since our last article, UNH’s sideways trade has turned out as expected, with market sentiments still mixed from the lingering cybersecurity impact and ongoing CMS recalculation across the entire insurer sector.

With the health care company set to report their FQ2’24 earnings call, there are a few things to monitor indeed.

1. Impact From Cyberattack

UNH has reiterated their FY2024 adj EPS guidance of $27.75 (+10.4% YoY) at the midpoint, with it “excluding the impacts of the direct response costs and Brazil sale.”

However, readers must also note that the management has already highlighted that the cyberattack may potentially trigger a bottom-line impact of up to -$1.35 per share in FY2024. This is on top of the $22M ransomware payment.

While the cyberattack may very well be a one-time incident, we are uncertain indeed, with this event building upon over “600 data breaches reported by health care organizations involving more than 42 million Americans in 2022.”

In addition, UNH has yet to offer any in-depth commentary on the remediation/ prevention efforts beyond implementing “MFA on all of its external-facing systems,” since it is uncertain if the additional layers of security may impact its bottom-lines.

With regulators already pushing for mandated “cybersecurity best practices necessary to protect the health care sector from further, devastating, easily preventable cyberattacks” and the company also facing a potential “class action securities lawsuit” arising from the cyberattack, readers may want to brace for more bottom-line impacts and/ or legal battles ahead.

2. Brazil Divestiture

UNH expects to divest the Brazil segment by Q2’24, with it expected to incur a hefty $7B impairment. For now, we are not overly concerned, since the impairment is mostly “non-cash and is being recorded due to foreign currency translation losses,” implying minimal impact on its bottom-line.

At the same time, we believe that the divestiture is good for the overall business, since it only comprises $6B or the equivalent 1.5% of its annual revenues, while being unprofitable.

For now, we believe that UNH may emerge with an improved portfolio profile, especially since the management has already highlighted that they are “confident in getting back to that baseline performance in 2025,” after lapping the impact of the cyberattack.

As a result, readers may look for clues from the management’s financial reports moving forward, since we believe the divestiture is likely to bring about a bottom-line boost as early as H2’24, if not FQ3’24.

3. Rising Medical Costs

Nonetheless, the rising costs for health care cannot be denied, based on UNH’s growing Medical Care Ratio of 84.3% (+2.1 points YoY) in FQ1’24, compared to FY2019 levels of 82.5% (+0.9 points YoY).

The same has also been highlighted by its peers, including CVS Health (CVS) at 90.4% (+5.8 points YoY), Centene (CNC) at 87.1% (+0.1 YoY), Elevance Health (ELV) at 85.6% (-0.2 points YoY), and Humana (HUM) at 88.9% (+3 points YoY).

It is apparent that as we overlap a tougher YoY comparison and as utilization increases drastically, we may see 2024 bring forth higher Medical Care Ratios than pre-pandemic levels, worsened by the high inflationary environment.

Even so, with this being a market wide trend, we believe that readers need not be concerned, especially since UNH continues to report one of the lowest Medical Care Ratios thus far.

At the same time, the health care company continues to report higher Medicare Advantage members served in FQ1’24 at 7.76M (+0.9% QoQ/ +2.9% YoY), with the ongoing CMS recalculations expected to unlock up to $1B in additional bonus payments in 2025.

While it is uncertain how much UNH may eventually receive, we believe that it may reduce expenses while moderating Medical Care Ratios in 2025, further underscoring the management’s confidence surrounding the 2025 baseline performance.

UNH’s Robust Financial Performance

As a result, while FQ2’24 and H2’24 may bring forth higher Medical Care Ratios, we believe that UNH’s headwinds are likely to temporal as discussed in our previous article, significantly aided by the robust financial performance observed in Optum Health and Rx, implying its ability to grow profitably despite the ongoing disruptions.

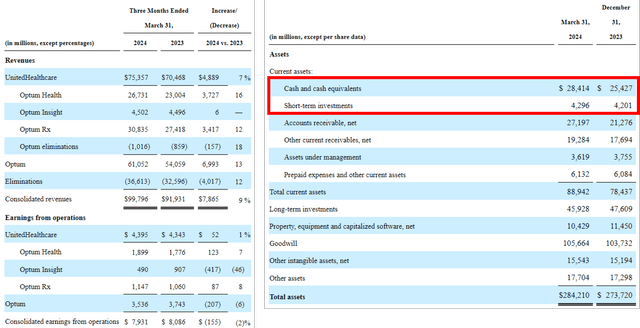

The healthcare company’s extremely rich FQ1’24 balance sheet with cash/ short-term investments of $32.7B (+10.3% QoQ/ -29.6% YoY) has allowed it to rapidly respond with over $6B in emergency funding as well, further underscoring why it remains well capitalized to weather the near-term headwinds.

So, Is UNH Stock A Buy, Sell, or Hold?

UNH’s Valuation

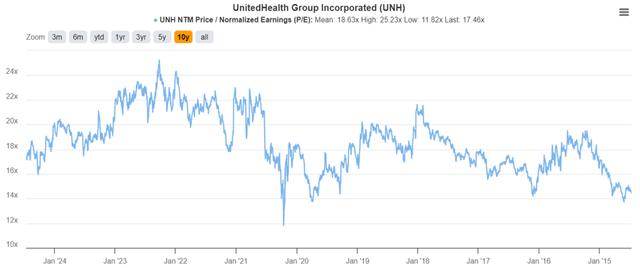

For now, we believe that UNH remains a gift at these levels, since the stock is still trading near to our fair value estimate of $478.50 discussed in our last article, based on the 1Y P/E mean of 19.05x (not far from its 10Y mean of 18.63x) and FY2023 adj EPS of $25.12.

Even after updating our calculation method based on the FY2024 adj EPS of $26.40 (after deducting the -$1.35 impact from the cyberattack) and the 10Y mean of 18.63x, the stock is still trading near to our new fair value estimate to $491.80.

At the same time, with UNH still expected to generate a similar top/ bottom-line growth through FY2026 – aided by the management’s “reiterated +13% to +16% long term EPS growth,” we are reiterating our original long-term price target of $674.70, with the recent pullback triggering improved upside potential of +39.2%.

Readers must also note that the management recently raised the quarterly dividends by an impressive +11.7% to $2.10 per share, implying an expanded forward yield of 1.73% compared to the 4Y average yields of 1.33% and the sector median of 1.43%.

This further underscores the management’s confidence in generating robust profitability/ cash flow while continuing to return great value to its long-term shareholders.

The recent raise also builds upon the robust 3Y Dividend Growth at +14.1% compared to the sector median of +6%, with the Seeking Alpha Quant still rating its dividend safety as A+.

As a result of the attractive risk/ reward ratio across both dividend incomes and capital appreciation prospects, we are reiterating our Buy rating for the UNH stock here.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

The analysis is provided exclusively for informational purposes and should not be considered professional investment advice. Before investing, please conduct personal in-depth research and utmost due diligence, as there are many risks associated with the trade, including capital loss.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.