Summary:

- UnitedHealth Group just published its Q1-23 earnings, beating even my above-consensus expectations. Once again, UnitedHealth proved that analysts are underrating its healthcare empire.

- UnitedHealthcare (insurance) grew by 12.0%, Optum Health (care delivery) grew by 31.7%, Optum Insights (health-tech & analytics) grew by 19.5%, and Optum Rx (pharmacy services) grew by 9.26%.

- Overall, revenues grew by 14.7% YoY, and EBIT margins increased by 13 bps, continuing the margin expansion trend as the higher-margin Optum businesses become an increasingly larger part of the group.

- As I expected, UnitedHealth Group is on pace for another mid-double-digit growth year, beating the unexplainably low analyst estimates and its own too-conservative guidance.

- I reiterate my Strong Buy rating and update my price target to $635.90 per share.

jetcityimage

UnitedHealth Group (NYSE:UNH) just announced its Q1-23 results, reporting 14.7% revenue growth and a 13 bps EBIT margin expansion from the prior year period. The healthcare empire shows no sign of slowing down, demonstrating its unparalleled presence throughout the entire healthcare value chain with its insurance, care delivery, pharmacy services, and health-tech businesses. I reiterate my Strong Buy rating, with a price target of $635.9 per share.

Background

A month and a half ago, I published an article about UNH and rated the stock a Strong Buy despite the pessimistic environment surrounding healthcare stocks at the time. I urge you to read that article, in which I described my investment thesis in detail and why I expected a margin expansion, as well as the group’s unique synergies, its ambitious leadership, its operating segments, risks, and the major growth prospects I project for 2023 and beyond.

In short, my investment thesis regarding UnitedHealth Group is based upon its full control of the healthcare value chain with its insurance, care delivery, pharmacy services, and health-tech businesses. The synergies between its four segments are immense, and every other health services company aspires to build the capabilities which UNH already has. Additionally, the group’s Optum Insight business is unparalleled in the industry with its above 20% EBIT margins, and $30B backlog.

Regarding valuation, I showed that UNH trades at a premium compared to its supposed peers, but explained why I find the premium justified, as UNH is incomparable to any other healthcare services company, not in terms of growth, not in terms of margins, and not in terms of capabilities. Moreover, I explained why my model assumes higher growth than the consensus, as I thought that the analysts’ consensus being below the high end of the company’s guidance is underrating its high quality and disregards its history of beating both expectations and guidance. For these reasons, I rated the stock a Strong Buy.

Now, let’s focus on the company’s results, see how my projections fared compared to the consensus, and provide an updated model. Spoiler alert: I reiterate my Strong Buy rating as UNH was able to beat even my own projections, which were already higher than the consensus.

Q1-23 Highlights

UnitedHealth Group reported consolidated revenues of $91.9B, a 14.7% increase from the prior year. Based on its historical seasonality, the health empire is on pace to deliver above 13.3% growth for the entire year. I’m very glad to see the company is on pace to beat my $367.0B sales (13.0% growth) expectation, which means it’s on pace to essentially destroy the consensus expectations of $359.7B for the year. For the quarter, the company reported a consolidated operating profit of $8.0B, reflecting an 8.8% margin.

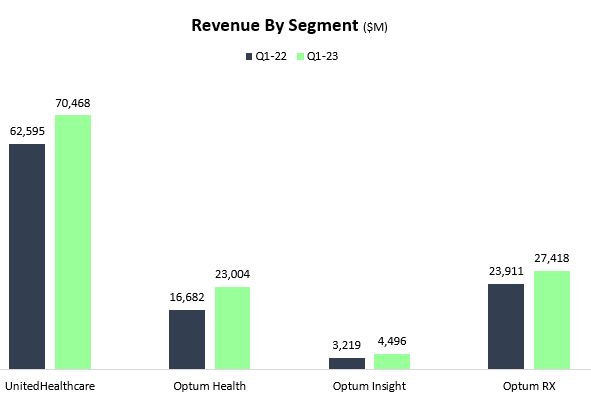

Created by the author using data from UNH’s financial report

As we can see, growth was broad-based across all segments. United Healthcare, the insurance business, grew by 12.0%; Optum Health, the care delivery provider, grew by 31.7%; Optum Insights, the health-tech solutions and analytics business, grew by 19.5%; and Optum Rx, the pharmacy services segment, grew by 9.3%.

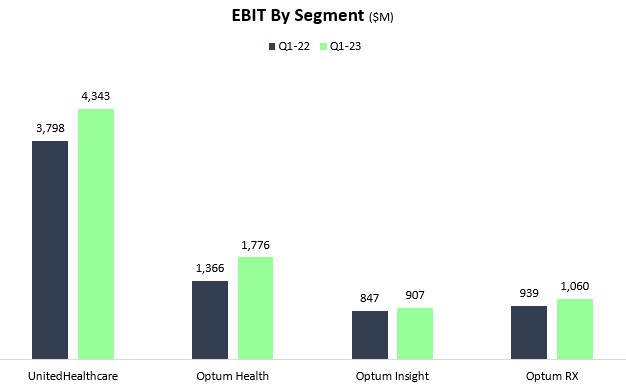

Created by the author using data from UNH’s financial report

Looking at EBIT per segment, UnitedHealthcare grew by 14.3%, Optum Health grew by 30.0%, Optum Insight grew by 7.0% and Optum Rx grew by 12.9%. We saw margin declines in the Optum businesses, mainly due to the integration of Change Healthcare, as well as accelerated investments in services, capabilities, and product offerings to care providers and health plans.

Some other notable numbers – The company’s MCR ratio amounted to 82.2%, which is close to UNH’s historical average rate, and the Optum Insight backlog increased by 35% to $31B compared to the prior year. Optum Health now serves 103 million customers.

Overall, I find UNH’s numbers very impressive, as the company’s growth accelerated from what is an already tough comparison.

Important Notes From The Call

Let’s begin with the increased regulatory scrutiny on pharmacy benefit managers (PBMs) which was weighing down health services stocks in the first months of the year. Regarding that, it’s important to note that Optum Rx is more than a PBM, as only 50.0% of its revenues are attributable to its PBM operation. Additionally, Optum Rx is dedicated and obliged to the lowest net cost. The business does not make money if it doesn’t save money for its customers. As drug companies essentially have monopolies over their patented drugs for many years, PBMs are viewed by UNH’s management as essential players in the industry, because they aggregate enough buying power to fight these temporary monopolies. In my view, this comment by the management is not completely objective, but it does have merits. The bottom line is that PBMs already operate with very low margins, and there just isn’t too much fat to trim. Thus, I don’t view this subject as a material risk.

Another point I’d like to address is pre-authorizations, which require healthcare providers to obtain coverage approvals from health plans before conducting certain non-emergency medical procedures. In essence, cutting the prior-authorization requirement means patients would receive care faster and more conveniently, while the provider will need to take the risk of not being paid by the patient’s insurer. In March, UNH announced it plans to cut 20% of prior authorizations beginning in Q3-23. While this does add some risk, it’s important to note that these cuts are only relevant to specific patients who are covered by specific insurers, essentially meaning the risk is very calculated, and is spread between both the provider and the insurer.

Thirdly, I want to address the return-to-normal trend within UNH. After three irregular years which were affected by Covid-19, and in UNH’s case, affected positively, the company is now returning to pre-pandemic patterns. These patterns will be demonstrated in revenue seasonality, and more importantly in the company’s MCR ratio. Regarding seasonality, we can now expect UNH’s revenues and profits to spread around its historical 49% in H1 and 51% in H2. Regarding MCR ratios, we can expect to see 81%-83% MCR ratios for the foreseeable future.

The Correct Valuation Method

Before going into my updated financial model, I’d like to dig a little deeper into the unique cash cycle of an insurance company. In my CVS article, I described in detail why evaluating such companies based on regular free cash flows could be misleading, as demonstrated by the peculiar 13.6% FCF yield CVS traded at. Basically, insurance customers pay their premiums in advance and on a regular basis. However, the cash expenses on such customers occur at a later stage and theoretically may never occur at all. This is what Warren Buffett refers to as float with his Berkshire insurance businesses.

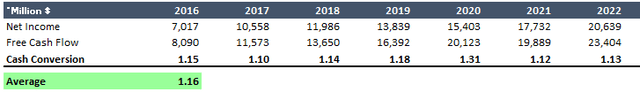

Let’s take a look at UNH’s historical cash conversion:

Created and calculated by the author using data from UnitedHealth Group financial reports

The conversion rate from net income and free cash flow is typically referred to as the cash conversion rate or cash productivity and there are several approaches to its calculation. I calculate it as free cash flow divided by net income. Basically, a cash conversion rate below one means the company is financing its customers, whereas a cash conversion above one means the opposite. Generally, a higher cash conversion rate is better.

As we can see, the average cash conversion rate for UNH between 2016-2022 is 1.16. On one hand, UNH generates a lot of cash and that’s a good thing. On the other hand, this is only a timing issue. UNH is regulatory obliged to pay out at least 80.0% of the cash it receives in premiums.

In the CVS article, I decided to base my valuation solely on multiples and received many questions about what tweaks I make to my DCF model in order to normalize the company’s cash flows. So, I’ll explain. All I do is calculate normalized free cash flows based on the following accounts: Net Income + Depreciation & Amortization – Capex. In essence, I replace the operating cash flow metric with net income, as net income reflects only income received for services and products that were already provided.

Now, enough with accounting, let’s talk about UNH’s updated model.

Updated Financial Model

In the February article, I provided my near-term projections for UNH:

In the near term, I believe the consensus is slightly off. For some reason, UNH does not get enough credit for constantly beating its own guidance and market expectations, which the company has done every year since 2008. While management is guiding for revenues of $360.0B at the high point, the consensus according to Seeking Alpha is $359.2B. In my opinion, UNH is going to beat its guidance once again. Specifically, I forecast 2023 revenues of $367.0B ($7.0B above guidance), and Q1-23 revenues of $90.1B, compared to the consensus of $89.7B. My EBIT forecast for the year is $32.3B, compared to the guidance mid-point of $31.8B. My earnings forecast for Q1-23 is $5.7B, compared to the consensus $5.4B. My forecast is mainly based on historical seasonality, using Q4-22 and Q1-22 as a baseline, and my assumption margins will improve in Q1-23 due to the earlier flu season. After its May earnings, we’ll find out who came closer to actual results, and I’ll update my model accordingly.

Based on the Q1 results, I need to slightly adjust my assumptions upwards. For FY23, I now expect revenues of $369.9B, EBIT of $32.9B, and a net income of $23.5B. For Q2-23, I project revenues of $90.6B and a net income of $5.8B, higher than the consensus of $89.8B in sales and a net income of 5.7B.

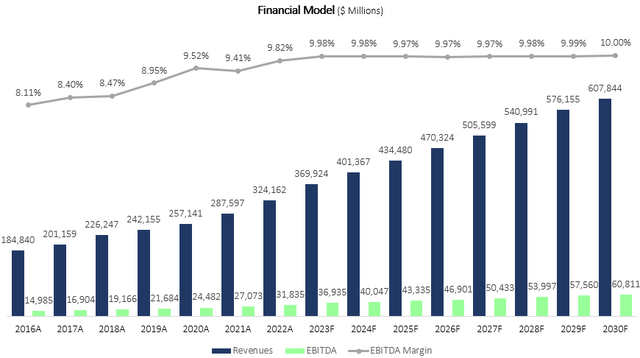

As a consequence of the quarterly adjustment, I need to update my long-term model as well. I now forecast UNH will grow revenues at a 7.3% CAGR between 2023-2030, which is higher than the consensus of approximately 5%-6% growth, but below the company’s past 7-year CAGR of 9.8%. I estimate revenues will grow at this pace due to backlog fulfillment at Optum Insight, and the company’s ability to keep or grow its market share in all the other segments.

I project EBITDA margins will increase incrementally up to 10.0% in 2030 due to higher growth in the higher margin segments. I find this margin very achievable, as Optum continues to outgrow the insurance business, and Optum itself should see a margin expansion compared to Q1, as its margins were weighed down by integration and investment expenses which are going to decrease from 2024 and beyond.

Overall, my assumptions result in EBITDA growth at the same pace as revenues. This is slightly below management’s guidance for operational growth of 10.0%. In my opinion, the management’s long-term 13.0%-16.0% EPS guidance will be met, though I forecast the buyback contribution will be higher than 3.0%.

Created and calculated by the author using data from UNH’s financial reports and the author’s projections

Taking a WACC of 8.2%, I estimate UNH’s fair value at $635.90 per share. While this does represent a relatively high P/E multiple on 2023 earnings of 25.3, I believe UNH is due for a significant multiple expansion based on the quality of its growth drivers, and the stability its traditional businesses provide.

One very crucial point to be made, I don’t expect the stock to reach my price target in the near term. UNH accumulates value at a steady double-digit pace, and I expect the stock to rise accordingly.

Conclusion

A shallow look at UnitedHealth Group could lead investors to believe the company is overvalued, as it trades for almost double its peers’ multiples. However, a deeper look paints a different picture – there is no other health services company like UNH. With its unique synergies and industry-leading margins, I strongly believe the company is going to continue to deliver double-digit EPS growth for the foreseeable future. Thus, I rate the stock a Strong Buy and estimate its fair value at $635.90 per share.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of UNH either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.