Summary:

- UnitedHealth Group Incorporated is likely to announce its 14th consecutive dividend increase in June.

- Dividend coverage looks spectacularly strong by any metric.

- UNH stock has almost always looked pricey to me, but the recent underperformance might be an opportunity.

jetcityimage

UnitedHealth Group Incorporated (NYSE:UNH) investors may be forgiven if they don’t realize their stock pays a dividend. I mean, who has time for a 1.36% yield these days, especially when the stock has doubled in the last 5 years? I don’t know about you, but whenever I looked at the stock in the past, it was green. Rain or shine, UNH stock was up. The last 6 months or so have been a little quiet for the stock and I believe that is just a well-deserved rest after years of running, before the next leg up.

But then, no one knows when exactly that next leg up will be. Or if this little quiet period will actually be the trend for a while. Luckily, this article is not about the stock price but about UNH’s dividend, which is one of the strongest I’ve seen in my extensive history of following and writing about dividend stocks on Seeking Alpha. Let’s see what exactly I mean by that.

- UNH’s current annual dividend of $6.60 gives the stock a yield of 1.375%. I am sure almost everyone scoffs at that. But wait, let’s see if the next point impresses you.

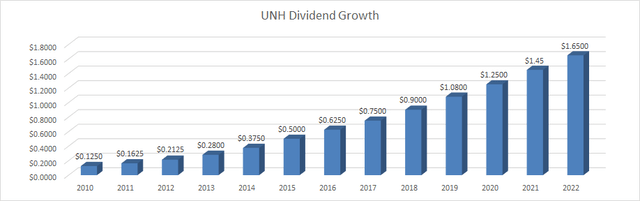

- UNH has been paying dividends since at least 2001 and has been increasing dividends since 2010. That makes it 13 consecutive years of dividend growth. Still not impressed?

- Since 2010, the dividend has grown 13 folds and the lowest increase was last year’s 14.29%, with the 5-year average being 17.38%. What else you say? Boy, tough cookie, aren’t you?

UNH DG (Compiled by author with data from Seeking Alpha)

- In spite of the 13 consecutive and very generous increases since 2010, UNH’s payout ratio based on forward earnings per share (“EPS”) is 26.40%. Okay, this time, I will be the skeptic. I’ve stated many times in my past articles that EPS can be a bit misleading due to fluctuations and one-time events. Frequent readers of my articles know I prefer Free Cash Flow (“FCF”). Let’s see how UNH does, based on that metric.

- FCF Based Coverage:

- UNH currently has 931 million shares outstanding.

- Since the company currently pays $1.65/share in quarterly dividend, a quarterly FCF of $1.536 billion is needed to cover dividend payments. That is, $1.65 times 931 million shares.

- On average, UNH has generated $5.057 billion in quarterly FCF over the last 5 years. That means the payout ratio using this metric is an equally impressive 30%.

- At this point, I don’t know about you, but I am mighty impressed.

- Since we just talked about shares outstanding, as impressive as UNH has been in shareholder returns (both capital and dividends), the company’s shares outstanding has reduced only by 3% in the last 5 years. Dividend-paying companies retiring shares has double benefits: EPS goes up while the company saves money every single quarter as the retired shares don’t need a dividend payment. This is an area investors should track closely in the future.

- Other than EPS and FCF, I monitor a company’s cash and debt levels. UNH’s cash and short-term equivalents on hand have more than doubled in the last 5 years to $46.50 billion. The company’s debt has doubled as well in the same span, reaching $70.59 billion. However, a low debt-to-equity ratio of 0.86 should alleviate any concerns about the company’s leverage.

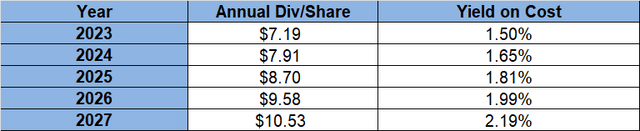

- Now, what about the likely upcoming dividend increase I mentioned earlier? Going by the company’s history (2022 and 2021), I expect the announcement to come in early June. Since the dividend growth rate has fallen a bit in the last 3 years, let’s assume there is a slight fall this year too, and assume the dividend is raised by “just” 12%. That should place the new quarterly dividend at $1.85, which should push the yield past 1.50% based on the current share price of ~$480. Can UNH afford more? Absolutely, based on the numbers above. If the company manages 10% dividend growth/yr for the next 5 years, the yield on cost goes well past 2% for someone buying here. I am fairly confident that this all-weather bellwether will easily beat these numbers, though.

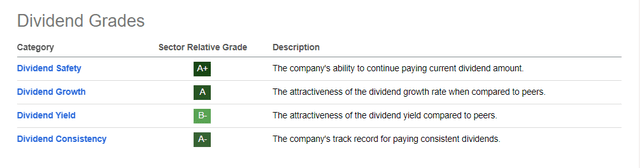

- Finally, it appears like Seeking Alpha’s quant system agrees that UNH’s dividend is golden as shown by the ratings below: A+, A, B-, A-. I can almost hear my parents say they wish I had these grades when I was at school. That’s water under the bridge. Right now, I wish all my stocks have dividend grades like this.

UNH SA Dividend Grades (seekingalpha.com)

Conclusion

UnitedHealth Group is a juggernaut, to put it mildly. As a consumer of Optum, I can confidently agree with this SA article that it is the differentiator. The only problem with the stock has been its rich valuation almost all the time. But then, a forward multiple of 19 for a company expected to grow earnings at 13%/yr is not too rich if you think about it. A median price target that is 25% away actually makes a case for undervaluation. I am seriously considering initiating a position in this stock given its relative underperformance this year, especially with an immediate bump in dividend income likely in June.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, but may initiate a beneficial Long position through a purchase of the stock, or the purchase of call options or similar derivatives in UNH over the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.